Webinar: DWA International Equity & Currency Update

Join us Wednesday, December 21st at 2:00 p.m. ET for a live webcast to discuss the state of the currency market, the trends that are impacting international equity returns, and the Deutsche Currency Hedged ETF Models that are available on the DWA Research Platform. Hosted with Deutsche ETFs, we will discuss the developments within the currency and international market from a technical perspective, while Deutsche ETFs will provide fundamental insights pertaining to this segment of the market. Deutsche ETFs offers investors currency hedged and unhedged equity ETFs, covering almost every corner of the global marketplace.

DWA International Equity & Currency Update:

- Date: Wednesday, December 21st, 2016

- Time: 2:00 p.m. ET

- Speakers: Ben Jones, Senior Analyst, DWA & Robert Bush, ETF Strategist, Deutsche Asset Management

- Register here.

Registration is required and the password for the event is pnfpnf.

Rescheduled Webinar: Introducing the BMO Elkhorn DWA MLP SelectTM Index ETN

Join us Thursday, December 22nd at 12:00 pm ET for a live webcast as we discuss the upcoming BMO Elkhorn DWA MLP SelectTM Index ETN (BMLP), the first Dorsey Wright MLP strategy tracking the DWA MLP SelectTM Index. We will discuss both the advantages of the ETN structure as it relates to MLP exposure and why it's particularly appropriate for Dorsey Wright's MLP solution.

Learn the methodology behind the DWA MLP SelectTM Index, which employs a rules-based rotation in an effort to deliver positive excess returns versus its peers, while currently offering an index yield of 7.42%. Registration is required and the password for the webinar is pnfpnf.

- Date: Thursday, December 22nd, 2016

- Time: 12:00 PM ET

- Register Now

*Note this webinar was originally scheduled for Tuesday, December 13th at 12:00 p.m. ET. Those already registered do not need to re-register.

Here at Dorsey Wright, one of the patterns that we follow is the “big base breakout.” Recall that in all cases, the "big base breakout" involves two stages, initially a consolidation phase of horizontal movement within a trading range, and then a show of strength by a stock breaking out of this trading range. To best describe this chart pattern we will begin by breaking down the literal meaning of the term "big base." "Big base" refers to the consolidation stage of a chart pattern whereby a security will trade in a horizontal fashion for some length of time, along the way developing both an area of support below, as well as resistance overhead. The latter half of the term, "breakout", refers to the action of the security "breaking" out of this consolidation phase. A "breakout" is a move through significant resistance or support. Obviously a move through resistance is a positive signal here, whereas a violation of support would be seen as a sign of weakness in a particular security.

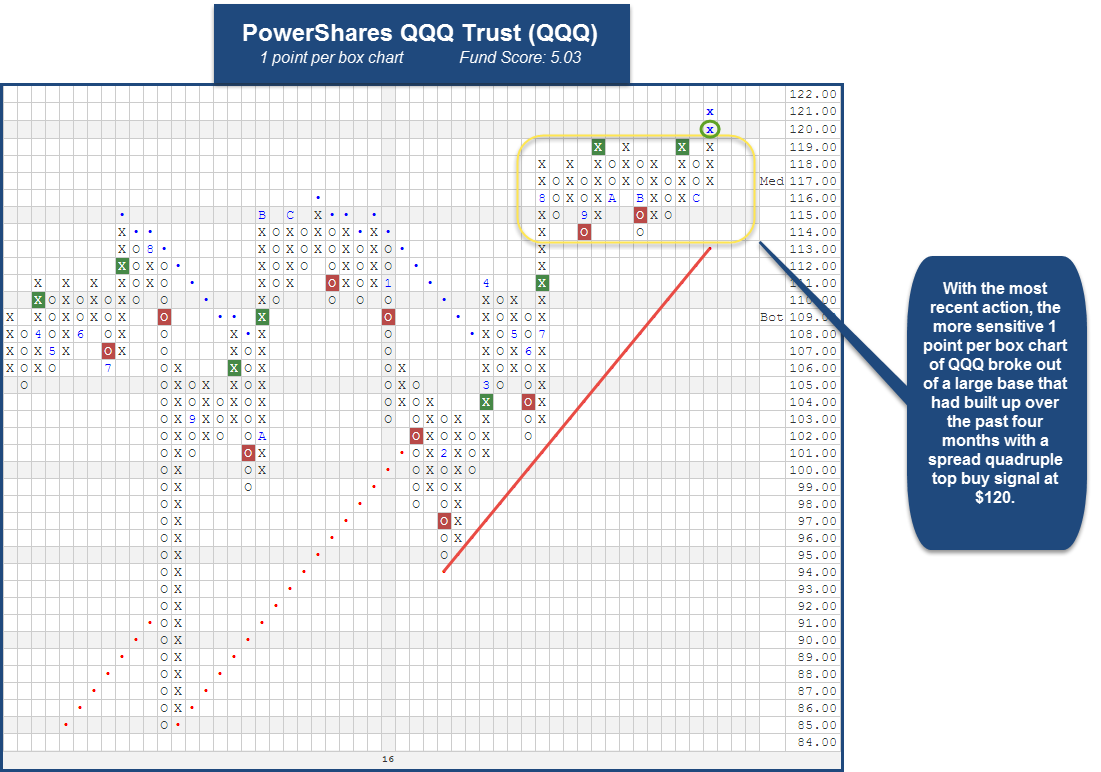

One noteworthy big base breakout that caught our attention comes from the more sensitive 1 point per box chart of the PowerShares QQQ Trust QQQ. In the image below, we find that with the most recent action, QQQ managed to breakout of a base it had maintained over the course of the last four months or so. QQQ completed a spread quadruple top buy signal at $120 and continued higher to $121 intraday, a new all-time high. QQQ has a robust fund score of 5.03, speaking to its strong trending and relative strength characteristics. QQQ is actionable here with significant support at $114.

- The Restaurant ETF BITE, which was launched late 2015 is set to close on December 22nd, 2016. It currently has less than $1.5 million in assets. The fund has one direct competitor, the USCF Restaurant Leaders ETF (MENU), which launched in November.

- The WEAR ETF (WEAR) has been launched by Exchange Traded Concepts and is listed on the Bats exchange. WEAR covers wearable technology and seeks to track an index provided by EQM Indexes. The fund comes with an expense ratio of 0.85%.

- The two remaining equity ETFs from ETF Securities are closing down. The ETFS Zacks Earnings Large-Cap U.S. Index Fund ZLRG and ETFS Zacks Earnings Small-Cap U.S. Index Fund ZSML will both trade up until January 23, 2017. These funds were not able to gather a significant amount of assets and therefore will be closing. ETFs Securities shut down two other funds in November.

We continue our annual "12 Days of Christmas" series today with the next installment of “Themes to Know for 2017." When we look at where the last 12 months has left us with respect to our indicators, key charts, and other relationships, there are several themes we feel are particularly noteworthy and are worth exploring in this year's series of features. In case you missed it, you can review the article for Days 1 & 2 using the links below:

Day 1: "Sector Themes: The Rise of the Financials Sector"

Day 2: "Sector Themes: The Rise of the Energy & Industrial Sectors"

Day 3 - The US Dollar Study

Today we wanted to spend some time on the US Dollar to provide you with an updated view on its technical picture and some historical context for its price movements. We find now is a very important time to delve into the behavior of the "greenback," as the US Dollar’s recent improvement has been among the more notable positive developments and is a trend we need to be aware of as we head into 2017. On a year-to-date basis the US Dollar has gained 2.37% (thru 12/12/2016), but much of that performance has come during the fourth quarter, as the US Dollar has gained 5.80% since the start of October. This action has pushed the greenback to reach levels that haven’t been seen since April of 2003. This dollar has been bullish since May 4, 2011, the start of the current "rising dollar environment," making it now the longest rising dollar environment since we have been tracking this currency. With that said, let's take a look at the nearer term picture of Dollar, and then we will expand our view and analysis.

What is the US Dollar Index (DX/Y)?

To begin we should first explain that the US Dollar Index DX/Y is priced in terms of a weighted basket of major foreign currencies. When we refer to moves in "the dollar," it is this index to which we are referring. The US Dollar Index is a geometrically-averaged calculation of six currencies weighted against the US dollar, which has been in existence since 1973. Futures Contracts were listed on the Index back in 1985 and only one major reconstitution of the Index has taken place since that time, a move to include the Euro.

Today the US Dollar Index contains six component currencies, which are "trade-weighted": the Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona and Swiss Franc. Prior to the formation of the Euro FX, the US Dollar Index contained ten currencies, including as well the West German Mark, French Franc, Italian Lira, Dutch Guilder and Belgium Franc. Today the currency weights contributing to the pricing of this Index are as follows:

Currency Weights:

- Euro = 57.6%

- Canadian Dollar = 9.1%

- Japanese Yen = 13.6%

- Sweden Krona = 4.2%

- British Pound = 11.9%

- Swiss Franc = 3.6%

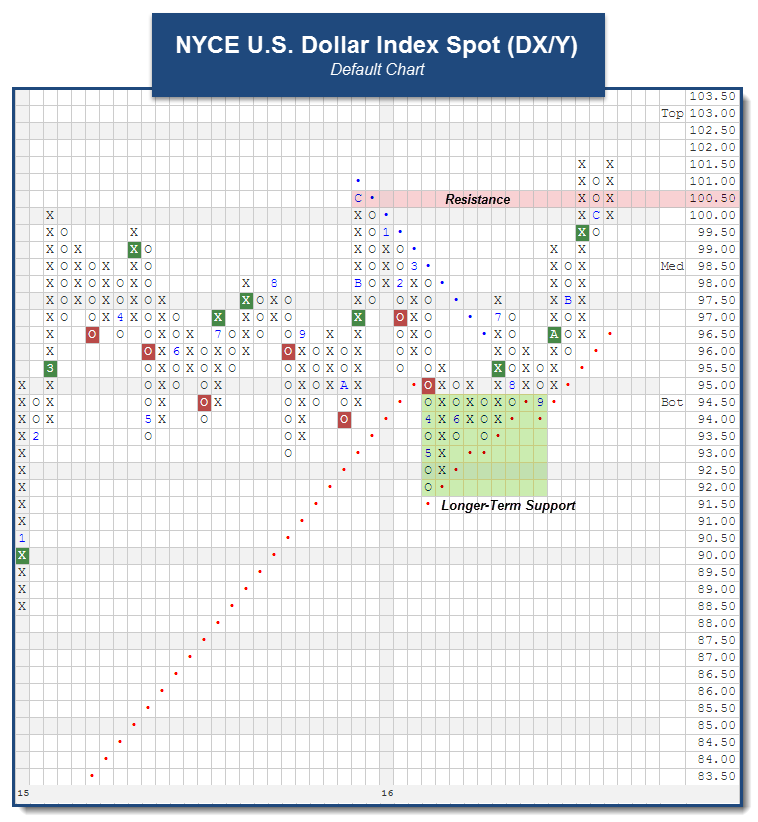

Although we continue to find ourselves in a rising dollar environment, anyone who has been following the US Dollar Index DX/Y, knows that not much rising was seen between March of 2015 and November 2016. After rallying up to the $100 level in March 2015, the Dollar consolidated between $93 and $100 for much of the year. We eventually witnessed the Index better its highs in December by moving up to the $100.50 level, but this was shortly followed by a roughly 8.5% drawdown during the first part of 2016, which brought the currency into a negative trend. After finding support at $92, the Dollar rallied to move back to a near-term buy signal in June and the trend shifted back to positive in July. As the currency has continued to show improvement, we have seen it rally to up to the $101.50 level, which cleared resistance at $100.50 and made for a 52-week high. Currently, we continue to trade near these highs, and this has brought us to levels we haven’t seen on the chart since April of 2003. Overall, the new high continues a strong uptrend in the Dollar. From here, initial support can be found at $99.50 and at the bullish support line at $97. Additionally, multiple levels of support also exist below the trend line, the most notable being at $92, the May 2016 low. As the US Dollar continues in its positive run, it is worth understanding the historical implications of a rising dollar, which we discuss in further detail below.

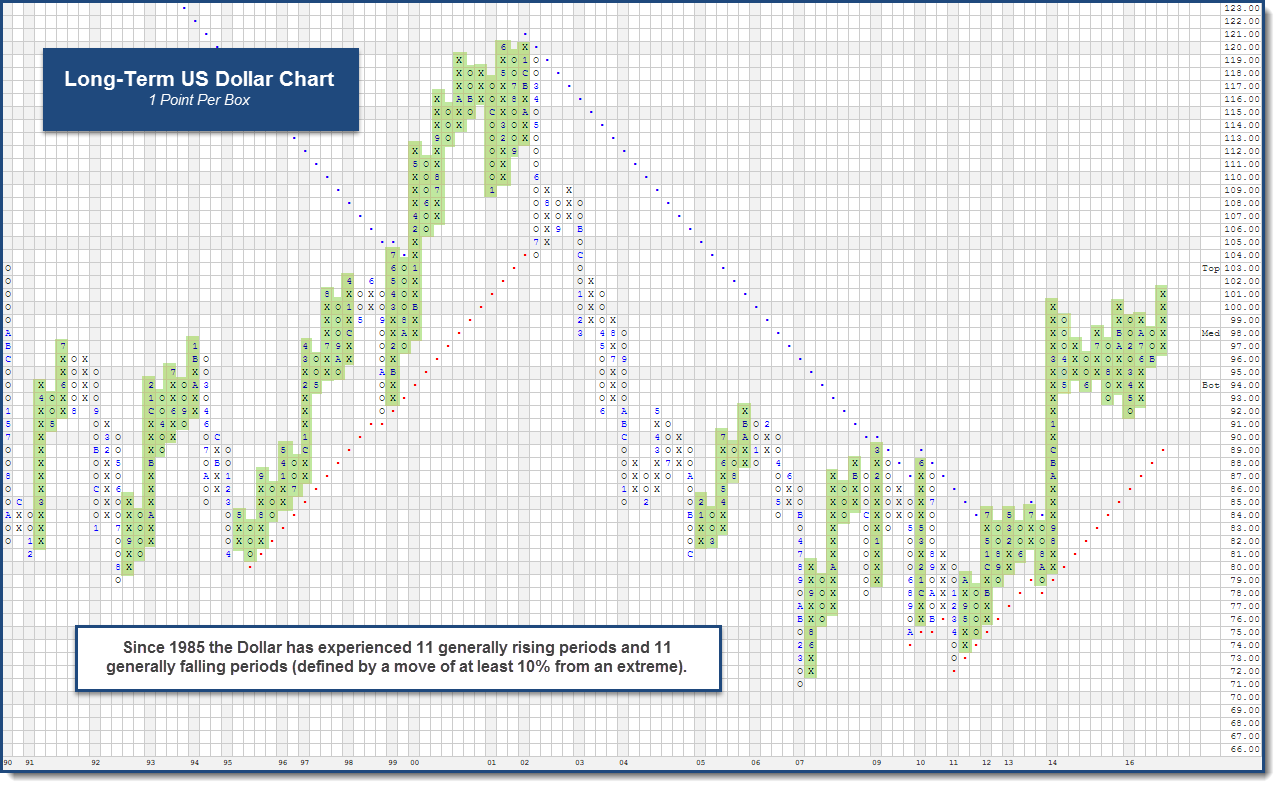

Our data on this Index goes back to the point in time when a liquid market was created for this calculation of the Dollar with the inception of futures contracts on the US Dollar Index (in 1985). Since that time we have seen many significant moves for the Dollar, and we would like to focus on identifying any meaningful correlation between other major asset classes and moves in the underlying currency markets. In other words, do some assets perform better with consistency in a rising dollar market, and vice versa?

Traditional measures of correlation would look at daily or monthly returns of some security, the Dollar for example, and then match up the returns of something else (a bond index perhaps) in the same manner. If bonds were generally up during the same sessions that the Dollar posted gains, they would be considered positively correlated. If bonds were generally down during days (or months) when the Dollar was up, they would be considered inversely correlated. Such data is available elsewhere and didn't truly provide the type of research we wanted to provide to you. Before we began to study this we set out a definition for "rising dollar market", versus a "falling dollar market."

Study Parameters:

- Rising Dollar Market: Any move of at least 10% from a low constitutes a new "rising dollar market." The beginning of this trend is established at the low watermark and the trend remains in force until a correction of at least 10% occurs, at which point the peak of that rally then marks the end of the rising trend in the dollar. This represents a "trough to peak" move in the dollar, and that time period is what we use to qualify a rising dollar market.

- Falling Dollar Market: Any decline of at least 10% in the dollar index from a peak begins a "falling dollar market". The beginning of this trend is established at the high watermark and the trend remains in force until a rally of at least 10% occurs off a low, at which point the trough of that decline marks the end of the falling trend in the dollar. This represents a "peak to trough" move in the dollar, and the time period within is what we used to qualify a falling dollar market.

As the chart above shows, there have been various markets for the US Dollar over the last 31 years. In sum, there have been a total of 11 rising dollar markets and 11 falling dollar markets (including the current "rising" stint, which began on May 4th, 2011) using our basic criteria. Interestingly, the duration of each (rising or falling) has averaged 514 days during the study period and resulted in moves of about +/- 20% in each direction (keep in mind that the manner in which these trends were calculated means that no trend could have resulted in a move materially less than 10% in either direction). What is worth noting is that the current "rising dollar" period has now become the longest on record, running at +2,000 days so far. This has helped the average number of days for a rising dollar to push up to 582. Moreover, the return for DX/Y during the rising environment is well above the average +21%, coming in at +37.38% during this recent rising dollar period (through 12/6/2016). Below we offer you a recap of all the historical rising and falling dollar environments, and associated returns for DX/Y, in addition to other pertinent benchmarks.

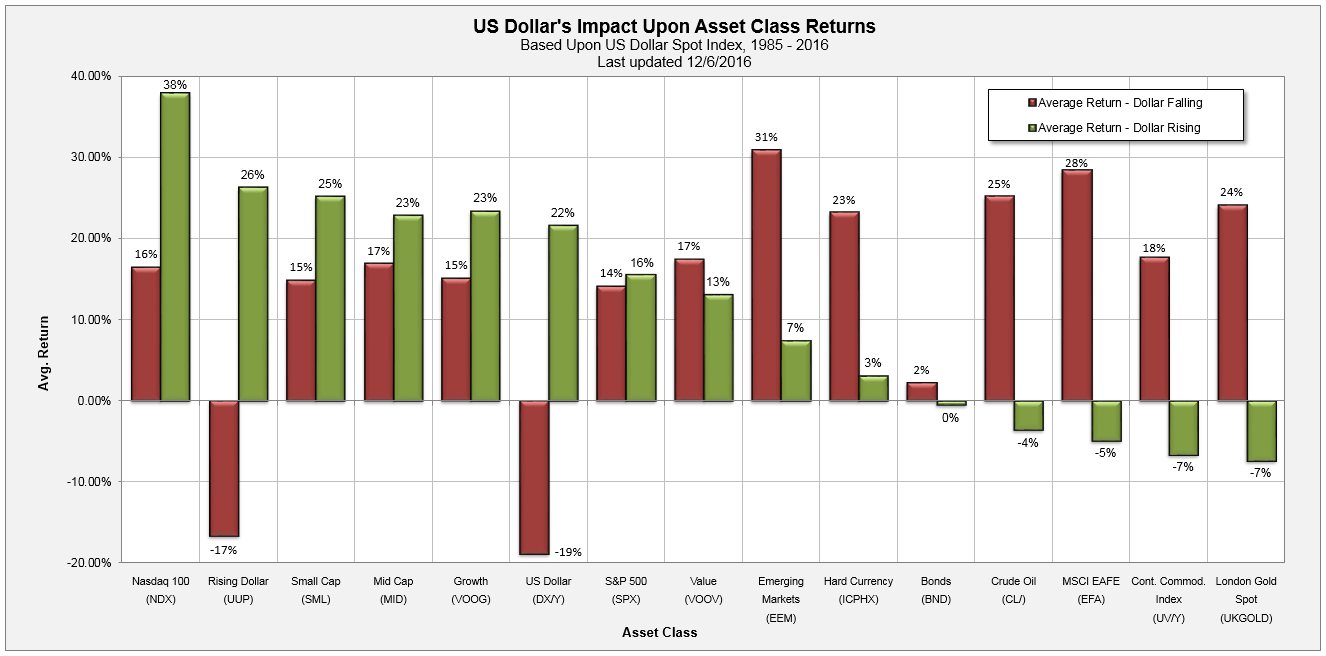

Having identified "rising dollar" and "falling dollar" environments going back to 1985, the next step was to look at various asset classes and their respective performance during these markets. To accomplish this we chose investment vehicles representing Domestic Equity, International Equity, Emerging Markets, Domestic Fixed Income, Foreign Currency, Various Equity Styles (Large, Mid, Small, Value, and Growth), and Commodities. The results were interesting as many assets did show meaningful performance biases during either rising or falling dollar markets.

The red bars in the graphics below represent average performance during all falling dollar markets, while the green bars represent average performance by that same asset class during all rising dollar markets. For some assets we did not have data going back to 1985, so returns reflect the average since the time at which we had data (those dates are denoted). For example, based on the graphic below we can see that the S&P 500 Index SPX has performed well in both rising dollar and falling dollar markets, and has averaged positive absolute returns in both during our study period. Generally speaking, in a rising dollar market, Small Cap US stocks, Mid Cap US stocks, and Growth stocks (though not always Value) tend to do quite well. Interestingly, it has been the Nasdaq 100 NDX that has produced the greatest gains during a rising dollar period with an average return of +38%. Meanwhile, strong asset classes during falling dollar periods include Non-US Equities and Commodity indices, as well as Gold. Emerging Markets EEM had an average return of 31% during falling dollar periods, followed closely by Developed (International) Markets EFA, which gained 28%.

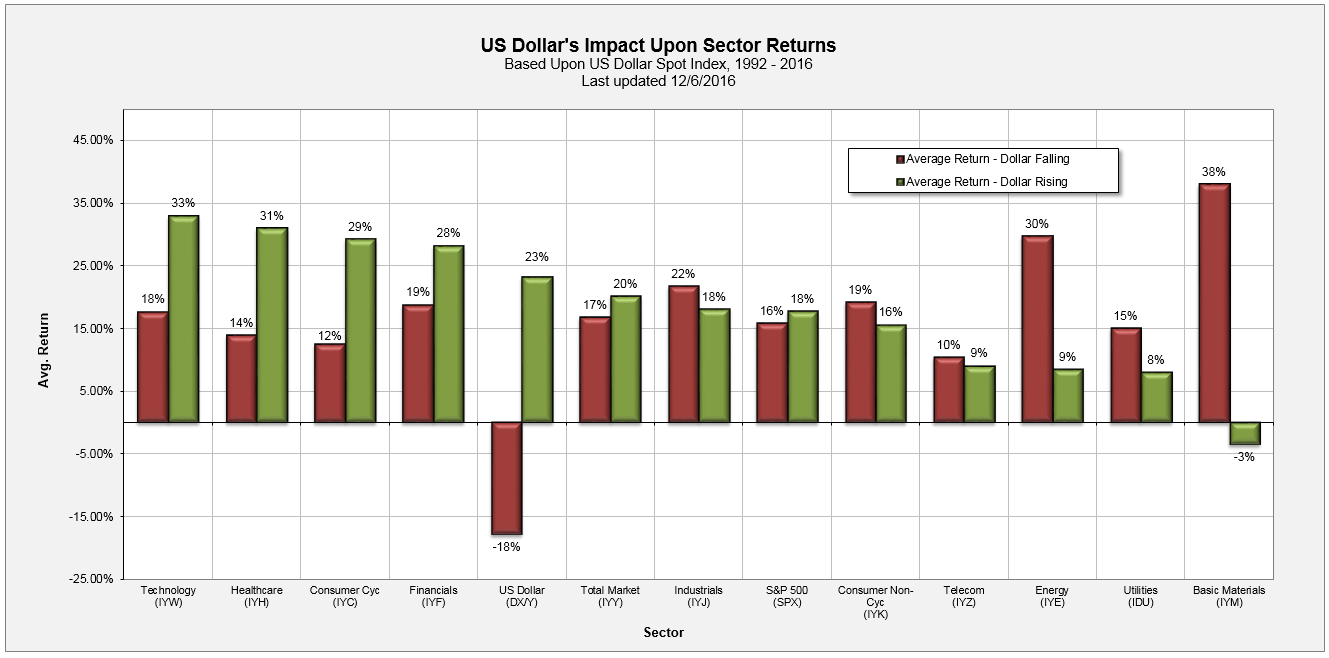

We found the results of this initial study interesting enough to add another layer to it, looking specifically within the US Equity market, but sub-dividing it based upon broad sectors. We had to adjust the time frame of the study a bit based upon data availability, but we have sector index data beginning in 1992, affording ample history for a meaningful data sample. Again, our study includes the old 10 broad market sectors (Basic Materials, Consumer Cyclicals, Consumer Non-Cyclicals, Energy, Financials, Healthcare, Industrials, Technology, Telecommunications, and Utilities). The results of the study are found below, and the red bars represent average performance during falling dollar markets, while the green bars represent average performance by that sector during rising dollar markets. Interestingly, four of the sectors performed better in rising dollar markets, while six performed better in falling dollar markets. Of note, the Basic Materials sector is the best performing group, by far, when the dollar is falling; and also the only sector to post negative absolute returns during rising dollar environments! Energy is the other big beneficiary during a falling dollar market. Conversely, when the dollar is rising, Technology, Financials, Consumer Cyclical, and Healthcare are historically the notable winners. One last point on the sector performance is that Energy has historically held up in a rising dollar market, despite its connections to Commodities, having posted returns that slightly lag the market.

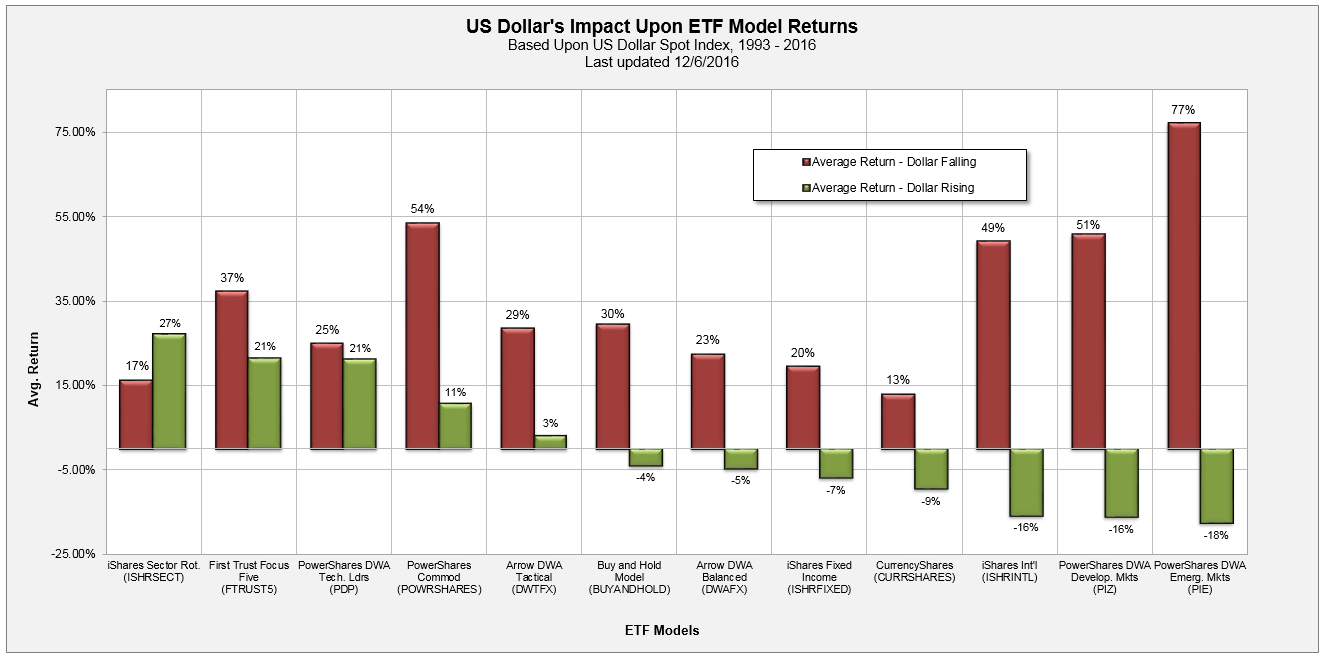

We also examined a handful of Guided ETF Models and DWA products during both rising dollar and falling dollar markets. The performance data was based upon the US Dollar Spot Index and data from the ETF Models and DWA Products (using back-tested data prior to the product or model's inception date). To some extent, much like the Asset Class returns examined above, the ETF models and products produced similar returns per asset class during rising and falling dollar markets. As it turns out the PowerShares DWA Emerging Market Momentum ETF PIE was the best performing asset during a falling dollar market along with the other assets tied to Commodities and International Equities. Interestingly enough, all models and products examined below produced double digit returns during falling dollar environments, but the majority of outperformance came from Commodity and Non-US Equity related exposure. During rising dollar markets, US Equities outperformed as the iShares Sector Rotation Model ISHRSECT was the best performing model below, up an average of 27%. The PowerShares Commodity Model POWRSHARES produced positive returns, along with the First Trust Focus Five Model FTRUST5, PowerShares DWA Momentum ETF PDP, and the Arrow DWA Tactical Fund DWTFX. Notice how International Equities underperformed the most during rising dollar markets as the iShares International Model ISHRINTL, PowerShares DWA Developed Markets Momentum ETF PIZ, and PIE were in double digit, negative territory during periods where the dollar was rising. As well, during rising dollar environments, which often encompass rising interest rate periods, the iShares Fixed Income Model ISHRFIXED was down an average of -7%.

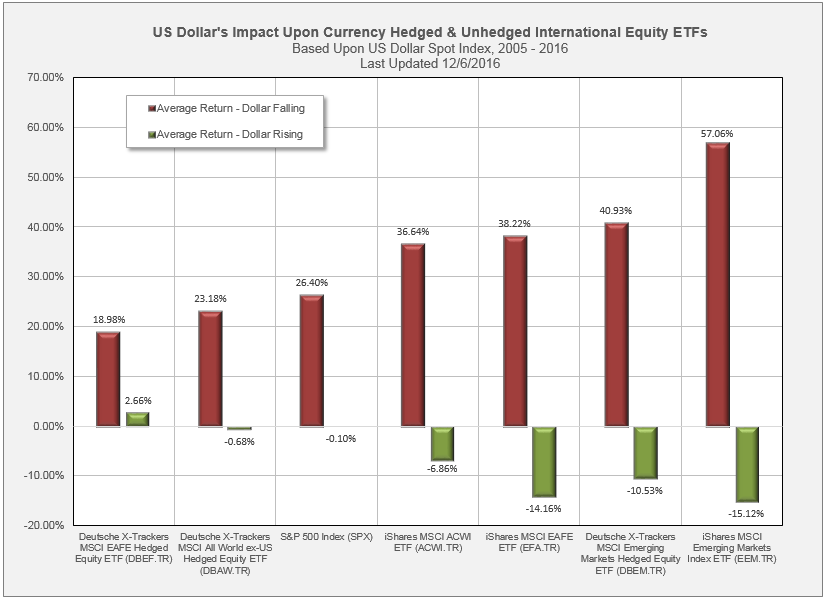

As you saw in the Asset Class study, International Equities tend to struggle during rising dollar environments and thrive in falling dollar environments. But what if you were to hedge for the currency exposure? Would that have any impact on the returns for International Equities in either dollar environment? Recall that if you buy a non-currency hedged international equity ETF, there are multiple conversions that have to take place, adding currency risk into the equation. Your US Dollars are converted into foreign currencies because the underlying shares in the ETF are denominated in currencies other than US Dollars. Even if the local markets rise in value, those gains can be eliminated because of a depreciating local (foreign) currency, ie: a rising dollar environment. It is because of that type of scenario that International Equities tend to struggle in rising dollar environments. The investment is worth less because of a depreciating local currency. However, in theory, hedging the exposure through a currency hedged product would help protect against such an event because it would mitigate the negative impact of a rising dollar on a foreign equity investment.

In the study below we looked at three sets of hedged and unhedged currency ETFs. We looked at Emerging Markets, Developed Markets, and All World ex-US. Notice how all of the International ETFs, hedged and unhedged, did well during a falling dollar (red) environment, confirming what we found in the Asset Class study. However, there is a difference in how they perform, on average, in a rising dollar environment. Notice how all of the unhedged International ETFs produced negative average returns in rising dollar environments, yet their hedged counterparts (except for the Emerging Markets version) were able to mitigate some of the impact of a rising dollar. The biggest difference can be seen looking at the Deutsche X-Trackers MSCI EAFE Hedged ETF DBEF.TR versus the unhedged iShares MSCI EAFE ETF EFA.TR. In a rising dollar environment, EFA.TR was down an average of -14.16% while DBEF was up an average of +2.66%. Suffice it to say, investors do stand to benefit from being currency hedged in a rising dollar environment. Although the hedged ETFs were still positive during falling dollar environments the returns were muted compared to their unhedged counterparts. (Editor's Note: Correction to the graph for EFA.TR and EEM.TR / 12/21/16).

We touched on the broader Asset Classes earlier and we discovered that Commodities generally perform better during a falling dollar environment versus a rising dollar environment. We wanted to delve deeper and find out if any particular Commodity groups perform better than others during rising and falling dollar environments. For this exercise, we used the PowerShares DB Energy Fund DBE, the United States Copper Index Fund CPER, the SPDR Gold Trust ETF GLD, and the PowerShares DB Agriculture Fund DBA to represent the broad Commodity groups. Each of these funds have index data going back to 1991, and the results of the study are very interesting. As we can see in the graph below, Energy generates positive returns on average during both rising and falling dollar environments in our study, although on average the performance in a falling dollar environment is decidedly better. Copper on the other hand registered the best performance on average when the dollar is falling at 59%, while Gold and Agriculture are up 28.33% and 24.73%. All three of the aforementioned sub-groups of Commodities lost in excess of 4% on average during rising dollar environments.

The performance information above is based on price return, not inclusive of dividends or all transaction costs. Prior to each ETFs inception date, performance data is created using underlying index data. Investors cannot invest directly in an index. Indexes have no fees. Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss.

Some performance information presented is the result of back-tested performance. Back-tested performance is hypothetical (it does not reflect trading in actual accounts) and is provided for informational purposes to illustrate the effects of the discussed strategy during a specific period. Back-tested performance results have certain limitations. Such results do not represent the impact of material economic and market factors might have on an investment advisor’s decision making process if the advisor were actually managing client money. Back-testing performance also differs from actual performance because it is achieved through retroactive application of a model investment methodology designed with the benefit of hindsight.

Each investor should carefully consider the investment objectives, risks and expenses of any Exchange-Traded Fund ("ETF") prior to investing. Before investing in an ETF investors should obtain and carefully read the relevant prospectus and documents the issuer has filed with the SEC. ETF's may result in the layering of fees as ETF's impose their own advisory and other fees. To obtain more complete information about the product the documents are publicly available for free via EDGAR on the SEC website (http://www.sec.gov).

Every week, the analysts here at DWA organize and write approximately 11 feature stories focusing within the inventories of multiple ETF providers. These articles can be found within the weekly ETF reports we conduct for those ETF families with which we provide guided model-based solutions. The weekly reports can be accessed from the Research Menu, but as of this week we will also compile a handful of those stories, which we feel are particularly relevant. We hope that this will serve as an "in case you missed it..." sort of section, where you can quickly access timely ETF features in a comprehensive fashion each week. We will include a link to the report along with a brief abstract summarizing our discussion within the respective features. This week's compilation is below.

First Trust Size and Style Change:

There is a change to the First Trust Size and Style Model FTSIZESTYLE this month. This month the First Trust Mid Cap Growth AlphaDEX Fund FNY will be removed and the First Trust Small Cap Growth AlphaDEX Fund FYC will be added. Recall that the First Trust Size and Style Model is evaluated on a monthly basis and the strategy is driven by the DALI Size and Style rankings. The Model seeks to hold the top three Size and Style groups and changes are made when there is a change to... (Read More)

Guggenheim Equal Weight Sector Model Change:

This week, we have a change in the Guggenheim Equal Weight Sector Model GUGGSECT. The Guggenheim S&P Equal Weight Health Care ETF RYH has been removed from the Model. This Model is designed to target exposure to the Guggenheim Equal Weight Sector ETFs that are demonstrating positive Relative Strength versus the Model benchmark, the Guggenheim S&P 500 Equal Weight ETF RSP. Each week we monitor 10 Relative Strength charts for each ETF in the Model's universe versus the RSP. As a result of the most recent market action, RYH reversed into O's versus the RSP, warranting its... (Read More)

iShares Sector Rotation Change:

Today there is a change within the iShares Sector Rotation Model. The buy and sell decisions within this portfolio are determined based on individual RS charts for each of the members in the potential universe versus the iShares Dow Jones US ETF IYY. Over the course of the past week, there has been enough of a price dispersion between the iShares U.S. Healthcare ETF IYH and the IYY to cause a reversal down in to O's on the RS chart. This reversal tells us that IYH is weakening relative to the broad market and as a result, we have sold the... (Read More)

State Street Sector Model Change:

For the fifth consecutive week, there has been a change in the State Street Sector Model SSTREET. This week, the SPDR S&P Oil & Gas Equipment & Services ETF XES has been added to the Model. Recall that in order for an ETF to earn a spot within the State Street Sector Model SSTREET, it must be in a column of X's versus the S&P 500 Index SPX on a 6.5% relative strength chart. Over the past week of trading, the RS chart of XES vs SPX reversed up into X’s, warranting its addition to the SSTREET holdings. This Model remains fully-invested through sector-based ETFs within the broader... (Read More)

The Distribution Report below places Major Market ETFs and Indices into a bell curve style table based upon their current location on their 10-week trading band. The middle of the bell curve represents areas of the market that are "normally" distributed, with the far right being 100% overbought on a weekly distribution and the far left being 100% oversold on a weekly distribution. The weekly distribution ranges are calculated at the end of each week, while the placement within that range will fluctuate during the week. In addition to information regarding the statistical distribution of these market indexes, a symbol that is in UPPER CASE indicates that the RS chart is on a Buy Signal. If the symbol is dark Green then the stock is on a Point & Figure buy signal, and if the symbol is bright Red then it is on a Point & Figure sell signal.

The average Bullish Percent reading this week is 60.3% up 3.25% from the previous week

| <--100 | -100--80 | -80--60 | -60--40 | -40--20 | -20-0 | 0-20 | 20-40 | 40-60 | 60-80 | 80-100 | 100-> | |||

|

||||||||||||||

Legend:

| Symbol | Name | Symbol | Name |

| AGG | iShares Barclays Aggregate Bond Fund | NASD | Nasdaq Composite |

| CL/ | Crude Oil Continuous | NDX | NASDAQ Non Financial Index |

| DJIA | Dow Jones Industrial Average | RSP | Guggenheim S&P 500 Equal Weight ETF |

| DVY | iShares Dow Jones Select Dividend Index | RUT | Russell 2000 Index |

| DX/Y | NYCE U.S.Dollar Index Spot | SHY | iShares Barclays 1-3 Year Tres. Bond Fund |

| EFA | iSharesMSCI EAFE Index Fund | SML | S&P 600 Small Cap Index |

| FXE | CurrencyShares Euro Trust | SPX | S & P 500 Index |

| GC/ | Gold Continuous | TLT | iShares Barclays 20+ Year Treasury Bond Fund |

| GSG | iShares S&P GSCI Commodity-Indexed Trust | UV/Y | Continuous Commodity Index |

| HYG | iShares High Yield Corporate Bond Fund | VOOG | Vanguard S&P 500 Growth ETF |

| ICF | iShares Cohen & Steers Realty Index | VOOV | Vanguard S&P 500 Value ETF |

| IEF | iShares Lehman 7-10 Yr. Tres. Bond Fund | VWO | Vanguard MSCI Emerging Markets ETF |

| LQD | iShares iBoxx $ Investment Grade Corp. | XLG | Guggenheim Russell Top 50 ETF |

| MID | S&P 400 MidCap Index |

Long Ideas

| Stock | Symbol | Sector | Current Price | Action Price | Target | Stop | Notes |

|---|---|---|---|---|---|---|---|

| Franklin Electric Co | FELE | Machinery and Tools | $41.95 | low-40s | 60 | 34/30 | 5/5'er, RS buy signal generated in July, Top 25% of sector matrix. |

| Align Technology, Inc. | ALGN | Healthcare | $98.53 | 95-99 | 114 inc. | 91/83 | 5 for 5'er, leader in favored HEAL sector, Positive Diverger |

| Noble Energy Inc. | NBL | Oil | $39.84 | hi-30s | 53 | 32 | 3/5'er, Positive Trend change, Improving RS, Rally thru all near-term resistance. |

| Papa Johns Intl Inc | PZZA | Restaurants | $86.53 | 86-90 | 111 | 73 | 5 for 5'er, #1 spot in Restaurant sector matrix, pulled back from new all time highs, strong small cap play |

| Murphy Oil Corp | MUR | Oil | $33.24 | 31-34 | low-50s | 27 | 3/5'er, Yield of 3%, Top 15 of Oil Sector matrix, Quadruple top breakout, Potential covered write with April 35 calls. |

| Citrix Systems, Inc. | CTXS | Software | $88.87 | 86-91 | 104 | 80 | 3/5'er, Big Base Breakout, Potential New Peer RS buy signal. |

| Golar LNG Ltd | GLNG | Transports/Non Air | $23.90 | 23-24 | 37.50 | 21/19.5 | 5 for 5'er, favored TRAN sector, consecutive higher tops and higher bottoms, good R-R, pos weekly mom change |

| Jack Henry & Associates Inc | JKHY | Software | $89.58 | 86-90 | 104 | 84/78 | 4/5'er, "90 to 100 play", Spread Quadruple top breakout |

| Raytheon Company | RTN | Aerospace Airline | $143.81 | 140s | 190 | 132 | 4/5'er, Long-term market leader, PB to o'sold territory, Potential bullish catapult formation. |

Short Ideas

| Stock | Symbol | Sector | Current Price | Action Price | Target | Stop | Notes |

|---|---|---|---|---|---|---|---|

| Morningstar, Inc. | MORN | Finance | $76.36 | (73-77) | 65 | 82 | 0 for 5'er, laggard in otherwise strong Finance sector, consecutive sell signals, reverted to mean off of 52-week low |

Follow-Up Comments

| Comment |

|---|

| MAS Masco Corporation R ($32.68) - Building - MAS was a long recommendation over a year ago from a level about 10% below where the stock changes hands today. The most recent chart activity was a 3-box reversal up, which we will use to adjust stop loss levels to $29, now a first sell signal. The attribute rating remains 3, okay to hold for now. |

| SCG Scana Corp ($73.74) - Utilities/Electricity - Shares of SCG rallied to break a triple top at $74, returning to a buy signal after a successful test of the bullish support line. We will raise our recommended stop loss point to $67 at this time and otherwise continue to hold all open long exposure here. Those not involved may consider new long commitments in the $71-75 range. |

| TTWO Take-Two Interactive Software, Inc. R ($50.83) - Software - TTWO is a long recommendation from May and the stock has been able to develop in very orderly fashion toward a series of new highs since that time. The triple top break at $51 is the latest example of this, marking a new high and allowing us to raise trading stops to $45 and investor stops to $35 (bullish support line). Still okay to consider new long exposure here in the low-50s as well. |

DWA Spotlight Stock

RTN Raytheon Company R ($143.16) - Aerospace Airline - Shares of RTN reversed back into a column of X's on Tuesday, which is generally a rather benign event within the Point & Figure charting realm, but in this case provides a new entry point. The reversal comes after a sharp exhale for a stock that had published new all-time highs at $152 just a few weeks ago. The pullback brought the stock back to the middle of its trading band and this reversal offers indication that the pullback has subsided as new buyers have stepped into the stock. The reversal up also forms a higher bottom, which allows for a potential bullish catapult formation to be completed at $154, as the last pattern development was a triple top break last month. RTN is a long-term market leader, having sustained an RS buy signal for 8 years now. We will use the recent development to add long exposure in the 140s, using a stop loss point of $132, which would break two bottoms. Our target is $190 based upon a vertical count.

| 14 | 15 | 16 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 152.00 | X | 152.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 150.00 | X | O | 150.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 148.00 | X | O | 148.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 146.00 | X | O | 146.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 144.00 | X | C | x | 144.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 142.00 | 8 | A | X | O | x | Med | 142.00 | |||||||||||||||||||||||||||||||||||||||||||||||

| 140.00 | X | O | X | O | X | O | x | 140.00 | ||||||||||||||||||||||||||||||||||||||||||||||

| 138.00 | 7 | O | X | O | X | O | 138.00 | |||||||||||||||||||||||||||||||||||||||||||||||

| 136.00 | X | 9 | O | X | 136.00 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 134.00 | 6 | B | 134.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 132.00 | 5 | 132.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 130.00 | X | 130.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 128.00 | X | X | 4 | 128.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 126.00 | X | O | X | O | X | Bot | 126.00 | |||||||||||||||||||||||||||||||||||||||||||||||

| 124.00 | X | O | X | O | X | 124.00 | ||||||||||||||||||||||||||||||||||||||||||||||||

| 122.00 | X | 1 | X | 2 | X | 122.00 | ||||||||||||||||||||||||||||||||||||||||||||||||

| 120.00 | B | O | X | O | 120.00 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 118.00 | X | O | X | 118.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 116.00 | X | O | 116.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 114.00 | X | 114.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 112.00 | 3 | X | 112.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 110.00 | X | X | X | O | X | A | 110.00 | |||||||||||||||||||||||||||||||||||||||||||||||

| 108.00 | C | O | X | O | X | O | X | O | X | 108.00 | ||||||||||||||||||||||||||||||||||||||||||||

| 106.00 | B | O | X | O | X | 4 | X | O | 9 | 106.00 | ||||||||||||||||||||||||||||||||||||||||||||

| 104.00 | X | O | X | 1 | 2 | O | X | 8 | X | 104.00 | ||||||||||||||||||||||||||||||||||||||||||||

| 102.00 | X | X | X | X | O | O | X | 6 | X | O | X | 102.00 | ||||||||||||||||||||||||||||||||||||||||||

| 100.00 | 3 | O | 4 | X | O | X | X | O | X | O | X | O | X | X | O | X | • | 100.00 | ||||||||||||||||||||||||||||||||||||

| 99.00 | X | O | X | O | X | X | O | X | X | O | X | O | X | X | O | O | 7 | O | X | O | X | • | 99.00 | |||||||||||||||||||||||||||||||

| 98.00 | X | O | X | O | X | O | X | O | 5 | O | 6 | O | 9 | A | X | O | X | O | X | O | X | O | X | • | 98.00 | |||||||||||||||||||||||||||||

| 97.00 | X | O | O | X | O | X | O | X | O | X | O | X | X | O | X | X | O | X | O | X | O | O | • | 97.00 | ||||||||||||||||||||||||||||||

| 96.00 | X | O | O | O | X | O | X | O | X | O | X | O | X | O | X | O | O | • | 96.00 | |||||||||||||||||||||||||||||||||||

| 95.00 | X | X | O | O | O | X | O | X | O | X | O | X | • | 95.00 | ||||||||||||||||||||||||||||||||||||||||

| 94.00 | X | O | X | O | X | O | X | O | O | X | • | 94.00 | ||||||||||||||||||||||||||||||||||||||||||

| 93.00 | X | O | X | O | X | O | X | O | • | 93.00 | ||||||||||||||||||||||||||||||||||||||||||||

| 92.00 | X | X | 2 | X | 7 | X | O | X | • | 92.00 | ||||||||||||||||||||||||||||||||||||||||||||

| 91.00 | X | X | O | X | O | X | O | O | X | • | 91.00 | |||||||||||||||||||||||||||||||||||||||||||

| 90.00 | X | O | X | O | X | O | 8 | • | 90.00 | |||||||||||||||||||||||||||||||||||||||||||||

| 89.00 | X | X | O | X | O | X | • | 89.00 | ||||||||||||||||||||||||||||||||||||||||||||||

| 88.00 | X | O | X | 1 | O | • | 88.00 | |||||||||||||||||||||||||||||||||||||||||||||||

| 87.00 | X | O | X | • | 87.00 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 86.00 | X | C | • | 86.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 85.00 | X | • | 85.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 84.00 | B | • | 84.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 83.00 | X | • | 83.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 82.00 | X | • | 82.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 81.00 | X | X | • | 81.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 80.00 | X | O | X | • | 80.00 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 79.00 | X | O | X | • | 79.00 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 78.00 | 9 | O | X | • | 78.00 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 77.00 | X | A | X | • | 77.00 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 76.00 | X | O | X | • | 76.00 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 75.00 | X | O | X | • | 75.00 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 74.00 | X | O | • | 74.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 73.00 | 8 | • | 73.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 72.00 | X | • | 72.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 71.00 | X | • | 71.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 70.00 | X | • | 70.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 69.00 | X | • | 69.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 68.00 | X | • | 68.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 67.00 | O | X | • | 67.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 66.00 | O | X | • | 66.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 65.00 | 7 | • | 65.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 14 | 15 | 16 |

| Comments |

|---|

| BCO The Brink's Company ($42.28) - Protection Safety Equipment - After years of basically a stagnant chart, BCO has really been moving in 2016. The stock has rallied from 26 to a high of 45 this year. In December, BCO pulled back from that rally to 45 and settled back to the middle of the ten week trading band and just recently reversed up to make a higher bottom. This reversal up sets up a nice opportunity to enter new positions with a stop/hedge point afforded at 38, a double bottom. The next upside price objective is 60. |

| CINF Cincinnati Financial Corporation ($78.36) - Insurance - After finding support at $69 in November, CINF broke a double top at $79, a new all-time high. This stock is a strong 4 for 5’er that has been trading in a positive trend since March 2010 and is showing superior near-term strength relative to both the market and its peers. Okay to hold here or buy on a potential pullback as the stock is nearing the top of the 10 week trading band. The first sign of trouble from here comes with a move to $68. Note this stock has a yield of 2.45% attached to it. |

| CRY CryoLife, Inc. ($19.03) - Healthcare - The main trend is positive for CRY and the stock has put together a string of three consecutive double top buy signals after holding the support line in April. Most recently we have seen CRY reversed up to make yet another bottom. Okay to buy this 5 for 5'er with the first sign of trouble coming at 17.5, a double bottom. |

| CX Cemex S.A.B. de C.V. (Mexico) ADR ($8.80) - Building - Over the last several years, CX has traded in a range of the single digits up to the 14 area. After testing the bottom end of that large range in January, CX has been consistently moving higher and the most recent reversal up sets up for a triple top breakout at 9.5. A move to 9.5 would suggest that CX is likely to test that resistance in the 14 area. |

| FANG Diamondback Energy Inc ($105.14) - Oil - After forming a double top at $112, FANG broke a double bottom at $104. This sets up a shakeout pattern. The shakeout is initiated upon a reversal into X’s from here, but it will not be completed unless a triple top is broken at $114. The stock is a 4 for 5’er ranking in the top half of the favored Oil sector matrix. New positions may be initiated upon a reversal into X’s from here or upon the potential triple top break at $114. Support comes against the bullish support line at $96. |

| HTHT China Lodging Group Ltd. ($53.59) - Leisure - We continue to see textbook positive chart patterns out of HTHT. To set the stage, the stock broke a spread triple top at 48 in November. This breakout was followed by a double top at 49 later that month. After rallying to 53 and pulling back, HTHT has given another double top buy signal at 54. Okay to buy the stock here and on pullbacks. The next price objective is 61 and the stock's first sign of any trouble would come at 49, a double bottom. It would take a move to 45 to violate the bullish support line. |

| INTU Intuit Inc. ($118.16) - Software - With the most recent action, INTU broke a double top at $118, a new all-time high. This double top also completes a bullish catapult pattern following a triple top break in March. This stock is a perfect 5 for 5’er as it is trading in a positive trend and is showing superior strength relative to both the market and its peers. Okay to hold here or buy on a pullback as the stock is nearing the top of the 10 week trading band. The first sign of trouble from here comes with a move to $102, a double bottom sell signal. |

| MO Altria Group Inc. ($66.73) - Food Beverages/Soap - After developing support at $61, MO has broken a double top at $67, marking its tenth consecutive buy signal. Weekly momentum recently flipped positive as well, which indicates the potential for further price appreciation over the next several weeks. The stock has a technical attribute score of 5 and provides an attractive yield in excess of 3.5%. New entries are welcomed on this breakout. Initial support is offered between $60 and $61, while longer term support is at $57. Those already long should be aware of resistance from its previous high in July at $70. |

| STX Seagate Technology ($40.84) - Computers - STX broke a double top at $41 on Tuesday, a new 52 week high and the third consecutive buy signal on the chart. This move broke through the bearish resistance line, flipping the trend back to positive for the first time since June 2015 and therefore upticking this name to a 3 for 5’er. Okay to buy or hold here as the weight of the evidence is positive. The first sign of trouble from here comes with a move to $36, a double bottom sell signal. |

| WM Waste Management, Inc. ($70.83) - Waste Management - WM broke a double top at $71, a new chart high and the sixth consecutive buy signal on the chart since January. WM is a strong 3 for 5’er that has been trading above the bullish support line since January 2013. Furthermore, this stock ranks within the top third of the favored Waste Management sector RS matrix. Demand is in control and the weight of the evidence is positive. Okay to hold here or buy on a pullback as the stock is trading at the top of the 10 week trading band, indicating that it is 100% overbought here. Support is at $62, the October low. |

Daily Option Ideas for December 13, 2016

New Recommendations

| Name | Option Symbol | Action | Stop Loss |

|---|---|---|---|

| PowerShares QQQ Trust - $120.46 | O:QQQ 17F114.00D16 | Buy the June 114.00 calls at 10.00 | 110.00 |

Follow Ups

| Name | Option | Action |

|---|---|---|

| The Dow Chemical Company ( DOW) | Jan. 50.00 Calls | Raise the option stop loss to 6.10 (CP: 8.10) |

| Automatic Data Processing, Inc. ( ADP) | Feb. 80.00 Calls | Raise the option stop loss to 11.70 (CP: 13.70) |

| United Continental Holdings Inc. ( UAL) | Mar. 50.00 Calls | Stopped at 23.20 (CP: 21.95) |

| Canadian Natural Resources Ltd. ( CNQ) | Mar. 28.00 Calls | Raise the option stop loss to 4.50 (CP: 6.50) |

| Waste Management, Inc. ( WM) | Apr. 60.00 Calls | Raise the option stop loss to 8.90 (CP: 10.90) |

| Chubb Ltd ( CB) | Feb. 120.00 Calls | Raise the option stop loss to 10.10 (CP: 13.10) |

| Automatic Data Processing, Inc. ( ADP) | Feb. 85.00 Calls | Raise the option stop loss to 11.70 (CP: 13.70) |

| Apple Inc. ( AAPL) | Apr. 105.00 Calls | Raise the option stop loss to 10.40 (CP: 12.40) |

New Recommendations

| Name | Option Symbol | Action | Stop Loss |

|---|---|---|---|

| V.F. Corporation - $56.33 | O:VFC 17Q60.00D19 | Buy the May 60.00 puts at 6.10 | 61.00 |

Follow Up

| Name | Option | Action |

|---|---|---|

| Cray, Inc. (CRAY) | Apr. 25.00 Puts | Stopped at 4.70 (CP: 4.70) |

| Kraft Heinz Co/The (KHC) | Apr. 85.00 Puts | Stopped at 85.00 (CP: 85.00) |

New Recommendations

| Name | Option Sym. | Call to Sell | Call Price | Investment for 500 Shares | Annual Called Rtn. | Annual Static Rtn. | Downside Protection |

|---|---|---|---|---|---|---|---|

| CryoLife, Inc. $19.45 | O:CRY 17D20.00D21 | Apr. 20.00 | 1.05 | $9,050.00 | 26.74% | 13.29% | 4.49% |

Still Recommended

| Name | Action |

|---|---|

| General Cable Corp (BGC) - 20.20 | Sell the February 20.00 Calls. |

| United Rentals, Inc. (URI) - 107.03 | Sell the March 110.00 Calls. |

| Zillow Group Inc. Class C (Z) - 36.28 | Sell the May 40.00 Calls. |

| Carmax Group (KMX) - 62.80 | Sell the April 65.00 Calls. |

| AtriCure, Inc. (ATRC) - 18.81 | Sell the April 20.00 Calls. |

The Following Covered Write are no longer recommended

| Name | Covered Write |

|---|---|

|

|

|