Broad emerging markets and international small cap names have each showed improvement in recent weeks.

The emerging markets equity space has been the major improver for international stocks over the past few weeks, as we can see through the Asset Class Group Scores (ACGS) page. These rankings show how the score for the emerging markets diversified group has now risen back above the sought after 4 score threshold, with a recent posting of 4.01 through trading Tuesday. This marks the first time the group has been above 4.00 on an average score basis since the market decline ensued in March, which ultimately led the group to a multi-year score low of only 1.54 by the end of May. Furthermore, this recent movement also marks the highest average score for the broad emerging markets representative since May of 2018, as the space has rallied to score significantly higher than its pre-COVID readings.

Another international group that has shown noticeable strength in recent weeks is the international small cap space, which just moved to a score posting of 3.62 to notch its own highest score level since June of 2018. Furthermore, we can see that the group possesses an average score direction of 2.28, which is the 15th highest directional reading out of all 135 groups tracked on the ACGS system. Perhaps unsurprisingly, emerging markets diversified has the highest directional reading of any non-US specific group with a posting of 2.75.

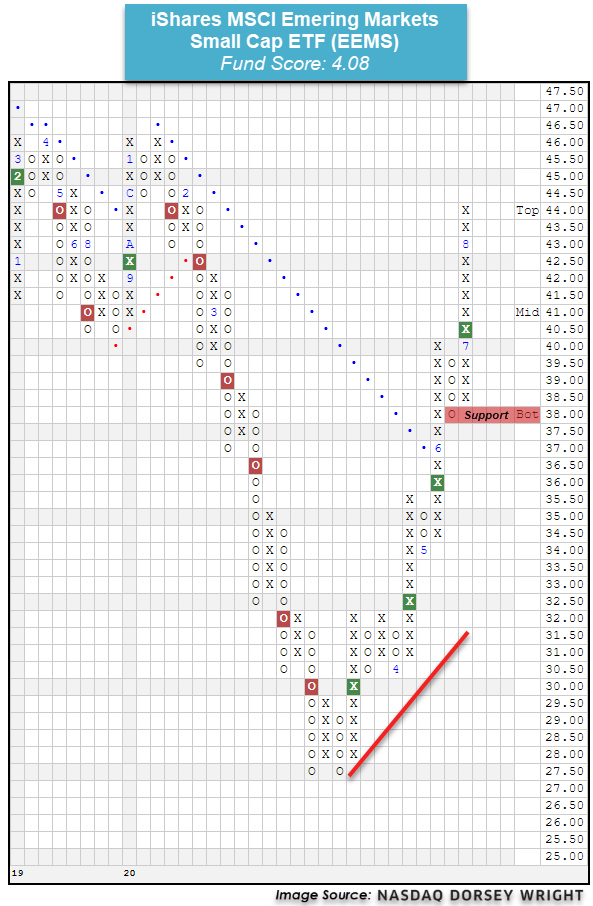

In using the ideas tab directly to the left of the international small cap group name, we can see a variety of fund representatives that have shown recent improvement. Given the recent strength displayed by broader emerging markets, it makes sense to take a look at those international small-cap funds with more focused exposure toward emerging economies. One such fund is the iShares MSCI Emerging Markets Small Cap ETF EEMS, which has moved significantly higher off its March low of $27.50 to give four consecutive buy signals while ascending to its current level of $44. This fund boasts a 4.08 recent score posting, which bests the aforementioned 4.01 score for emerging markets as well as the 3.48 average score for all non-US funds. EEMS also carries a strongly positive score direction of 3.79, which is indicative of the recent improvement from both emerging markets and specifically international small caps. The overall weight of the evidence is strong here and continues to improve, however, those looking for long exposure should note that EEMS is in a slightly elevated territory with an intraday weekly overbought/oversold reading of 78% at the time of this writing on Wednesday. Initial support can be found at $38. Note that EEMS also carries a 2.60% yield.