There is a change to the iShares Sector Rotation Model (ISHRSECT) this week: sell the iShares Cohen & Steers Realty ETF (ICF).

There is a change to the iShares Sector Rotation Model ISHRSECT this week: sell the iShares Cohen & Steers Realty ETF ICF. ISHRSECT utilizes a relative strength versus benchmark methodology which compares each of the funds in the model universe against the iShares Dow Jones US ETF IYY. Those funds showing near-term relative strength against the benchmark (i.e. are in a column of Xs) are included in the portfolio and are removed only when they show weakness relative to the benchmark (i.e. reverse down into a column of Os). When an addition or deletion is made, the portfolio is rebalanced so each position is equally weighted. ICF was removed the portfolio because it reversed down into a column of Os on its relative strength chart against IYY, demonstrating short-term relative weakness.

ICF reached a recent high of $104 in last month’s trading, where it failed to break through its bearish resistance line and reversed down. In trading earlier this week, the fund gave a second consecutive sell signal when it broke a triple bottom at $93. ICF currently has an unfavorable 0.69 fund score and –3.73 fund score direction.

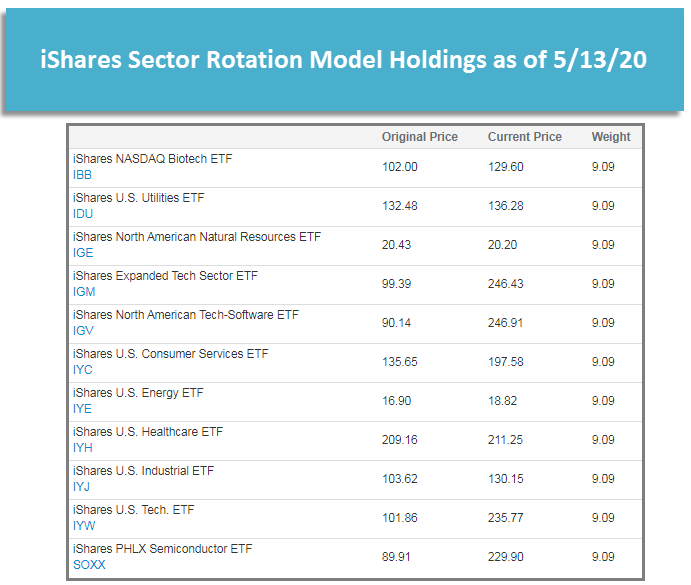

Year-to-date (through 5/13) ISHRSECT has returned –9.27%, outpacing the S&P 500 SPX which is down –12.71%. With the removal of ICF, the model now has exposure to 11 iShares sector and subsector ETFs which are shown below. This is the sixth change to the model this year.