Daily Summary

Fall Symposium Early Bird Pricing Ends 9/30!

Register soon for our Fall Symposium to take advantage of early bird pricing.

Friday Feature: Look Out for the Back Half of September

The month of September is known for its historically lackluster returns, but data suggests it may be wrong to blame this unfortunate phenomenon on the entirety of the month. If anything, the back half of September is what investors should be pointing fingers at.

Market Distribution Table

The curve has an average reading of -39.91.

Daily Equity Roster

Today's featured stock is PepsiCo, Inc. (PEP).

Analyst Observations

AMZN, ASH, BA, BABA, BERY, CE, ECL, FDX, FND, GS, IQV, LOW, LSTR, NTES, QCOM, TRGP, WAT, WDAY, and XOM

Daily Option Ideas

Call: Toast Inc (TOST); Put: Barrick Gold Corp (GOLD); Covered Write: The AES Corp (AES).

Upcoming Webinar: A More Precise Approach to Fixed Income - Relative Strength Rotation Among Sector-Based High Yield Bonds

Join us on Tuesday, September 20th at 2 pm EST for a discussion with BondBloxx. In this webinar, Cole Feinberg and JoAnne Bianco, Partners at BondBloxx ETFs, will join Chuck Fuller, Portfolio Manager at Nasdaq Dorsey Wright to discuss what is driving high yield fixed income from a sector perspective, and how the tactical nature of the BondBloxx High Yield Sector Rotation ETF Model can position investors to take advantage of the changing landscape. There will also be ample time for questions from the audience. This event is approved for one hour of CIMA and CFP CE credit.

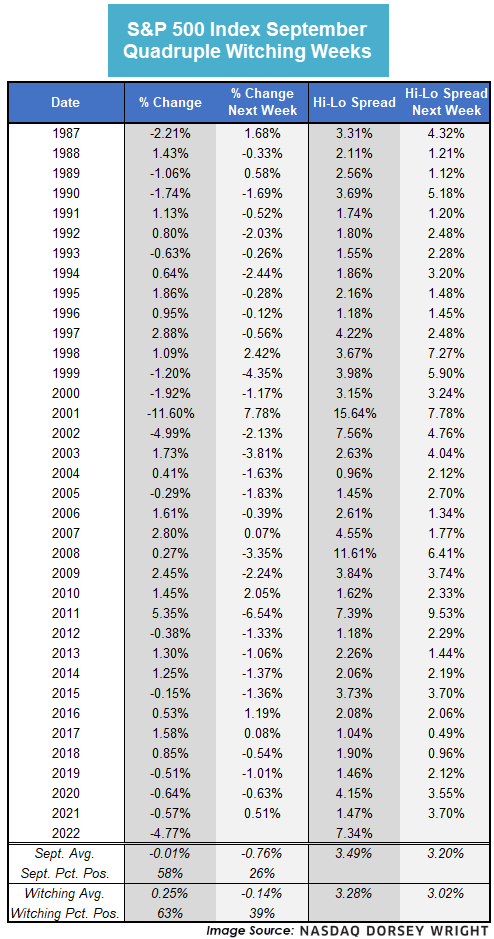

Triple Witching occurs when stock options, futures, and futures options all expire on the same day, which is generally on the third Friday of the last month in each calendar quarter. Friday, September 16, will be the third such "triple witching" of 2022; the other prior two occurring in March and June. Technically we could employ the phrase "Quadruple Witching", as the advent of single stock futures provided a fourth derivative medium also expiring on Friday, but old habits die hard, and frankly "Quadruple Witching" just doesn't roll off the tongue in quite the same fashion. Nonetheless, these "witching" weeks can often bring with them an increased level of volatility.

While the word volatility, in and of itself, generally brings with it negative connotations, it does not necessarily mean the market must go down. In fact, 63% of all “witching” Fridays since June 1987 have seen the S&P 500 Index SPX show positive performance for that week. This was not the case this week, as the S&P 500 notched a weekly loss of -4.77% to mark the largest weekly loss for SPX since June 17 (the last witching Friday), when the index dropped -5.79%. While the last two “witching” Fridays have seen sharp declines, the first witching Friday this year occurred on March 18 and saw the index post a significant weekly gain of 6.16%. This variation indicates the uncertainty in how these weeks will play out, but it has been clear that these weeks bring added volatility.

To get an idea of how past Triple Witchings in September have played out historically, we went back to 1987 and pulled data on the S&P 500 Index SPX during the week with Triple Witching culminating on that Friday. These 36 weeks have averaged a return of -0.01% for SPX, which is about flat, with 58% of the weeks showing a gain. These numbers are slightly lower than the broader numbers for Witching Fridays in any month. Over the next week, however, the SPX tends to see more negative returns following a Witching Friday in September, with an average loss of -0.76% and only a 26% positive hit rate. Again, these numbers are slightly lower than the other Witching months, but we see a similar drop-off in the subsequent weeks. It is also interesting to note that the SPX averages about a 3.5% spread between the weekly highs and lows during September Witching weeks, although the spread this week came in at 7.34%, the highest since 2011. We generally see similar spreads in the week that follows, which sits at an average of 3.20%, highlighting the potential for further volatility as we head toward the end of the month.

Do you want to take your analysis and portfolio management to the next level? Do you need to evolve your business strategies to address the ever-changing market? If so, join us from November 2nd through November 4th for the Nasdaq Dorsey Wright Fall Symposium in Richmond, VA!

The Symposium is designed specifically for financial professionals who already utilize Point & Figure and Relative Strength methodologies in their practice, as well as those who would like to learn more. Attendees have the option to add an introductory half-day session prior to the main event, designed to provide a firm understanding of the methodologies discussed over the following two days. The main seminar will start on Thursday morning, and feature a combination of lectures, small group sessions, case study work, website tutorials, and Q&A time. There will also be ample opportunities to network with other advisors. The full event will expose you to new ideas, frameworks, and tools that can help you manage your business more effectively. You will have a chance to engage with the analyst team from Nasdaq Dorsey Wright as well as seasoned peers in the business. The Symposium is pending approval for CE credit toward the CFP®, CIMA®, CPWA®, and RMA certifications.

Dates

Wednesday, November 2nd, 2022 – Introductory Sessions

Thursday, November 3rd and Friday, November 4th, 2022 – Advanced Sessions

Fee –

Early Bird Discount of $200/person will be applied to registrations made on or before September 30th, 2022!

$1,200 per person (Advanced Sessions)

$1,400 per person (Introductory & Advanced Sessions)

*Payment will be processed upon sign-up and is inclusive of breakfast and lunch both days, the cocktail reception and dinner Thursday evening, and all training materials. Fees are non-refundable and non-transferable.

Location

The Historic Jefferson Hotel in downtown Richmond, VA

About the Jefferson Hotel: Since 1895, The Jefferson Hotel has been recognized by discerning travelers as Richmond's grandest hotel and one of the finest in America. Known for its genuinely friendly service, luxurious guestrooms, breathtaking architecture, and elegant décor, The Jefferson Hotel is reminiscent of a more gracious era. Guests of The Jefferson enjoy a variety of amenities and services, unmatched by any other luxury Richmond hotel. Visit - https://www.jeffersonhotel.com/

Travel

Everyone is responsible for their own travel arrangements and hotel reservations. A group discount is available at the Jefferson Hotel when reserved on or before October 3rd, 2022 (information provided upon registration and receipt; limited quantities available).

Register Now

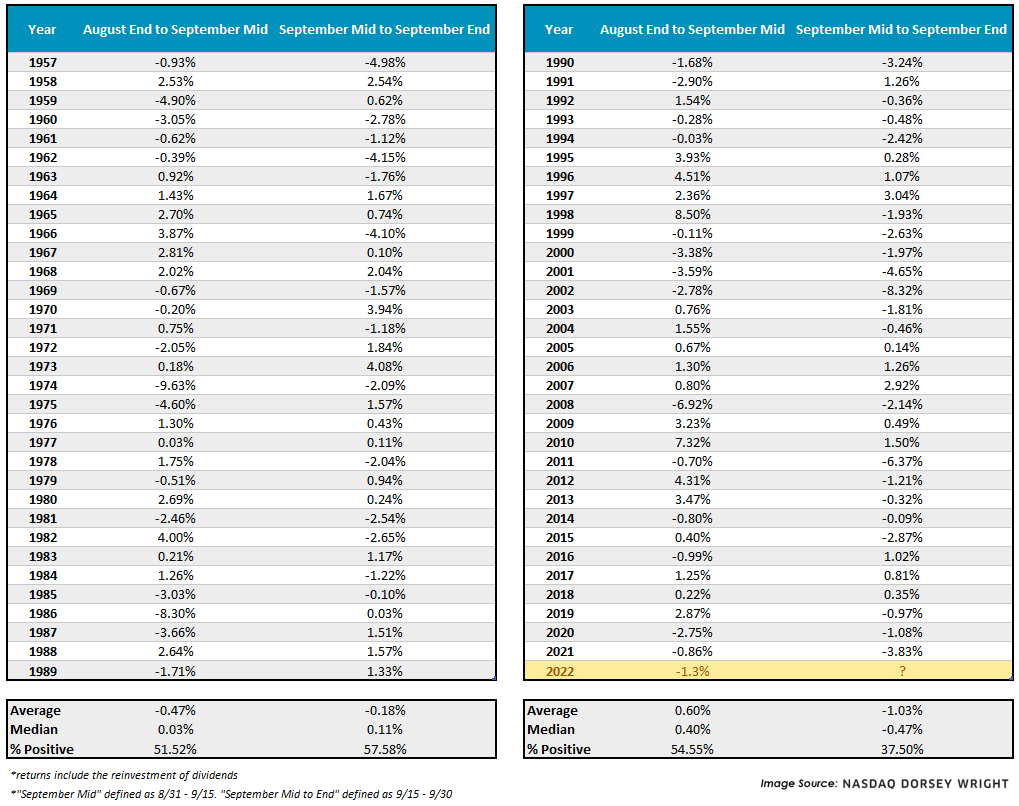

As recently discussed in a DWA Prospecting Report, September is historically one of the weakest months for equities and so far, the month is living up to precedent with flying colors. Through trading yesterday (9/15), the S&P 500 (SPX) and the Dow (.DJIA) were down over -1% while the Nasdaq Composite had lost over -2% since the end of August. With total return data beginning in 1957, that is the 18th worst first half (1H) September performance on record for the S&P 500. Before September 2020 when SPX was down -2.75%, you must look back to 2008 to find a lower 1H return.

A loss of just over -1% may seem anticlimactic for a period holding the “weakest month of the year” title, but historically, the back half of September has presented the most challenges. Since 1957, the 1H September average and median return have been 0.07% and 0.19%, respectively, and positive about 53% of the time; meanwhile, the second half (2H) September average and median return have been -0.59% and -0.09%, respectively, and positive just 47% of the time.

Maybe this has been a thing of the past and archaic market environments/structures are skewing these numbers? The data suggests otherwise. In fact, since 1990 the return profile is worse as just 38% of 2H Septembers have been positive with an average loss of -1.03%. Maybe our lookback is still too far? What about just the past 10 years? From 2012 – 2021, the 2H of September has been negative 70% of the time with an average loss of -0.8%.

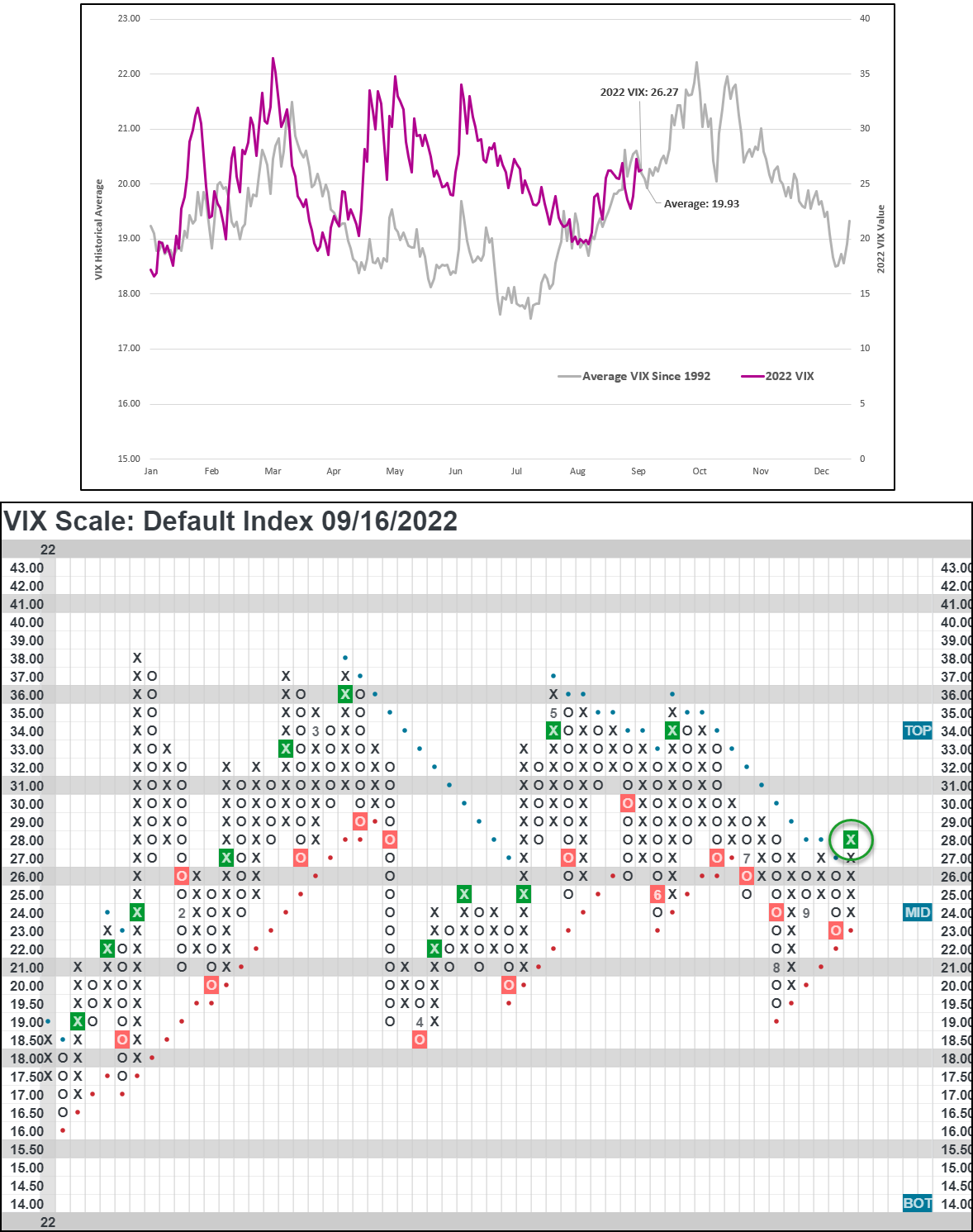

A coincidental observation relates to market volatility, commonly discussed via the CBOE SPX Volatility Index (VIX). Along with the 2H of September being historically weak from a return perspective, volatility also tends to be higher - which makes sense given that VIX and SPX tend to be negatively correlated. As for exactly why the second half of September is more volatile, the jurors and academics alike are still out deliberating, but some common attributions are quarter-end rebalancing/trading and the end of summer travel/time off work.

The VIX ended around 26 yesterday (9/15) which puts it slightly above the 30-year average, but it would not be uncommon to see this tick even higher. In fact, this upward trend could be evidenced already as earlier this week (9/13) we saw VIX break through its bearish resistance line and give a Point & Figure buy signal for the first time since June of this year.

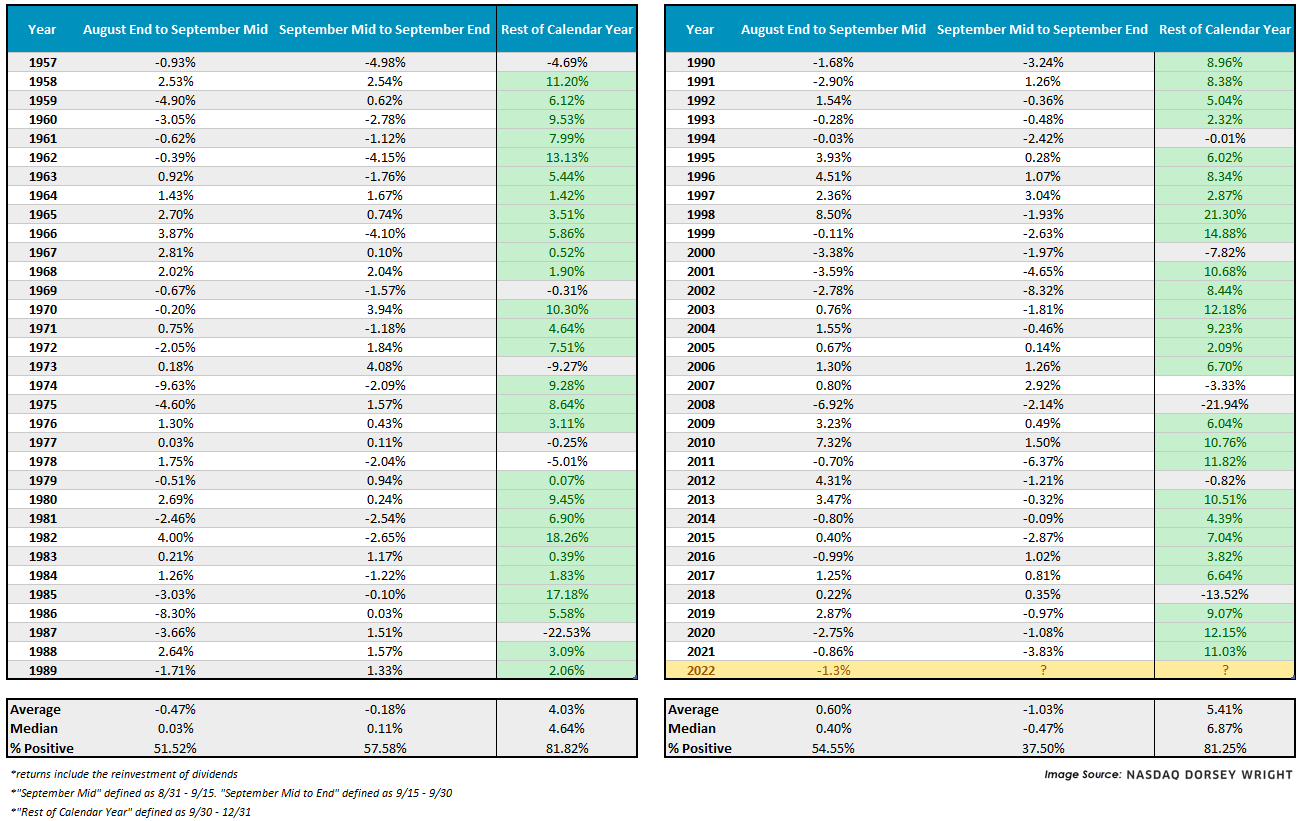

Now, before the bears get too excited about this potential weak/bumpy stretch ahead of us, notice we left out a key piece of information in the first return tables which we have now added below - the past performance for the rest of the calendar year (far right-hand column). From the end of September to the end of the calendar year the S&P 500 has been positive over 80% of the time with an average gain between 4% and 5% – and that stat is consistent from 1957 to 2021. Furthermore, of the times SPX has been down -1% or more in the 1H of September, the rest of the calendar year (from month end until year-end) has been positive 14 out of 17 times - the three outliers being 1987, 2000, and 2008.

Investors tend to have a love/hate relationship with October (which we will probably outline in a report next week) so a majority of this could be attributed to the tailwinds of the seasonally strong period in the market, Santa Claus Rally, Sell in May Go Away Come Back in November, or whatever you want to call it. Regardless, the numbers speak for themselves.

With 2022 being a year unlike any other, by seemingly countless measurements, there is a real possibility of deviating from historical norms given that has been the theme this year. However, someone with their glass half full may rationalize a potential buying opportunity within the next several weeks based on these metrics of seasonality.

Portfolio View - Major Market ETFs

| Symbol | Name | Price | Yield | PnF Trend | RS Signal | RS Col. | Fund Score | 200 Day MA | Weekly Mom |

|---|---|---|---|---|---|---|---|---|---|

| DIA | SPDR Dow Jones Industrial Average ETF Trust | 310.36 | 1.94 | Positive | Sell | O | 2.26 | 335.18 | -3W |

| EEM | iShares MSCI Emerging Markets ETF | 38.14 | 2.76 | Negative | Sell | O | 0.38 | 43.75 | -2W |

| EFA | iShares MSCI EAFE ETF | 60.77 | 4.88 | Negative | Sell | O | 0.45 | 70.02 | -3W |

| FM | iShares MSCI Frontier and Select EM ETF | 26.60 | 3.01 | Positive | Sell | O | 1.90 | 30.91 | -1W |

| IJH | iShares S&P MidCap 400 Index Fund | 241.54 | 1.47 | Negative | Sell | X | 3.58 | 255.58 | -3W |

| IJR | iShares S&P SmallCap 600 Index Fund | 94.62 | 1.76 | Positive | Sell | O | 2.41 | 103.30 | -3W |

| QQQ | Invesco QQQ Trust | 291.10 | 0.62 | Negative | Sell | O | 1.76 | 332.71 | -3W |

| RSP | Invesco S&P 500 Equal Weight ETF | 140.15 | 1.68 | Positive | O | 4.70 | 149.78 | -3W | |

| SPY | SPDR S&P 500 ETF Trust | 390.12 | 1.52 | Positive | Sell | O | 2.38 | 425.19 | -3W |

| XLG | Invesco S&P 500 Top 50 ETF | 292.14 | 1.17 | Positive | Sell | O | 2.11 | 326.12 | -3W |

Additional Comments:

The SPDR Dow Jones Industrial Average ETF Trust DIA remains on the buy signal printed a month ago and moved lower this week to a price of $310. The fund has a current score of 2.26 with a negative score direction yet barely remains in a positive trend. The fund scores below the average US score of 2.76. Support is offered at $300, with further support shown at $265 from October 2020.

The iShares MSCI Emerging Markets ETF EEM gave its ninth consecutive sell signal this week and is at a current price of $38. The fund has a very weak score at 0.38 with a -1.43 score direction and remains firmly in a negative trend. EEM is also beneath the average non-US score of 1.47. The overall technical picture for EEM remains negative. Support is seen at $35.50 on the default chart.

The iShares MSCI EAFE ETF EFA reversed up this week into a column of X’s to a current price of $63.00. The fund has a weak score of 0.45 which is below the average non-US equity fund of 1.47 and is paired with a -1.34 score direction. The fund remains in a negative trend and on a second consecutive sell signal. Support is offered at $60 on the default chart.

The iShares MSCI Frontier and Select EM ETF FM reversed down this week to a current price of $26.50. The fund has a weak score of 1.90 and is paired with a -1.73 score direction. The technical picture is negative, following other international equity funds lower. The fund is seen at support on the default chart at $26.50

The iShares S&P MidCap 400 Index Fund IJH remains in a column of O’s failing to test its bearish resistance line from last month. The price remains unchanged, sitting at $240. IJH has a current fund score of 3.58, which is above the average US score of 2.76. The reversal back into O’s brings the fund back into the middle of its 10-week trading band. Support can be found at $220 on the default chart.

The iShares S&P SmallCap 600 Index Fund IJR reversed down into a column of O’s this week to give a sell signal and is at a current price of $93. IJR remains under the 3.0 score threshold at 2.41 but does have a .76 positive score direction. Initial support is offered at $90 and further support is offered at $89.

The Invesco QQQ Trust QQQ moved lower this week to give a sell signal and is at a current price of $290. With this week’s movement, the fund violated its bullish support line. The recent 1.76 fund score is lower than the average US fund (2.76), and the fund holds a negative 2.29 score direction. QQQ initial support is offered at $280 and further support at $270 on the default chart.

The Invesco S&P 500 Equal Weight ETF RSP reversed down this week giving a sell signal and testing its bullish support line. The fund is at a current price of $138 and still holds a positive score direction of 1.01, paired with a fund score of 4.70. This beats the average S&P 500 Index fund score of 3.31 and remains the highest score of funds in this report. The fund remains at support, its bullish support line, yet further support is offered at $132 on the default chart.

The SPDR S&P 500 ETF Trust SPY reversed down into O’s with this week's action to a price of $385, violating its bullish support line and giving a sell signal. SPY has a 2.38 score posting yet a positive score direction of 0.67. Initial support is offered at $375 and further support is offered at $365 on the default chart.

The Invesco S&P 500 Top 50 ETF XLG remains in a column of O’s this week and currently sits at a price of $290. XLG has a 2.11 fund score and a negative score direction of -2.15. Like the other large-cap domestic equity funds, this mega-cap representative saw its technical picture weaken over the past several months, and while the return to a buy signal in August is a positive sign, further confirmation is needed before signaling a return to a more positive technical picture. Initial support is offered at $280 and further support at $250 from October 2020.

Average Level

-39.91

| AGG | iShares US Core Bond ETF |

| USO | United States Oil Fund |

| DIA | SPDR Dow Jones Industrial Average ETF |

| DVY | iShares Dow Jones Select Dividend Index ETF |

| DX/Y | NYCE U.S.Dollar Index Spot |

| EFA | iShares MSCI EAFE ETF |

| FXE | Invesco CurrencyShares Euro Trust |

| GLD | SPDR Gold Trust |

| GSG | iShares S&P GSCI Commodity-Indexed Trust |

| HYG | iShares iBoxx $ High Yield Corporate Bond ETF |

| ICF | iShares Cohen & Steers Realty ETF |

| IEF | iShares Barclays 7-10 Yr. Tres. Bond ETF |

| LQD | iShares iBoxx $ Investment Grade Corp. Bond ETF |

| IJH | iShares S&P 400 MidCap Index Fund |

| ONEQ | Fidelity Nasdaq Composite Index Track |

| QQQ | Invesco QQQ Trust |

| RSP | Invesco S&P 500 Equal Weight ETF |

| IWM | iShares Russell 2000 Index ETF |

| SHY | iShares Barclays 1-3 Year Tres. Bond ETF |

| IJR | iShares S&P 600 SmallCap Index Fund |

| SPY | SPDR S&P 500 Index ETF Trust |

| TLT | iShares Barclays 20+ Year Treasury Bond ETF |

| GCC | WisdomTree Continuous Commodity Index Fund |

| VOOG | Vanguard S&P 500 Growth ETF |

| VOOV | Vanguard S&P 500 Value ETF |

| EEM | iShares MSCI Emerging Markets ETF |

| XLG | Invesco S&P 500 Top 50 ETF |

Long Ideas

| Symbol | Company | Sector | Current Price | Action Price | Target | Stop | Notes |

|---|---|---|---|---|---|---|---|

| RLI | R L I Corp | Insurance | $109.28 | 110s | 161 | 96 | 5 for 5'er, top 20% of INSU sector matrix, spread triple top, R-R>2.0 |

| GPK | Graphic Packaging Intl. | Forest Prods/Paper | $22.72 | 21 - 23 | 26 | 18 | 5 for 5'er, #2 of 15 in favored FORE sector matrix, LT pos mkt RS, triple top, 1.3% yield |

| KDNY | Chinook Therapeutics Inc. | Biomedics/Genetics | $21.56 | 17-20 | 22 | 15 | 5 TA rating, top decile BIOM sect., cons. buy signals, pos. monthly mom. |

| ABBV | AbbVie Inc. | Drugs | $142.51 | low 150s - low 160s | 192 | 134 | 5 for 5'er, top 20% of DRUG sector matrix, 3.7% yield |

| UNH | UnitedHealth Group Incorporated | Healthcare | $522.91 | 510s - 530s | 632 | 432 | 5 for 5'er, top 25% of HEAL sector matrix, LT pos mkt RS, 1.3% yield |

| CI | CIGNA Corporation | Insurance | $289.96 | 260s - low 280s | 356 | 224 | 4 for 5'er, #3 of 67 in INSU sector matrix, new ATH, 1.6% yield |

| TMUS | T-Mobile US Inc. | Telephone | $141.02 | mid 130s - mid 140s | 172 | 120 | 5 for 5'er, #5 of 3 in TELE sector matrix. LT pos mkt RS, triple top breakout |

| TMO | Thermo Fisher Scientific Inc. | Healthcare | $551.98 | 560s - 590s | 808 | 496 | 5 for 5'er, top quartile of HEAL sector matrix, LT pos mkt RS, big base breakout, R-R>2.0 |

| WPC | W.P. Carey & Co. LLC | Real Estate | $83.46 | $80s | 100 | 71 | 4 TA rating, top decile REAL sector, consec. buy signals, recent pos. wkly mom., buy-on-pullback, 5.01% yield |

| MCD | McDonald's Corporation | Restaurants | $253.47 | hi 240s - mid 260s | 324 | 220 | 4 for 5'er, top third of favored REST sector matrix, LT pos mkt RS, bullish triangle, 2.15% yield |

| ABC | AmerisourceBergen Corporation | Drugs | $139.81 | mid 140s - mid 150s | 172 | 126 | 4 for 5'er, top half of favored DRUG sector matrix, triple top, pos trend change, 1.2% yield |

| LVS | Las Vegas Sands Corp. | Gaming | $39.69 | hi 30s - low 40s | 56 | 30 | 4 TA rating, top third GAME sect., recent pos. trend., pos. monthly mom. |

| XENE | Xenon Pharmaceuticals Inc | Healthcare | $39.30 | mid to upper $30s | 42 | 30 | 5 for 5'er, top 25% of favored HEAL sector matrix, spread quad top, pullback from ATH |

| NOC | Northrop Grumman Systems Corporation | Aerospace Airline | $485.08 | 470s to 510s | 616 | 396 | 4 TA rating, top decile of AERO sect., spread triple top breakout, pos. wkly mom. |

| SBCF | Seacoast Banking Corporation of Florida | Banks | $31.84 | mid 30s | 47 | 29 | 5 for 5'er, 15 of 122 in favored BANK sector matrix, bearish signal reversal,1.9% yield |

| PEP | PepsiCo, Inc. | Food Beverages/Soap | $165.88 | 170s - low 180s | 230 | 152 | 4 for 5'er, top quartile of favored FOOD sector matrix, spread quintuple top, pos mon mom flip, R-R>2.0, 2.6% yield |

| BYD | Boyd Gaming Corp | Gaming | $53.76 | mid-hi 50s | 67 | 47 | 4 TA rating, top third GAME sect., consec. buy signals, buy-on-pullback |

| GD | General Dynamics Corporation | Aerospace Airline | $228.46 | mid 220s -low 240s | 320 | 204 | 4 for 5'er, #8 of 44 in AERO sector matrix, LT pos mkt RS, spread triple top, R-R>2.0, 2.15% yield |

| CUBE | CubeSmart | Real Estate | $43.78 | low-high 40s | 72 | 38 | 4 TA rating, top half RETA sect. matrix, buy-on-pullback, 3.55% yield, R-R > 2.5. |

| DTE | DTE Energy Company | Utilities/Electricity | $130.60 | mid 120s - hi 130s | 166 | 108 | 4 TA rating, top quintile EUTI sect., buy-on-pullback, 2.69% yield. |

| TPR | Tapestry Inc. | Textiles/Apparel | $33.22 | lo-mid 30s | 46 | 26 | 5 TA rating, cons. buys, LT RS buy, buy-on-pullback, 3.44% yield. |

| SLGN | Silgan HLDG Inc | Household Goods | $47.00 | mid-to-hi 40s | 64 | 38 | 4 for 5'er, top quintile of HOUSE sector matrix, bearish signal reversal, R-R>2.5, 1.4% yield |

| HSY | The Hershey Company | Food Beverages/Soap | $219.62 | 220s - 230s | 292 | 190 | 4 for 5'er, top 10% of favored FOOD sector matrix, shakeout/triple top breakout, good R-R, 1.85% yield |

| NXST | Nexstar Media Group Inc. | Media | $192.52 | 190s - low 200s | 242 | 172 | 5 for 5'er, #2 of 44 in MEDI sector matrix, LT pos RS, multiple consec buy signals, 1.9% yield |

| MS | Morgan Stanley | Wall Street | $88.26 | mid 80s - low 90s | 131 | 72 | 4 TA rating, top half WALL sect., LT market RS buy, buy-on-pullback, 3.47% yield, R-R > 3 |

| EVH | Evolent Health | Software | $38.92 | hi 30s - low 40s | 45 | 32 | 5 for 5'er, 17 of 141 in SOFT sector matrix, LT pos trend & mkt RS, bullish catapult |

| TCOM | Trip.com Group Ltd. | Leisure | $26.46 | mid-hi 20s | 37.50 | 20 | 4 TA rating, top quintile of LEIS sector, consec. buy signals, buy-on-pullback. |

| PEP | PepsiCo, Inc. | Food Beverages/Soap | $165.88 | mid 160s - mid 170s | 230 | 152 | 4 for 5'er, top third of FOOD sector matrix, spread quad top breakout, pullback from ATH, R-R>4.0, 2.7% yield |

Short Ideas

| Symbol | Company | Sector | Current Price | Action Price | Target | Stop | Notes |

|---|

Removed Ideas

| Symbol | Company | Sector | Current Price | Action Price | Target | Stop | Notes |

|---|---|---|---|---|---|---|---|

| DVN | Devon Energy Corporation | Oil | $69.48 | hi 60s - low 70s | 90 | 58 | DVN fell to a sell signal on Friday. OK to hold here. Raise stop to $60. |

Follow-Up Comments

| Comment | |||||||

|---|---|---|---|---|---|---|---|

|

|

|||||||

DWA Spotlight Stock

PEP PepsiCo, Inc. R ($166.37) - Food Beverages/Soap - PEP is 4for 5'er that ranks in the top third of the food beverages/soap sector matrix. In last month's trading, PEP broke a spread quadruple top, taking out resistance that had been in place since January and establishing a new all-time high. The stock has subsequently pulled back with the market and now sits in moderately oversold territory, offering an entry point for long exposure. positions may be added in the mid $160s to mid $170s and we will set our initial stop at $152, which would take out PEP's 2022 low. We will use the bullish price objective, $230, as our target price, giving us a reward-to-risk ratio north of 4.0. PEP also carries a 2.73% yield.

| 19 | 20 | 21 | 22 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 180.00 | X | 180.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 178.00 | • | X | O | 178.00 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 176.00 | 1 | 2 | X | X | • | 8 | O | 176.00 | |||||||||||||||||||||||||||||||||||||||||||||

| 174.00 | X | O | X | O | X | O | X | O | • | X | O | 174.00 | |||||||||||||||||||||||||||||||||||||||||

| 172.00 | X | O | X | O | X | O | X | O | • | X | 9 | Mid | 172.00 | ||||||||||||||||||||||||||||||||||||||||

| 170.00 | X | O | X | O | 4 | 5 | X | O | X | 7 | O | 170.00 | |||||||||||||||||||||||||||||||||||||||||

| 168.00 | X | O | O | X | X | O | X | O | X | O | X | O | 168.00 | ||||||||||||||||||||||||||||||||||||||||

| 166.00 | X | C | O | X | O | X | O | O | X | O | X | O | 166.00 | ||||||||||||||||||||||||||||||||||||||||

| 164.00 | B | O | X | O | X | O | X | O | X | 6 | X | 164.00 | |||||||||||||||||||||||||||||||||||||||||

| 162.00 | X | O | X | O | O | X | O | X | O | X | 162.00 | ||||||||||||||||||||||||||||||||||||||||||

| 160.00 | X | O | 3 | X | O | O | X | Bot | 160.00 | ||||||||||||||||||||||||||||||||||||||||||||

| 158.00 | X | X | O | X | • | O | X | • | 158.00 | ||||||||||||||||||||||||||||||||||||||||||||

| 156.00 | X | O | X | O | X | • | O | • | 156.00 | ||||||||||||||||||||||||||||||||||||||||||||

| 154.00 | X | O | X | O | • | • | 154.00 | ||||||||||||||||||||||||||||||||||||||||||||||

| 152.00 | X | 9 | X | • | 152.00 | ||||||||||||||||||||||||||||||||||||||||||||||||

| 150.00 | 7 | A | • | 150.00 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 148.00 | • | C | 5 | • | 148.00 | ||||||||||||||||||||||||||||||||||||||||||||||||

| 146.00 | 2 | • | X | O | 4 | • | 146.00 | ||||||||||||||||||||||||||||||||||||||||||||||

| 144.00 | X | O | • | X | X | X | O | X | • | 144.00 | |||||||||||||||||||||||||||||||||||||||||||

| 142.00 | X | O | X | • | 9 | O | X | O | X | 1 | X | X | • | 142.00 | |||||||||||||||||||||||||||||||||||||||

| 140.00 | A | 1 | O | X | O | • | 8 | O | A | O | X | O | X | O | X | • | 140.00 | ||||||||||||||||||||||||||||||||||||

| 138.00 | 9 | O | C | O | X | O | • | X | X | O | X | O | B | O | X | O | X | • | 138.00 | ||||||||||||||||||||||||||||||||||

| 136.00 | X | O | X | O | 3 | O | • | X | O | X | 7 | O | X | O | X | 2 | O | 3 | • | 136.00 | |||||||||||||||||||||||||||||||||

| 134.00 | X | X | B | X | O | X | O | • | X | O | X | O | X | O | X | O | X | O | X | • | 134.00 | ||||||||||||||||||||||||||||||||

| 132.00 | 6 | O | X | O | O | X | O | • | X | O | X | O | X | O | X | O | O | X | • | 132.00 | |||||||||||||||||||||||||||||||||

| 130.00 | 5 | O | X | O | O | • | X | 5 | O | X | O | O | • | 130.00 | |||||||||||||||||||||||||||||||||||||||

| 128.00 | X | 7 | X | O | • | X | 6 | • | 128.00 | ||||||||||||||||||||||||||||||||||||||||||||

| 126.00 | X | 8 | X | O | X | X | • | X | • | 126.00 | |||||||||||||||||||||||||||||||||||||||||||

| 124.00 | 4 | O | O | X | O | X | O | X | X | • | 124.00 | ||||||||||||||||||||||||||||||||||||||||||

| 122.00 | X | X | O | X | O | X | O | X | X | O | X | • | 122.00 | ||||||||||||||||||||||||||||||||||||||||

| 120.00 | O | X | O | X | O | X | O | X | O | X | O | X | O | X | • | 120.00 | |||||||||||||||||||||||||||||||||||||

| 118.00 | O | 8 | X | O | 3 | O | X | O | X | O | X | O | X | 4 | X | • | 118.00 | ||||||||||||||||||||||||||||||||||||

| 116.00 | 2 | X | O | B | C | X | O | X | O | X | O | X | O | X | O | • | 116.00 | ||||||||||||||||||||||||||||||||||||

| 114.00 | O | X | O | X | O | 2 | O | O | X | O | • | O | X | • | 114.00 | ||||||||||||||||||||||||||||||||||||||

| 112.00 | O | X | O | X | O | 1 | O | • | • | O | X | • | 112.00 | ||||||||||||||||||||||||||||||||||||||||

| 110.00 | O | 7 | A | X | O | X | • | • | O | X | • | 110.00 | |||||||||||||||||||||||||||||||||||||||||

| 108.00 | O | X | O | X | O | X | • | O | X | • | 108.00 | ||||||||||||||||||||||||||||||||||||||||||

| 106.00 | 3 | X | O | O | • | O | X | • | 106.00 | ||||||||||||||||||||||||||||||||||||||||||||

| 104.00 | 4 | 6 | • | O | X | • | 104.00 | ||||||||||||||||||||||||||||||||||||||||||||||

| 102.00 | O | X | • | O | • | 102.00 | |||||||||||||||||||||||||||||||||||||||||||||||

| 100.00 | 5 | X | • | • | 100.00 | ||||||||||||||||||||||||||||||||||||||||||||||||

| 99.00 | O | X | • | 99.00 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 98.00 | O | X | • | 98.00 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 97.00 | O | X | • | 97.00 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 96.00 | O | • | 96.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 19 | 20 | 21 | 22 |

| AMZN Amazon.com Inc. ($123.09) - Internet - AMZN broke a double bottom at $122 for a second sell signal. the move also brings the 4 for 5'er down to test the bullish support line, which would be violated upon a move below $120. Support for AMZN also lies at $116, $108, and in the $102 to $104 range. |

| ASH Ashland Inc. ($98.73) - Chemicals - ASH fell to a sell signal on Friday when it broke a triple bottom at $98, violating its trend line in the process, which will drop it to an unfavorable 2 for 5'er. From here, the next level of support sits at $96. |

| BA The Boeing Company ($143.97) - Aerospace Airline - BA reversed down into Os and broke a double bottom at $144 for ta fourth consecutive sell signal in the stock. BA is a 2 for 5'er that ranks in the top half of the Aerospace Airline sector matrix. Support lies at $142. Additional support can be found at $136 and $132. |

| BABA Alibaba Group Holding Ltd (China) ADR ($85.84) - Internet - BABA broke a double bottom at $87 for a second consecutive sell signal before falling to $86 and taking out near-term support. BABA now trades at levels not seen since May. Support for the stock now lies at $82 and $79. |

| BERY Berry Plastics Group Inc. ($51.82) - Household Goods - BERY fell to a sell signal on Friday when it broke a triple bottom at $52 and continued lower to $51 where it now sits against support. The move also violated BERY's trend line, which will drop it to an unfavorable 2 for 5'er. BERY ranks 16th out of 32 names in the household goods sector matrix. |

| CE Celanese Corporation ($102.47) - Chemicals - CE continued lower on Friday, breaking a spread triple bottom at $104, taking out the last support the stock has found this year. CE Is a 1 for 5'er and ranks in the bottom decile of the chemicals sector matrix. |

| ECL Ecolab Inc. ($157.60) - Chemicals - ECL fell to a sell signal on Friday when it broke a double bottom at $158, violating its trend line in the process. Friday's move adds confirmation to an already negative picture as ECL is now a 0 for 5'er. The stock now sits against support at $156. |

| FDX FedEx Corporation ($160.84) - Aerospace Airline - FDX fell from $212 to $156, giving a second consecutive sell signal and violating all near-term support as the stock plunged on earnings. FDX will become a 0 for 5'er as it will give RS sell signals versus the market and its peer group. Look for a potential bounce from extremely oversold territory as a possible point of exit for those who continue to hold. Support lies at $154 on the default chart as well as in the $128 to $130 range. |

| FND Floor & Decor Holdings Inc ($80.16) - Retailing - FND broke a double bottom at $78 to return to a sell signal and violate the bullish support line. FND will become a 3 for 5'er due to the trend flip, although the stock does still rank among the top quartile of the Retailing sector matrix. Support lies at $77 and in the $70 to $71 range. |

| GS Goldman Sachs Group, Inc. ($324.85) - Wall Street - GS shares moved lower today to break a double bottom at $320 to mark its first sell signal. This 2 for 5'er has been in a positive trend since July but on an RS sell signal versus the market since June 2016. GS shares are trading near the middle of their trading band with a weekly overbought/oversold reading of 10%. From here, support is offered at $280. |

| IQV IQVIA Holdings Inc. ($204.11) - Healthcare - IQV shares moved lower today to break a triple bottom at $204 to mark its first sell signal. This 3 for 5'er moved to a negative trend today but has been on an RS buy signal versus the market since August 2017. IQV shares are trading in slightly oversold territory with a weekly overbought/oversold reading of -47%. From here, support is offered at $196. |

| LOW Lowe's Companies Inc. ($190.98) - Building - LOW broke a double bottom at $190 for a second consecutive sell signal and a violation of the bullish support line. This will drop the stock to a 3 for 5'er trading in a negative trend. LOW still ranks in the top third of the Building sector matrix and possesses a yield north of 2%. Support also lies at $188 and $184. |

| LSTR Landstar System, Inc. ($141.01) - Transports/Non Air - LSTR shares broke a double bottom at $140 on Friday to give a second consecutive sell signal and now test their lows from June of this year. The 3 for 5'er recently moved to the bottom half of the transports/non-air stock sector matrix, and a move to $136 would put the stock at its lowest level since January of 2021. No new exposure here. Those looking to reduce positions may consider trimming into a rally. |

| NTES Netease.com Inc. (China) ADR ($82.46) - Internet - NTES broke a spread triple bottom at $83 for a second sell signal. The move takes out all near-term support and brings the stock down to levels not seen since March. NTES is a 2 for 5'er that ranks in the bottom half of the Internet sector matrix. Support lies at $83. From there, support lies in the high-$60s. |

| QCOM QUALCOMM Incorporated ($124.95) - Semiconductors - QCOM fell Friday to break a double bottom at $124, marking a third consecutive sell signal. This 2 for 5'er moved to a negative trend in August and reversed down into a column of Xs against the market in March of this year. The overall weight of the evidence is negative here, avoid long exposure. Further support may be seen at $122 and $120. Note the potential for overhead resistance may be seen initially at $134. QCOM also carries a 2.35% yield. |

| TRGP Targa Resources Corp. ($68.64) - Gas Utilities - TRGP broke a double bottom at $68 to initiate a shakeout pattern. The stock is a 4 for 5'er that possesses a yield of 1.9%. From here, the shakeout pattern would be complete upon the triple top break at $74. Support lies at $67 and $66, the bullish support line. |

| WAT Waters Corporation ($283.93) - Electronics - Shares of WAT broke a spread triple bottom at $288 on Friday and now test their lowest levels since April of 2021. The stock is rated as a 3 for 5'er but has recently moved to the bottom half of the electronics stock sector matrix and monthly momentum just flipped negative. No new exposure here. Those considering reducing their position may consider selling into a rally as WAT is currently trading in oversold territory. |

| WDAY Workday Inc. ($152.29) - Software - WDAY fell Friday to break a spread triple bottom at $154 before falling to $150 intraday. This 0 for 5'er moved to a negative trend in April and ranks in the lower third of the software sector RS matrix. Weekly momentum also just flipped negative, suggesting the potential for further downside from here. Avoid long exposure. Further support may be seen at $142 and $136. The potential for overhead resistance may be seen at $172, which is also the current location of the bearish resistance line. |

| XOM Exxon Mobil Corporation ($93.21) - Oil - XOM fell to a sell signal on Friday when it broke a double bottom at $94 and continued lower, breaking a spread triple bottom at $92, where it now sits against support. The move also violated XOM's trend line which will drop the stock to a 3 for 5'er. XOM ranks 17th of 84 names in the oil sector matrix and carries a 3.6% yield. |

Daily Option Ideas for September 16, 2022

New Recommendations

| Name | Option Symbol | Action | Stop Loss |

|---|---|---|---|

| Toast, Inc. Class A - $19.19 | O: 22L17.50D16 | Buy the December 17.50 calls at 3.90 | 17.00 |

Follow Ups

| Name | Option | Action |

|---|---|---|

| Visa Inc. ( V) | Oct. 215.00 Calls | Stopped at 192.00 (CP: 192.92) |

| Morgan Stanley ( MS) | Sep. 85.00 Calls | Expired at 2.43. |

New Recommendations

| Name | Option Symbol | Action | Stop Loss |

|---|---|---|---|

| Barrick Gold Corporation - $15.33 | O: 22X16.00D16 | Buy the December 16.00 puts at 1.68 | 17.00 |

Follow Up

| Name | Option | Action |

|---|---|---|

| Comcast Corporation (CMCSA) | Sep. 42.50 Puts | Expired at 7.98. |

| The Coca-Cola Company (KO) | Sep. 65.00 Puts | Expired at 5.46. |

| Micron Technology, Inc. (MU) | Oct. 60.00 Puts | Raise the option stop loss to 6.40 (CP: 8.40) |

| Tyson Foods, Inc. (TSN) | Jan. 80.00 Puts | Raise the option stop loss to 7.00 (CP: 9.00) |

| Celanese Corporation (CE) | Dec. 110.00 Puts | Initiate an option stop loss of 8.30 (CP: 10.30) |

| Meta Platform Inc. (META) | Dec. 160.00 Puts | Raise the option stop loss to 20.30 (CP: 22.30) |

| General Electric Company (GE) | Dec. 75.00 Puts | Initiate an option stop loss of 8.15 (CP: 10.15) |

New Recommendations

| Name | Option Sym. | Call to Sell | Call Price | Investment for 500 Shares | Annual Called Rtn. | Annual Static Rtn. | Downside Protection |

|---|---|---|---|---|---|---|---|

| The AES Corporation $26.69 | O: 22K26.00D18 | Nov. 26.00 | 1.40 | $12,310.75 | 26.38% | 26.55% | 4.38% |

Still Recommended

| Name | Action |

|---|---|

| Antero Resources Corp (AR) - 39.76 | Sell the November 40.00 Calls. |

| Plug Power Inc. (PLUG) - 29.30 | Sell the November 27.50 Calls. |

| Sunrun Inc (RUN) - 37.36 | Sell the November 40.00 Calls. |

| Cenovus Energy Inc. (CVE) - 18.81 | Sell the December 19.00 Calls. |

| Livent Corp. (LTHM) - 33.32 | Sell the January 40.00 Calls. |

| Bloomin' Brands Inc (BLMN) - 20.70 | Sell the January 22.50 Calls. |

| Devon Energy Corporation (DVN) - 69.48 | Sell the January 75.00 Calls. |

| Marathon Oil Corporation (MRO) - 26.80 | Sell the January 26.00 Calls. |

| Targa Resources Corp. (TRGP) - 72.15 | Sell the January 75.00 Calls. |

| American Express Company (AXP) - 156.13 | Sell the January 160.00 Calls. |

| Albemarle Corp (ALB) - 286.75 | Sell the December 310.00 Calls. |

| Albemarle Corp (ALB) - 286.75 | Sell the December 310.00 Calls. |

The Following Covered Write are no longer recommended

| Name | Covered Write |

|---|---|

| Amazon.com Inc. ( AMZN - 126.28 ) | December 135.00 covered write. |

| Tapestry Inc. ( TPR - 33.22 ) | November 35.00 covered write. |

| Marriott International, Inc. ( MAR - 162.51 ) | January 170.00 covered write. |