Each year, we produce 12 articles throughout the last few weeks of the year, all revolving around one central concept. This year, all 12 articles will revolve around the topic of "Enhancing Your Process With Scalable Customization in 2021. Today we are creating Custom FSM Models via the Model Builder tool.

Over the last decade, the advisory business has continued to evolve rapidly with the growing trends of lower fees and increased automation. With the influx of low-cost index funds and Robo-advisors offering nearly-free financial planning, investors can now gain beta market exposure at rock-bottom prices without ever setting foot in an advisor's office. The upshot is that it is now more challenging than ever for you as a traditional financial advisor to justify your fee and grow your client base. That said, you must scale your process and sharpen your value proposition as much as possible. To help you do just that, this year's 12 Days of Christmas Series, "Enhancing Your Process With Scalable Customization in 2021," will navigate you through the benefits, use/implementation, and customization of rules-based, Relative Strength-driven guided model portfolios. Additionally, this series will highlight the NDW Model Builder Tool's new features, providing relevant use-cases to help you scale your business in the coming year.

Day 1 - Benefits of Models and a Rules-Based Process

Day 2 - The Relative Strength Process

Day 3 - Model Foundations - The Relative Strength Matrix

Day 4 - Model Foundations – Technical Attributes and the Fund Score Method (FSM)

Day 5 - Model Foundations - Matrix Models

Day 6 - Model Foundations - FSM Models

Day 7 – DALI and Tactical Allocation Models

Day 8 - Custom Model Builder - Static Allocation

Day 9 - Custom Modeler Part 2 - Matrix Model Builder

Thus far, our 12 Days of Christmas Series, “Enhancing Your Process with Scalable Customization in 2021,” has covered the background methodologies of the relative strength (RS) matrix, the Fund Score Method, and how these tools are utilized in the premade models available on the NDW research platform. We have also learned about the using Custom Model Builder tool to create custom static allocations and matrix models. Today, we will continue with the Custom Model Builder focusing on custom FSM models.

The basic layout of the FSM Model Builder is similar to the static allocation and matrix model builder we previously covered. As you begin by setting your universe, then apply your parameters and finally test the model. Because it is based upon the Fund Score Method, which is designed for ETFs and mutual funds, the FSM Model Builder can be especially useful for creating a model for a client's 401k or similar plan that has a set menu of investment options.

The FSM Modeler is accessed through the same page as the static allocation and matrix options, which is found under Models & Products > Custom Models. After clicking the “Create New Model” button, you would then select FSM and click Next. Keep in mind that you should make use of the “Back” and “Next” buttons in the upper right-hand corner of the Model Builder tool instead of the previous/forward buttons on your browser as you make your way through the workflow.

Step 1 – Creating a Universe and Strategy.

The process for creating a custom FSM model is very similar to that of the custom matrix model we reviewed yesterday with the primary difference being that the model inventory will be evaluated based upon fund score as opposed to matrix rank.

Once you have selected FSM as the model type you will then need to select your universe. This is one area in which creating a custom FSM model differs from creating a custom matrix model as the universe of a matrix model is pre-determined by the securities included in the matrix. In addition to adding securities manually, you can use another FSM-based tool, TeamBuilder, to help select the model universe. We will outline this process later.

Once you have selected your universe, you then move on to creating your strategy. You can select from four premade strategy templates or create your own. The four premade strategies consist of two strategies with two holdings, one evaluated monthly and one evaluated on a seasonal quarter basis (seasonal quarters lag calendar quarters by one month), and two five holding strategies with the same evaluation intervals. Just as with the matrix models, you then select which buy and sell thresholds the model will use, the difference being that instead of using matrix rank, the universe will be ranked by fund score (if you’ve included individual equities in your universe they will be ranked based on their technical attribute rating.)

The target number of holdings dictates how many names the model will seek to hold upon each evaluation. This could differ from the buy criteria, which allows you to pull more names than your target number of holdings into the Overlays page (next) for further filtering capabilities. Keep in mind that the buy criteria either needs to be the same as your target number of holdings or larger if you want to utilize further filtering. The sell criteria selection dictates at what threshold the model will move out of a name in favor of the next highest-ranked name that the model does not already own. Similar to the matrix models, you can select to buy and sell securities based on their rank, i.e., fifth, or on their percentile rank within the universe.

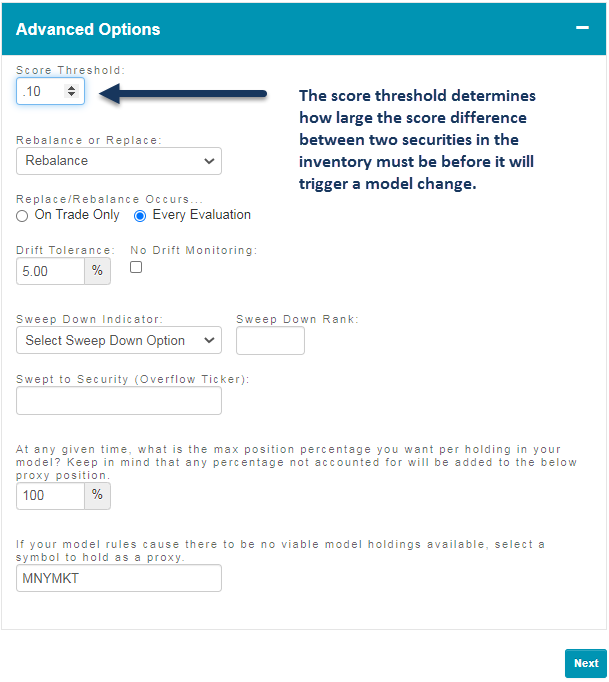

Just as with the matrix modeler, at the bottom of the Strategy page, you can use the Advanced Options to edit the guidelines of your evaluation or to designate a member of the model inventory as a Sweep Down Indicator. If the Sweep Down Indicator rises to a particular level you set, the model will begin to move allocation to another security, which does not have to be a name included in the model inventory. The Sweep Down Indicator is designed to be a risk-management tool, allowing you to move allocation from any names the Sweep Down Indicator beats to another security (e.g., a money market fund). This is similar to one of the risk-management tools employed by each of the premade FSM models available on the platform, as each of those models includes our US Money Market Proxy MNYMKT in the model inventory. This proxy is then scored and ranked in the same fashion as a normal fund.

One advanced option that is different in the FSM modeler is the “Score Threshold.” This option determines how large the difference between the scores of two securities must be before it will trigger a model change. For example, if our score threshold was set to 0.10 and Security A had a score of 3.02, while one of the current holdings, Security B has a score of 3.00, there would be no change as the 0.02 difference between the two is less than the 0.10 threshold.

Step 2 – Applying Overlays

The optional overlays for an FSM model function the same way they do for a matrix model; you have the option to re-rank the buy list by volatility, yield, or rRisk. You can also apply filters according to similar parameters as well as sector constraints. This keeps the FSM ranking intact but skips any name that does not meet your criteria. The sector constraints allow us to set a maximum weighting that any single sector can have in the model portfolio. If we did not want more than 20% of the model allocated to one sector, setting the sector restraint will cause the model to skip any lower-ranked names in a particular sector after that sector has hit its cap. The model would then purchase names from other sectors that still fit the buy criteria until the target number of holdings is met.

Step 3 - Model Previews & Saving a Model

Previewing and saving a custom FSM model is the same as for a matrix model. After ensuring that the model criteria you have selected is correct, in addition to finalizing the model name and symbol, you can view a preview of the backtested model results. Remember to make sure that your benchmark fits the strategy you are looking to test. There is a variety of price return and total return benchmarks available for selection. You also have the capability to use any symbol housed on the NDW system as your benchmark, which includes any custom models you may have created.

The preview page will include the same data that we discussed in last Thursday’s feature, in addition to information on the trades associated with the backtest. You can also download the trade history to a CSV file. The “Exit Preview” button will allow you to go back and make further edits to the model prior to saving it. If you are comfortable with the results of the model, you can click on the green “Save Model” button to save it on the system.

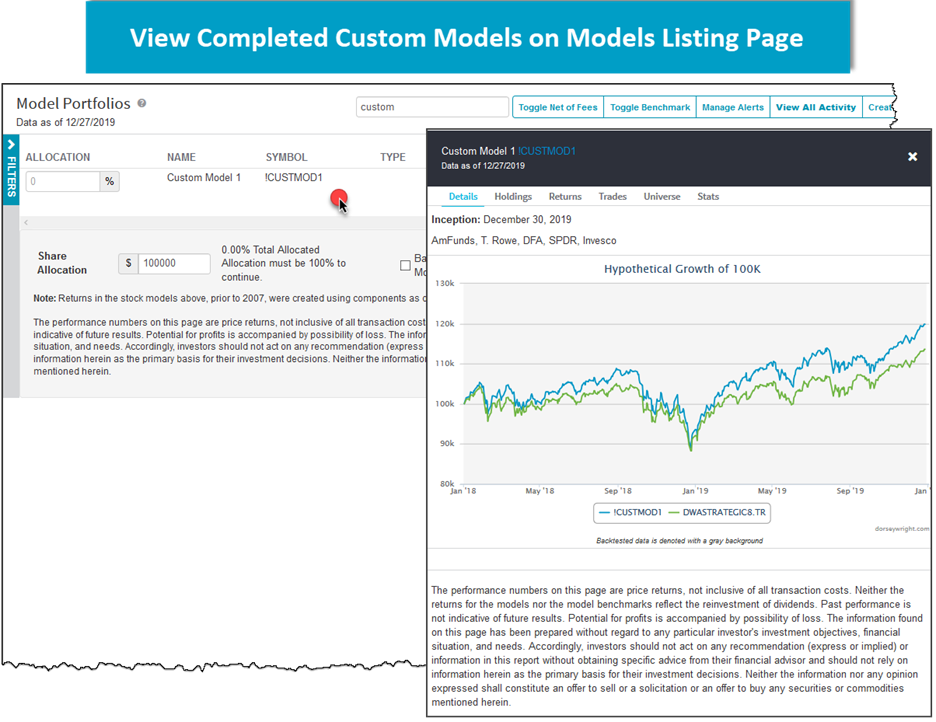

After saving your model, it can be accessed under the Custom Models page, or through the Custom Models filter on the regular Models Listing page. One final point to note is that saving a new model will not automatically turn on alerts for that strategy; you will need to go into the Model Portfolios page and click on the bell icon for the model to be notified of any potential changes.

Appendix: Creating a Universe with TeamBuilder

As we briefly mentioned above, in addition to creating a model universe within the custom modeler, you can also use TeamBuilder tool. TeamBuilder is a simple and efficient way to build a model inventory of your preferred investment vehicles as it allows you to quickly and efficiently assess mutual fund families, ETF groups/providers, portfolios, and/or custom symbols relative to each other and the broader market. We will ll work through a sample workflow process below, building a specific team from a curated inventory and then using that selection in the Custom Model Service.

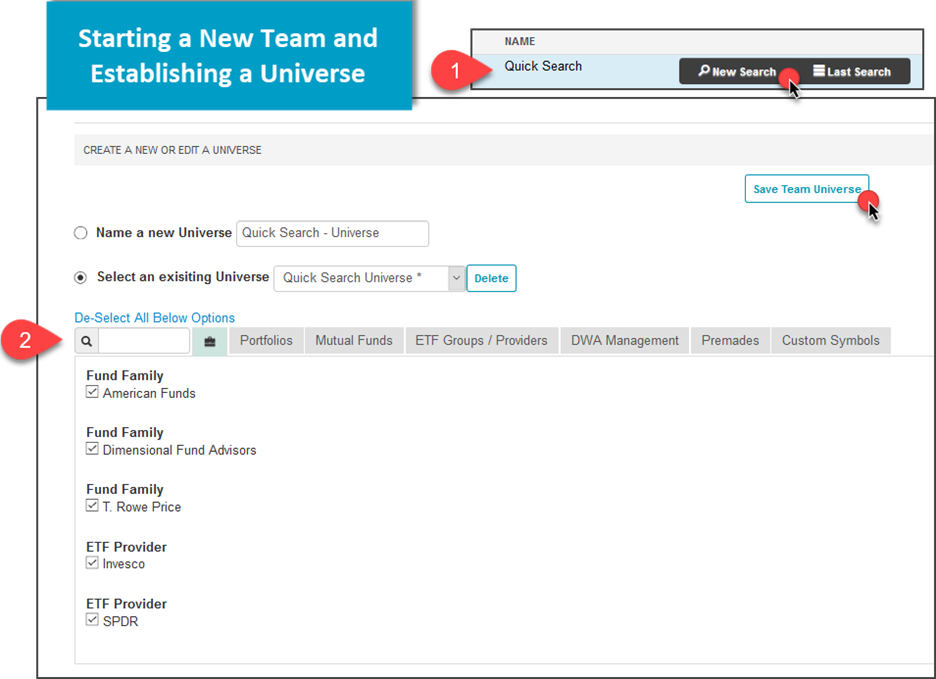

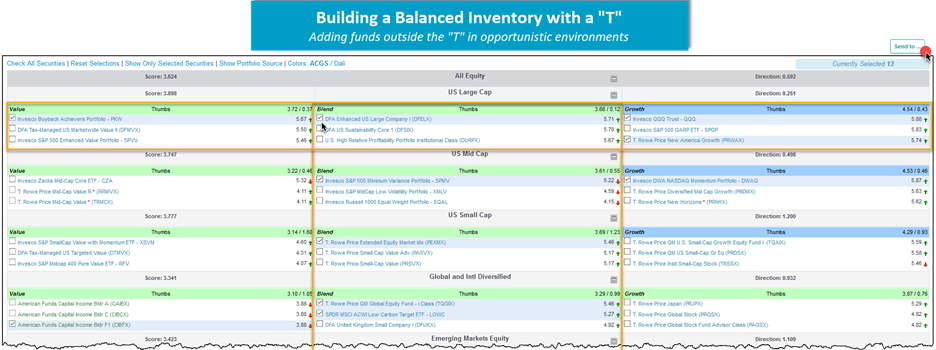

First, we will start a new Team by selecting "New Search" from the Team Builder menu. From here, we can establish a team universe. For our example, we will use American Funds, Dimensional Fund Advisors, and T. Rowe Price from the Mutual Funds selection tab. Additionally, we will include State Street (SPDR) and Invesco ETFs from the ETF Groups/Providers tab. Once checked, click "Save Team Universe".

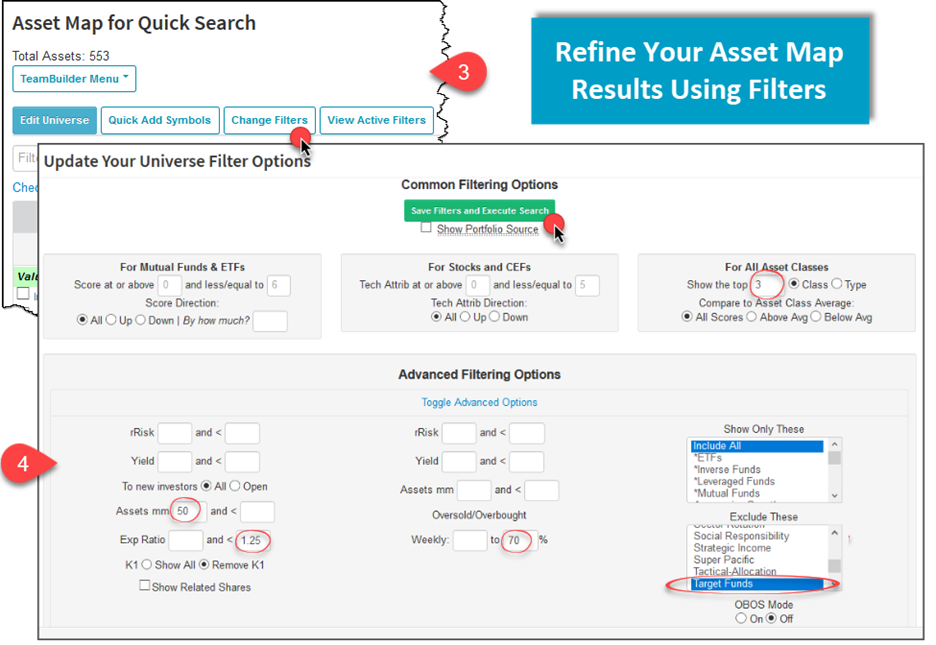

Next, we will use the "Change Filters" button at the top of the subsequent page to refine our Asset Map filters, limiting search results to the top 3 funds in each asset class. We also removed funds that were heavily overbought, had expense ratios above 1.25%, and had assets under management less than $50 MM. Additionally, we excluded target-date products.

From the Asset Map screen, we can select assets for our custom model. For a balanced inventory, consider examining the Asset Map in a “T” (displayed below) fashion as you work your way through the style box for equities and fixed income asset classes. The "T" formation is used to describe the shape of the focus on core-based investments within a traditionally-referenced size and style box. The "T" revolves around a blended allocation, which can offer a smoother ride relative to a concentrated style-box focus toward growth or value and can be used as the foundation for your investment selection process. Outside of the "T", you may choose to add funds in green (3-4 fund score) or blue (4+ fund score) groups that offer opportunistic advantages.

Once we've selected our inventory, we can send the funds to a portfolio using the NDW Shuttle Tool ("Send To") for an easy import into our custom model. Next, we'll navigate to the Custom Models Control Panel by clicking on the Models & Products tab, choosing "Custom Models". Select "Create New Model", and fill out the required inputs. For this model, we will choose an annual rebalance frequency. By selecting "Add Assets" on the top of the Universe menu of the tool, we can search for and add our previously-selected tickers from Team Builder. Moving through the criteria selection process, we encounter the ability to establish maximum allowable "Drifts", or deviations from target allocation before a forced rebalance, as well as the ability to toggle our custom model benchmark and set a theoretical advisory fee. Note that the start date of your model backtest will be limited to the max common available date among your selected inventory.

From here, the modeler offers the ability to preview your model, adjusting assumptions such as the benchmark and advisory fee. Once your model concept has been tested to your standards, you can select "Create Model" to finalize your custom buy and hold strategy. Your new model and all of the associated statistics are now found on the models listing page under the "Custom Models" filter, in the same fashion as the guided NDW models provided for you.