Friday marked the third Quadruple Witching day in 2022. We examined historical movements around such events.

Upcoming Webinar: A More Precise Approach to Fixed Income - Relative Strength Rotation Among Sector-Based High Yield Bonds

Join us on Tuesday, September 20th at 2 pm EST for a discussion with BondBloxx. In this webinar, Cole Feinberg and JoAnne Bianco, Partners at BondBloxx ETFs, will join Chuck Fuller, Portfolio Manager at Nasdaq Dorsey Wright to discuss what is driving high yield fixed income from a sector perspective, and how the tactical nature of the BondBloxx High Yield Sector Rotation ETF Model can position investors to take advantage of the changing landscape. There will also be ample time for questions from the audience. This event is approved for one hour of CIMA and CFP CE credit.

Triple Witching occurs when stock options, futures, and futures options all expire on the same day, which is generally on the third Friday of the last month in each calendar quarter. Friday, September 16, will be the third such "triple witching" of 2022; the other prior two occurring in March and June. Technically we could employ the phrase "Quadruple Witching", as the advent of single stock futures provided a fourth derivative medium also expiring on Friday, but old habits die hard, and frankly "Quadruple Witching" just doesn't roll off the tongue in quite the same fashion. Nonetheless, these "witching" weeks can often bring with them an increased level of volatility.

While the word volatility, in and of itself, generally brings with it negative connotations, it does not necessarily mean the market must go down. In fact, 63% of all “witching” Fridays since June 1987 have seen the S&P 500 Index SPX show positive performance for that week. This was not the case this week, as the S&P 500 notched a weekly loss of -4.77% to mark the largest weekly loss for SPX since June 17 (the last witching Friday), when the index dropped -5.79%. While the last two “witching” Fridays have seen sharp declines, the first witching Friday this year occurred on March 18 and saw the index post a significant weekly gain of 6.16%. This variation indicates the uncertainty in how these weeks will play out, but it has been clear that these weeks bring added volatility.

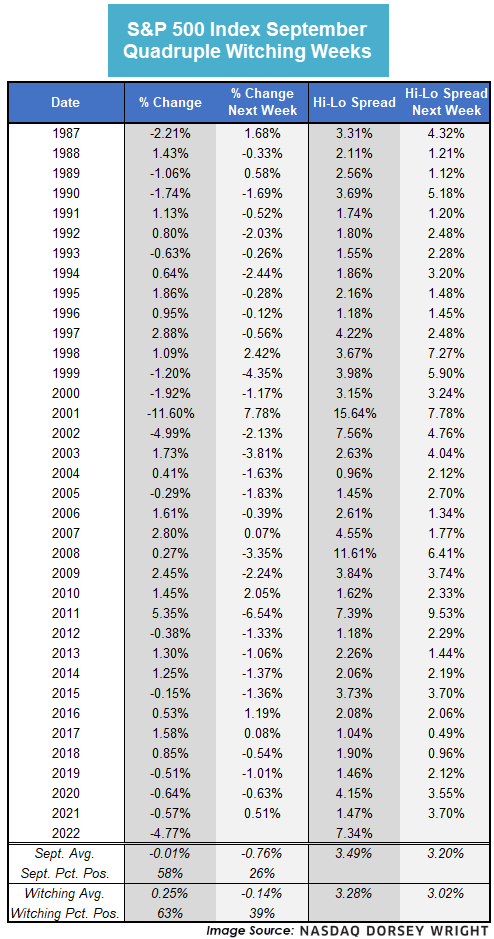

To get an idea of how past Triple Witchings in September have played out historically, we went back to 1987 and pulled data on the S&P 500 Index SPX during the week with Triple Witching culminating on that Friday. These 36 weeks have averaged a return of -0.01% for SPX, which is about flat, with 58% of the weeks showing a gain. These numbers are slightly lower than the broader numbers for Witching Fridays in any month. Over the next week, however, the SPX tends to see more negative returns following a Witching Friday in September, with an average loss of -0.76% and only a 26% positive hit rate. Again, these numbers are slightly lower than the other Witching months, but we see a similar drop-off in the subsequent weeks. It is also interesting to note that the SPX averages about a 3.5% spread between the weekly highs and lows during September Witching weeks, although the spread this week came in at 7.34%, the highest since 2011. We generally see similar spreads in the week that follows, which sits at an average of 3.20%, highlighting the potential for further volatility as we head toward the end of the month.