The Real Estate sector has sat at the bottom of our long-term technical rankings for nearly two years now, but it is not all doom and gloom. Today, we highlight some promising areas with demonstrated strength.

Real Estate is still a hot topic on Main Street. Anecdotes about home prices, mortgage rates, bidding wars, and home equity are still frequent dinnertime conversations. Almost by default, if someone says they bought a house (or any property) a few years ago the internal response is, “Wow, that must have been a great investment.” However, if someone on Wall Street says they bought Real Estate stocks a few years ago, the internal response is not the same; in fact, the thoughts are probably opposite.

Since the S&P 500 bottomed in October 2022, the Real Estate Select Sector SPDR Fund (XLRE) has produced a total return of about 15%...which is pretty dismal given the S&P 500 is up about 45% over the same timeframe. To make matters worse, Technology (XLK) and Communication Services gained 70% over the same period and Industrials (XLI) are up north of 40%.

Admittedly October 2022 is a relatively short lookback period, but the story is the same over the past five years. From April 2019 to April 2024 XLRE has gained 22% including dividends…that is the worst return of the 11 major SPDR sector funds by far. For reference, the S&P 500 is up almost 100% since April 2019. So, you could argue that there is a significant bifurcation in Real Estate “sentiment” between Main Street and Wall Street.

Not coincidentally, the Real Estate sector has scored below 4.0 on our Asset Class Group Scores page consistently since November 2019. The low technical score simply reveals that most Real Estate ETFs and Mutual Funds have not performed well on an absolute or relative basis.

We could end our piece with the chart above, but that would not be most helpful. We could also try and extensively explain why this has been the case (interest rates, demographics, COVID, etc.) but that is not the intended takeaway either.

Avoiding technically weak sectors for prolonged periods is extremely important, but we also recognize that many portfolio managers have strategic sector diversification mandates. Furthermore, with interest rates ticking higher this week and rate cut expectations dwindling, some investors may want high-yielding Real Estate stocks due to bond prices treading water (if not outright falling). So, let’s look at some technically plausible options.

Perhaps not surprisingly, Residential REITS are currently one of the stronger subgroups. As of yesterday (4/11), 70% of names traded above their 50-day moving average (^TWECRESIREIT), and nearly 60% sat on a Point & Figure buy signal (^BPECRESIREIT). Another subgroup with strong stocks is Leisure. As of Thursday, 62% of names traded above their bullish support line (^PTECLEISREIT), and 56% sat on Point & Figure buy signals (^BPECLEISREIT).

To locate these strong citizens, consider using the detailed subsector search tool within the security screener. We found the below stocks through this process:

| Symbol | Name | Price | Tech Attrib/Score | DWA Sector | Overbought/Oversold | ||

|---|---|---|---|---|---|---|---|

| AMH | American Homes 4 Rent | 36.09 |

|

Real Estate |

|

||

| AVB | AvalonBay Communities, Inc. | 185.95 |

|

Real Estate |

|

||

| BHM | Bluerock Homes Trust, Inc. Class A | 16.35 |

|

Real Estate |

|

||

| BOWFF | Boardwalk REIT | 53.44 |

|

Real Estate |

|

||

| HST | Host Hotels & Resorts Inc. | 20.33 |

|

Leisure |

|

||

| INVH | Invitation Homes Inc | 34.61 |

|

Real Estate |

|

||

| PEB | Pebblebrook Hotel Trust | 15.68 |

|

Real Estate |

|

||

| RHP | Ryman Hospitality Properties | 112.73 |

|

Real Estate |

|

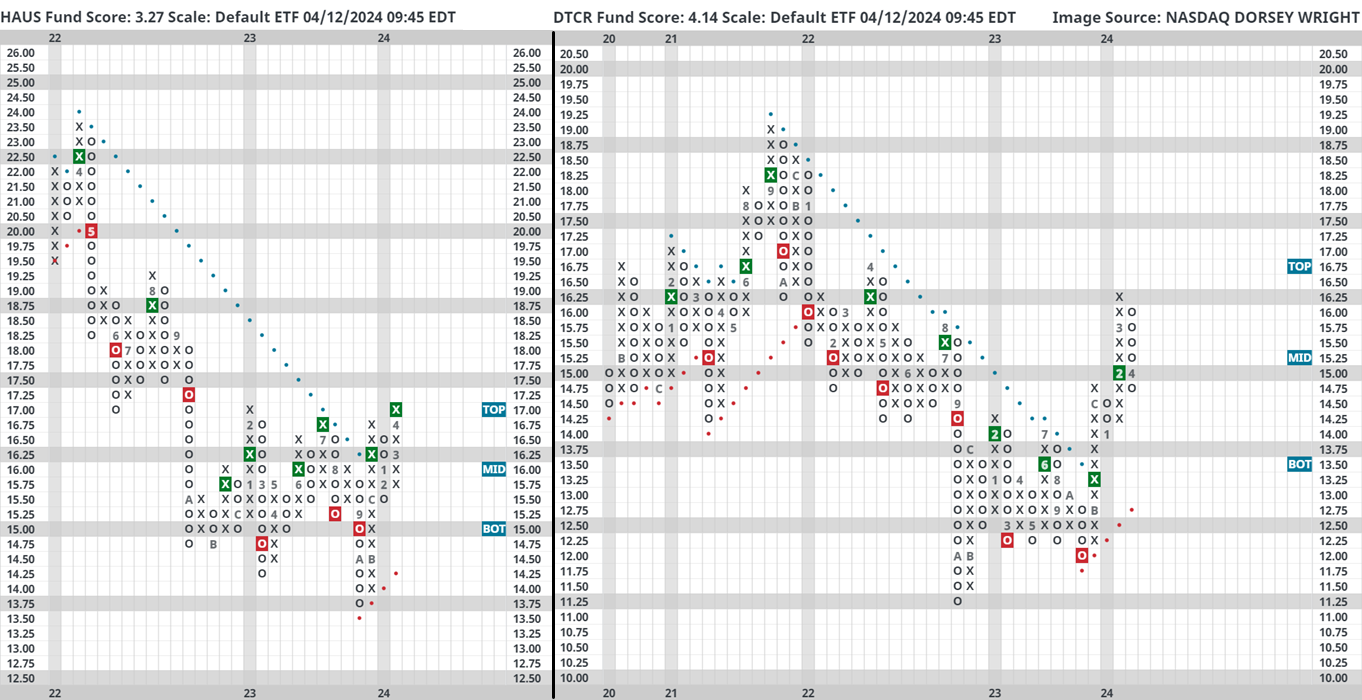

Those who prefer to use funds also have a couple of good options. In the Residential camp there is the Residential REIT ETF (HAUS). The ETF currently carries a fund score above 3.0 and recently (on Tuesday) matched its chart highs from February 2023. Although overextended at the moment, the weight of the technical evidence is positive and a breakout to $17.25 would provide additional bullish confirmation.

Another technically sound idea is the Global X Data Center & Digital Infrastructure ETF (DTCR). The fund carries a score above 4.0 and recently pulled back to the middle of its ten-week trading band, offering an attractive entry point. For what it’s worth, notice that DTCR was in a multiyear downtrend (traded below its bearish resistance line) until November 2023 before breaking out to the upside.

There are usually strong stocks/funds in weak sectors, it just takes more patience and diligence to seek them out. By definition, this is where and when active management (i.e., not passively owning everything) can really add value.