Emerging Markets climb higher, flying in the “blue sky zone“ for over a week now

Monday Market Update Webinar Replay: Missed Monday's (8/24) webcast? Click the link(s) below for a recap:

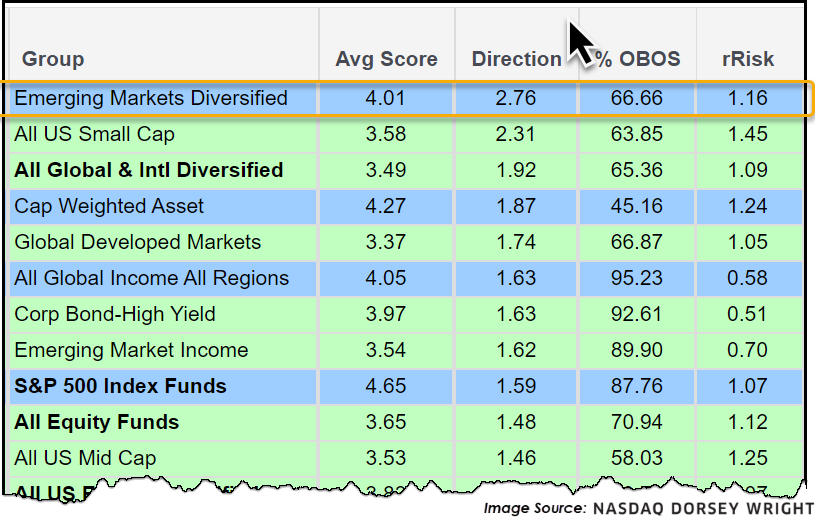

The Emerging Markets space continues to demonstrate strength, recently powering its way into the sought-after “blue sky zone” on the Asset Class Group Scores (ACGS) page with an average group score of 4.01. Furthermore, the group posts the highest score direction of all macro segments on the ACGS page with a reading of 2.76, speaking to the continued improvement of the group over the past six months. Note thematic tailwinds for the Emerging Markets space stemming (in part) from a weakening US Dollar, a topic of continued discussion given historic returns.

Looking to an investable product like the iShares MSCI Emerging Markets ETF EEM, we note a stellar 5.09 fund score, 4.49 positive score direction, four consecutive buy signals, recent flip to positive monthly momentum and an actionable Overbought/Oversold (OBOS) reading of 43%. The weight of the evidence continues to favor emerging equity markets and those looking to diversify their equity exposure with selective international plays may consider the emerging markets space at current levels. For other technically sound investable options, consider using the “Other Ideas” button atop the trend chart or the blue 350 to the left of the group name on the ACGS page.