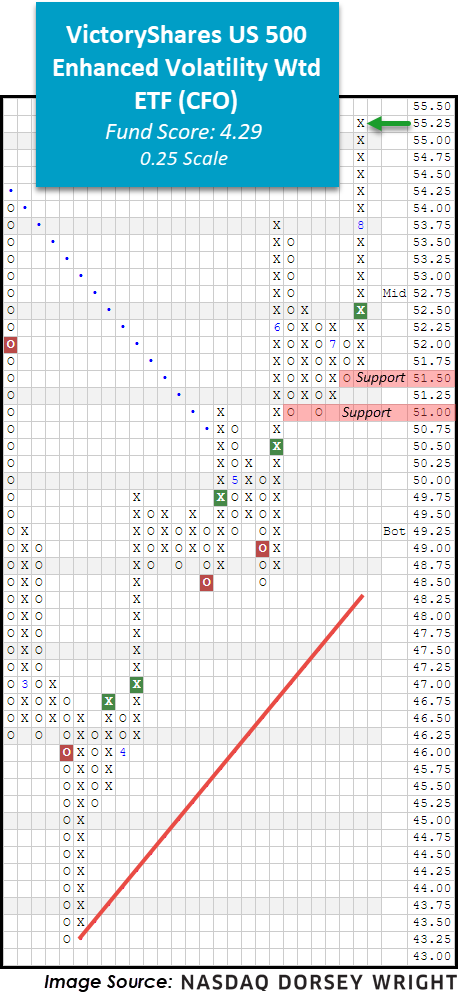

Whether evoking alarm, happiness, or confusion, broad large-cap equity indices are within single digits of new all-time highs; a topic further articulated in last week’s (8/13) Prospecting: Peak to (almost) Peak section. In fact, although summer months are historically associated with lackluster returns in the investment world, 2020 is on track to override its Summertime Blues as the S&P 500 SPX, Dow Jones Industrial Average DJIA, and Nasdaq Composite NASD have currently posted gains of 14.43%, 13.81%, and 19.36%, respectively (data from 5/25/2020 – 8/17/2020). As a previously narrow market rally continues to broaden we note increased participation from many individual stocks and ETFs, like the VictoryShares US 500 Enhanced Volatility Wtd ETF CFO as it recently hit a new all-time chart high at $55.

Since posting a bottom at $43.50 CFO rallied to give two consecutive buy signals, the most recent coming with a double top break at $52, and push past the previous all-time chart high at $54 posted in January of 2020. CFO also boasts an optimal fund score of 4.29 and a strongly positive score direction of 1.89, complimenting the overall technical strength present. Additionally, CFO recently experienced a flip to positive monthly momentum, suggesting the potential for further upside from here. The weight of the evidence is positive for CFO yet those looking to initiate new long exposure may consider waiting for a pullback or price normalization as the fund is approaching the top of its ten-week trading band. CFO currently resides on a “stem” (elongated column of Xs), so we look for initial support on a more sensitive scale which we find at $51.50 and $51 on the quarter-point chart. Note CFO also offers a yield of 1.12%.

For additional information on the mechanics or methodology of the VictoryShares US 500 Enhanced Volatility Wtd ETF, click here to review the fact sheet.

This weekly overview is designed to be used as a "radar" screen to bring your attention to potentially important technical changes that may require your attention and potential action. When evaluating the Fund Score, the strongest issues have scores of 4 or higher while those ETFs with scores below a 3 are no longer considered solid citizens.

Symbol

Name

Price

Fund Score

PnF Signal

RS Col.

PnF Trend

Weekly Mom

CDC

VictoryShares US EQ Income Enhanced Volatility Wtd ETF

48.63

3.28

Buy

O

Positive

+4W

CDL

VictoryShares US Large Cap High Div Vol Wtd ETF

41.82

2.10

Buy

O

Positive

+4W

CEY

VictoryShares Emerging Market High Dividend Volatility Wtd ETF

20.12

0.66

Buy

O

Positive

-7W

CEZ

VictoryShares Emerging Market Volatility Wtd ETF

24.01

2.01

Buy

O

Positive

-2W

CFA

VictoryShares US 500 Volatility Wtd ETF

55.06

3.13

Buy

O

Positive

+5W

CFO

VictoryShares US 500 Enhanced Volatility Wtd ETF

55.15

4.29

Buy

O

Positive

+4W

CID

VictoryShares International High Div Volatility Wtd ETF

27.10

1.20

Buy

O

Negative

+5W

CIL

VictoryShares International Volatility Wtd ETF

37.42

2.51

Buy

O

Positive

+4W

CIZ

VictoryShares Developed Enhanced Volatility Wtd ETF

28.46

0.81

Buy

O

Negative

+19W

CSA

VictoryShares US Small Cap Volatility Wtd ETF

44.09

2.86

Buy

O

Positive

+4W

CSB

VictoryShares US Small Cap High Dividend 100 Volatility Wtd ETF

39.75

2.61

Buy

O

Positive

+4W

CSF

VictoryShares US Discovery Enhanced Volatility Wtd ETF

42.09

3.57

Buy

X

Positive

+4W

UEVM

VictoryShares USAA MSCI Emerging Markets Value Momentum ETF

41.66

2.64

Buy

O

Positive

-2W

UITB

VictoryShares USAA Core Intermediate-Term Bond ETF

54.35

4.32

Buy

O

Positive

-2W

UIVM

VictoryShares USAA MSCI International Value Momentum ETF

41.33

1.14

Buy

O

Positive

+6W

ULVM

VictoryShares USAA MSCI USA Value Momentum ETF

49.09

4.24

Buy

O

Positive

+5W

USTB

VictoryShares USAA Core Short-Term Bond ETF

51.73

3.94

O

-7W

USVM

VictoryShares USAA MSCI USA Small Cap Value Momentum ETF

50.94

2.91

Buy

O

Positive

+4W

VSDA

VictoryShares Dividend Accelerator ETF

36.10

4.00

Buy

X

Positive

+5W

VSMV

VictoryShares US Multi-Factor Minimum Volatility ETF

32.65

3.75

Buy

O

Positive

+6W

This section of the report categorizes all of the Victory Mutual Funds by their respective broad group. Along with each group, you can view the Average Group Score, which is an average of the scores of all funds represented in that particular group. Those Victory Mutual Funds that meet or exceed the Average Group Score will be highlighted in green in order to easily view those Victory Mutual Funds that have superior strength within their respective group. You want to focus on those Victory Mutual Funds that exhibit superior strength when looking to add new exposure to a particular group.

| Large Cap Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 3.8 | VFGAX | Victory NewBridge Large Cap Growth A | 5.69 |

| SSVSX | Victory Special Value A | 4.27 | |

| CUHCX | Victory US 500 Enhanced Volatility Wtd Index Fund | 4.26 | |

| SRVEX | Victory Diversified Stock A | 4.24 | |

| MUXYX | Victory S&P 500 Index Y | 4.09 | |

| VBFGX | Victory Strategic Allocation R | 3.82 |

| Small Cap Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 3.6 | GPSCX | Victory RS Small Cap Equity A | 5.33 |

| RSEGX | Victory RS Small Cap Growth A | 5.33 | |

| SSGSX | Victory Sycamore Small Company Opp A | 3.60 | |

| VSCVX | Victory Integrity Small-Cap Value A | 2.36 |

| Global Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 3.5 | MAEMX | Victory Trivalent Emerging Mkts Sm-Cp A | 5.82 |

| MISAX | Victory Trivalent International Sm-Cp A | 4.40 | |

| MAICX | Victory Trivalent Intl Fd-Core Eq A | 3.16 |

| Mid Cap Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 3.4 | GETGX | Victory Sycamore Established Value R | 4.70 |

| MGOYX | Victory Munder Mid-Cap Core Growth Y | 3.98 | |

| MAIMX | Victory Integrity Mid-Cap Value A | 2.47 | |

| MAISX | Victory Integrity Small/Mid-Cap Value A | 1.72 |

| Sector Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 3.3 | MNNAX | Victory Munder Multi-Cap A | 4.97 |

| RSNRX | Victory Global Natural Resources A | 4.82 | |

| RSIFX | Victory RS Science and Technology A | 4.64 |

The distribution curve places each ETF on a bell curve according to their respective degrees of overbought or oversold status using a 10-week distribution. ETFs that are statistically oversold will appear on the left-hand side of the bell curve, while those that have become statistically overbought will appear on the right-hand side of the bell curve. Perhaps the most useful attribute of this feature is that it displays the entire universe on the curve at one time to give us a general picture of whether the Victory ETF universe is generally overbought on a near-term basis, or generally oversold. Our best opportunities are to buy strong relative strength ETFs that have regressed back toward mean conditions based on market weakness, or have become oversold based upon extreme market weakness. Weekly Distribution is a short-term gauge that is most helpful in timing entry and exit points, while the longer-term information of trend and relative strength is a more controlling factor in the decision of whether to buy or sell.

Average Level

52.39