There are no changes to report this morning.

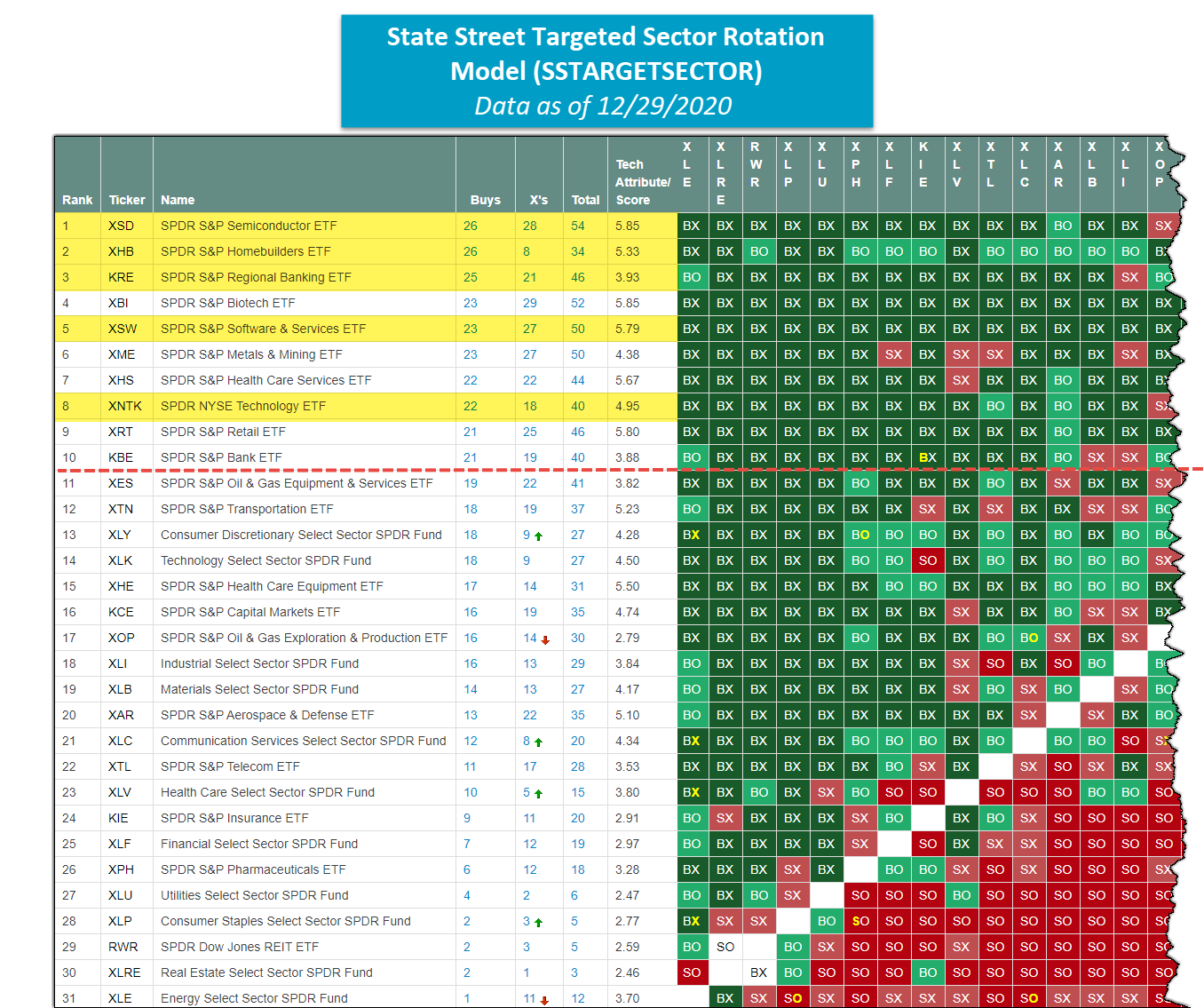

As of January 13, we will no longer be publishing the weekly State Street ETF report. With that in mind, over the next two weeks, we will be reviewing the methodologies underlying each of the four SSGA strategies so that you can continue running them on your own going forward if you wish. Last week, we discussed the State Street Sector Rotation Model SSTREET, which can be accessed here. Today, we’ll review the State Street Targeted Sector Rotation Model SSTARGETSECTOR.

The SSTARGETSECTOR model uses utilizes a relative strength (RS) matrix to determine its holdings. The strongest ETFs are held in the model until they fall significantly out of favor versus the other members. The model is evaluated weekly and will always own five positions. Upon a change, the model holdings will rebalance so each position is equally-weighted at 20%. Currently, the model owns technology XNTK, regional banking KRE, semiconductors XSD, homebuilders XHB, and software & services XSW. Year-to-date, the SSTARGETSECTOR is up 28.19%, outperforming the S&P 500 Index SPX by 12.83%.

Model Rules

- State Street US‐sector ETFs are the universe used.

- Remains 100% invested.

- State Street US‐sector ETFs are compared to each other to determine inclusion using a 3.25% Relative Strength matrix.

- The top five ETFs within the model universe are bought and are only sold when they fall sufficiently out of favor versus the other potential ETFs on a Relative Strength basis.

- A new ETF is only added when one ETF falls out of favor.

- Upon a change, if any one position is more than 27% or less than 13%, the change is made, and all positions are rebalanced back to 20% each. If these collars are not breached, then the change is made using a replacement method.

Like a radar screen, the Weekly Activity Summary gives you a snap shot view of any technical changes to the State Street universe of ETFs. Included in the summary below are both long term technical changes and intermediate term technical changes.

StateStreet ETFs Moving to Negative Monthly Momentum

| Symbol | Name | Price | Score | 30 Day Rtn | 90 Day Rtn | YTD Rtn |

|---|---|---|---|---|---|---|

| BIL | SPDR Bloomberg Barclays 1-3 Month T-Bill ETF | 91.520 | 0.4132 | -0.011 | 0.000 | 0.098 |

| SPBO | SPDR Portfolio Corporate Bond ETF | 36.150 | 3.2556 | -0.012 | 2.032 | 6.874 |

| SPLB | SPDR Portfolio Long Term Corporate Bond ETF | 33.010 | 3.2606 | -0.212 | 3.870 | 9.631 |

StateStreet ETFs Moving to Negative Weekly Momentum

| Symbol | Name | Price | Score | 30 Day Rtn | 90 Day Rtn | YTD Rtn |

|---|---|---|---|---|---|---|

| DGT | SPDR DJ Global Titans ETF | 95.935 | 3.3198 | 1.545 | 16.874 | 7.047 |

| SPEU | SPDR Portfolio Europe ETF | 37.970 | 3.1084 | 3.517 | 15.793 | 4.170 |

| FEZ | SPDR EURO STOXX 50 ETF | 42.180 | 3.0697 | 2.903 | 16.039 | 3.408 |

| SPMD | SPDR Portfolio S&P 400 Mid Cap ETF | 39.990 | 3.3814 | 3.173 | 22.556 | 10.378 |

| SPLG | SPDR Portfolio S&P 500 ETF | 43.660 | 4.1775 | 2.176 | 10.953 | 15.442 |

| GWX | SPDR S&P International Small Cap ETF | 35.220 | 4.1636 | 4.079 | 16.008 | 10.546 |

| EWX | SPDR S&P Emerging SmallCap | 51.490 | 4.3976 | 3.042 | 16.021 | 11.789 |

| CWB | SPDR Bloomberg Barclays Convertible Bond ETF | 81.580 | 4.7458 | 3.831 | 18.421 | 46.991 |

| GNR | SPDR S&P Global Natural Resources ETF | 44.750 | 3.1173 | 2.332 | 19.174 | -3.034 |

| EBND | SPDR Bloomberg Barclays Emerging Markets Local Bond ETF | 27.980 | 2.8047 | 1.894 | 6.469 | 0.251 |

| EDIV | SPDR S&P Emerging Markets Dividend ETF | 28.030 | 1.4593 | 3.394 | 15.397 | -12.679 |

| GAL | SPDR SSgA Global Allocation ETF | 42.505 | 3.3933 | 1.832 | 9.155 | 6.119 |

| MDY | SPDR S&P MIDCAP 400 ETF Trust | 415.720 | 3.5073 | 3.243 | 22.693 | 10.746 |

| KCE | SPDR S&P Capital Markets ETF | 74.190 | 4.7358 | 5.660 | 27.881 | 25.173 |

| JNK | SPDR Bloomberg Barclays High Yield Bond ETF | 108.610 | 2.6930 | 0.882 | 4.162 | -0.849 |

| MDYG | SPDR S&P 400 Mid Cap Growth ETF | 68.500 | 5.3812 | 3.678 | 19.359 | 19.986 |

| MDYV | SPDR S&P 400 Mid Cap Value ETF | 54.930 | 3.2120 | 2.615 | 26.596 | 0.274 |

| INKM | SPDR SSgA Income Allocation ETF (INKM) | 33.640 | 2.8796 | -0.015 | 8.298 | -1.896 |

| SPY | SPDR S&P 500 ETF Trust | 371.460 | 4.0945 | 2.142 | 10.920 | 15.410 |

| SPTM | SPDR Portfolio S&P 1500 Composite Stock Market ETF | 45.770 | 4.1974 | 2.211 | 11.934 | 14.827 |

| XLE | Energy Select Sector SPDR Fund | 37.630 | 3.7042 | -3.290 | 25.643 | -37.325 |

| XLF | Financial Select Sector SPDR Fund | 28.990 | 2.9674 | 1.826 | 20.440 | -5.815 |

| XSD | SPDR S&P Semiconductor ETF | 165.360 | 5.8461 | 6.109 | 31.520 | 56.162 |

| XHB | SPDR S&P Homebuilders ETF | 57.930 | 5.3266 | 0.017 | 7.517 | 27.291 |

| XME | SPDR S&P Metals & Mining ETF | 32.280 | 4.3842 | 6.994 | 38.898 | 10.208 |

| XES | SPDR S&P Oil & Gas Equipment & Services ETF | 44.350 | 3.8188 | 5.070 | 58.619 | -45.179 |

| XOP | SPDR S&P Oil & Gas Exploration & Production ETF | 57.390 | 2.7858 | -0.847 | 36.415 | -39.462 |

| XRT | SPDR S&P Retail ETF | 64.270 | 5.7953 | 4.999 | 29.420 | 39.687 |

| SHM | SPDR Nuveen Bloomberg Barclays Short Term Municipal Bond ETF | 49.790 | 2.3397 | -0.140 | -0.160 | 1.385 |

| SLY | SPDR S&P 600 Small Cap ETF | 78.700 | 4.1959 | 4.252 | 29.292 | 8.627 |

| SLYV | SPDR S&P 600 Small Cap Value ETF | 65.300 | 3.9055 | 2.415 | 30.365 | -0.624 |

| SLYG | SPDR S&P 600 Small Cap Growth ETF | 75.610 | 4.3295 | 5.660 | 28.087 | 17.188 |

| XAR | SPDR S&P Aerospace & Defense ETF | 112.810 | 5.0966 | 2.985 | 29.162 | 3.391 |

| SJNK | SPDR Bloomberg Barclays Capital Short Term High Yield Bond ETF | 26.880 | 2.7018 | 0.863 | 3.904 | -0.223 |

| RLY | SPDR SSgA Multi-Asset Real Return ETF (RLY) | 24.490 | 2.9391 | 2.083 | 12.176 | -3.610 |

| SPHY | SPDR Portfolio High Yield Bond ETF | 26.458 | 2.9559 | 1.128 | 4.618 | 0.372 |

| VLU | SPDR S&P 1500 Value Tilt ETF | 120.026 | 3.2951 | 1.403 | 17.901 | 6.077 |

| SMLV | SPDR SSGA US Small Cap Low Volatility Index ETF | 94.505 | 2.7866 | 2.207 | 24.730 | -5.571 |

| SPSM | SPDR Portfolio S&P 600 Small Cap ETF | 35.380 | 4.1784 | 4.243 | 29.218 | 8.428 |

| ZCAN | SPDR Solactive Canada ETF | 63.871 | 2.8932 | 1.092 | 11.975 | 2.922 |

| SMEZ | SPDR EURO STOXX Small Cap ETF | 71.610 | 4.5168 | 4.291 | 19.157 | 16.006 |

| SYV | SPDR MFS Systematic Value Equity ETF | 69.073 | 2.7979 | 2.213 | 12.708 | -3.945 |

The distribution curve places each ETF on a bell curve according to their respective degrees of overbought or oversold status using a 10-week distribution. ETFs that are statistically oversold will appear on the left-hand side of the bell curve, while those that have become statistically overbought will appear on the right-hand side of the bell curve. Perhaps the most useful attribute of this feature is that it displays the entire universe on the curve at one time with an "average level" to give us a general picture of whether the State Street ETF universe is generally overbought on a near-term basis, or generally oversold. Our best opportunities are to buy strong market ETFs that have regressed back toward mean conditions based on market weakness, or have become oversold based upon extreme market weakness.

Weekly Distribution is a short-term gauge that is most helpful in timing entry and exit points, while the longer-term information of trend and relative strength is a more controlling factor in the decision of whether to buy or sell. The Distribution Curve below displays those ETFs with positive RS in uppercase letters and those ETFs with poor RS versus the market in lowercase letters. As well, those ETFs that are on a Point & Figure Buy signal appear in Green letters, while those on Sell signals can appear in Red letters. Box Color indicates the Sector Status Rating. Green = Favored, Yellow = Average, and Red = Unfavored.

Average Level 53.43

<--100

-100--80

-80--60

-60--40

-40--20

-20-0

0-20

20-40

40-60

60-80

80-100

100->

The DWA Matrix uses a Point & Figure relative strength comparison of each index to one another to identify the strongest and the weakest among the universe used. The ETFs with the most relative strength buy signals (suggesting outperformance) versus the others in the group are listed at the top. These ETFs should be overweighted in the portfolio. Those ETFs with the least amount of relative strength buy signals versus the others in the group are listed at the bottom. These ETFs should be underweighted in the portfolio.

The State Street ETF Model Portfolios are designed to identify major leadership themes within a market, doing so through the use of Point and Figure relative strength tools. Each of the State Street Models are evaluated weekly and guided by a rules-based investment methodology. The construction of the State Street Sector ETF Portfolio is done through an analysis of the each State Street Sector ETF relative strength chart versus the S&P 500, while the Global Sector Rotation model employs a relative strength matrix ranking of the model's inventory. In either case, those with strong relative strength make the cut and are eligible to be included in the portfolio, while those that aren't, will sit upon the sideline. For more information on the portfolio construction and back testing please see the information files on the Models Page. To enter a portfolio amount and see shares to be purchased as well as modify the portfolio to your specifications, click here. (Note: All State Street ETF Models are updated Wednesday mornings by 9:30 am EST)

- State Street Sector ETF Model: No changes this week.

- State Street Global Rotation ETF Model: No changes this week.

- State Street Targeted Sector Rotation ETF Model: No changes this week.

- State Street Fixed Income Model: No changes this week.

State Street Sector Model SSTREET

| ETF Name | Symbol | DWA Suggested Weighting | Yield | Date Added |

|---|---|---|---|---|

| SPDR NYSE Technology ETF | XNTK | 5.000% | 0.3435 | 03/11/2009 |

| SPDR S&P Bank ETF | KBE | 5.000% | 2.7317 | 11/10/2020 |

| SPDR S&P Regional Banking ETF | KRE | 5.000% | 2.9670 | 11/10/2020 |

| Energy Select Sector SPDR Fund | XLE | 5.000% | 10.8627 | 11/24/2020 |

| Technology Select Sector SPDR Fund | XLK | 5.000% | 0.9667 | 02/25/2009 |

| Health Care Select Sector SPDR Fund | XLV | 5.000% | 2.1079 | 01/28/2014 |

| Consumer Discretionary Select Sector SPDR Fund | XLY | 5.000% | 0.9127 | 02/24/2010 |

| SPDR S&P Semiconductor ETF | XSD | 5.000% | 0.3137 | 02/25/2014 |

| SPDR S&P Biotech ETF | XBI | 5.000% | 0.0801 | 04/21/2020 |

| SPDR S&P Homebuilders ETF | XHB | 5.000% | 0.7073 | 05/12/2020 |

| SPDR S&P Metals & Mining ETF | XME | 5.000% | 1.2726 | 11/17/2020 |

| SPDR S&P Oil & Gas Equipment & Services ETF | XES | 5.000% | 2.5777 | 11/17/2020 |

| SPDR S&P Oil & Gas Exploration & Production ETF | XOP | 5.000% | 2.7177 | 11/24/2020 |

| SPDR S&P Retail ETF | XRT | 5.000% | 1.0164 | 06/02/2020 |

| SPDR S&P Pharmaceuticals ETF | XPH | 5.000% | 0.5473 | 05/12/2020 |

| SPDR S&P Health Care Equipment ETF | XHE | 5.000% | 0.0030 | 09/20/2016 |

| SPDR S&P Aerospace & Defense ETF | XAR | 5.000% | 0.6942 | 12/08/2020 |

| SPDR S&P Health Care Services ETF | XHS | 5.000% | 1.9203 | 12/15/2020 |

| SPDR S&P Software & Services ETF | XSW | 5.000% | 0.2804 | 10/25/2011 |

| Communication Services Select Sector SPDR Fund | XLC | 5.000% | 0.7124 | 10/02/2018 |

* - Model Inception:1/17/2007

State Street Global Rotation Model SSWORLD

| ETF Name | Symbol | DWA Suggested Weighting | Yield | Date Added |

|---|---|---|---|---|

| SPDR S&P China ETF | GXC | 33.333% | 1.0920 | 07/18/2017 |

| SPDR S&P 500 ETF Trust | SPY | 33.333% | 1.5320 | 09/27/2011 |

| SPDR MSCI EAFE StrategicFactors ETF | QEFA | 33.333% | 2.3599 | 06/28/2016 |

* - Model Inception:10/28/2008

State Street Targeted Sector Rotation Model SSTARGETSECTOR

ETF Name

Symbol

DWA Suggested Weighting

Yield

Date Added

SPDR NYSE Technology ETF

XNTK

20.000%

0.3435

10/25/2016

SPDR S&P Regional Banking ETF

KRE

20.000%

2.9670

12/01/2020

SPDR S&P Semiconductor ETF

XSD

20.000%

0.3137

09/15/2020

SPDR S&P Homebuilders ETF

XHB

20.000%

0.7073

07/07/2020

SPDR S&P Software & Services ETF

XSW

20.000%

0.2804

07/31/2018

* - Model Inception: 07/28/2010

State Street Fixed Income Model SSFIXED

ETF Name

Symbol

DWA Suggested Weighting

Yield

Date Added

SPDR Bloomberg Barclays Convertible Bond ETF

CWB

25.000%

2.1525

05/19/2020

SPDR Portfolio Long Term Corporate Bond ETF

SPLB

25.000%

3.0999

04/14/2020

SPDR Wells Fargo Preferred Stock ETF

PSK

25.000%

5.0970

04/14/2020

SPDR Bloomberg Barclays International Corporate Bond ETF

IBND

25.000%

0.4868

09/01/2020

* - Model Inception: 04/27/2011