There are no model changes this week. As of January 13, we will no longer be publishing the weekly State Street ETF report. Additionally, the SSTREET, SSTARGETSECTOR, and SSWORLD models will no longer be supported on the NDW Research Platform. We will, however, continue to run and support the State Street Fixed Income Model [SSFIXED], which follows the same underlying methodology as the SPDR Dorsey Wright Fixed Income Allocation ETF (DWFI). We will alert all users with SSGA model alerts of these changes over the next week. At the bottom of today's feature, we provide a Q4 2020 and 2020 model review.

There are no model changes to report this week.

As of January 13, we will no longer be publishing the weekly State Street ETF report. Additionally, the SSTREET, SSTARGETSECTOR, and SSWORLD models will no longer be supported on the NDW Research Platform. We will, however, continue to run and support the State Street Fixed Income Model SSFIXED, which follows the same underlying methodology as the SPDR Dorsey Wright Fixed Income Allocation ETF DWFI. We will alert all users with SSGA model alerts of these changes over the next week.

Over the last two weeks, we have continued our review of the underlying methodologies for the three SSGA models that will no longer be supported so that users may continue to run them on their own going forward using the matrix tool and/or the Custom Modeler Tool. We first discussed the State Street Sector Rotation Model SSTREET, which can be accessed here, and we reviewed the State Street Targeted Sector Rotation Model SSTARGETSECTOR last week, which can be accessed here. Today, we’ll cover the State Street Global Rotation Model SSWORLD.

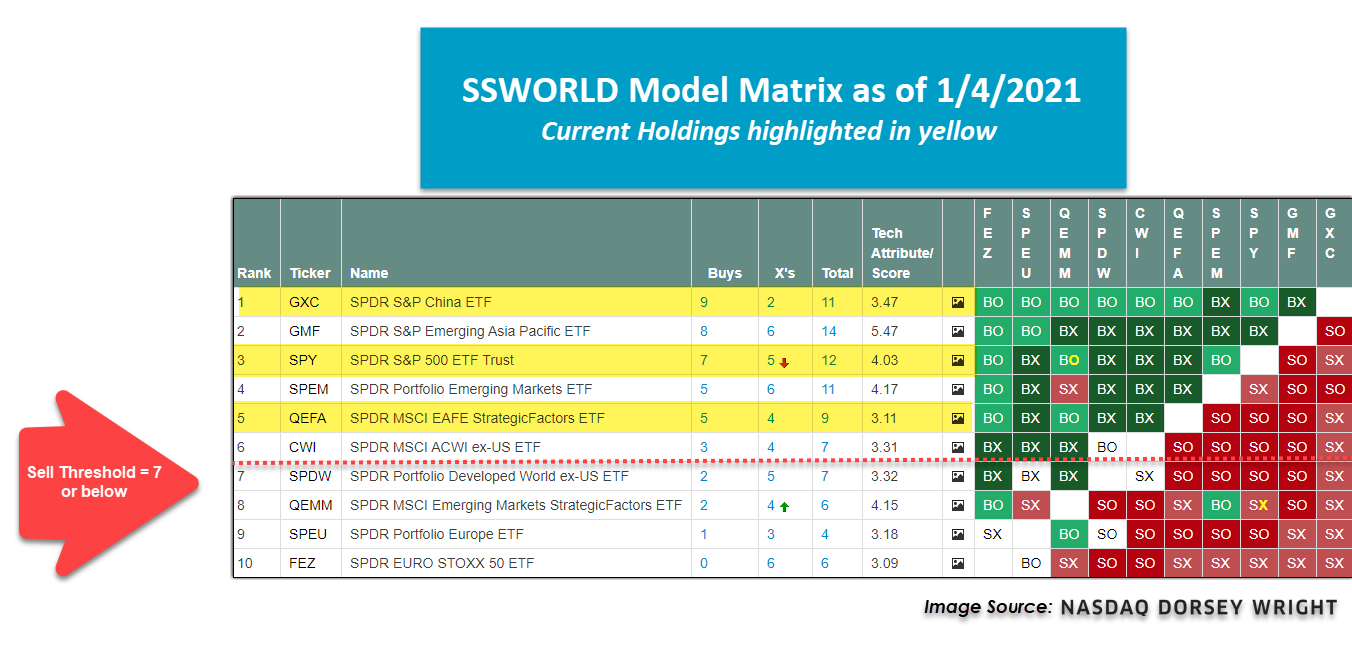

The SSWORLD model is a global rotation model that is matrix-based, like the SSTARGETSECTOR model we discussed last week. We start with a universe of 10 global ETFs, including the US representative SPY, and compare them to one another using a 3.25% RS matrix. The model owns the strongest three ETFs and will hold them until they fall significantly out of favor, which for this model is defined as a ranking of 7 or below. The model is reviewed on a weekly basis for any changes. Upon a change, the model will sell the weak position and will rotate into the strongest ETF not already held in the model. The holdings will then be rebalanced back to equal-weight at 33.33% each.

Currently, the SSWORLD model provides exposure to China GXC, the US SPY, and developed markets via a Smart Beta index that blends low volatility, quality and value exposures together in a single strategy QEFA. These global trends have stayed relatively consistent as there has not been a model change since July 2017. If you have any questions on any of these models, please give us a call at 804-320-8511 or email us at dwa@dorseywright.com.

Q4 2020 & 2020 Performance Review

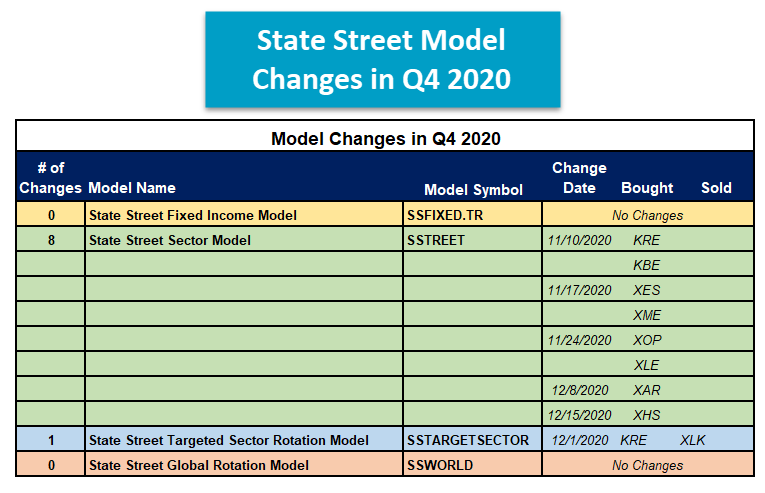

All four State Street Models finished Q4 as well as the year 2020 in positive territory. In Q4, all but the SSWORLD model outperformed the respective model benchmark, while each SSGA model successfully outperformed on a year-to-date basis. When all was said and done, there were eight model changes to report in the State Street Sector Model SSTREET and one change in the State Street Targeted Sector Rotation Model SSTARGETSECTOR model. There were no changes to the State Street Fixed Income SSFIXED.TR or SSWORLD models. Here is a summary of what transpired during the final quarter of 2020.

- The State Street Sector Model SSTREET experienced eight changes throughout the fourth quarter, each change being a “buy”. As a result, the SSTREET model currently offers exposure to 20 sector ETFs, each with a 5% weighting. The portfolio itself was up 17.95% in Q4, outpacing the SPX's return of 11.69%. For the year 2020, SSTREET gained 27.92%, outperforming the SPX’s return of 16.26%.

- The State Street Fixed Income Model SSFIXED.TR did not experience any changes over the fourth quarter of the year. When all was said and done, SSFIXED.TR finished Q4 with a gain of 9.37%, outperforming its benchmark, the iShares US Core Bond ETF Trust AGG.TR’s return of 0.73%. For all of 2020, SSFIXED.TR posted a gain of 17.45% and outperformed the AGG.TR’s return of 7.48%. Note these performance numbers are total return and include dividends and distributions.

- The State Street Global Rotation Model SSWORLD did not experience any changes during the fourth quarter and has not experienced any change since July 2017. The portfolio itself was up 11.29%, which underperformed the model benchmark, the iShares MSCI ACWI ETF ACWI, by -2.22%. For all of 2020, however, the SSWORLD posted a gain of 15.92%, outperforming the ACWI’s return of 14.47%. SSWORLD currently provides exposure to China (GXC), U.S. (SPY), and broad developed markets (QEFA).

- Finally, the State Street Targeted Sector Rotation Model SSTARGETSECTOR finished the final quarter of 2020 with an impressive gain of 20.35%, which outperformed the SPX's return of 11.69%. Additionally, the model experienced just one change in early December. This was the best performing SSGA model in the fourth quarter as well as for all of 2020. For the year, SSTARGETSECTOR finished up 29.87%, outperforming the SPX’s return of 16.26%.