There are no model changes to report this week.

As of January 13, we will no longer be publishing the weekly State Street ETF report. Additionally, the SSTREET, SSTARGETSECTOR, and SSWORLD models will no longer be supported on the NDW Research Platform. We will, however, continue to run and support the State Street Fixed Income Model SSFIXED, which follows the same underlying methodology as the SPDR Dorsey Wright Fixed Income Allocation ETF DWFI. We will alert all users with SSGA model alerts of these changes over the next week.

Over the last two weeks, we have continued our review of the underlying methodologies for the three SSGA models that will no longer be supported so that users may continue to run them on their own going forward using the matrix tool and/or the Custom Modeler Tool. We first discussed the State Street Sector Rotation Model SSTREET, which can be accessed here, and we reviewed the State Street Targeted Sector Rotation Model SSTARGETSECTOR last week, which can be accessed here. Today, we’ll cover the State Street Global Rotation Model SSWORLD.

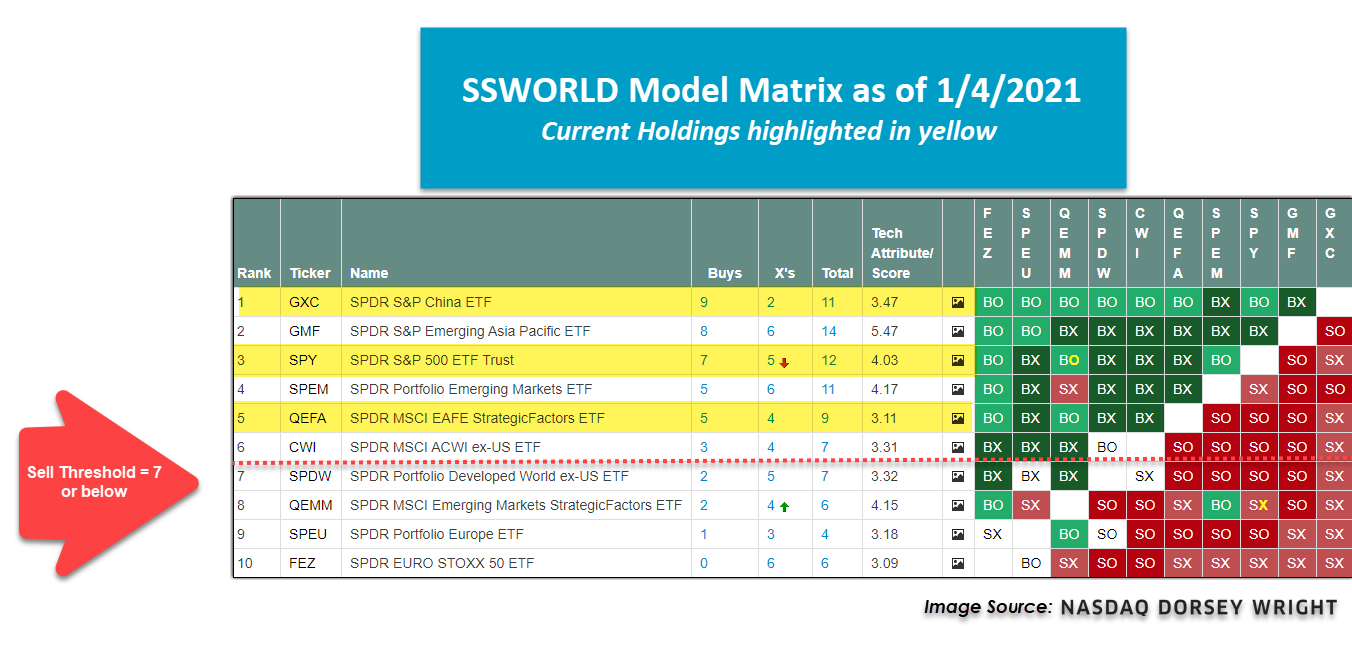

The SSWORLD model is a global rotation model that is matrix-based, like the SSTARGETSECTOR model we discussed last week. We start with a universe of 10 global ETFs, including the US representative SPY, and compare them to one another using a 3.25% RS matrix. The model owns the strongest three ETFs and will hold them until they fall significantly out of favor, which for this model is defined as a ranking of 7 or below. The model is reviewed on a weekly basis for any changes. Upon a change, the model will sell the weak position and will rotate into the strongest ETF not already held in the model. The holdings will then be rebalanced back to equal-weight at 33.33% each.

Currently, the SSWORLD model provides exposure to China GXC, the US SPY, and developed markets via a Smart Beta index that blends low volatility, quality and value exposures together in a single strategy QEFA. These global trends have stayed relatively consistent as there has not been a model change since July 2017. If you have any questions on any of these models, please give us a call at 804-320-8511 or email us at dwa@dorseywright.com.

Q4 2020 & 2020 Performance Review

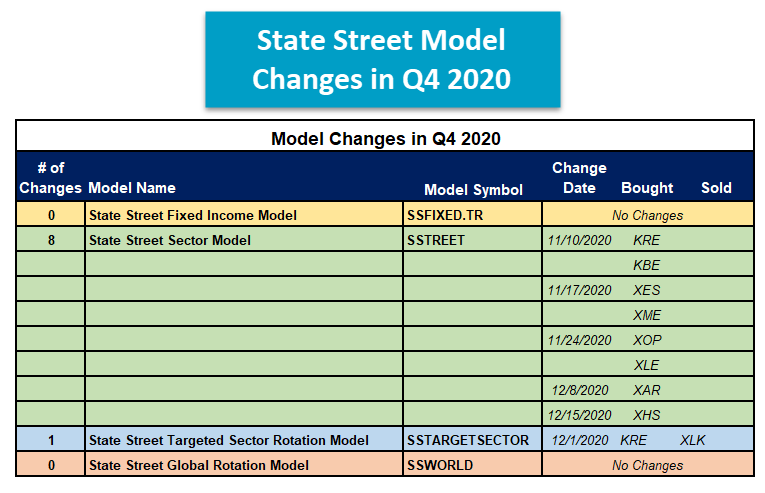

All four State Street Models finished Q4 as well as the year 2020 in positive territory. In Q4, all but the SSWORLD model outperformed the respective model benchmark, while each SSGA model successfully outperformed on a year-to-date basis. When all was said and done, there were eight model changes to report in the State Street Sector Model SSTREET and one change in the State Street Targeted Sector Rotation Model SSTARGETSECTOR model. There were no changes to the State Street Fixed Income SSFIXED.TR or SSWORLD models. Here is a summary of what transpired during the final quarter of 2020.

- The State Street Sector Model SSTREET experienced eight changes throughout the fourth quarter, each change being a “buy”. As a result, the SSTREET model currently offers exposure to 20 sector ETFs, each with a 5% weighting. The portfolio itself was up 17.95% in Q4, outpacing the SPX's return of 11.69%. For the year 2020, SSTREET gained 27.92%, outperforming the SPX’s return of 16.26%.

- The State Street Fixed Income Model SSFIXED.TR did not experience any changes over the fourth quarter of the year. When all was said and done, SSFIXED.TR finished Q4 with a gain of 9.37%, outperforming its benchmark, the iShares US Core Bond ETF Trust AGG.TR’s return of 0.73%. For all of 2020, SSFIXED.TR posted a gain of 17.45% and outperformed the AGG.TR’s return of 7.48%. Note these performance numbers are total return and include dividends and distributions.

- The State Street Global Rotation Model SSWORLD did not experience any changes during the fourth quarter and has not experienced any change since July 2017. The portfolio itself was up 11.29%, which underperformed the model benchmark, the iShares MSCI ACWI ETF ACWI, by -2.22%. For all of 2020, however, the SSWORLD posted a gain of 15.92%, outperforming the ACWI’s return of 14.47%. SSWORLD currently provides exposure to China (GXC), U.S. (SPY), and broad developed markets (QEFA).

- Finally, the State Street Targeted Sector Rotation Model SSTARGETSECTOR finished the final quarter of 2020 with an impressive gain of 20.35%, which outperformed the SPX's return of 11.69%. Additionally, the model experienced just one change in early December. This was the best performing SSGA model in the fourth quarter as well as for all of 2020. For the year, SSTARGETSECTOR finished up 29.87%, outperforming the SPX’s return of 16.26%.

Like a radar screen, the Weekly Activity Summary gives you a snap shot view of any technical changes to the State Street universe of ETFs. Included in the summary below are both long term technical changes and intermediate term technical changes.

StateStreet ETFs Moving to Negative Monthly Momentum

| Symbol | Name | Price | Score | 30 Day Rtn | 90 Day Rtn | YTD Rtn |

|---|---|---|---|---|---|---|

| BIL | SPDR Bloomberg Barclays 1-3 Month T-Bill ETF | 91.510 | 0.3647 | -0.022 | -0.011 | -0.011 |

| SPBO | SPDR Portfolio Corporate Bond ETF | 35.990 | 3.1768 | 0.195 | 2.012 | -0.648 |

| XNTK | SPDR NYSE Technology ETF | 142.915 | 4.8799 | 5.007 | 17.836 | 1.107 |

| SPLB | SPDR Portfolio Long Term Corporate Bond ETF | 32.640 | 3.1160 | -0.183 | 3.258 | -1.390 |

| XLK | Technology Select Sector SPDR Fund | 128.730 | 4.3125 | 2.134 | 9.316 | -0.992 |

| XLP | Consumer Staples Select Sector SPDR Fund | 66.720 | 2.6503 | -1.346 | 2.963 | -1.082 |

| XLY | Consumer Discretionary Select Sector SPDR Fund | 160.610 | 4.1608 | 1.633 | 6.491 | -0.106 |

| XHB | SPDR S&P Homebuilders ETF | 57.000 | 5.1046 | 0.476 | 2.684 | -1.110 |

| SPYG | SPDR S&P 500 Growth ETF | 54.830 | 4.3631 | 1.218 | 8.082 | -0.832 |

| MMTM | SPDR S&P 1500 Momentum Tilt ETF | 160.827 | 3.1371 | 1.750 | 6.935 | -0.779 |

| SYG | SPDR MFS Systematic Growth Equity ETF | 115.104 | 4.2275 | 2.386 | 5.517 | -0.824 |

| ULST | SPDR SSgA Ultra Short Term Bond ETF | 40.430 | 0.8666 | -0.025 | -0.025 | -0.012 |

| XLC | Communication Services Select Sector SPDR Fund | 66.720 | 4.1992 | -0.388 | 12.703 | -1.126 |

StateStreet ETFs Giving a Buy Signal on Trend Chart

| Symbol | Name | Price | Score | 30 Day Rtn | 90 Day Rtn | YTD Rtn |

|---|---|---|---|---|---|---|

| XES | SPDR S&P Oil & Gas Equipment & Services ETF | 48.980 | 3.8876 | 7.224 | 70.722 | 9.233 |

StateStreet ETFs Moving to Positive Weekly Momentum

| Symbol | Name | Price | Score | 30 Day Rtn | 90 Day Rtn | YTD Rtn |

|---|---|---|---|---|---|---|

| SPAB | SPDR Portfolio Aggregate Bond ETF | 30.730 | 2.5671 | 0.228 | 0.261 | -0.195 |

| SPTL | SPDR Portfolio Long Term Treasury ETF | 44.760 | 2.1019 | 0.743 | -1.842 | -0.820 |

| SPSB | SPDR Portfolio Short Term Corporate Bond ETF | 31.390 | 2.5201 | 0.064 | 0.128 | -0.032 |

StateStreet ETFs Moving to Negative Weekly Momentum

| Symbol | Name | Price | Score | 30 Day Rtn | 90 Day Rtn | YTD Rtn |

|---|---|---|---|---|---|---|

| EBND | SPDR Bloomberg Barclays Emerging Markets Local Bond ETF | 28.160 | 2.9610 | 1.514 | 7.032 | 0.392 |

| HYMB | SPDR Nuveen Bloomberg Barclays High Yield Municipal Bond ETF | 58.960 | 2.7736 | 1.149 | 4.133 | -0.051 |

| XNTK | SPDR NYSE Technology ETF | 142.915 | 4.8799 | 5.007 | 17.836 | 1.107 |

| IBND | SPDR Bloomberg Barclays International Corporate Bond ETF | 38.075 | 3.8358 | 1.588 | 6.325 | 0.462 |

| XLK | Technology Select Sector SPDR Fund | 128.730 | 4.3125 | 2.134 | 9.316 | -0.992 |

| XLV | Health Care Select Sector SPDR Fund | 113.770 | 3.9148 | 1.093 | 6.456 | 0.291 |

| XBI | SPDR S&P Biotech ETF | 140.450 | 5.7402 | 3.120 | 18.453 | -0.234 |

| SPYG | SPDR S&P 500 Growth ETF | 54.830 | 4.3631 | 1.218 | 8.082 | -0.832 |

| XTL | SPDR S&P Telecom ETF | 85.075 | 3.5259 | 4.591 | 21.813 | 0.383 |

| MMTM | SPDR S&P 1500 Momentum Tilt ETF | 160.827 | 3.1371 | 1.750 | 6.935 | -0.779 |

| ZDEU | SPDR Solactive Germany ETF | 64.441 | 2.9942 | 2.239 | 7.276 | 1.748 |

| SYE | SPDR MFS Systematic Core Equity ETF | 96.561 | 3.9443 | 1.334 | 8.468 | -0.596 |

The distribution curve places each ETF on a bell curve according to their respective degrees of overbought or oversold status using a 10-week distribution. ETFs that are statistically oversold will appear on the left-hand side of the bell curve, while those that have become statistically overbought will appear on the right-hand side of the bell curve. Perhaps the most useful attribute of this feature is that it displays the entire universe on the curve at one time with an "average level" to give us a general picture of whether the State Street ETF universe is generally overbought on a near-term basis, or generally oversold. Our best opportunities are to buy strong market ETFs that have regressed back toward mean conditions based on market weakness, or have become oversold based upon extreme market weakness.

Weekly Distribution is a short-term gauge that is most helpful in timing entry and exit points, while the longer-term information of trend and relative strength is a more controlling factor in the decision of whether to buy or sell. The Distribution Curve below displays those ETFs with positive RS in uppercase letters and those ETFs with poor RS versus the market in lowercase letters. As well, those ETFs that are on a Point & Figure Buy signal appear in Green letters, while those on Sell signals can appear in Red letters. Box Color indicates the Sector Status Rating. Green = Favored, Yellow = Average, and Red = Unfavored.

Average Level 55.06

<--100

-100--80

-80--60

-60--40

-40--20

-20-0

0-20

20-40

40-60

60-80

80-100

100->

The DWA Matrix uses a Point & Figure relative strength comparison of each index to one another to identify the strongest and the weakest among the universe used. The ETFs with the most relative strength buy signals (suggesting outperformance) versus the others in the group are listed at the top. These ETFs should be overweighted in the portfolio. Those ETFs with the least amount of relative strength buy signals versus the others in the group are listed at the bottom. These ETFs should be underweighted in the portfolio.

The State Street ETF Model Portfolios are designed to identify major leadership themes within a market, doing so through the use of Point and Figure relative strength tools. Each of the State Street Models are evaluated weekly and guided by a rules-based investment methodology. The construction of the State Street Sector ETF Portfolio is done through an analysis of the each State Street Sector ETF relative strength chart versus the S&P 500, while the Global Sector Rotation model employs a relative strength matrix ranking of the model's inventory. In either case, those with strong relative strength make the cut and are eligible to be included in the portfolio, while those that aren't, will sit upon the sideline. For more information on the portfolio construction and back testing please see the information files on the Models Page. To enter a portfolio amount and see shares to be purchased as well as modify the portfolio to your specifications, click here. (Note: All State Street ETF Models are updated Wednesday mornings by 9:30 am EST)

- State Street Sector ETF Model: No changes this week.

- State Street Global Rotation ETF Model: No changes this week.

- State Street Targeted Sector Rotation ETF Model: No changes this week.

- State Street Fixed Income Model: No changes this week.

State Street Sector Model SSTREET

| ETF Name | Symbol | DWA Suggested Weighting | Yield | Date Added |

|---|---|---|---|---|

| SPDR NYSE Technology ETF | XNTK | 5.000% | 0.2957 | 03/11/2009 |

| SPDR S&P Bank ETF | KBE | 5.000% | 2.4438 | 11/10/2020 |

| SPDR S&P Regional Banking ETF | KRE | 5.000% | 2.7776 | 11/10/2020 |

| Energy Select Sector SPDR Fund | XLE | 5.000% | 5.6203 | 11/24/2020 |

| Technology Select Sector SPDR Fund | XLK | 5.000% | 0.9189 | 02/25/2009 |

| Health Care Select Sector SPDR Fund | XLV | 5.000% | 1.4884 | 01/28/2014 |

| Consumer Discretionary Select Sector SPDR Fund | XLY | 5.000% | 0.8216 | 02/24/2010 |

| SPDR S&P Semiconductor ETF | XSD | 5.000% | 0.2561 | 02/25/2014 |

| SPDR S&P Biotech ETF | XBI | 5.000% | 0.2001 | 04/21/2020 |

| SPDR S&P Homebuilders ETF | XHB | 5.000% | 0.7321 | 05/12/2020 |

| SPDR S&P Metals & Mining ETF | XME | 5.000% | 0.9884 | 11/17/2020 |

| SPDR S&P Oil & Gas Equipment & Services ETF | XES | 5.000% | 1.3303 | 11/17/2020 |

| SPDR S&P Oil & Gas Exploration & Production ETF | XOP | 5.000% | 2.3402 | 11/24/2020 |

| SPDR S&P Retail ETF | XRT | 5.000% | 1.0100 | 06/02/2020 |

| SPDR S&P Pharmaceuticals ETF | XPH | 5.000% | 0.4700 | 05/12/2020 |

| SPDR S&P Health Care Equipment ETF | XHE | 5.000% | 0.0000 | 09/20/2016 |

| SPDR S&P Aerospace & Defense ETF | XAR | 5.000% | 0.6264 | 12/08/2020 |

| SPDR S&P Health Care Services ETF | XHS | 5.000% | 0.2302 | 12/15/2020 |

| SPDR S&P Software & Services ETF | XSW | 5.000% | 0.2601 | 10/25/2011 |

| Communication Services Select Sector SPDR Fund | XLC | 5.000% | 0.6748 | 10/02/2018 |

* - Model Inception:1/17/2007

State Street Global Rotation Model SSWORLD

| ETF Name | Symbol | DWA Suggested Weighting | Yield | Date Added |

|---|---|---|---|---|

| SPDR S&P China ETF | GXC | 33.333% | 1.0353 | 07/18/2017 |

| SPDR S&P 500 ETF Trust | SPY | 33.333% | 1.5330 | 09/27/2011 |

| SPDR MSCI EAFE StrategicFactors ETF | QEFA | 33.333% | 1.8181 | 06/28/2016 |

* - Model Inception:10/28/2008

State Street Targeted Sector Rotation Model SSTARGETSECTOR

ETF Name

Symbol

DWA Suggested Weighting

Yield

Date Added

SPDR NYSE Technology ETF

XNTK

20.000%

0.2957

10/25/2016

SPDR S&P Regional Banking ETF

KRE

20.000%

2.7776

12/01/2020

SPDR S&P Semiconductor ETF

XSD

20.000%

0.2561

09/15/2020

SPDR S&P Homebuilders ETF

XHB

20.000%

0.7321

07/07/2020

SPDR S&P Software & Services ETF

XSW

20.000%

0.2601

07/31/2018

* - Model Inception: 07/28/2010

State Street Fixed Income Model SSFIXED

ETF Name

Symbol

DWA Suggested Weighting

Yield

Date Added

SPDR Bloomberg Barclays Convertible Bond ETF

CWB

25.000%

2.3441

05/19/2020

SPDR Portfolio Long Term Corporate Bond ETF

SPLB

25.000%

3.0155

04/14/2020

SPDR Wells Fargo Preferred Stock ETF

PSK

25.000%

5.0872

04/14/2020

SPDR Bloomberg Barclays International Corporate Bond ETF

IBND

25.000%

0.4512

09/01/2020

* - Model Inception: 04/27/2011