There were no changes to the KraneShares Dynamic China Rotation Model this week; we highlight the recent improvement in the KraneShares Electric Vehicles & Future Mobility Index ETF (KARS).

There were no changes to the KraneShares Dynamic China Rotation Model this week, as each of the holdings continued to maintain sufficient relative strength against the Chinese fixed income representative.

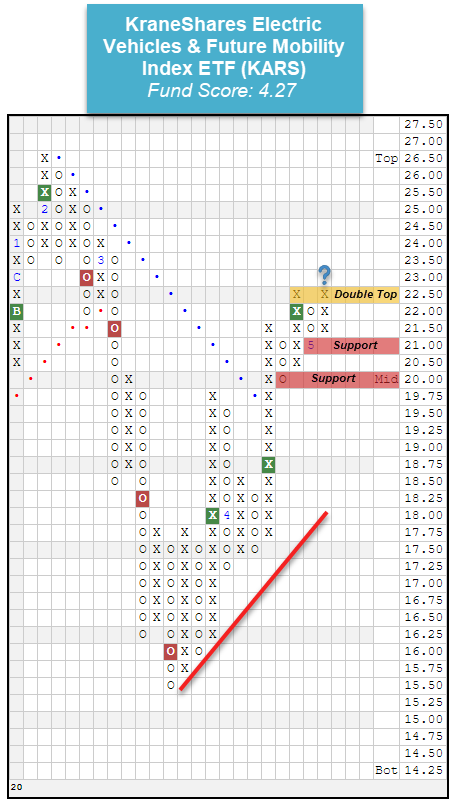

The past few weeks of market action have seen some surprising continued improvement from the KraneShares Electric Vehicles & Future Mobility Index ETF KARS, which seeks to invest in global companies that are engaged in the production of electric vehicles, their components, as well as any other companies that are focused on changing the future of mobility (source: kraneshares.com). The fund fell significantly from its February high of $26.50 to give four consecutive sell signals, ultimately falling to an all-time low of $15.50 on March 19th. Since that time, however, the fund has demonstrated notable improvement, moving higher to give two consecutive buy signals before breaking through to a positive trend at $19.75 and giving its third consecutive buy signal at $22. The fund has most recently moved higher over the past week to reverse back up into a column of X's and set up a double top formation at $22.50, with movement to $23 marking another buy signal. KARS has also shown advancement from a fund score perspective, with it possesses an ideal 4.27 fund score and a strongly positive 2.98 fund score direction. Those looking to gain exposure to KARS may consider the fund at current levels or upon a breakout at $23, with initial support offered at $21 and further support found at $20. From there, support may be found at the bullish support line, which currently sits at $18.