Today, there is a change within the iShares Sector Rotation Model, which is to sell the remaining Healthcare exposure through the IYH.

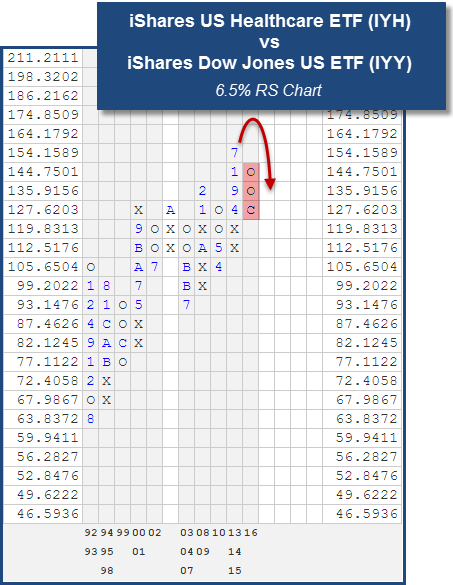

Today there is a change within the iShares Sector Rotation Model. The buy and sell decisions within this portfolio are determined based on individual RS charts for each of the members in the potential universe versus the iShares Dow Jones US ETF IYY. Over the course of the past week, there has been enough of a price dispersion between the iShares U.S. Healthcare ETF IYH and the IYY to cause a reversal down in to O's on the RS chart. This reversal tells us that IYH is weakening relative to the broad market and as a result, we have sold the IYH out of the portfolio. The IYH was previously added to the model back on January 7th of 2015. While it was a leader within that portfolio during different times of its holding period, it ultimately contributed a loss of -3.34 while in the portfolio. Fortunately, the model still managed to beat both the IYY and the SPX, rallying 11.73 versus 10.63% and 10.82%, respectively (from 1/7/15-12/7/16). As a result of this change, the model has rid itself of all healthcare exposure, as it sold out of Biotech IBB earlier in the year. Additionally, each of the remaining 10 positions will be rebalanced to 10% each to reflect an equally weighted portfolio.