Daily Summary

DWA ETF Spotlight: Large Cap Growth Leadership

Thus far in 2020 and throughout the COVID-19-induced sell-off and partial recovery, there has been a pronounced size and style bias within the US equity market in favor of growth over value and large-cap over small-cap.

Market Distribution Table

The average distribution reading is 19.87% overbought.

Daily Equity Roster

Today's featured stock is HSBC Holding PLC (HSBC).

Analyst Observations

AMAT, COHR, CPRT, EDIT, ENTG, GWPH, IAC, QLYS, RUN & TERP

Daily Option Ideas

Call: Oracle Corp (ORCL), Put: International Business Machines (IBM), Covered Write: Comcast Corp (CMCSA)

Applying the Fund Score Method through FSM Models: Join us on Thursday, May 21st at 1pm ET for a live webinar on the application of fund scores in a systematic, rules-based model. This webinar will feature an overview of the various FSM strategies and potential implementation ideas. Click here to register!

Replay for Fund Scores and Asset Class Group Scores Webinar: We have a replay available for our latest webinar on Fund Scores and the Asset Class Group Scores page that took place on Thursday, May 14th. In this webinar, we explore the concepts and methodology used to calculate the Fund Score that is assigned to ETFs and Mutual Funds across the NDW Research Platform. Click here to view the replay!

Replay of Monday's Market Update Webinar - We now have the replay available from our Monday, May 18th market update webinar. Links to the video and presentation slides are provided below.

Click here to access the replay

Click here to access the slides

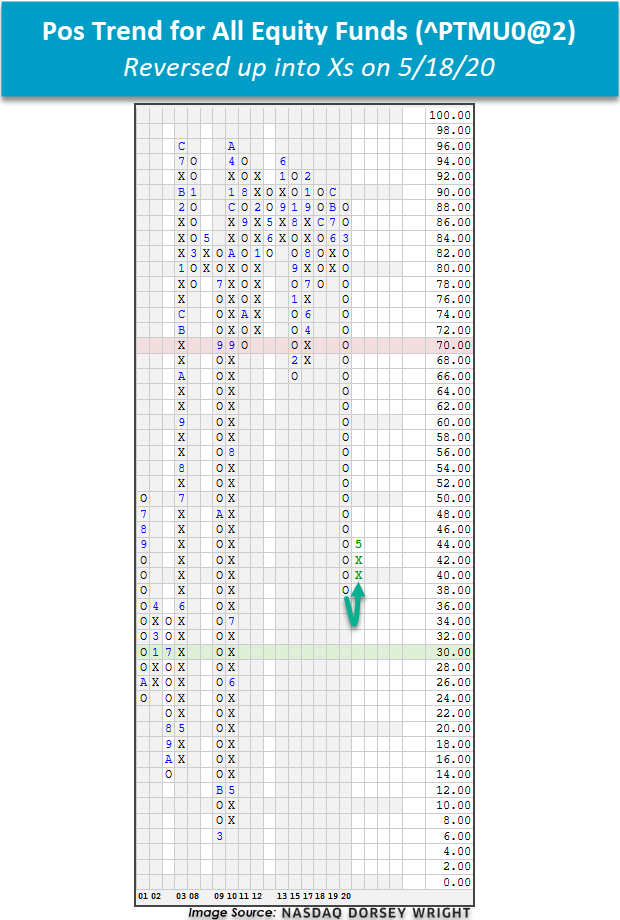

Indicator Updates: With yesterday’s market action, Bullish Percent (BP) indicators for the NYSE ^BPNYSE and S&P 500 ^BPSPX both reversed back up into Xs and are now in midfield. As a refresher, BP indicators are participation readings that assess the percentage of stocks within a universe that are trading on Point & Figure buy signals and reversals up indicate that offense is back on the field for the respective universes. Yesterday also saw the reversal up for the Positive Trend for All Equity Funds ^PTMU0@2, which, as the name implies, measures the percentage of mutual funds and ETFs trading in a positive trend on their intermediate-term fund scale charts. This indicator had fallen to a multi-year low of 38% and until yesterday, had yet to reverse back up into Xs since before the recent market selloff; the indicator suggests that we’re beginning to see continued bullish follow-through from equity funds around the world. Furthermore, today’s intraday action should result not only in the continued ascent of the column level on BPSPX but also trigger a reversal up into Xs on the Bullish Percent for Nasdaq 100 Stocks BPNDX. You can monitor BP, PT, and other major indicator charts from the Technical Indicator Report found under the Asset Allocation tab at the top of the platform.

-

Goldman Sachs releases three low-cost beta ETFs built around Solactive indexes as it enters the core ETF business.

- Goldman Sachs MarketBeta U.S. Equity ETF (GSUS) tracks the Solactive GBS United States Large & Mid Cap Index, holds 504 securities, and carries an expense ratio of 0.07%.

- Goldman Sachs MarketBeta Emerging Markets Equity ETF (GSEE) tracks the Solactive GBS Emerging Markets Large & Mid Cap Index and costs a net 0.36% in expense ratio.

-

Goldman Sachs MarketBeta International Equity ETF (GSID) tracks the Solactive GBS Developed Markets ex-North America Large & Mid Cap Index and carries an expense ratio of 0.20%.

-

A look at the top 5 ETF absolute inflows since the S&P 500 Index SPX bottom (3/23 – 5/14):

- Within the fixed income space, the iShares iBoxx USD Investment Grade Corporate Bond ETF LQD has had the most inflows with $12.1 billion and the iShares iBoxx USD High Yield Corporate Bond ETF HYG came in third on the list with $6.2 billion

- In terms of commodities, the SPDR Gold Trust GLD had the second-highest inflows over the period with $9.7 billion and the United States Oil Fund LP USO had the fifth-highest inflows with $4.4 billion.

-

Fourth on the list is the Health Care Select Sector SPDR Fund XLV which has seen $4.5 billion in net inflows.

-

After the Fed’s announcement on March 23rd of the Secondary Market Corporate Credit Facility (SMCCF), the program officially launched last week.

- On the launch date of May 12th, the program bought $305 million of ETFs within the U.S. corporate debt market.

- The program was designed to help cushion the impact of the coronavirus on the U.S. economy and financial markets

(Sources: etf.com, Bloomberg.com)

Thus far in 2020 and throughout the COVID-19-induced sell-off and partial recovery, there has been a pronounced size and style bias within the US equity market in favor of growth over value and large-cap over small-cap. Large-cap growth sits atop the DALI size and style rankings, as it has for more than a year, with that relative strength advantage having been clearly demonstrated through the performance dispersion this year.

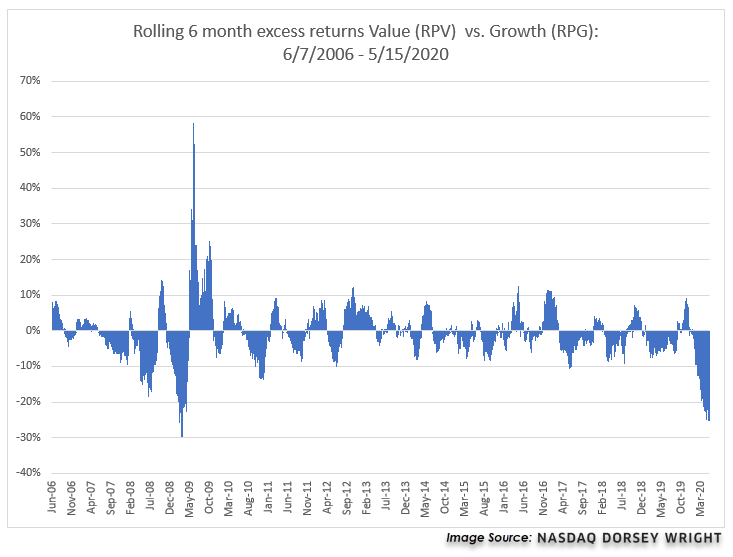

Year-to-date (through 5/18), the Invesco S&P 500 Pure Growth ETF RPG has generated a price return of -4.35%, putting it ahead of the S&P 500 SPX by just over 4.2%, as the index has returned -8.57%. Meanwhile, the S&P 500 Pure Value ETF RPV has produced a return of -35.01% over the same period, a whopping differential of almost 31%. Dispersion at this level is something one might expect to see between the best- and worst-performing individual stocks in the S&P 500, but not between two style funds derived from the same index, each of which contains more than 100 holdings. On average since 2009, RPV and RPG have had a performance differential of 4.39% in any given calendar year. In 2016 RPV returned 17.05% while RPG returned 3.56%, making it the only year during this time that produced a performance difference in the double digits. So needless to say, the disparity we've seen this year is not typical. One way to view this relationship is through a rolling six-month return comparison of RPV against RPG from mid-2006 through last Friday (5/15). This picture represents how the relationship between these two funds typically rotates in favorability, with RPV being favored in certain times and RPG favored in others. When viewing the historical comparison we see that there has not been this level of dispersion favoring RPG since the early-2009 timeframe.

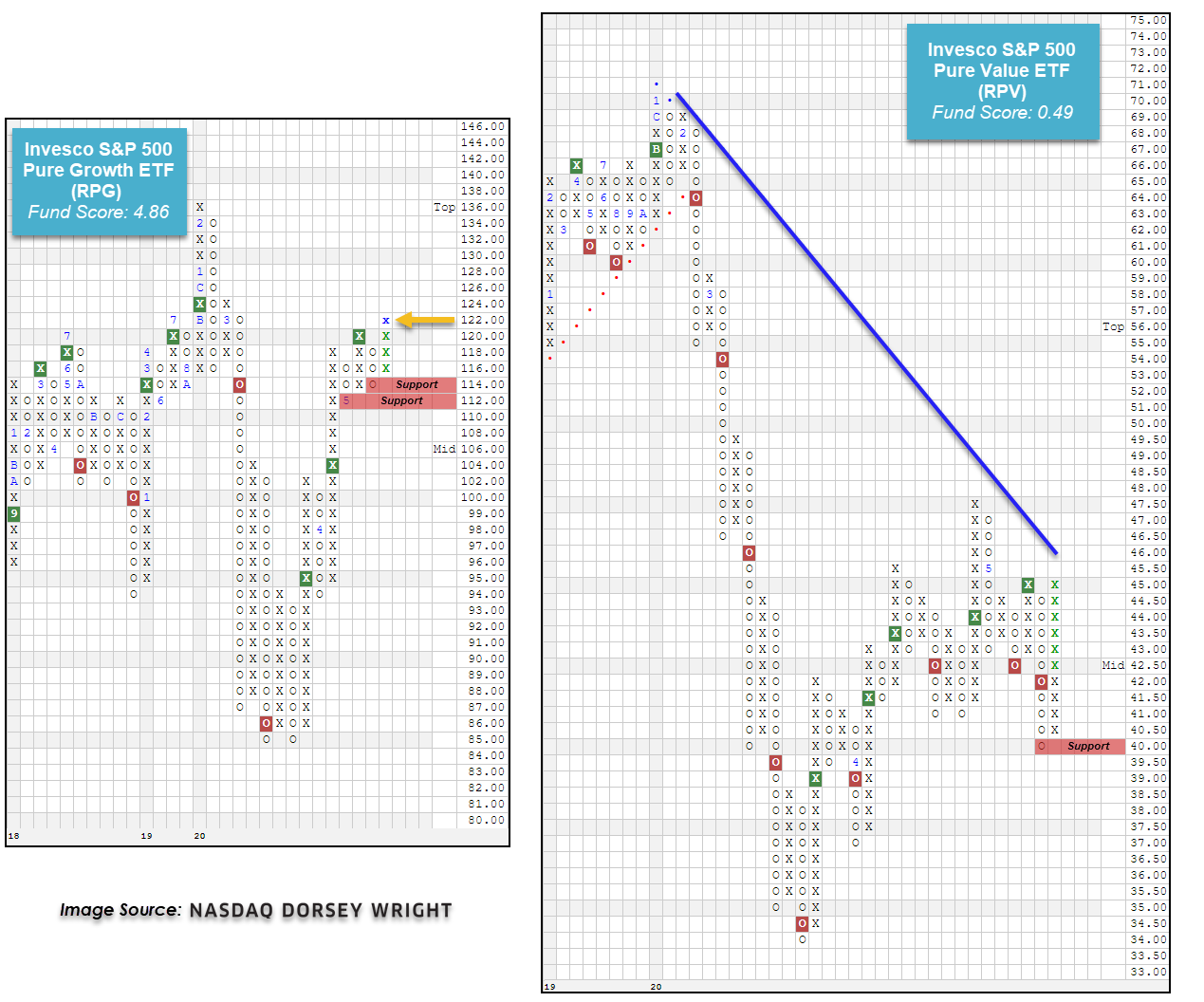

The stark contrast between growth and value is also readily apparent when we look at the technical pictures of RPG and RPV. RPG currently has a robust 4.86 fund score and a positive 1.15 fund score direction. After bottoming at $85 on its default chart in March RPG has rebounded to give three consecutive buy signals, and with movement on Tuesday broke out to give a fourth consecutive buy signal at $121. Throughout the volatility of 2020 RPG has maintained its positive trend, which has been intact since 2015. RPV, by comparison, has a dismal 0.49 fund score and -3.70 score direction. On its default chart, RPV is currently on a sell signal after breaking a triple bottom in last week's trading. While the fund has rebounded from its March low, it has largely traded sideways in April and May and remains in a negative overall trend after violating its bullish support line in February.

The dispersion between growth and value has not been limited to large-cap – the iShares Russell 2000 Growth ETF IWO has posted a year-to-date return of -10.22%, which while weaker than its large-cap counterpart, is significantly better than that of the iShares Russell 2000 Value ETF IWN which is down -25.18%.

As mentioned at the onset, the second major size & style trend in the US equity market has been the dominance of large over small, which is evident in the relative performance of the S&P 500 SPX and the Russell 2000 RUT as RUT's year-to-date return of -20.07% lags the S&P's by 11.5%. What is less-readily apparent is that this size bias exists not only across, but within capitalization categories. While SPX is down -8.57% year-to-date, the S&P Equal Weighted Index SPXEWI is down nearly twice as much at -16.72%. Further illustrating this phenomenon, the Invesco S&P 500 Top 50 ETF XLG, which holds the 50 largest companies in the S&P 500, has returned -3.08%, besting SPX by more than 5%. So, while demand for large-cap stocks has held up better than demand for small caps, it has been mega-cap stocks that investors have favored most.

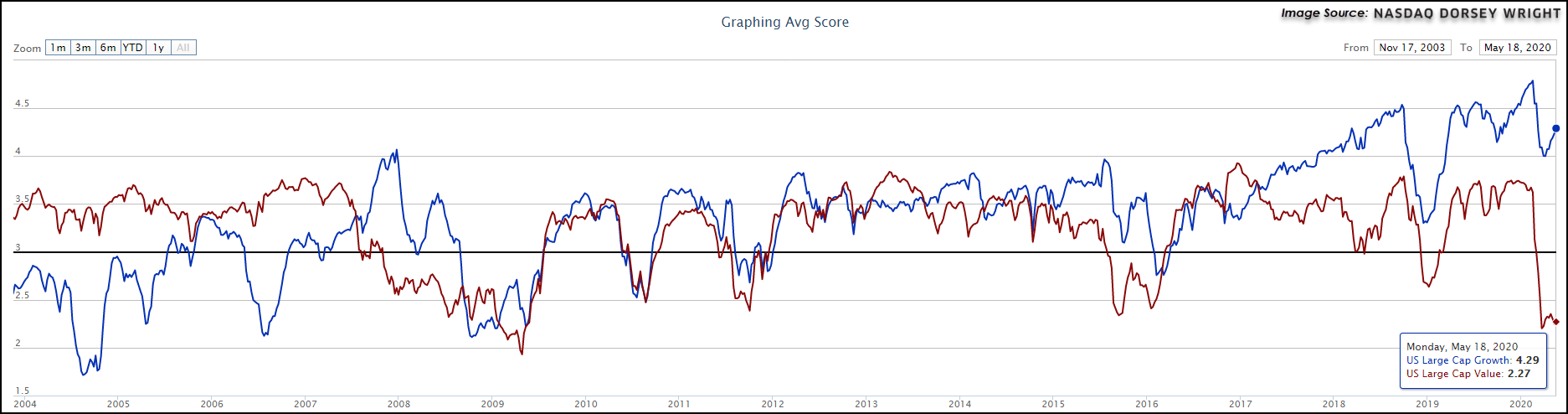

We can also see this relationship on the Asset Class Group Scores (ACGS) page by viewing the US style breakdown of the relative rankings, which displays large-, mid-, and small-cap split off into growth, blend, and value groupings. Even though the group scores of these areas have certainly changed with the recent market turbulence, the relative ranking of the groups has remained largely the same. Growth continues to best value across each of the three size classifications, with perhaps the most notable dispersion coming from US large cap growth over US large cap value. Using a historical score history graph comparison, we can see that the current 4.29 average score for large-cap growth significantly outpaces the 2.49 average score for large-cap value. This actually marks the largest differential between the two groups throughout the history of the ACGS tool, which dates back to the end of 2003. While such a large dispersion does bring about the contrarian mindset of a potential mean reversion event, we have not seen any action begin to occur within the underlying technical pictures of these two areas. Growth-oriented names, and especially those focused in larger-capitalization companies, have continued to push the broader domestic equity market higher over the past few weeks, and their technical resilience reinforces their current positioning as market leaders heading towards the end of the first half of 2020.

iShares Sector Rotation Model Update: Sell Cohen & Steers Realty ETF (ICF)

There was a change to the iShares Sector Rotation Model ISHRSECT this week: sell the iShares Cohen & Steers Realty ETF ICF. ISHRSECT utilizes a relative strength versus benchmark methodology which compares each of the funds in the model universe against the iShares Dow Jones US ETF IYY. Those funds showing near-term relative strength against the benchmark (i.e. are in a column of Xs) are included in the portfolio and are removed only when they show weakness relative to the benchmark (i.e. reverse down into a column of Os). When an addition or deletion is made, the portfolio is rebalanced so each position is equally weighted. ICF was removed from the portfolio because it reversed down into a column of Os on its relative strength chart against IYY, demonstrating short-term relative weakness…(Read more)

KraneShares Feature: Electric Vehicles & Future Mobility Index ETF (KARS)

The past few weeks of market action have seen some surprising continued improvement from the KraneShares Electric Vehicles & Future Mobility Index ETF KARS, which seeks to invest in global companies that are engaged in the production of electric vehicles, their components, as well as any other companies that are focused on changing the future of mobility (source: kraneshares.com). The fund fell significantly from its February high of $26.50 to give four consecutive sell signals, ultimately falling to an all-time low of $15.50 on March 19th. Since that time, however, the fund has demonstrated notable improvement, moving higher to give two consecutive buy signals before breaking through to a positive trend at $19.75 and giving its third consecutive buy signal at $22…(Read more)

Franklin Weekly Feature: LibertyQ Global Equity ETF (FLQG)

While the relative strength picture has remained largely unchanged for the broader international equities group, we have noticeable improvement taking place across many of the individual trend charts of broad global equity funds, in both developed and international market representatives. One such global fund is the Franklin LibertyQ Global Equity ETF FLQG, which has risen up from a near-term low of $23.50 to give two consecutive buy signals during its ascent to recent levels at $29.50. While the chart has improved the fund still sits in an overall negative trend, although recent strength has led FLQG to near its long-term bearish resistance line that currently sits at $31.50…(Read more)

Average Level

19.87

| AGG | iShares US Core Bond ETF |

| USO | United States Oil Fund |

| DIA | SPDR Dow Jones Industrial Average ETF |

| DVY | iShares Dow Jones Select Dividend Index ETF |

| DX/Y | NYCE U.S.Dollar Index Spot |

| EFA | iShares MSCI EAFE ETF |

| FXE | Invesco CurrencyShares Euro Trust |

| GLD | SPDR Gold Trust |

| GSG | iShares S&P GSCI Commodity-Indexed Trust |

| HYG | iShares iBoxx $ High Yield Corporate Bond ETF |

| ICF | iShares Cohen & Steers Realty ETF |

| IEF | iShares Barclays 7-10 Yr. Tres. Bond ETF |

| LQD | iShares iBoxx $ Investment Grade Corp. Bond ETF |

| IJH | iShares S&P 400 MidCap Index Fund |

| ONEQ | Fidelity Nasdaq Composite Index Track |

| QQQ | Invesco QQQ Trust |

| RSP | Invesco S&P 500 Equal Weight ETF |

| IWM | iShares Russell 2000 Index ETF |

| SHY | iShares Barclays 1-3 Year Tres. Bond ETF |

| IJR | iShares S&P 600 SmallCap Index Fund |

| SPY | SPDR S&P 500 Index ETF Trust |

| TLT | iShares Barclays 20+ Year Treasury Bond ETF |

| GCC | WisdomTree Continuous Commodity Index Fund |

| VOOG | Vanguard S&P 500 Growth ETF |

| VOOV | Vanguard S&P 500 Value ETF |

| EEM | iShares MSCI Emerging Markets ETF |

| XLG | Invesco S&P 500 Top 50 ETF |

Long Ideas

| Symbol | Company | Sector | Current Price | Action Price | Target | Stop | Notes |

|---|---|---|---|---|---|---|---|

| HLI | Houlihan Lokey Inc | Banks | $64.39 | upper $50s - mid to upper 60s | $68 | $49 | 5 for 5'er, pullback from AT high, consec buy signals, top 25% of DWABANK, pos week mom, 2.09% yield |

| ADBE | Adobe Systems Incorporated | Software | $367.97 | hi 330s - low 360s | 404 | 288 | 4 for 5'er, top third of favored SOFT sector matrix, LT pos mkt RS, multi consec buys, pot. covered write Earnings 6/11 |

| ATSG | Air Transport Services Group Inc. | Aerospace Airline | $21.05 | low 20s | 33.50 | 17.50 | 4 for 5'er, top third of favored AERO sector matrix, spread quad top, pot. covered write, R-R>3.0 |

| CIEN | CIENA Corporation | Telephone | $51.36 | upper 40s to mid 50s | $58 | $37 | 5 for 5'er, pullback from 52 week high, pos trend, top 25% telephone sector matrix, consec buy signals Earnings 6/4 |

| ABBV | AbbVie Inc. | Drugs | $91.47 | 82 - 89 | 100 | 71 | 3 for 5'er, favored DRUG sector, triple top breakout, 5.6% yield |

| KKR | KKR & Co. L.P | Finance | $25.85 | mid-to-upper 20s | 44.50 | 21 | 4 for 5'er, top half of FINA sector matrix, triple top, 2.2% yield, cov. write opp., R-R>4.0 |

| FNV | Franco-Nevada Corp. | Precious Metals | $147.24 | 140s to mid 150s | 171 | 118 | 4 for 5'er, pullback from AT high, consec buy signals, pos mon mom |

| ICE | IntercontinentalExchange Inc. | Wall Street | $96.00 | 90s | 125 | 77 | 5 for 5'er, top 25% of WALL sector matrix, LT pos mkt RS, multi consec buy signals, 1.3% yield |

| DGX | Quest Diagnostics Incorporated | Healthcare | $109.04 | mid $110s to $130s | $132 | $92 | 4 for 5'er, pullback from AT high, consec buy signals, top 25% of favored healthcare sector, 2.02% yield |

Short Ideas

| Symbol | Company | Sector | Current Price | Action Price | Target | Stop | Notes |

|---|---|---|---|---|---|---|---|

| HSBC | HSBC Holding PLC (United Kingdom) ADR | Banks | $25.26 | (26 - 23) | 17 | 28 | 1 for 5'er, bottom third of unfavored BANK sector matrix, LT neg mkt RS, multi sell signals, lower tops and lower bottoms |

Removed Ideas

| Symbol | Company | Sector | Current Price | Action Price | Target | Stop | Notes |

|---|---|---|---|---|---|---|---|

| PCAR | PACCAR Inc. | Autos and Parts | $69.97 | high 60s - low 70s | 87 | 58 | OK to add or maintain exposure here. Abide by $58 stop. |

Follow-Up Comments

| Comment |

|---|

| NVO Novo Nordisk A/S (Denmark) ADR R ($64.55) - Drugs - With no support available on the default chart between $50 and $62, we will raise our stop to $58, a potential spread quad bottom break on NVO's $0.50 chart. |

| QDEL Quidel Corporation R ($183.69) - Healthcare - We will now raise our stop to $162, the first potential sell signal on QDEL's default chart. |

| PODD Insulet Corporation R ($196.49) - Healthcare - We will now raise our stop to $180, the second potential sell signal on PODD's default chart. |

DWA Spotlight Stock

HSBC HSBC Holding PLC (United Kingdom) ADR R ($25.04) - Banks - HSBC is a 1 for 5'er that ranks in the bottom third of the unfavored banks sector matrix and has been on a market RS sell signal since 2001. On its default chart, the stock has been in a negative trend since August 2019 and has given three consecutive sell signals producing a series of lower tops and lower bottoms since then. It now sits one box away from giving fourth consecutive sell signal which would come with a double bottom break at $23. Short exposure may be added in the $23 - $26 range and we will set our initial buy stop at $28, the first potential buy signal on HSBC's chart. Using a modified vertical price objective based on the most recent sell signal, we will set our target price at $17.

| 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | ||||||||||||||||||||||||||||||||||||||||||||||

| 58.00 | X | • | • | 58.00 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 57.00 | X | X | O | X | • | • | • | 57.00 | |||||||||||||||||||||||||||||||||||||||||||||

| 56.00 | X | O | 5 | O | X | O | 9 | • | 1 | • | • | • | 56.00 | ||||||||||||||||||||||||||||||||||||||||

| 55.00 | X | O | X | O | X | O | X | O | X | O | X | • | • | X | • | • | 55.00 | ||||||||||||||||||||||||||||||||||||

| 54.00 | 1 | 2 | X | 6 | 7 | 8 | X | O | X | O | X | O | 7 | • | X | O | X | • | 54.00 | ||||||||||||||||||||||||||||||||||

| 53.00 | X | 3 | X | O | X | O | C | O | X | O | 5 | O | • | X | O | X | O | • | 53.00 | ||||||||||||||||||||||||||||||||||

| 52.00 | C | 4 | X | O | X | O | X | 3 | 4 | O | • | 1 | 2 | X | O | • | 52.00 | ||||||||||||||||||||||||||||||||||||

| 51.00 | X | O | O | 2 | O | X | 9 | • | C | O | O | • | 51.00 | ||||||||||||||||||||||||||||||||||||||||

| 50.00 | B | • | O | X | A | X | • | X | O | X | • | 50.00 | |||||||||||||||||||||||||||||||||||||||||

| 49.00 | X | • | O | O | X | O | • | X | 3 | X | O | • | 49.00 | ||||||||||||||||||||||||||||||||||||||||

| 48.00 | A | • | C | X | O | • | X | O | X | O | • | 48.00 | |||||||||||||||||||||||||||||||||||||||||

| 47.00 | • | • | • | X | • | O | X | 6 | • | 7 | 4 | 6 | • | 47.00 | |||||||||||||||||||||||||||||||||||||||

| 46.00 | X | • | 5 | • | 9 | • | 1 | X | O | 8 | • | X | 8 | • | 46.00 | ||||||||||||||||||||||||||||||||||||||

| 45.00 | O | X | O | X | O | • | X | • | O | 4 | O | X | O | • | 6 | O | • | 45.00 | |||||||||||||||||||||||||||||||||||

| 44.00 | O | X | O | X | O | X | • | X | • | 3 | X | 7 | X | O | • | • | 2 | X | O | 5 | • | 44.00 | |||||||||||||||||||||||||||||||

| 43.00 | 3 | 4 | O | X | O | 8 | • | O | X | O | O | X | • | 1 | O | 5 | 9 | X | 4 | O | • | 43.00 | |||||||||||||||||||||||||||||||

| 42.00 | O | 6 | O | X | • | O | O | X | O | X | O | X | A | B | O | X | O | • | 42.00 | ||||||||||||||||||||||||||||||||||

| 41.00 | O | X | 7 | X | • | O | C | O | X | O | X | O | X | O | X | O | 41.00 | ||||||||||||||||||||||||||||||||||||

| 40.00 | O | X | O | • | O | A | X | O | 4 | O | X | C | • | 7 | 40.00 | ||||||||||||||||||||||||||||||||||||||

| 39.00 | O | • | • | O | X | O | B | O | • | • | 8 | 9 | 39.00 | ||||||||||||||||||||||||||||||||||||||||

| 38.00 | • | 9 | X | O | 9 | • | O | X | O | 38.00 | |||||||||||||||||||||||||||||||||||||||||||

| 37.00 | O | 1 | X | • | O | X | O | 37.00 | |||||||||||||||||||||||||||||||||||||||||||||

| 36.00 | O | X | • | O | 2 | 36.00 | |||||||||||||||||||||||||||||||||||||||||||||||

| 35.00 | O | X | • | O | 35.00 | ||||||||||||||||||||||||||||||||||||||||||||||||

| 34.00 | O | X | X | • | O | 34.00 | |||||||||||||||||||||||||||||||||||||||||||||||

| 33.00 | O | X | O | X | 8 | • | O | Top | 33.00 | ||||||||||||||||||||||||||||||||||||||||||||

| 32.00 | 2 | X | O | X | O | 7 | • | 3 | 32.00 | ||||||||||||||||||||||||||||||||||||||||||||

| 31.00 | O | X | 5 | X | O | X | • | O | 31.00 | ||||||||||||||||||||||||||||||||||||||||||||

| 30.00 | 4 | 6 | O | X | • | O | X | 30.00 | |||||||||||||||||||||||||||||||||||||||||||||

| 29.00 | O | • | O | X | O | 29.00 | |||||||||||||||||||||||||||||||||||||||||||||||

| 28.00 | • | O | X | O | 28.00 | ||||||||||||||||||||||||||||||||||||||||||||||||

| 27.00 | O | 4 | X | 27.00 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 26.00 | O | X | O | Mid | 26.00 | ||||||||||||||||||||||||||||||||||||||||||||||||

| 25.00 | O | X | O | 25.00 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 24.00 | O | 5 | 24.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 |

| AMAT Applied Materials, Inc. ($55.89) - Semiconductors - Shares of AMAT returned to a buy signal on Tuesday with a triple top break at $55 and later moved higher to match resistance at $56. The 4 for 5’er resides in the favored semiconductors sector and recently reentered a positive trend on April 29th. Furthermore, AMAT demonstrates positive near-term strength versus the market, as it sits one box away from returning to an RS buy signal. The weight of the evidence is positive and those looking to initiate new long exposure may consider AMAT at current levels. Past $56, the next level of resistance resides at $61 while initial support is found at $50. Note AMAT also offers a yield of 1.56%. |

| COHR Coherent, Inc. ($145.46) - Electronics - Coherent shares broke a double top at $144 today, marking a third consecutive buy signal before advancing further to $146. This strong 5 for 5'er returned to a positive trend in early May and has maintained a market RS buy signal since September of 2019. Additionally, COHR ranks 9th of 59 names included in the favored electronics sector RS matrix. Demand is in control and long exposure may be added here, noting that initial support is offered at $128. Earnings are expected on 5/27. |

| CPRT Copart Incorporated ($85.46) - Autos and Parts - Copart shares broke a double top at $85 today, marking a third consecutive buy signal. This 5 for 5'er returned to a positive trend in late April and has remained on a market RS buy signal since March of 2017, confirming long-term strength against the broader market. Additionally, CPRT ranks in the top half of the favored autos and parts sector RS matrix. Demand is in control. Earnings are reported tomorrow (5/20) after market close and assuming no major reactions occur, long exposure may be added here. Note that support is offered at $78 and $77. |

| EDIT Editas Medicine Inc ($27.85) - Biomedics/Genetics - Shares of EDIT advanced on Tuesday to break a double top at $28 and give a fourth consecutive buy signal. The 4 for 5’er ranks in the top half of the favored biomedics/genetics stock sector matrix and recently reentered a positive trend on April 20th. Additionally, EDIT has remained on an RS buy signal versus the market since November of 2019 and is actionable from an Overbought/Oversold (OBOS) perspective. Demand is in control. The next level of resistance can be found at $29 while initial support is offered at $24. |

| ENTG Entegris Inc. ($58.10) - Semiconductors - Entegris shares broke a double top at $58 today, marking a fifth consecutive buy signal. This strong 5 for 5'er returned to a positive trend in early April and has maintained a market RS buy signal since July of 2016. Additionally, ENTG ranks 16th of 60 names included in the favored semiconductors sector RS matrix. Demand is in control and long exposure may be added here, nothing that support is offered at $53 and $51. Overhead resistance is found at $59, the stock's all-time high. |

| GWPH GW Pharmaceuticals PLC (United Kingdom) ADR ($123.00) - Drugs - GW Pharmaceuticals broke a double top at $122 during today's trading to mark a fourth consecutive buy signal. GWPH is a 3 for 5'er that returned to a positive trend in April and has recently experienced a flip to positive monthly momentum, suggesting the potential for further gains. Additionally, the stock ranks in the top third of the favored drugs sector RS matrix. The weight of the evidence is positive. Okay to add long exposure here or on a pullback, as the stock is approaching heavily overbought levels. Note that initial support is offered at $108. |

| IAC IAC/InterActiveCorp ($258.66) - Media - IAC shares completed a bullish catapult with a move to $256 during today's action, marking a fourth consecutive buy signal. This strong 5 for 5'er returned to a positive trend in late April and has maintained a market RS buy signal since May of 2017, confirming long-term strength. Additionally, IAC ranks 5th of 44 names included in the media sector RS matrix. Demand is in control and long exposure may be added here. Note that support is offered at $228. |

| QLYS Qualys Inc ($110.90) - Computers - Qualys shares broke a double top at $110 today, marking a fifth consecutive buy signal and testing an all-time high. This strong 5 for 5'er trades well above its recently-established bullish support line and has maintained a market RS buy signal since August of 2017. Additionally, QLYS ranks in the top third of the favored computers sector RS matrix. Demand is in control here and long exposure may be added on an individual basis or via the DWA Computer Sector Portfolio, of which QLYS is a holding. Support is offered at $102 and $99. |

| RUN Sunrun Inc ($15.94) - Utilities/Electricity - Sunrun shares broke a double top at $15.50 during today's trading, marking a fourth consecutive buy signal. Today's break also signifies a positive trend reversal for the stock, promoting it to a 4 for 5'er. RUN is also 1 box away from returning to a market RS buy signal and ranks 2nd of 48 names included in the favored utilities/electricity sector RS matrix. Monthly momentum has also recently flipped positive, suggesting the potential for further gains. Okay to add long exposure here as demand is in control. Note that support is offered at $13 and $12.50. |

| TERP Terraform Power Inc ($18.83) - Utilities/Electricity - TERP continued higher on Tuesday to break a double top at $19.50, resulting in a third consecutive buy signal. The 5 for 5’er resides in the favored utilities/electricity sector and is currently a holding in the DWA Electric Utilities Sector Portfolio, indicating strength amongst its peers. Additionally, TERP demonstrates positive long-term relative strength versus the market as it has remained on an RS buy signal since July of 2016 and recently experienced a flip to positive monthly momentum, suggesting the potential for further upside from here. Demand is in control. The next level of resistance resides at $20 while initial support can be found at $17.50. Note TERP also offers a yield of 4.23%. |

Daily Option Ideas for May 19, 2020

New Recommendations

| Name | Option Symbol | Action | Stop Loss |

|---|---|---|---|

| Oracle Corporation - $52.34 | ORCL2018I50 | Buy the September 50.00 calls at 5.30 | 46.00 |

Follow Ups

| Name | Option | Action |

|---|---|---|

| Tractor Supply Company ( TSCO) | Jul. 85.00 Calls | Stopped at 25.10 (CP: 23.80) |

| McCormick & Company, Incorporated ( MKC) | Sep. 150.00 Calls | Stopped at 28.90 (CP: 26.10) |

| Best Buy Co., Inc. ( BBY) | Sep. 75.00 Calls | Stopped at 14.80 (CP: 14.10) |

| Bristol-Myers Squibb Company ( BMY) | Sep. 60.00 Calls | Lower the stock stop price to 59.00 (CP: 62.89) |

New Recommendations

| Name | Option Symbol | Action | Stop Loss |

|---|---|---|---|

| International Business Machines Corp. - $120.29 | IBM2018U125 | Buy the September 125.00 puts at 12.50 | 130.00 |

Follow Up

| Name | Option | Action |

|---|---|---|

| Dollar Tree, Inc. (DLTR) | Aug. 85.00 Puts | Stopped at 81.00 (CP: 80.16) |

New Recommendations

| Name | Option Sym. | Call to Sell | Call Price | Investment for 500 Shares | Annual Called Rtn. | Annual Static Rtn. | Downside Protection |

|---|---|---|---|---|---|---|---|

| Comcast Corporation $38.09 | CMCSA2016J40 | Oct. 40.00 | 2.13 | $18,241.70 | 20.91% | 11.52% | 4.52% |

Still Recommended

| Name | Action |

|---|---|

| Copart Incorporated (CPRT) - 83.98 | Sell the August 85.00 Calls. |

| Micron Technology, Inc. (MU) - 45.92 | Sell the October 50.00 Calls. |

| Apollo Global Management Inc. (APO) - 43.51 | Sell the September 45.00 Calls. |

| Chevron Corporation (CVX) - 92.55 | Sell the September 95.00 Calls. |

| Electronic Arts Inc. (EA) - 117.12 | Sell the September 120.00 Calls. |

| Newmont Corp (NEM) - 66.26 | Sell the September 70.00 Calls. |

| Rent-A-Center, Inc. (RCII) - 24.86 | Sell the September 25.00 Calls. |

The Following Covered Write are no longer recommended

| Name | Covered Write |

|---|---|

|

|

|