Today, XES has been added to the SSTREET Model.

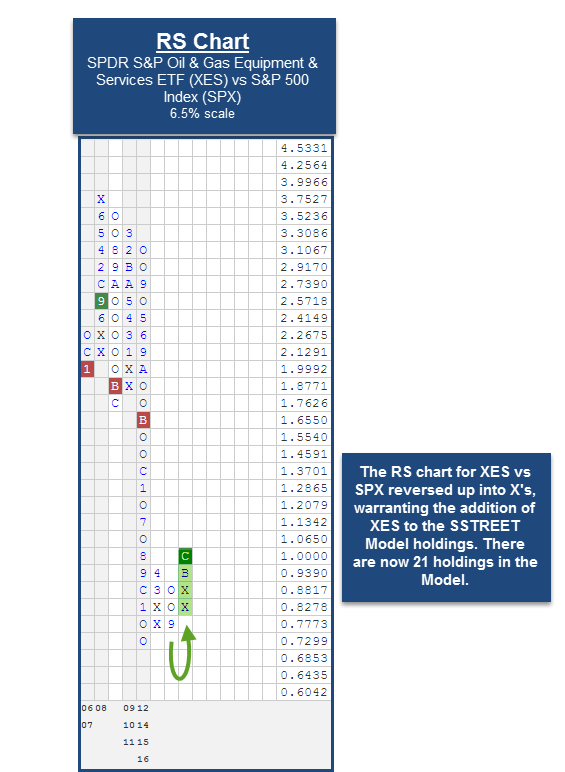

For the fifth consecutive week, there has been a change in the State Street Sector Model SSTREET. This week, the SPDR S&P Oil & Gas Equipment & Services ETF XES has been added to the Model. Recall that in order for an ETF to earn a spot within the State Street Sector Model SSTREET, it must be in a column of X's versus the S&P 500 Index SPX on a 6.5% relative strength chart. Over the past week of trading, the RS chart of XES vs SPX reversed up into X’s, warranting its addition to the SSTREET holdings. This Model remains fully-invested through sector-based ETFs within the broader State Street family of ETFs and is evaluated on a weekly basis. The number of holdings can vary based on sector leadership within changing markets. The Model draws from an inventory of 31 US sector products which range from cap-weighted broad sector exposure to equal-weighted sub-sector alternatives. With the addition of XES, the model is equally weighted across 21 positions, signaling toward the widespread strength in the market.

XES is an equal-weight Oil & Gas Equipment & Services fund with exposure to all S&P 500 components within that sector of the market. When looking at the default trend chart of XES, this fund has given two consecutive buy signals since September and currently has a fund score of 5.66, speaking to its strong relative strength and trending characteristics. Okay to buy here or on a pullback. Within the SSTREET model, XES will represent 4.76% moving forward and will bring the broad Energy exposure up to about 10% of the total portfolio.