The real estate sector is showing signs of life for the first time in a long time.

As discussed over the past few weeks, market breadth has materially improved, and the real estate sector is showing signs of life for the first time in a long time. I searched our archives to find the last report where the sector was discussed positively but came up empty handed. Three reports that did turn up are linked below:

There were plenty of rallies in the last two years, but none had the magnitude or endurance to pull the sector out of the basement rankings on our macro indicators. To that point, real estate funds have consistently carried one of the lowest average scores on our Asset Class Group Scores Page. However, the tide may now be changing. Earlier this week the real estate group score breached 3.0 which is a significant milestone and threshold for technical health. Granted, most other sectors still have higher scores; nonetheless, this is a big step in the right direction. The last time real estate moved into the 3.0 score zone was March 2021.

Note: This is a technicality, but important - the real estate group was most recently above the 3.0 score in May 2022, but it was on a downward trend, not an entrance/uptrend like we see today.

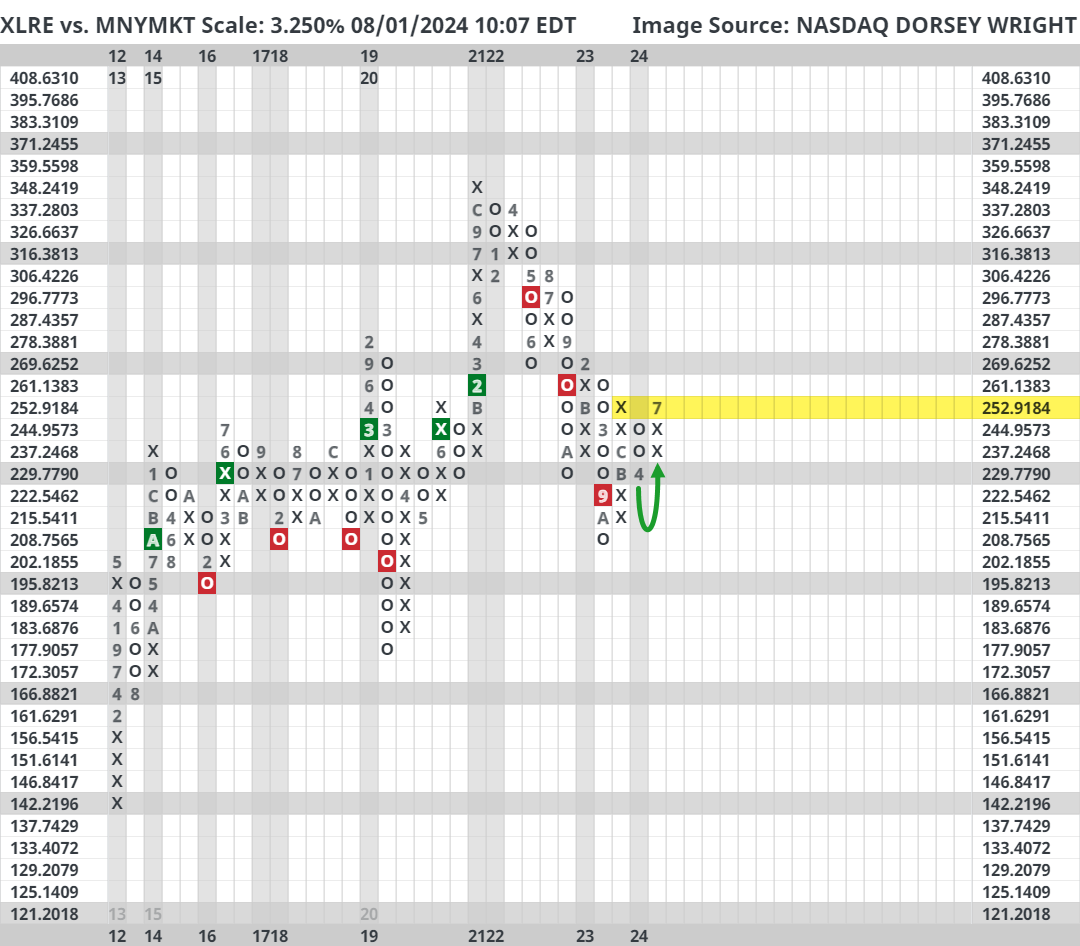

Earlier this week we also saw the Real Estate Select Sector SPDR Fund (XLRE) move into a column of Xs against our cash proxy (MNYMKT) on a 3.25% relative strength chart. In common speak, this means that real estate has recently outperformed cash by about 10% (3.25% box size x 3 box reversal = 9.75%). Remember that our cash proxy, MNYMKT, is the 13 Week Treasury Bill which has been no slouch as of late with short-term yields hovering around 5%.

Interestingly, XLRE is now the closest to giving a relative strength buy signal in over two years - roughly 3.25% further outperformance will do the trick. The last time XLRE printed a relative strength buy signal against cash was February 2021, but the last time XLRE returned to a relative strength buy signal was June 2020. Admittedly, the signal history on the chart below was inconsistent prior to 2020, but since then the chart has trended nicely (signals leading to further signals of the same kind).

What changed? In short, interest rates, and more specifically, the expectations for interest rates. The relationship of interest rates and real estate is summarized well by S&P Global, “All else being equal, higher interest rates tend to decrease the value of properties and increase REIT borrowing costs. In addition, higher interest rates make the relatively high dividend yields generated by REITs less attractive when compared with lower-risk, fixed-income securities, which reduces their appeal to income-seeking investors.” So, with the market looking for a cut in September and an accommodative monetary policy thereafter, perhaps real estate has some breathing room.

Another factor likely being weighed is the soft-landing probability. The real estate sector is not a traditionally defensive play, unlike utilities and consumer staples, which means that investors would likely not hang around if rates are crashing in the face of an economy falling apart. The jury is still out on this topic, and likely will be for a while, but it is still worth acknowledging.

For those with a strategic mandate to have real estate exposure, or those wanting a more opportunistic/tactical approach, we have emphasized for years that only focused exposure was justifiable. In other words, very few (if any) broad real estate funds were demonstrating healthy technical behavior, forcing investors to take a more tailored and/or individual stock approach. While that is largely still true today, we have seen some broad funds pop on the radar.

The XLRE trend chart has improved materially. With a fund score comfortably north of 3.0 and December 2023 resistance in the rearview mirror, the technical picture has brightened. Further bullish confirmation would come with a push past the February 2023 highs at $42. RSPR, the Invesco S&P 500 Equal Weight Real Estate ETF (RSPR), is another example with a fund score now above 3.0. It would be ideal to see RSPR clear its February 2023 highs; regardless, it is a good sign to see the largest (XLRE) and average (RSPR) real estate stocks putting up good performance.