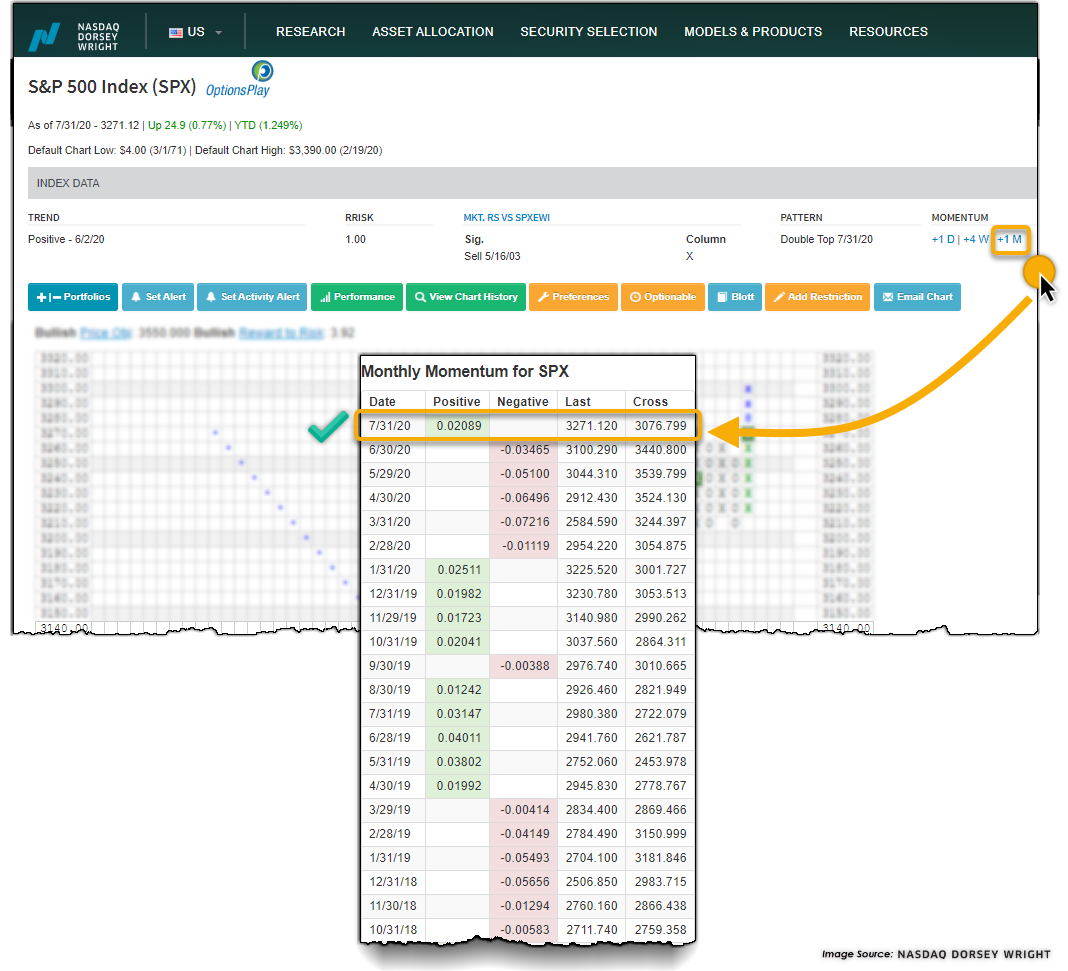

One technical characteristic that we monitor at NDW is momentum, which is a comparison between a short-term moving average versus a longer-term moving average. Recently, we've seen the monthly momentum of the S&P 500 Index (SPX) flip from negative to positive, along with many other US equities. Today, we'll discuss where these changes have been taking place and provide a list of actionable stocks that have experienced a flip to positive monthly momentum.

One technical characteristic that we monitor at NDW is momentum, which is simply a comparison between a short-term moving average versus a longer-term moving average. We track three types of momentum - daily, weekly, and monthly - and we do this for all stocks, ETFs, mutual funds, indices, and commodities. The daily momentum is a very short-term trading tool, while weekly momentum is used to help time trades, as it is an intermediate-term measure of strength. Generally speaking, though, it is the longer-term monthly momentum that allows us to identify trends in price movement, or at least the potential for these trends to develop. Recently, we've seen the monthly momentum for the S&P 500 Index flip positive after having been negative for the five months prior, along with many other US equities. Today, we'll discuss where these changes have been taking place and provide a list of actionable stocks that have experienced a flip to positive monthly momentum.

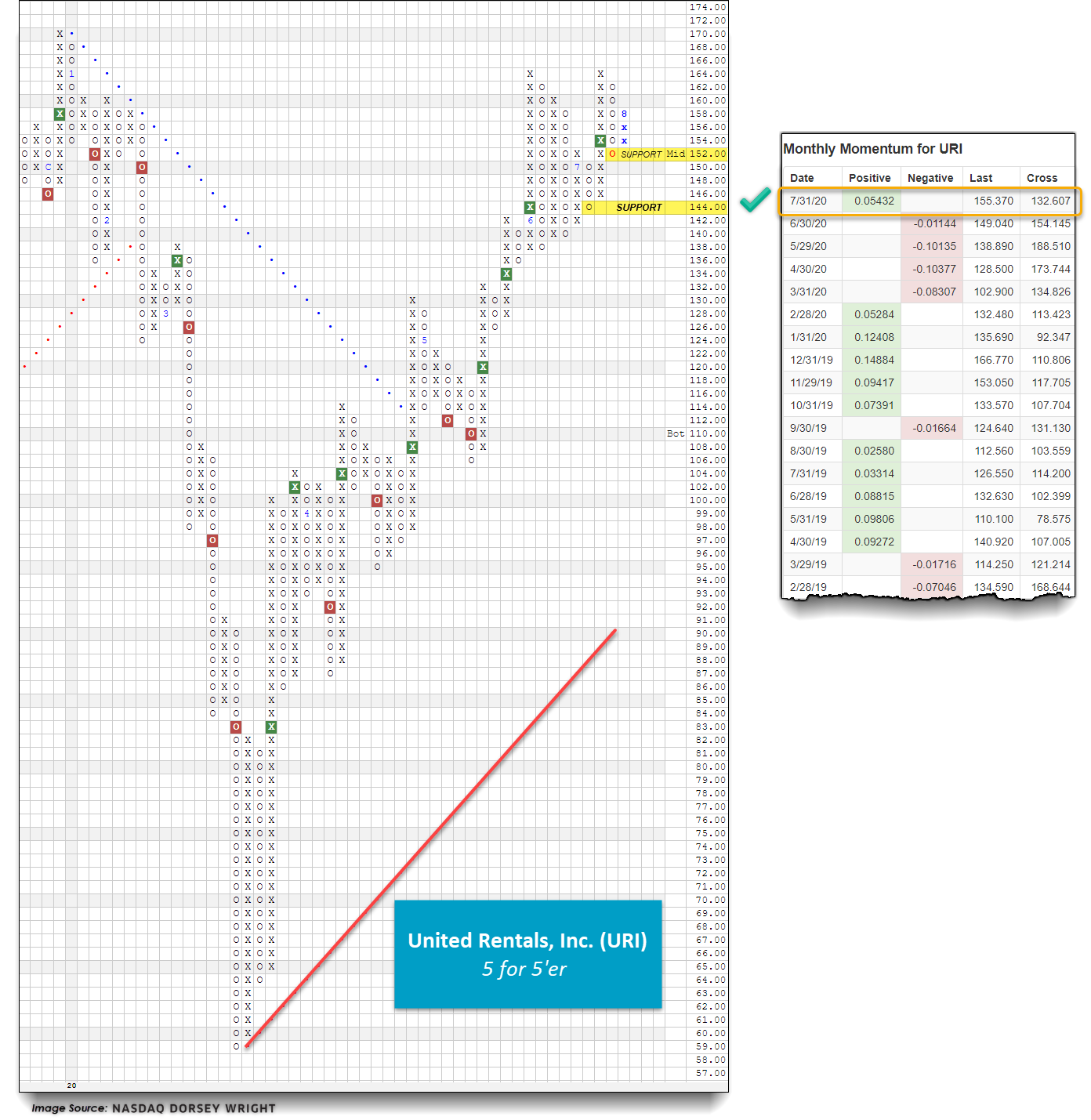

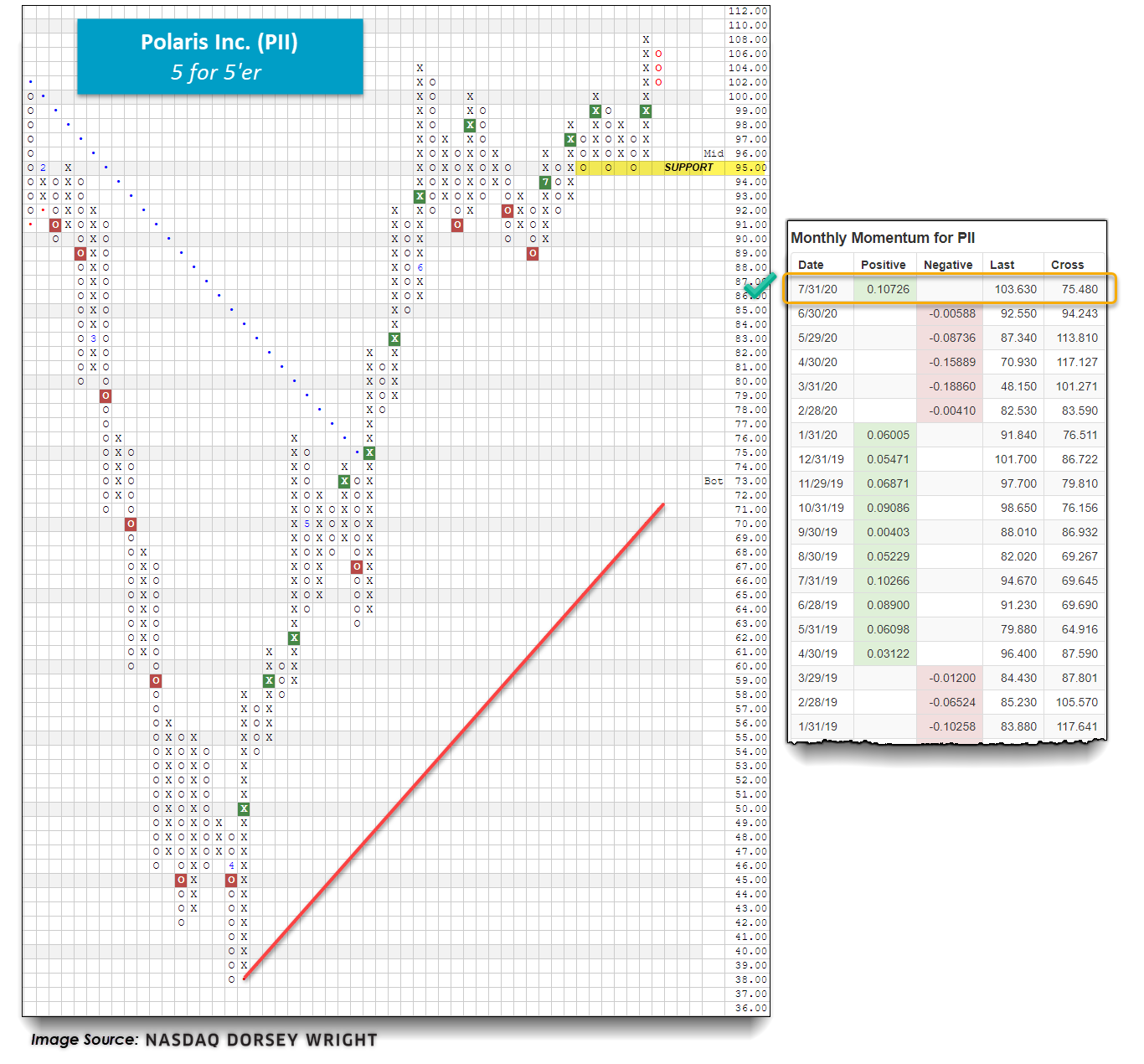

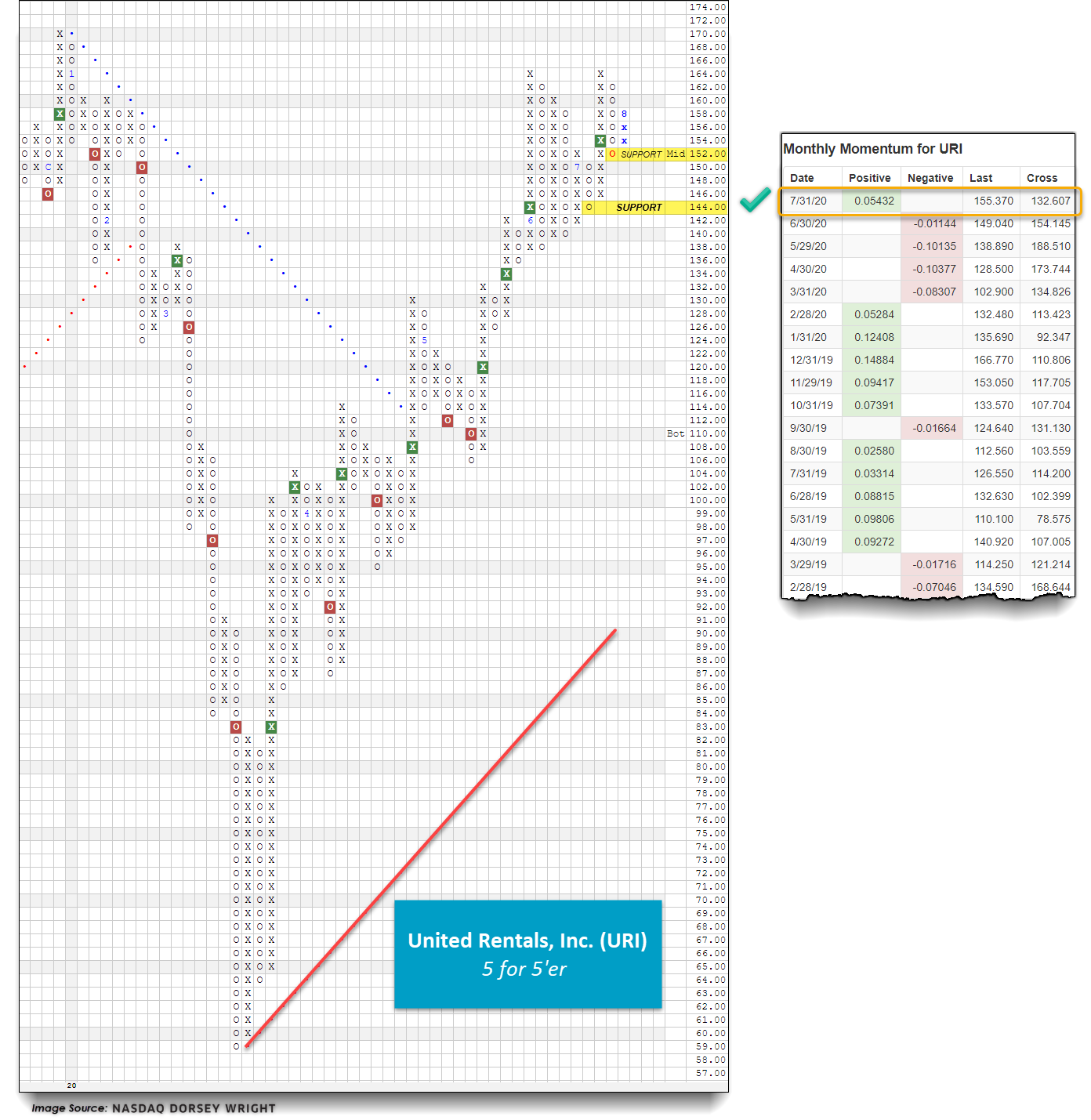

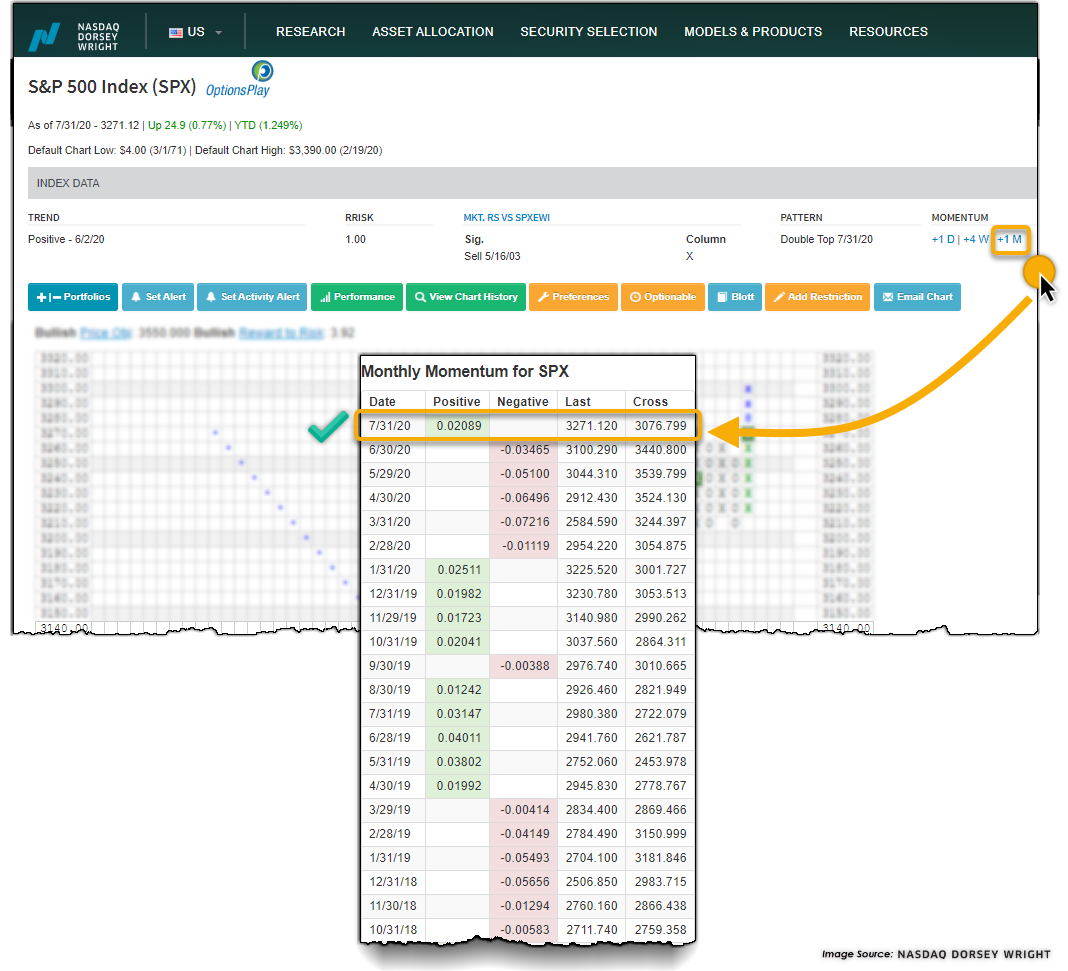

Specifically, the monthly momentum calculation looks at the one-month moving average relative to the five-month moving average for a given investment (the moving average is also exponentially weighted and smoothed). Generally speaking, when the one-month moving average crosses above the five-month, we say the monthly momentum is (has turned) positive, which suggests a period of strength in the stock. When the one-month moving average crosses below the five-month, we say the monthly momentum is negative, suggesting a period of weakness for the security in question. Click on the monthly momentum reading located on the top of each trend chart (shown in the image below) to see historical moving averages/cross points and monthly momentum readings.

Monthly Momentum Points:

- One-month versus five-month moving average (moving average is also exponentially weighted and smoothed).

- When the one-month moving average crosses above the five-month moving average, monthly momentum is considered to have turned positive.

- Momentum "flips," both positive and negative, generally last six to eight months.

- Click the monthly momentum reading at the top of a given stock or index chart to access the cross point and historical momentum readings.

- Can use the NDW Security Screener to isolate changes in momentum.

- We primarily use weekly momentum, but daily is beneficial for trading, and monthly changes are applicable for longer-term changes/turnaround plays.

Momentum calculations are used as a supplement and not as a substitution for the Point & Figure chart. When we get down to evaluating the individual stock chart, the three most essential parts are relative strength, overall trend, and individual Point & Figure patterns. Once we have determined that those three things are positive, we can then look towards some of the secondary tools, like monthly momentum, as a helpful guide. In other words, just because the monthly momentum may be on the verge of turning positive or negative -- that fact, in and of itself, does not change our opinion of a stock. If you are holding a stock that has experienced a huge run and is now beginning to break down and monthly momentum has turned negative, it would suggest that you may want to take some defensive action on that position. As another example, say you have a stock that has been trading sideways. At the same time, the overall market has experienced a correction, and the stock's monthly momentum is now turning back to positive. Because of this positive divergence from the broader market, we would consider purchasing this stock.

All in all, though, we do like to stay abreast of recent changes in monthly momentum, as it can be a confirming alert to take action, either protectively or in allocating new funds. To that end, we have screened our database of stocks to find out which stocks have just seen their monthly momentum turn back to positive. In doing this exercise, we focused on the S&P 1500 universe of stocks. Below is a quick snapshot of some of the technical characteristics for those 327 stocks that have just experienced a flip to positive monthly momentum.

S&P 1500 Stocks with One Month Positive Monthly Momentum Characteristics:

- 87.46% are trading on Point & Figure buy signals

- 88.69% are trading in overall positive trends

- 58.41% are on market RS buy signals

- The average technical attribute reading is a solid 3.35

- There are stocks from all 11 broad sectors represented. Industrials account for the highest number of changes to positive monthly momentum at 24.5% of the total, followed by the consumer cyclical sector at 18.3%. Communication services accounted for the least with just three stocks (0.9%).

- All size and style boxes are represented, with large-cap blend making up the majority at 17.7%, followed by mid-cap blend at 13.5%. Small-cap growth is the least represented at 5.5%, accounting for just 18 of the 327 stocks.

As of Monday, August 3, there are 327 stocks from the S&P 1500 universe that have recently experienced a flip to positive monthly momentum. Many of these names are not technically sound; however, they may make good tax-loss selling bounce plays. If you are looking for high RS names, you'll need to filter out some of the weaker names from the list. The easiest way to do this is by using the Security Screener tool under the "Security Selection" menu. We saved the 327 stocks from our initial monthly momentum screen as a custom portfolio using the NDW Shuttle tool and then selected it as our starting universe. We then applied the filters listed below to whittle our list down to 29 ideas. These 29 stocks are all trading in a positive trend and have given at least two consecutive buy signals, showing follow-through to the upside similar to the S&P 500 Index. Be sure to consult the trend chart on any given name to determine a more refined entry point, especially since several of the names are heavily overbought. Below the table of our results, we've highlighted two stocks from our list that we found particularly interesting and actionable.

Actionable Ideas Criteria:

- Price: >$20

- Optionable only

- 30 Day Average Volume: minimum 500,000

- Technical Attribute Rating: 3, 4, & 5

- Trend Chart: Buy signal

- Min Multiple Consec Signal Count: 2

- Trend Chart: Positive

- Sector Matrix Percentile Rank: 75 to 100

High-RS S&P 1500 Stock Ideas: Positive Monthly Momentum Flip

| Symbol |

Name |

Price |

Tech Attrib/Score |

DWA Sector |

Overbought/Oversold |

|

Aaron's, Inc. |

52.18 |

3  |

Retailing |

|

|

Accenture PLC |

224.78 |

5  |

Business Products |

|

|

American Equity Investment Life Holding |

25.45 |

4  |

Insurance |

|

|

Arthur J. Gallagher & Co. |

107.49 |

5  |

Insurance |

|

|

Advanced Micro Devices, Inc. |

77.43 |

5  |

Semiconductors |

|

|

Ameriprise Financial |

153.63 |

4  |

Finance |

|

|

Commercial Metals Corporation |

20.68 |

4  |

Steel/Iron |

|

|

Crocs, Inc. |

35.94 |

4  |

Textiles/Apparel |

|

|

Dick's Sporting Goods, Inc. |

45.62 |

4  |

Retailing |

|

|

H.B. Fuller Company |

45.34 |

4  |

Chemicals |

|

|

The Greenbrier Companies, Inc. |

25.73 |

3  |

Transports/Non Air |

|

|

Corning Incorporated |

31.00 |

3  |

Telephone |

|

|

Chart Industries, Inc. |

68.53 |

5  |

Oil Service |

|

|

Linde Plc |

245.11 |

5  |

Chemicals |

|

|

LivePerson, Inc. |

42.98 |

4  |

Computers |

|

|

Louisiana-Pacific Corporation |

31.67 |

5  |

Forest Prods/Paper |

|

|

Morgan Stanley |

48.88 |

5  |

Wall Street |

|

|

NeoGenomics, Inc. |

38.23 |

5  |

Biomedics/Genetics |

|

|

Polaris Inc. |

103.63 |

5  |

Leisure |

|

|

ProLogis |

105.42 |

5  |

Real Estate |

|

|

RH |

287.43 |

5  |

Retailing |

|

|

Sonic Automotive Inc. |

38.12 |

5  |

Retailing |

|

|

Stanley Black & Decker, Inc. |

153.32 |

3  |

Machinery and Tools |

|

|

Skyworks Solutions, Inc. |

145.58 |

4  |

Semiconductors |

|

|

Trimble Inc. |

44.51 |

3  |

Telephone |

|

|

United Rentals, Inc. |

155.37 |

5  |

Machinery and Tools |

|

|

Valvoline Inc |

20.52 |

4  |

Autos and Parts |

|

|

Worthington Industries, Inc. |

37.42 |

3  |

Steel/Iron |

|

|

Zoetis Inc. |

151.68 |

4  |

Drugs |

|

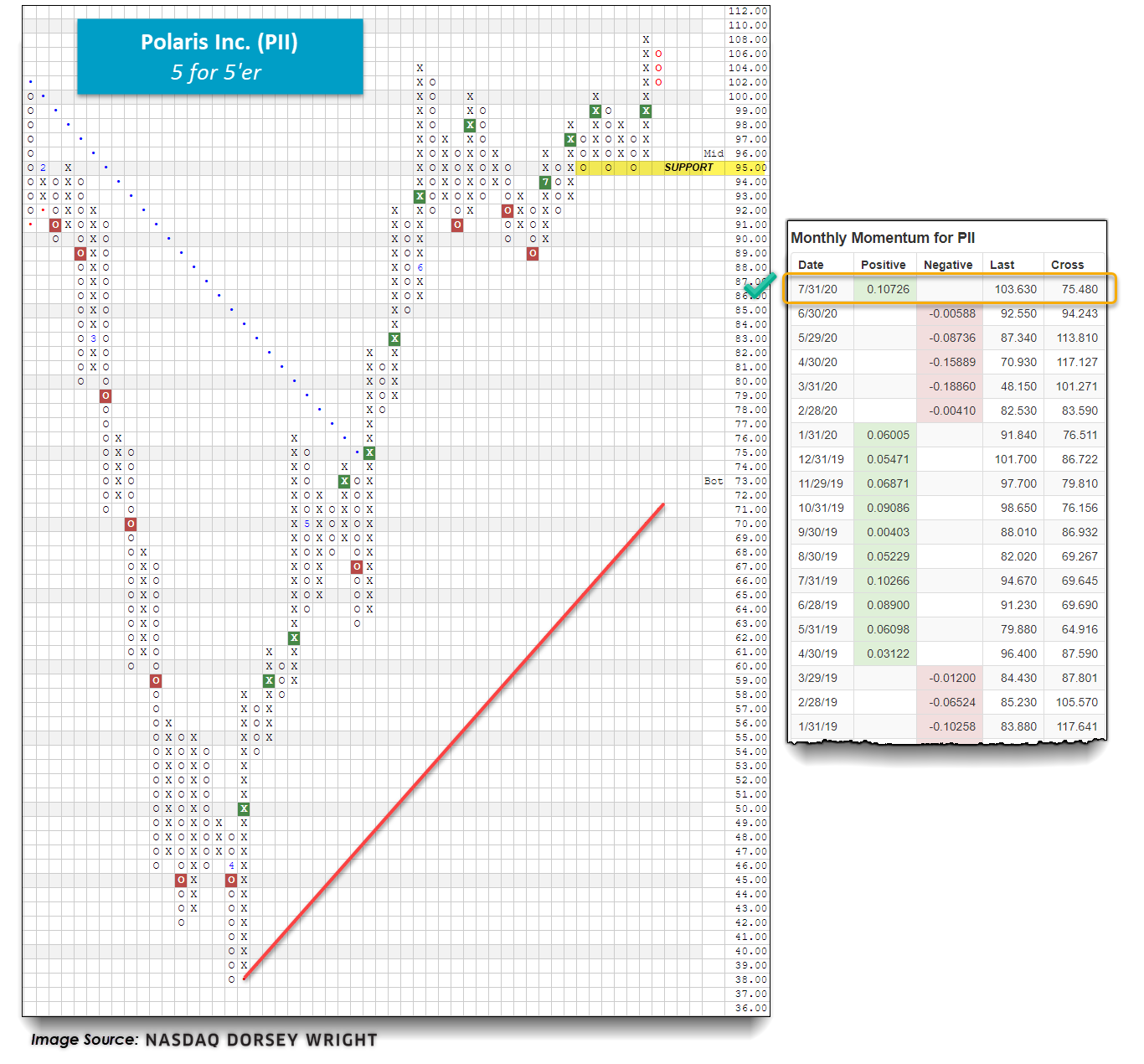

Polaris Inc. ($105.18) - Leisure – PII is a perfect 5 for 5'er in the leisure sector as all of its trending and relative strength metrics are currently positive, making this stock a high attribute name. After returning to a buy signal at $94 in July, PII went on to give a total of four consecutive buy signals, confirming that demand is in control. After reaching a new 52-week high at $108, PII experienced a pullback with Friday's market action to $102 and remains well above initial support at $95. Monthly momentum just flipped positive after having been negative for the previous five months. Additionally, weekly momentum also flipped positive, adding to the favorable technical picture. The weight of the evidence is positive, and PII has an OBSO% reading of just 34%, making this stock actionable at current levels. From here, initial support sits at $95, while a move to $110 would mark the fifth consecutive buy signal on the chart. Note PII provides a yield of 2.39%.

United Rentals, Inc. ($158.35) - Machinery and Tools – URI is one of the more attractive and actionable stocks that came across our high-RS positive monthly momentum screen. Similar to PII, this stock is a perfect 5 for 5'er as all of its trending and RS characteristics are positive here. Furthermore, URI ranks in the top 20% of the favored machinery and tools sector RS matrix. In May, URI returned to a buy signal at $120 before giving a total of four consecutive buy signals. The last buy signal that occurred was a bullish triangle in mid-July, which was followed by a rally to resistance at $164. After a brief pullback, URI has reversed back up into a column of X's with today's market action, putting the stock just four boxes from completing a spread triple top buy signal at $166. Monthly momentum just flipped positive after having spent the last four months on the negative side, suggesting the potential for higher prices. Demand is in control, making new positions welcome here as URI is just 5% overbought. From here, initial support sits at $152 while overhead resistance lies at $164.