There are no changes this week. Today we review the model methodology for the State Street Targeted Sector Rotation Model (SSTARGETSECTOR).

There are no changes to report this morning.

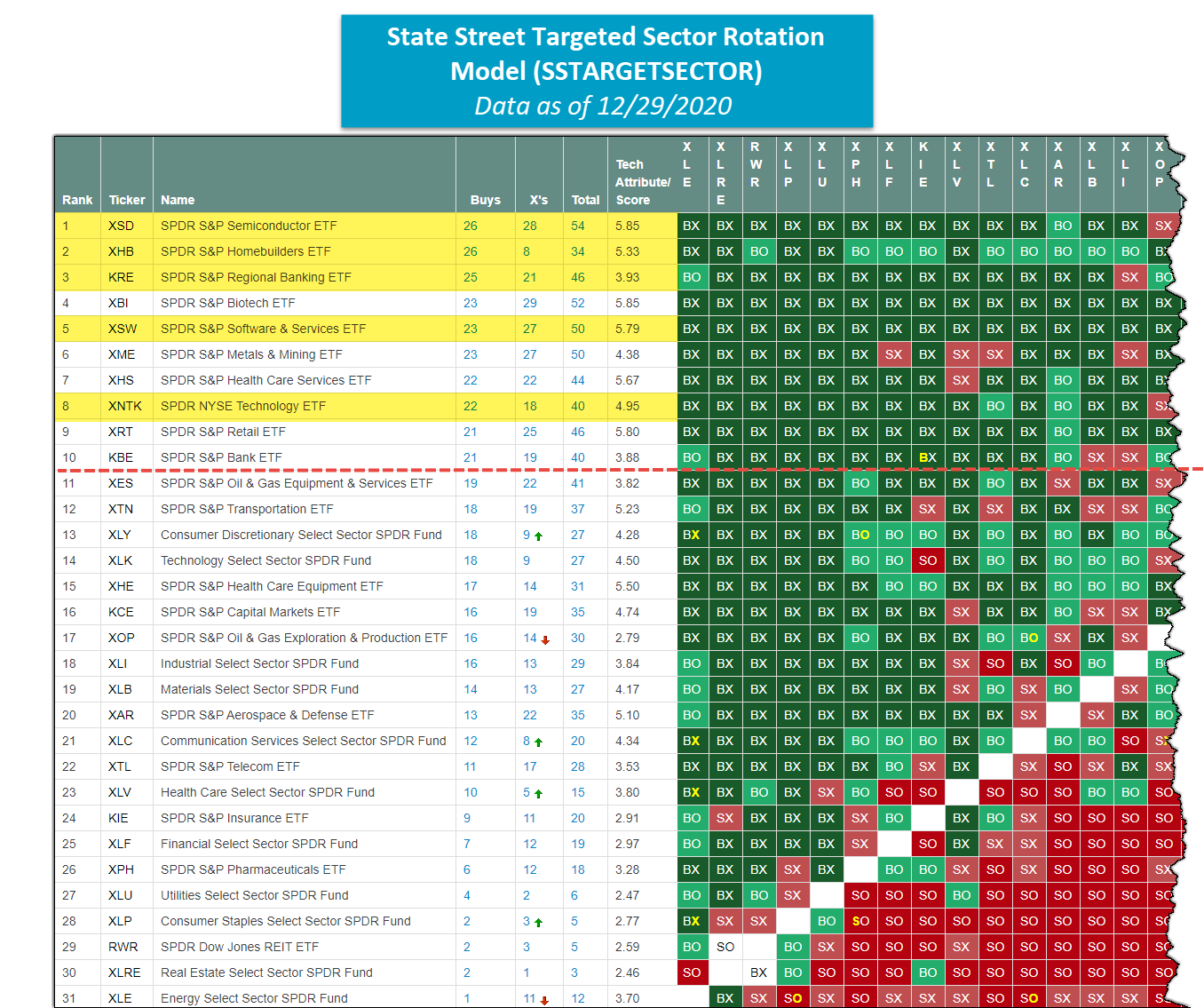

As of January 13, we will no longer be publishing the weekly State Street ETF report. With that in mind, over the next two weeks, we will be reviewing the methodologies underlying each of the four SSGA strategies so that you can continue running them on your own going forward if you wish. Last week, we discussed the State Street Sector Rotation Model SSTREET, which can be accessed here. Today, we’ll review the State Street Targeted Sector Rotation Model SSTARGETSECTOR.

The SSTARGETSECTOR model uses utilizes a relative strength (RS) matrix to determine its holdings. The strongest ETFs are held in the model until they fall significantly out of favor versus the other members. The model is evaluated weekly and will always own five positions. Upon a change, the model holdings will rebalance so each position is equally-weighted at 20%. Currently, the model owns technology XNTK, regional banking KRE, semiconductors XSD, homebuilders XHB, and software & services XSW. Year-to-date, the SSTARGETSECTOR is up 28.19%, outperforming the S&P 500 Index SPX by 12.83%.

Model Rules

- State Street US‐sector ETFs are the universe used.

- Remains 100% invested.

- State Street US‐sector ETFs are compared to each other to determine inclusion using a 3.25% Relative Strength matrix.

- The top five ETFs within the model universe are bought and are only sold when they fall sufficiently out of favor versus the other potential ETFs on a Relative Strength basis.

- A new ETF is only added when one ETF falls out of favor.

- Upon a change, if any one position is more than 27% or less than 13%, the change is made, and all positions are rebalanced back to 20% each. If these collars are not breached, then the change is made using a replacement method.