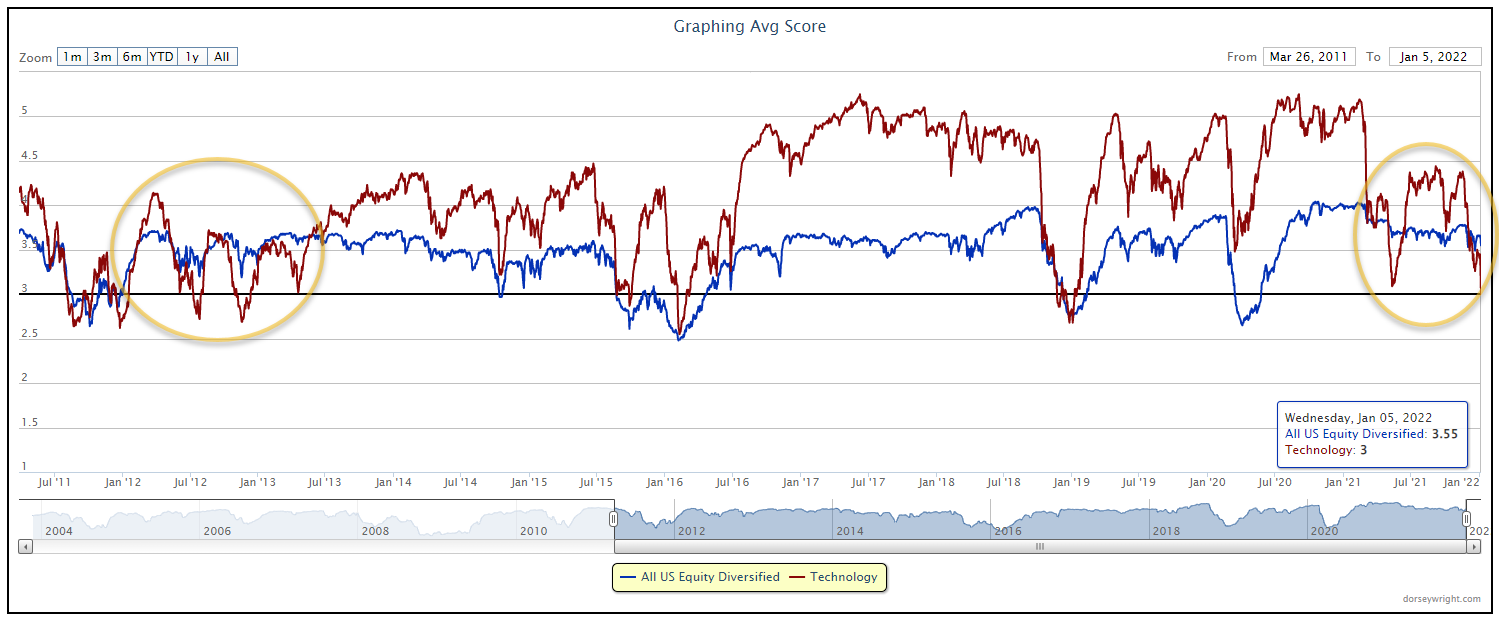

Technology has seen rapid score deterioration while the broad market has remained relatively stable

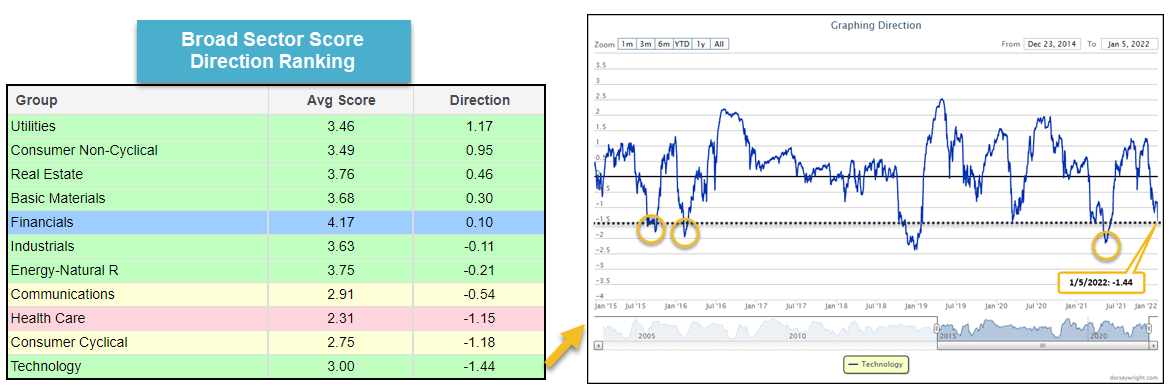

The US sector view on the Asset Class Group Scores (ACGS) page has seen quite the shake-up over the past month, with the New Year bringing a new layout of strength. These changes can be seen by sorting the sector groups by their average score direction, which shows the average gain or loss from a peak or trough over the past six months for each group. The risk-off sectors make up many of the names at the top of this sort, including groups such as utilities and consumer non-cyclical. Those groups at the bottom, or those with the lowest directional moves, include some of the risk-on groups such as technology and consumer cyclical.

The score decline in technology is especially noteworthy as the -1.44 directional move is among the most negative over the past 10 years. The group has only seen a directional move south of -1.50 on a handful of instances since 2010, including 2011, 2015-16, 2018, and May 2021. The only other time technology saw such a sharply negative score direction twice in the same rolling year came in October 2015 and February 2016.

Most of the prior large score declines for technology were also paired with significant score declines for the broad US equity market, as shown through the US equity diversified group. This was the case in the 2015-16 and 2018 timeframes. In each of those instances, the group score for both technology and US equity diversified dipped below 3.00 before moving higher. However, the most recent score declines for technology have not seen the same moves as the broad US market has remained relatively resilient. This was also the case during the 2011-12 timeframe when the technology group saw substantially more volatility in score than the market.

We have seen the technology group move much quicker than the US equity diversified group over the past several years, but much of that movement has remained at consistently elevated score territory. The recent score divergence south for technology may be taken as a sign of caution over the next few weeks, as there is the potential for further volatility in the sector that may not carry over to the broader market.