Agricultures have stormed higher with the broader commodities group to multi-year score highs.

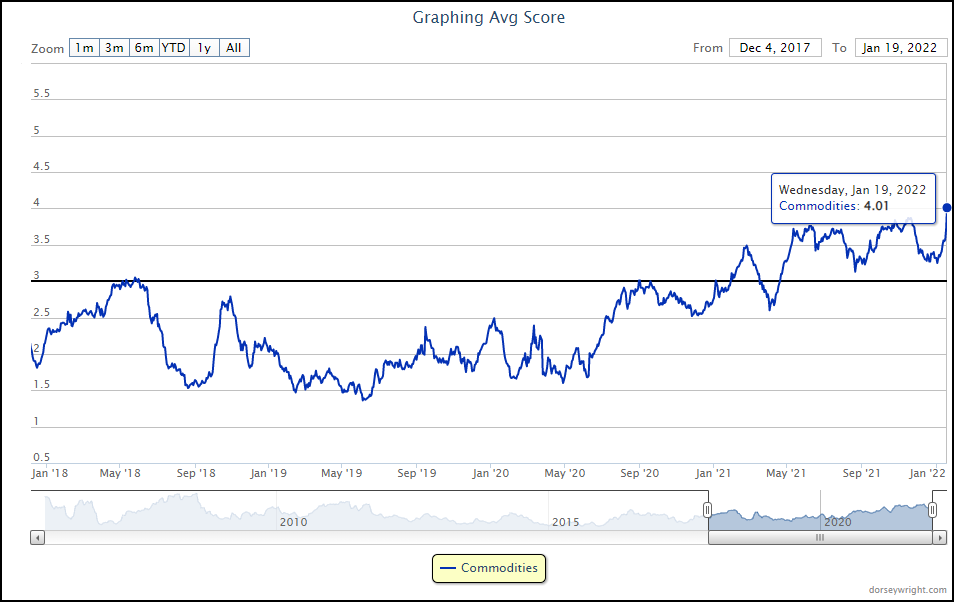

Alternative markets have been one of the few asset classes to start off 2022 on a strong footing, with muted returns from international equities and pullbacks experienced across domestic equities. One of the major stories in alternative investments this month has been the resurgence in oil, with the crude oil continuous CL/ chart reaching a new 52-week high at $86 in trading Wednesday (as discussed in yesterday’s Alternative Assets Overview). This has helped the broad commodities group climb into the “blue sky zone” on the Asset Class Group Scores (ACGS) page with the recent score posting of 4.01 marking the group’s highest average score reading since 2011. Commodities have remained north of the 3.00 score threshold since April of last year and began to move rapidly higher in late December before ascending to current levels.

The rise in crude oil prices has led to swift score movement from the MLPs group, which rose from a score of 3.15 at the end of 2021 to a recent score posting of 4.41. While this improvement has been notable, MLPs have a tendency to show heightened volatility with a group rRisk score of 2.48. The group is also nearing overbought positioning with the second-highest weekly OBOS average on the entire ACGS system at a recent posting of 79.74%.

There certainly may be actionable areas within the MLP space, however, oil-related funds are not the only aspect of commodity markets to show recent improvement. Agriculture showed improvement alongside broad commodities beginning at the end of 2020 but saw relatively muted movement throughout the second half of 2021. The group pushed higher this week to match the MLP group score at 4.41, marking its highest score since 2011 as well. The agriculture group score direction sits at 1.30, which is among the highest directional moves out of all 135 ACGS groups.

There are limited options for those looking to invest in the agriculture space, but one broad option is the Invesco DB Agriculture Fund DBA. This fund has shown notable improvement on its ¼ point chart, giving two consecutive buy signals before reversing back up into a column of Xs to form another double top at $20.25 in Wednesday’s trading. DBA sits at a favorable 4.53 fund score posting, which bests the average agriculture score (4.41) as well as the average all-US score (3.25), and is paired with a sharply positive 2.63 score direction. Note that DBA does generate a K1 and carries an expense ratio of 0.94%. Those looking to add exposure may consider DBA at current levels, with initial support seen on the ¼ point chart at $19.50.