This week, there is a change in the GUGGSECT Model as RYH has been removed.

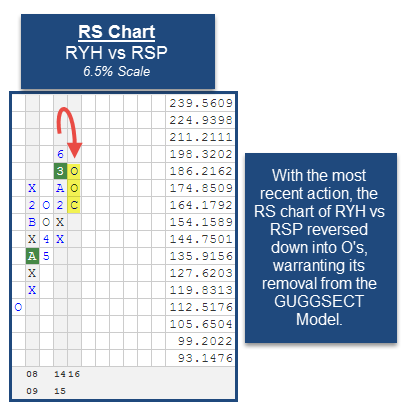

This week, we have a change in the Guggenheim Equal Weight Sector Model GUGGSECT. The Guggenheim S&P Equal Weight Health Care ETF RYH has been removed from the Model. This Model is designed to target exposure to the Guggenheim Equal Weight Sector ETFs that are demonstrating positive Relative Strength versus the Model benchmark, the Guggenheim S&P 500 Equal Weight ETF RSP. Each week we monitor 10 Relative Strength charts for each ETF in the Model's universe versus the RSP. As a result of the most recent market action, RYH reversed into O's versus the RSP, warranting its removal from the Model.

RYH had been a holding in the GUGGSECT Model since 2/19/2014. Over that timeframe, RYH posted a gain of 24.99% while the S&P 500 Index SPX was up 23.42% (through 12/12/2016). Looking at the trend chart of the RYH below, we find that after coming within just 2.5% of its all-time high in August, the chart pulled back significantly, breaking a double bottom at $142 in November. Additionally, it has seen considerable deterioration in its fund score which is now 1.45, down from 5.65 on 2/19/2014. As a result of this change, the GUGGSECT Model has five holdings equally weighted at 20% each. The Model maintains exposure to the following sectors: Consumer Discretionary, Energy, Technology, Utilities, and Real Estate.

The performance numbers above a price return is not inclusive of dividends or all transaction costs. Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss.