As underrepresented sectors in broad indexes perform well, low volatility equities offer access to a useful factor as well as a greater allocation to some of these underrepresented sectors.

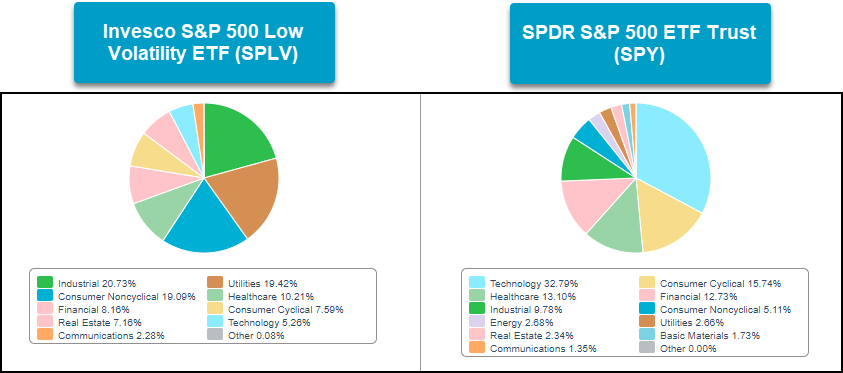

In last Friday’s Fund Score Overview, we looked at the improvement in low volatility equities. Low volatility equities offer a unique aspect to portfolio construction due to their vastly different sector exposure compared to a normal benchmark like the S&P 500 Index. Comparing the Invesco S&P 500 Low Volatility ETF (SPLV) to the SPDR S&P 500 ETF Trust (SPY), the technology exposure is the most apparent difference with SPY at 32.79% versus 5.26% for SPLV. The other major differences can be attributed to industrials, utilities, and consumer staples with SPLV having noticeably more exposure to these sectors than SPY.

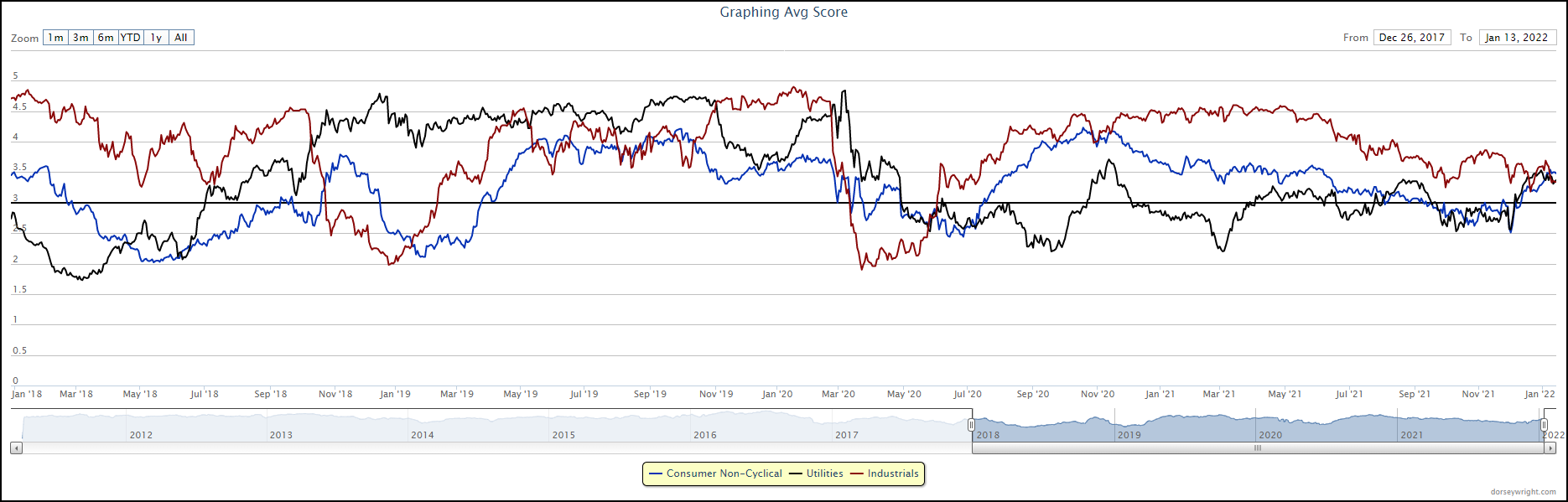

All three of these sectors hold acceptable average scores above 3.0 with staples and utilities possessing some of the best score directions on the entire Asset Class Group Scores page. Consumer staples is the strongest of the three as it has the highest average score and score direction in the group. Utilities have done well over the last few months as well. The Utilities Select Sector SPDR Fund (XLU) has returned 6.40% over the last 90 days compared to the S&P 500 Index’s (SPX) return of 4.20%. On the other hand, the technology group finds itself near the bottom of the sector rankings with an average score of 2.72 and a negative score direction of -1.72.

Both utilities and consumer staples saw a sharp boost in strength at the start of December and their scores have trended higher since. Industrials have been in good standing for most of 2020 and 2021 but its score has stagnated around the 3.50 mark, so not a recent improver like staples and utilities but it is still an acceptable group. The start of 2022 has seen technology weaken while areas like staples and utilities improve, so low volatility equities can be a quality addition to portfolio allocations in times like these.