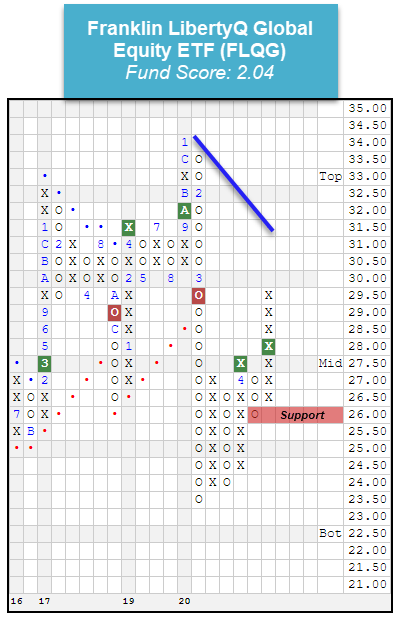

Highlighting recent improvement in the Franklin LibertyQ Global Equity ETF (FLQG).

The international equities asset class has seen continued long-term weakness from a relative-strength perspective, as it remains in the last place on our broad asset class ranking in DALI after falling to that position in March. Foreign equities have improved on an absolute basis over the past several weeks, in line with near-term strength from domestic equities, however, this improvement has been significantly more muted. The broad asset class has gained some buy signals in the DALI rankings, rising from a low of 65 signals to a recent posting of 82, although it still sits 30 signals below commodities.

While the relative strength picture has remained largely unchanged, we have noticeable improvement taking place across many of the individual trend charts of broad global equity funds, in both developed and international market representatives. One such global fund is the Franklin LibertyQ Global Equity ETF FLQG, which has risen up from a near-term low of $23.50 to give two consecutive buy signals during its ascent to recent levels at $29.50. While this chart level is certainly improved, the fund still sits in an overall negative trend, although recent strength has led FLQG to near its long-term bearish resistance line that currently sits at $31.50, four boxes north of current levels. FLQG also offers a 3.61% yield and has a low relative-risk (rRisk) score of 0.87, making this a name to keep an eye out for further improvement in the weeks to come. Initial support can be found at $26.