Today we have provided registration information for the rescheduled webinar: Introducing the BMO Elkhorn DWA MLP Select Index ETN, which has been rescheduled for Thursday, December 22nd at 2:00 pm ET. Those who have already registered do not need to re-register. We also bring a noteworthy big base breakout to your attention.

Webinar: DWA International Equity & Currency Update

Join us Wednesday, December 21st at 2:00 p.m. ET for a live webcast to discuss the state of the currency market, the trends that are impacting international equity returns, and the Deutsche Currency Hedged ETF Models that are available on the DWA Research Platform. Hosted with Deutsche ETFs, we will discuss the developments within the currency and international market from a technical perspective, while Deutsche ETFs will provide fundamental insights pertaining to this segment of the market. Deutsche ETFs offers investors currency hedged and unhedged equity ETFs, covering almost every corner of the global marketplace.

DWA International Equity & Currency Update:

- Date: Wednesday, December 21st, 2016

- Time: 2:00 p.m. ET

- Speakers: Ben Jones, Senior Analyst, DWA & Robert Bush, ETF Strategist, Deutsche Asset Management

- Register here.

Registration is required and the password for the event is pnfpnf.

Rescheduled Webinar: Introducing the BMO Elkhorn DWA MLP SelectTM Index ETN

Join us Thursday, December 22nd at 12:00 pm ET for a live webcast as we discuss the upcoming BMO Elkhorn DWA MLP SelectTM Index ETN (BMLP), the first Dorsey Wright MLP strategy tracking the DWA MLP SelectTM Index. We will discuss both the advantages of the ETN structure as it relates to MLP exposure and why it's particularly appropriate for Dorsey Wright's MLP solution.

Learn the methodology behind the DWA MLP SelectTM Index, which employs a rules-based rotation in an effort to deliver positive excess returns versus its peers, while currently offering an index yield of 7.42%. Registration is required and the password for the webinar is pnfpnf.

- Date: Thursday, December 22nd, 2016

- Time: 12:00 PM ET

- Register Now

*Note this webinar was originally scheduled for Tuesday, December 13th at 12:00 p.m. ET. Those already registered do not need to re-register.

Here at Dorsey Wright, one of the patterns that we follow is the “big base breakout.” Recall that in all cases, the "big base breakout" involves two stages, initially a consolidation phase of horizontal movement within a trading range, and then a show of strength by a stock breaking out of this trading range. To best describe this chart pattern we will begin by breaking down the literal meaning of the term "big base." "Big base" refers to the consolidation stage of a chart pattern whereby a security will trade in a horizontal fashion for some length of time, along the way developing both an area of support below, as well as resistance overhead. The latter half of the term, "breakout", refers to the action of the security "breaking" out of this consolidation phase. A "breakout" is a move through significant resistance or support. Obviously a move through resistance is a positive signal here, whereas a violation of support would be seen as a sign of weakness in a particular security.

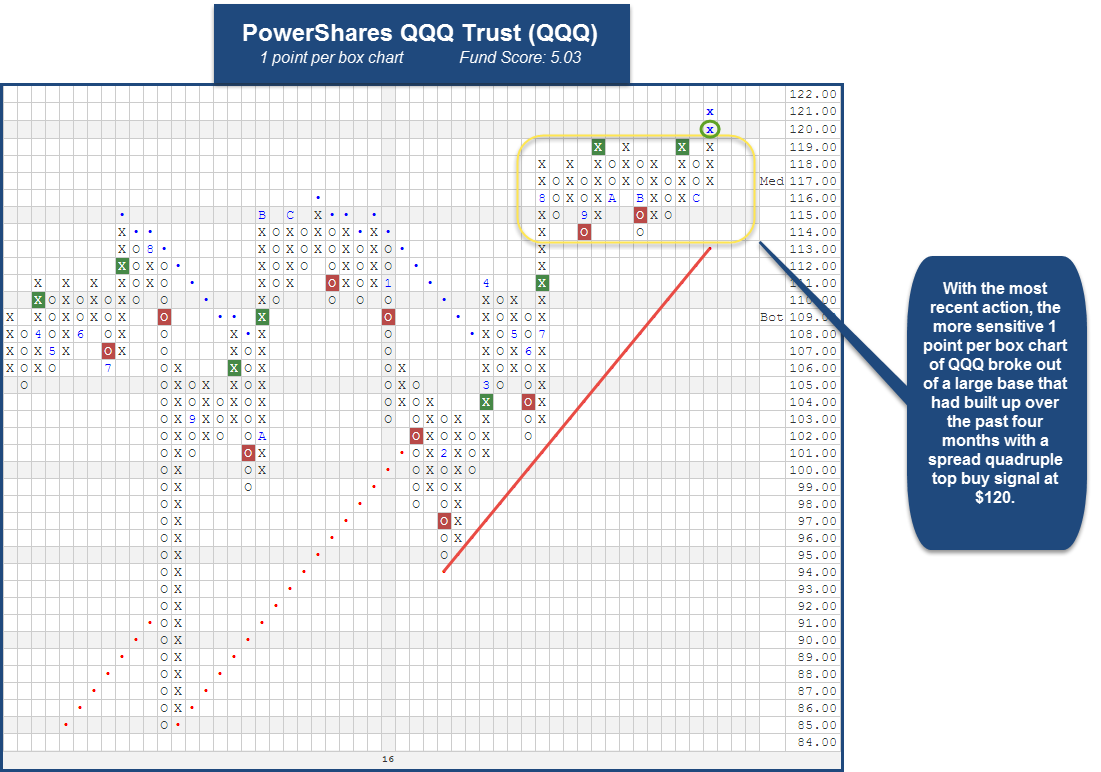

One noteworthy big base breakout that caught our attention comes from the more sensitive 1 point per box chart of the PowerShares QQQ Trust QQQ. In the image below, we find that with the most recent action, QQQ managed to breakout of a base it had maintained over the course of the last four months or so. QQQ completed a spread quadruple top buy signal at $120 and continued higher to $121 intraday, a new all-time high. QQQ has a robust fund score of 5.03, speaking to its strong trending and relative strength characteristics. QQQ is actionable here with significant support at $114.