So far this year there has been a lot of volatility in the domestic equity space and leadership has changed swiftly.

So far this year there has been a lot of volatility in the domestic equity space and leadership has changed swiftly. This is a good time to walk through the sector rankings to see what has changed so adjustments can be made. A few of these sectors we’ve touched on over the past week include utilities, staples, technology, and commodities. For a more in-depth look at those areas of the market, I would suggest reading those pieces which can be accessed by following the links below:

Leaders:

The most consistently high-scoring sector on the ACGS over the past year has been financials. The sector remains in a good position, but the area is not as hot as it once was. The group currently has a slightly negative score direction and is hovering around the 4.0 score threshold, so a bit more caution is needed relative to a few months ago. Three of the sector groups scoring above 4.0 are commodity-related which speaks to the strength found in the broader asset class. The area is deserving of exposure, although it can be hard to find when looking for more specific exposure like agricultural funds. Commodity groups do carry higher than average levels of volatility, so large amounts of exposure may not be possible for all clients. Lastly, basic materials has been an area of strength recently and the group has an average score of 4.05 alongside a positive score direction of 0.90. Basic materials can be associated with commodities as there is some overlap, especially when looking at industrial/base metals.

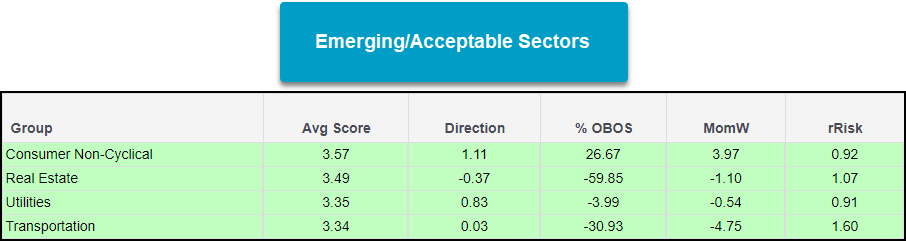

Emerging/Acceptable:

While there hasn’t been too much of a shakeup in terms of the higher-ranking groups on the ACGS page, the emerging and middle-of-the-pack groups have changed quite a bit so far this year. Most notably have been consumer non-cyclical (staples) and utilities. They both possess average scores in the mid-3.0 range and have some of the strongest score directions compared to other sectors. Real estate has been an interesting space over the past year and ended 2021 as one of the best performing sectors. Unfortunately, the sector has had a rocky start to 2022 but there are still positives from the space. The group's score and support levels on the Real Estate Select Sector SPDR Fund (XLRE) for the time being continue to hold up. This is an area to keep an eye on if/when domestic equities begin to firm up and put together some constructive price action. While transportation is still acceptable from an average score standpoint, it is the least desirable of the four sectors that find themselves scoring between 3.0 and 4.0 but there are opportunities within the space.

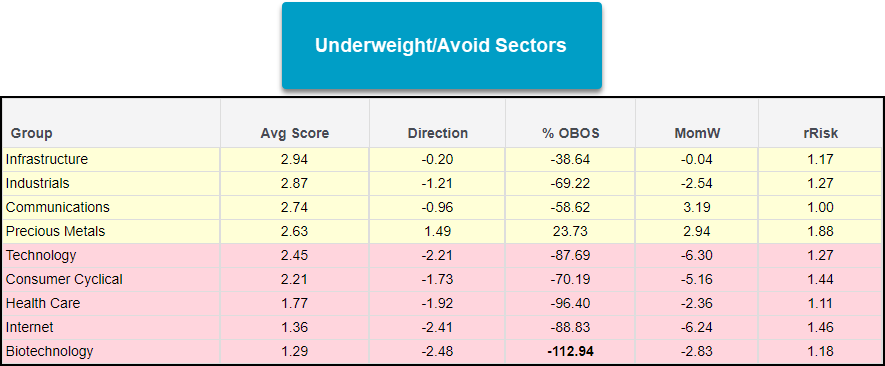

Underweight/Avoid:

Technology has been a long-standing leader for years but has taken a beating this year. An important point that’s made in the technology article above is that the group has rallied from these levels consistently over the last 10 years. However, there needs to be an increase in strength before considering initiating new positions in the sector. Consumer cyclicals share a similar story with technology as they have both been in leadership roles for years but have struggled lately. Healthcare and biotech have and continue to remain sectors to avoid. Infrastructure and industrials are both on the cusp of potentially moving into the “acceptable” range but aren’t areas to get too excited about in their current states. Besides technology, one of the more interesting areas of the entire market right now is precious metals. Precious metals have been near the bottom of the rankings for quite some time now, but the group has a positive score direction of 1.49 which is the highest of any sector group. The group still has some room to improve before serious consideration but will be an area to watch moving forward.