Each year, we produce 12 articles throughout the last few weeks of the year, all revolving around one central topic. This year, all 12 articles will revolve around the topic of "Enhancing Your Process With Scalable Customization in 2021". For Day 2, we highlight the Relative Strength Process.

Over the last decade, the advisory business has continued to evolve rapidly with the growing trends of lower fees and increased automation. With the influx of low-cost index funds and Robo-advisors offering nearly-free financial planning, investors can now gain beta market exposure at rock-bottom prices without ever setting foot in an advisor's office. The upshot is that it is now more challenging than ever for you as a traditional financial advisor to justify your fee and grow your client base. That said, you must scale your process and sharpen your value proposition as much as possible. To help you do just that, this year's 12 Days of Christmas Series, "Enhancing Your Process With Scalable Customization in 2021," will navigate you through the benefits, use/implementation, and customization of rules-based, Relative Strength-driven guided model portfolios. Additionally, this series will highlight the NDW Model Builder Tool's new features, providing relevant use-cases to help you scale your business in the coming year.

Day 1 - Benefits of Models and a Rules-Based Process

The Relative Strength Process

At Nasdaq Dorsey Wright, we consider Relative Strength (RS) to be one of the most important tools in our arsenal. We must position our portfolios towards those securities that possess positive Relative Strength in order to beat our benchmark performance measures. But what is Relative Strength? What does it mean for something to have positive Relative Strength? Relative Strength is simply a measure of performance compared to something else. In order to calculate the RS between two investments, we divide the closing price of Investment A by the closing price of Investment B and multiply that value by 100 to smooth the decimals. On its own, a single reading of this calculation is not particularly helpful. However, once the Relative Strength reading is plotted on a Point & Figure chart, the Relative Strength story comes alive.

Just as is the case with a Point & Figure trend chart that tracks price over time, a Relative Strength buy signal is given when a column of Xs exceeds the previous column of Xs and suggests that Investment A should be expected to outperform Investment B. Conversely, a Relative Strength sell signal occurs when a column of Os falls below the previous column of Os, suggesting that Investment A should be expected to underperform Investment B. The signal of a Relative Strength chart (buy or sell), depicts the long-term RS relationship, while the column (Xs or Os), shows where the shorter-term strength lies. One of the major benefits of this form of comparative analysis is that any two names with changing prices can be compared against one another on a Relative Strength chart.

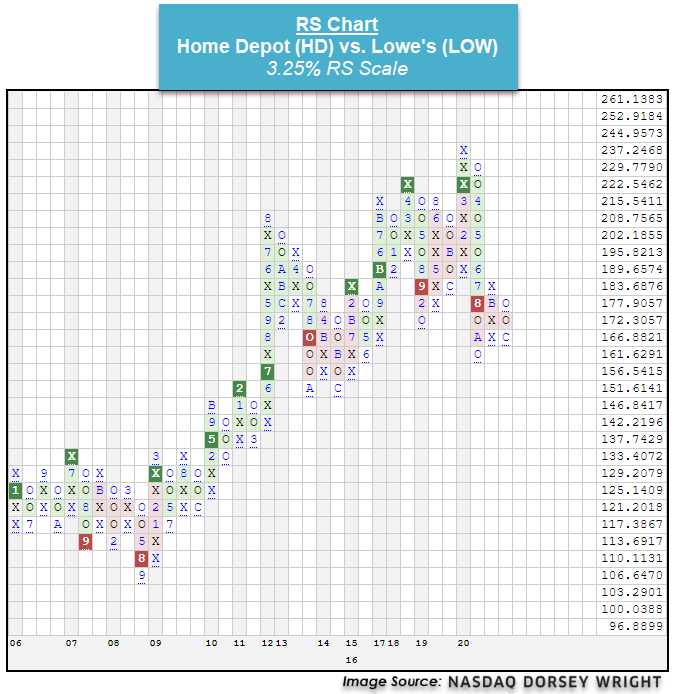

To illustrate the RS relationship, we have compared Home Depot HD and Lowe’s LOW on an RS chart utilizing a 3.25% scale. After giving a buy signal in March, the RS relationship between HD and LOW moved lower and returned to a sell signal on August 3, indicating that Lowe’s is favorable from a long-term perspective. The chart did move higher briefly in mid-November but recently reversed back down into Os on December 9. This also indicates that LOW is favorable from a near-term perspective. Since the chart moved to a sell signal on 8/3, LOW has outperformed HD with respective returns of 5.02% and -0.61% (through 12/11).

The Value of Relative Strength

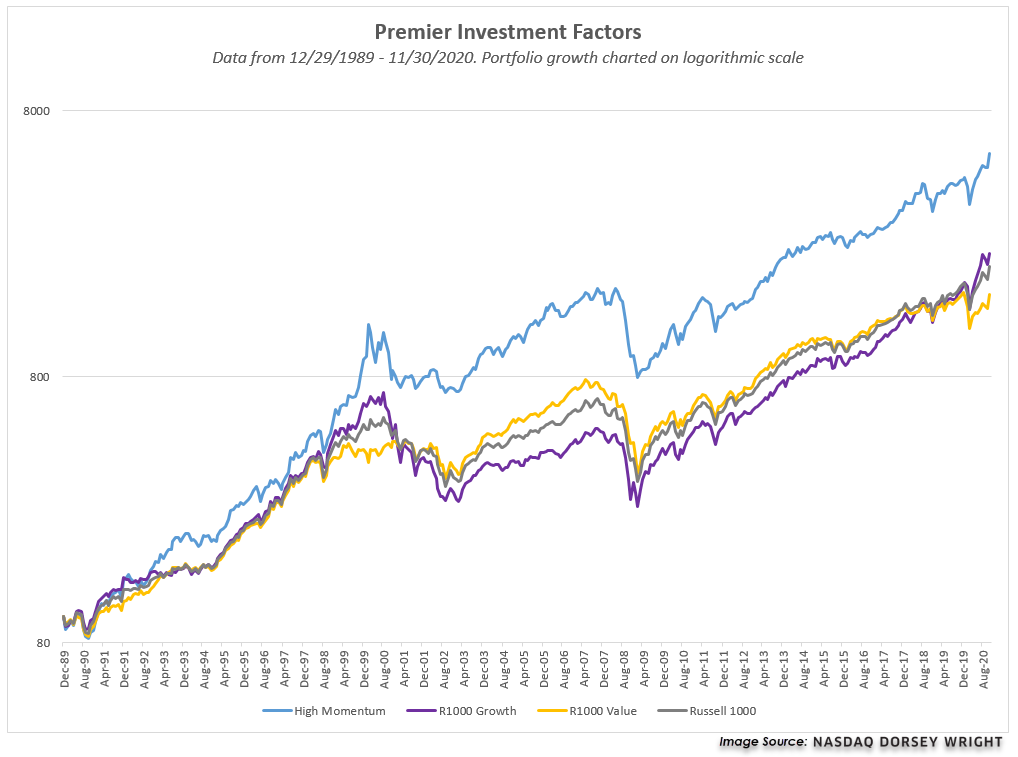

As an investment factor, Relative Strength (also known as momentum) has been shown to be a robust factor, and when used as a selection criterion, capable of delivering outperformance over the long-term. Unlike other stock selection criteria such as fundamental valuation, Relative Strength is evaluated on a purely quantitative or technical basis. As a result, RS removes subjectivity and emotion and lends itself to creating systematic, rules-based strategies for investing which are both repeatable and scalable.

There are multiple ways of measuring Relative Strength or momentum. Most of which are based on selecting the best-performing assets over a given lookback period, often six or 12 months. As mentioned above, Nasdaq Dorsey Wright’s primary method for measuring Relative Strength is based upon plotting the relative price movement of two names on a Point & Figure chart. We also track RS using percentile ranking methods, which we incorporate in our Fund Scores and through our Relative Strength ranking process used for the actively managed Systematic Relative Strength portfolios. In the case of constructing domestic equity portfolios, this typically results in owning a basket of stocks that have demonstrated positive Relative Strength, such as those that are on a buy signal (positive long-term RS) and in a column of Xs (positive short-term RS) against a market proxy like the S&P 500 SPX. As our research has found, the NDW method has managed to perform better than other methods of measuring momentum over time.

Relative Strength Expectations

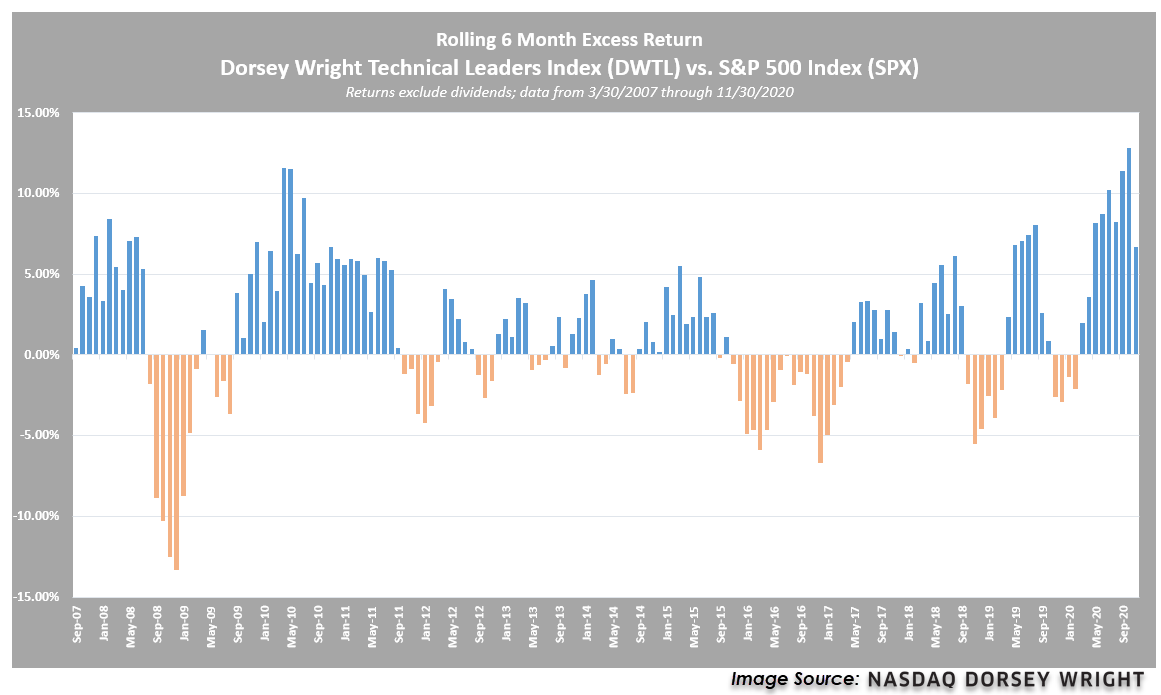

As you've heard us discuss before, every investment strategy, whether it is value investing, growth investing, fundamental, or even trend following, goes through periods of underperformance, and Relative Strength investing (RS) is no different. RS laggard periods can be uncomfortable, and when looking in the rearview mirror (early 2016 or late 2018), it serves as an unfriendly reminder of this. As you discuss your process with prospects and clients, it's important for them to understand that sometimes RS based strategies are not immune to periods of underperformance, however, we have found that the RS has tended to rebound out of these laggard periods, providing, at times, consistent and robust returns.

As is the case with any investment factor, Relative Strength is not a guarantee. It will not provide outperformance every day, week, month, quarter, or year; nor is that what it is designed to do. It is not designed to get you in at the bottom and get you out at the top. Instead, it is designed to allow you to participate in the “meat” of the move. It will force you to remain invested in strong trends and themes, even if your gut may be telling you the ride is over. Just as importantly, it will give you an indication to move to the sidelines when those trends do in fact come to an end.

A simple yet effective picture to help you set expectations is the "Relative Strength cycle" graph we use in various presentations. It shows the rolling six-month excess return of the Dorsey Wright Technical Leaders Index DWTL versus the S&P 500 Index SPX. Recall that the DWTL is an index that is designed to select 100 stocks on a quarterly basis that exhibit high RS within a universe of 1,000 stocks, so it provides a "proxy" for a Relative Strength strategy. Going back to March 2007, you can see how there are periods where DWTL, or Relative Strength, underperforms, but it's often followed by a strong rebound. The periods where it underperforms are often around market bottoms as well as choppy market environments where most Relative Strength and trend following strategies struggle. There is no doubt underperformance can be uncomfortable, and while not common, it is not unprecedented. However, it is also important to stress that these bouts of underperformance often present great opportunities. As new leadership trends rise to the top, these strategies tend to rebound up from a trough in the RS cycle.

Everyone has an ideal plan or vision that they THINK or HOPE will happen, but when reality kicks in, things can suddenly go awry. In order to be a successful investor (or advisor), you most certainly don’t have to be perfect. But you do need to have a plan that will act as your guide, telling you when to focus on wealth accumulation versus wealth preservation. This is where our rules-based, Relative Strength strategies come into play. Whether you're using the First Trust Focus Five Model, the moderate DALI Tactical Tilt Strategy, or the ESG Top 20 stock model in your portfolio, the answers to the following questions remain the same. Will we catch the exact top of the market and get out using RS? No. Will we catch the exact bottom to get back in? No. Will there be times the portfolio is down? Absolutely. Will the portfolio be positioned to adapt to and take advantage of major themes in leadership? Yes.

Finally, the overall goal of these relative strength strategies is to help us navigate the financial waters – whether the seas are calm or choppy – so that one day we can arrive at our end destination. Those without a strategy for knowing when to be invested and when to wait on the sidelines until getting the ball back have a high probability of finding themselves shipwrecked on a deserted island. The small changes made during the course are at first imperceptible, but down the final road, as you are making your way towards your final destination, those small changes add up and can make the difference in arriving in one piece versus getting stuck in the storm. While we'll never know what the future holds, we can be confident using a rules-based, emotionless strategy that will position us towards those names that are most likely to outperform in the future.