The 10YR US Treasury Yield Index (TNX) has reached its highest level since 2011. The Inverse Fixed Income group has crossed above the 3.0 group score threshold for the first time since 2009; and AGG has fallen to its lowest level in more than four years.

As we noted in Monday’s “Were You Aware…?” the US Treasury 10YR Yield Index TNX broke a spread triple top on 4/20/18. In trading on Tuesday and Wednesday TNX continued higher, reaching and ultimately surpassing 3.0%, to hit its highest level since 2011. The US Treasury 5YR Yield Index FVX and the US Treasury 30YR Yield Index TYX have each also given fresh buy signals within the last week.

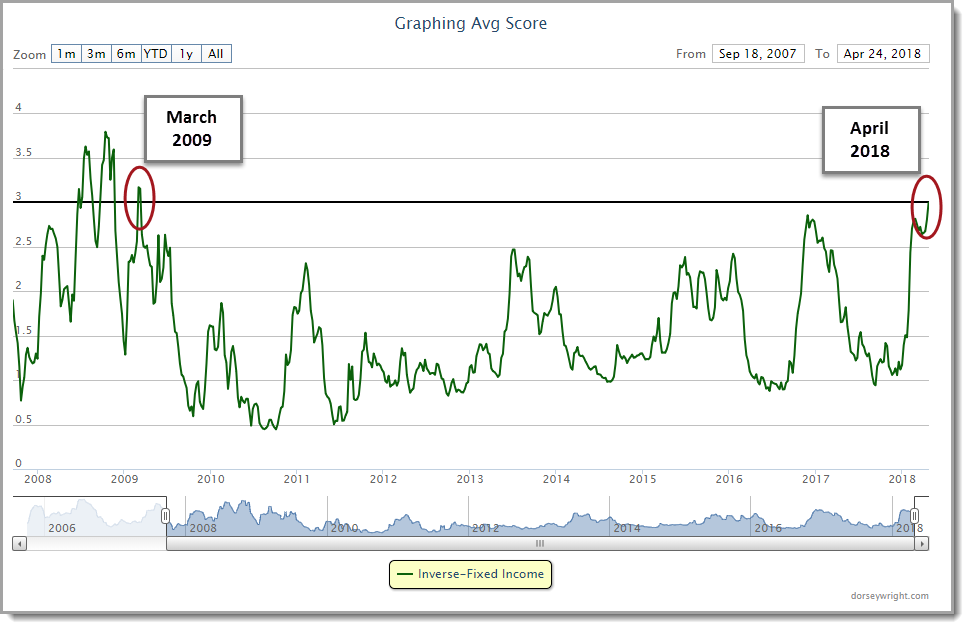

In what can be viewed as a related development, we have also seen the average group score for the Inverse Fixed Income group cross above the 3.0 score threshold for the first time since March 2009. The rise in rates has been accompanied by a general weakening across most segments of the fixed income market and currently, there are only two other fixed income groups – Floating Rate and Convertible Bonds – which rank above the 3.0 threshold.

While, TNX has reached its highest level in several years, the iShares US Core Bond ETF AGG, which is often used a general proxy for the U.S. bond market at-large, gave a fresh sell signal on its default chart on 4/20 and currently sits at its lowest level since December 2013.

With the weakness we are seeing across much of the fixed income market, you may wish to consider incorporating some less-rate-sensitive instruments in your clients’ fixed income allocations. Some potential segments to consider include: convertible bonds, floating rate bonds, high yield bonds, and target maturity ETFs, which can be used to create a held-to-maturity portfolio.