Each year, we produce 12 articles throughout the last few weeks of the year, all revolving around one central concept. This year, all 12 articles will revolve around the topic of "Enhancing Your Process With Scalable Customization in 2021. Today we'll learn about creating models of models.

Over the last decade, the advisory business has continued to evolve rapidly with the growing trends of lower fees and increased automation. With the influx of low-cost index funds and Robo-advisors offering nearly-free financial planning, investors can now gain beta market exposure at rock-bottom prices without ever setting foot in an advisor's office. The upshot is that it is now more challenging than ever for you as a traditional financial advisor to justify your fee and grow your client base. That said, you must scale your process and sharpen your value proposition as much as possible. To help you do just that, this year's 12 Days of Christmas Series, "Enhancing Your Process With Scalable Customization in 2021," will navigate you through the benefits, use/implementation, and customization of rules-based, Relative Strength-driven guided model portfolios. Additionally, this series will highlight the NDW Model Builder Tool's new features, providing relevant use-cases to help you scale your business in the coming year.

Day 1 - Benefits of Models and a Rules-Based Process

Day 2 - The Relative Strength Process

Day 3 - Model Foundations - The Relative Strength Matrix

Day 4 - Model Foundations – Technical Attributes and the Fund Score Method (FSM)

Day 5 - Model Foundations - Matrix Models

Day 6 - Model Foundations - FSM Models

Day 7 – DALI and Tactical Allocation Models

Day 8 - Custom Model Builder - Static Allocation

Day 9 - Custom Modeler Part 2 - Matrix Model Builder

Day 10 – Custom Modeler Part 3 – FSM Model Builder

Thus far, our 12 Days of Christmas Series, “Enhancing Your Process with Scalable Customization in 2021,” has covered the background methodologies of the relative strength (RS) matrix, the Fund Score Method, and how these tools are utilized in the premade models available on the NDW research platform. We have also learned about using the Custom Model Builder tool to create custom static allocation, matrix, and FSM models.

Now that we have learned how to create custom models, today we will see how we can take this one step further by creating a model of models by combining custom models we have created into a single static allocation. Using the static allocation tool to create models of models can be a powerful tool for efficiently creating customized client portfolios. You can create a foundation of a few matrix and/or FSM models that then can be combined into a custom static allocation tailored to a client’s individual needs.

In order to create a model of models, we navigate to the custom model tool just as we did previously by selecting Models & Products > Custom Models. After clicking the “Create New Model” button, you would then select Static Allocation and click Next. Keep in mind that you should make use of the “Back” and “Next” buttons in the upper right-hand corner of the Model Builder tool instead of the previous/forward buttons on your browser as you make your way through the workflow.

Step 1 – Creating a Universe

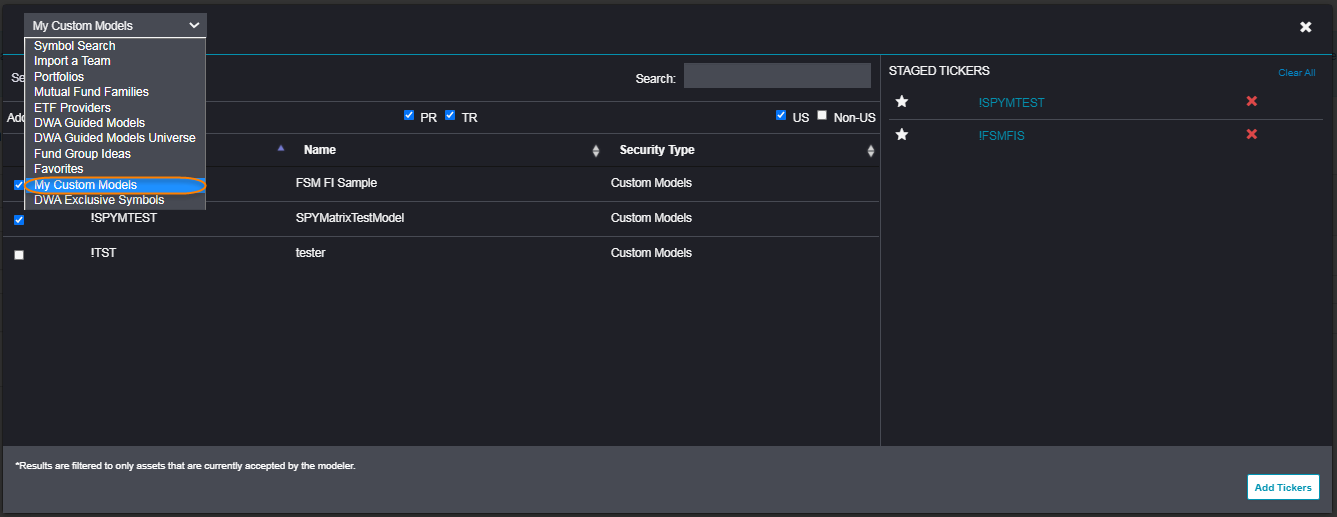

We will click “Add Assets” to create a universe for our model of models just as we did when we created a static allocation on Day 8. However, instead of adding single CUSIP securities, this time we are adding previously created custom models. You can see a list of your custom models by clicking the dropdown menu that says “Symbol Search” and then selecting custom models. From here, simply check the box next to each model you wish to include in your allocation and then click the “Add Tickers” button at the bottom right-hand corner. Note that you are not limited only to your custom models, if you wish you can also include DWA models, ETFs, stocks, or mutual funds.

Step 2 – Selecting a Strategy

In this case, selecting a strategy is simply selecting a rebalance frequency and a drift tolerance. Keep in mind, however, that these parameters apply to the models’ weighting within the static allocation. Each custom model will rebalance its underlying holdings using the frequency and drift tolerance you selected when you created it. For example, if you select quarterly rebalancing in the static allocation, but selected monthly rebalances for the individual models, the models will rebalance their underlying holdings each month, while rebalancing between the models will take place quarterly. There is nothing wrong, per se, with using different rebalance schedules or drift tolerances at the model level versus the top allocation level, but we do need to be cognizant of the fact that it can result in more (or less) frequent trades and affect portfolio turnover.

Step 3 – Model Preview and Saving a Model

Previewing and saving a model of models is the same as it was for the other types of models we have reviewed. After ensuring that the model criteria you have selected is correct, in addition to finalizing the model name and symbol, you can view a preview of the backtested model results. Just as with the other model types, the maximum length of the model history will be determined by the component with the shortest price history.

Remember to make sure that your benchmark fits the strategy you are looking to test. There is a variety of price return and total return benchmarks available for selection. You also have the capability to use any symbol housed on the NDW system as your benchmark, which includes any custom models you may have created. Using a static allocation as a custom benchmark can be especially useful in the case of a model of models, especially when it includes multiple asset classes.

As with the other model types, you also have the option to include a theoretical advisory fee. However, if you have included an advisory fee in the underlying models, including one here will result in the hypothetical fee being charged twice, resulting in performance that appears artificially low.

As with the single models, the preview page will include a variety of statistics and information on the trades associated with the backtest. You can also download the trade history to a CSV (comma-separated values / Excel) file. The “Exit Preview” button will allow you to go back and make further edits to the model prior to saving it. If you are comfortable with the results of the model, you can click on the green “Save Model” button to save it on the system.

After saving your model, it can be accessed under the Custom Models page, or through the Custom Models filter on the regular Models Listing page. One final point to note is that saving a new model will not automatically turn on alerts for that strategy; you will need to go into the Model Portfolios page and click on the bell icon for the model to be notified of any potential changes.