In absence of model changes this week we highlight the VictoryShares US 500 Enhanced Volatility Wtd ETF (CFO), as it recently posted a new all-time high

Whether evoking alarm, happiness, or confusion, broad large-cap equity indices are within single digits of new all-time highs; a topic further articulated in last week’s (8/13) Prospecting: Peak to (almost) Peak section. In fact, although summer months are historically associated with lackluster returns in the investment world, 2020 is on track to override its Summertime Blues as the S&P 500 SPX, Dow Jones Industrial Average DJIA, and Nasdaq Composite NASD have currently posted gains of 14.43%, 13.81%, and 19.36%, respectively (data from 5/25/2020 – 8/17/2020). As a previously narrow market rally continues to broaden we note increased participation from many individual stocks and ETFs, like the VictoryShares US 500 Enhanced Volatility Wtd ETF CFO as it recently hit a new all-time chart high at $55.

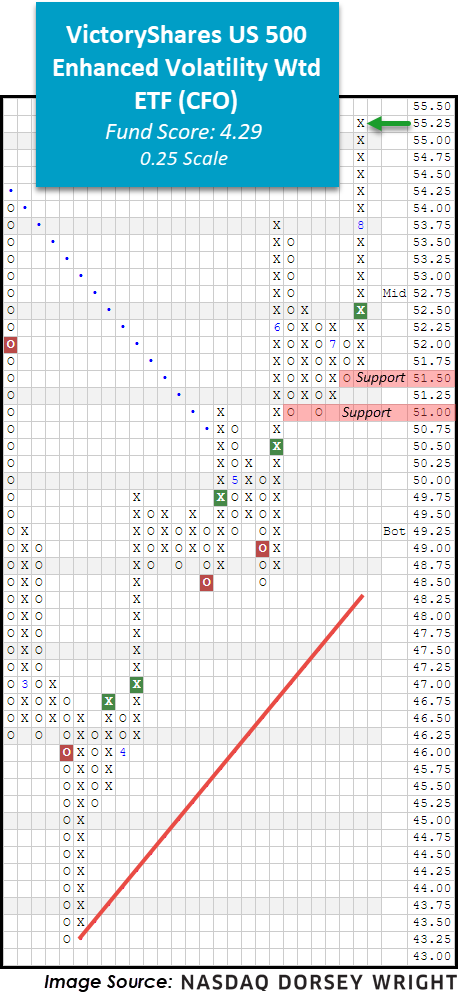

Since posting a bottom at $43.50 CFO rallied to give two consecutive buy signals, the most recent coming with a double top break at $52, and push past the previous all-time chart high at $54 posted in January of 2020. CFO also boasts an optimal fund score of 4.29 and a strongly positive score direction of 1.89, complimenting the overall technical strength present. Additionally, CFO recently experienced a flip to positive monthly momentum, suggesting the potential for further upside from here. The weight of the evidence is positive for CFO yet those looking to initiate new long exposure may consider waiting for a pullback or price normalization as the fund is approaching the top of its ten-week trading band. CFO currently resides on a “stem” (elongated column of Xs), so we look for initial support on a more sensitive scale which we find at $51.50 and $51 on the quarter-point chart. Note CFO also offers a yield of 1.12%.

For additional information on the mechanics or methodology of the VictoryShares US 500 Enhanced Volatility Wtd ETF, click here to review the fact sheet.