| A Agilent Technologies, Inc ($97.91) - Electronics - After forming a double top at $99, shares of A moved to a sell signal with today’s market action. This sets the chart up for a potential shakeout pattern. From here, the action point of the shakeout would trigger with a reversal up into Xs and the shakeout would complete with a triple top breakout at $100. A is a perfect 5 for 5’er within the favored electronics sector. From here, further support sits at $94. |

| ASND Ascendis Pharma A/S ($147.00) - Biomedics/Genetics - Shares of ASND moved higher Wednesday to break a triple top at $150. This 5 for 5'er moved back to a positive trend in April and has been on an RS buy signal against the market since early-2017. Weekly and monthly momentum also recently flipped positive, suggesting the potential for further upside from here. Initial support may be found at $140, which is also the current location of the bullish support line. Note that earnings are expected on 8/27. |

| CHD Church & Dwight Company ($96.47) - Household Goods - CHD advanced Wednesday to break a triple top at $96, marking a seventh consecutive buy signal and a new all-time high. This 5 for 5'er moved to a positive trend in April and ranks in the top third of the favored household goods sector RS matrix. The stock has also been on an RS buy signal against the market since late-2000. The weight of the technical evidence is positive, however, CHD has entered heavily overbought territory so those looking to add exposure would be best served to wait for a pullback or normalization of the trading band. Initial support can be found at $93, with further support offered at $92. |

| FND Floor & Decor Holdings Inc ($72.27) - Retailing - FND moved higher Wednesday to complete a shakeout pattern with a triple top break at $72. which also marked a new all-time high. This 5 for 5'er moved to a positive trend in May and ranks in the top quartile of the favored retailing sector RS matrix. The technical picture is strong and continues to improve, however, the recent movement has led FND to an intraday weekly overbought/oversold reading north of 80% so those looking to add exposure would be best served to wait for a pullback or normalization of the trading band. Initial support can be found at $65. |

| FSLR First Solar, Inc. ($76.20) - Semiconductors - FSLR completed a bullish triangle pattern with a double top breakout at $77. This stock is a solid 4 for 5’er within the favored semiconductors sector that ranks 2nd out of 64 names in the sector stock matrix. From here, initial support sits at $73, while FSLR faces resistance at $78. |

| NTGR NETGEAR, Inc. ($34.12) - Computers - Shares of NTGR advanced higher on Wednesday, breaking a double top at $34 to give a fourth consecutive buy signal. The 3 for 5'er ranks in the top quartile of the favored computers stock sector matrix and reentered a positive trend just last month, demonstrating favorable relative and absolute strength, respectively. Furthermore, weekly and monthly momentum are now both positive, adding to the favorable technical picture. The weight of the evidence is positive; however, those looking to initiate new long exposure may best wait for a pullback or price normalization as NTGR is approaching heavily overbought territory. Additional bullish confirmation would come with a move past current resistance around $34 while initial support is offered at $29. |

| OKTA Okta Inc ($205.78) - Software - OKTA returned to a buy signal on Wednesday at $208. This stock is a perfect 5 for 5’er within the favored software sector that ranks in the top half of the sector stock matrix. From here, initial support sits at $196 while OKTA faces resistance at $224. Earnings are expected on 8/27. |

| OMI Owens & Minor Incorporated ($17.11) - Healthcare - OMI broke a double top at $17.50, marking a new 52 week high in addition to the stock’s fifth consecutive buy signal. OMI is a perfect 5 for 5’er within the favored healthcare sector that moved back into a positive trend in late July. From here, initial support sits at $13. |

| RCL Royal Caribbean Cruises Ltd. ($61.54) - Leisure - RCL broke a double top at $63 before moving higher to $64 on Wednesday. This marks the second consecutive buy signal for the stock, which just moved back into a positive trend last week. Monthly momentum just flipped positive, suggesting the potential for higher prices and RCL has 3 out of 5 attributes in its favor. Demand is in control. From here, support sits at $56 with resistance at $66. Note RCL offers a yield of 5.17%. |

| WMS Advanced Drainage Systems Inc. ($59.47) - Machinery and Tools - WMS broke a double top at $60 before moving higher to $61. As a result, WMS is now trading at new all-time highs. The chart has given three consecutive buy signals, confirming that demand is in control. WMS is a perfect 5 for 5’er within the machinery and tools sector that has experienced three weeks of positive weekly momentum. Initial support sits at $56. |

Each week the analysts at DWA review and comment on all major asset classes in the global markets. Shown below is the summary or snapshot of the primary technical indicators we follow for multiple areas. Should there be changes mid-week we will certainly bring these to your attention via the report.

| Universe | BP Col & Level (actual) | BP Rev Level | PT Col & Level (actual) | PT Rev Level | HiLo Col & Level (actual) | HiLo Rev Level | 10 Week Col & Level (actual) | 10 Week Rev Level | 30 Week Col & Level (actual) | 30 Week Rev Level |

|---|---|---|---|---|---|---|---|---|---|---|

| ALL |

|

52% |

|

44% |

|

84% |

|

62% |

|

54% |

| NYSE |

|

62% |

|

50% |

|

86% |

|

68% |

|

54% |

| OTC |

|

48% |

|

40% |

|

84% |

|

58% |

|

52% |

| World |

|

54% |

|

42% |

|

|

|

56% |

|

50% |

Observations:

- All major bullish percent (BP) indicators remain unchanged from last week, resting (generally) in midfield position. BPNYSE currently reads the highest at 68% in a column of Xs.

- Three of the four major positive trend (PT) indicators did not experience change since the last discussion; the lone movement came from PTWORLD as it advanced higher in a column of Xs to 48%. All other PT indicators are in a column of Xs in midfield territory.

- All major HiLo indicators remain in high field position, unchanged from last week. Although elevated, remember that these indicators can remain in high field position for extended amounts of time.

- One of the major ten-week (TW) indicators advanced higher over the past week while the other three did not experience change. Similar to the movement in the world positive trend indicator, TWWORLD ticked higher in a column of Xs to 62%.

- Rounding out the updates we find two of the four major thirty-week indicators moving higher over the past week. 30ALL and 30WORLD ticked higher in a column of Xs to 60% and 56%, respectively, while 30NYSE and 30OTC reside at 60% and 58%, respectively.

Portfolio View - Major Market ETFs

| Symbol | Name | Price | Yield | PnF Trend | RS Signal | RS Col. | Fund Score | 200 Day MA | Weekly Mom |

|---|---|---|---|---|---|---|---|---|---|

| DIA | SPDR Dow Jones Industrial Average ETF Trust | 278.20 | 2.15 | Positive | O | 4.07 | 262.80 | +4W | |

| EEM | iShares MSCI Emerging Markets ETF | 44.75 | 2.00 | Positive | Sell | O | 5.11 | 40.84 | -2W |

| EFA | iShares MSCI EAFE ETF | 65.25 | 2.50 | Positive | Sell | O | 3.02 | 62.73 | -1W |

| FM | iShares MSCI Frontier 100 ETF | 24.56 | 3.23 | Negative | Sell | O | 0.39 | 25.90 | +1W |

| IJH | iShares S&P MidCap 400 Index Fund | 193.50 | 1.66 | Positive | Buy | O | 3.20 | 182.81 | +4W |

| IJR | iShares S&P SmallCap 600 Index Fund | 74.70 | 1.58 | Positive | Buy | O | 2.79 | 71.87 | +4W |

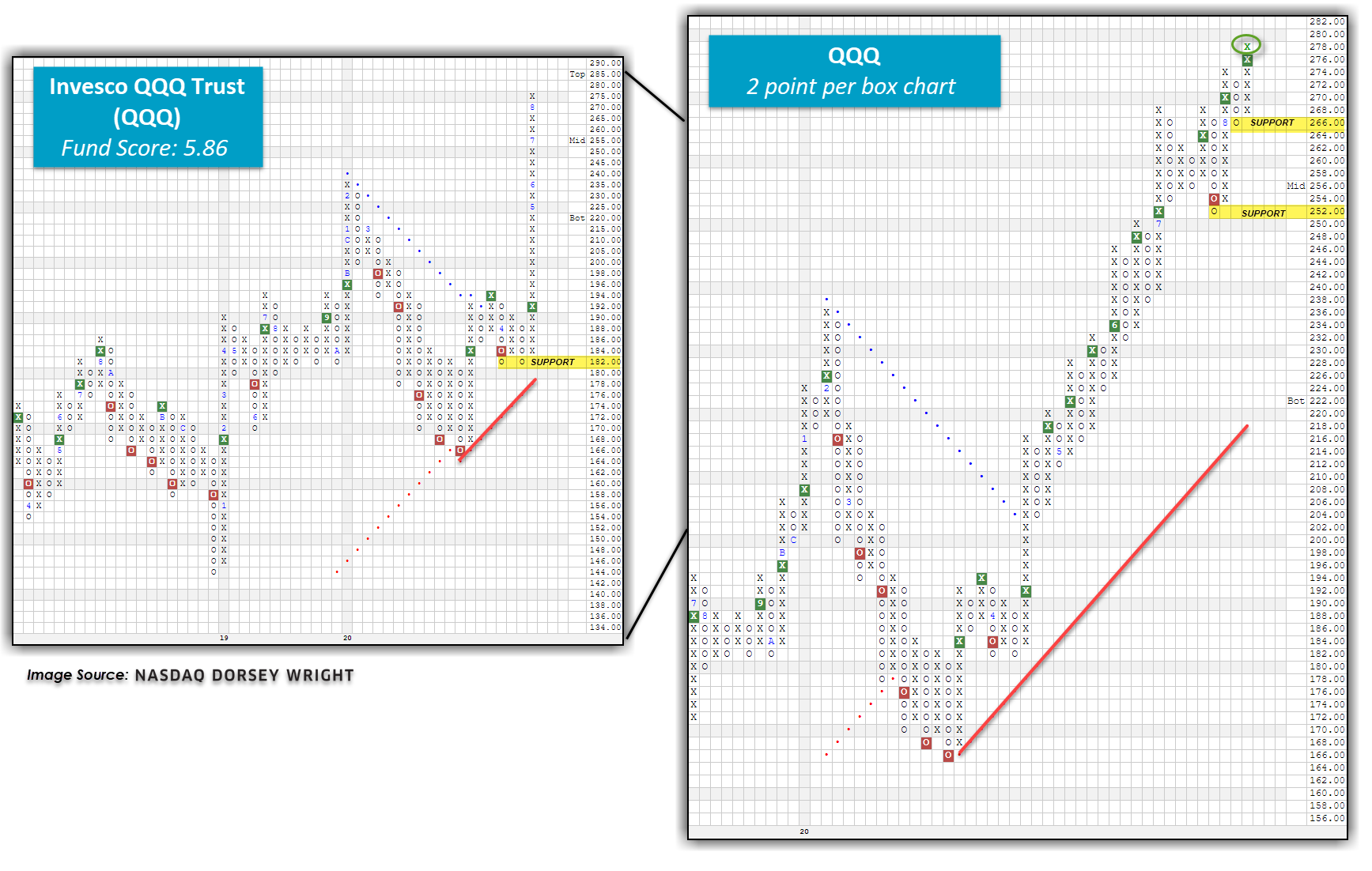

| QQQ | Invesco QQQ Trust | 277.97 | 0.59 | Positive | Buy | X | 5.86 | 223.16 | -2W |

| RSP | Invesco S&P 500 Equal Weight ETF | 110.39 | 1.94 | Positive | Buy | X | 4.04 | 104.60 | +4W |

| SPY | SPDR S&P 500 ETF Trust | 338.64 | 1.69 | Positive | O | 4.24 | 306.40 | +5W | |

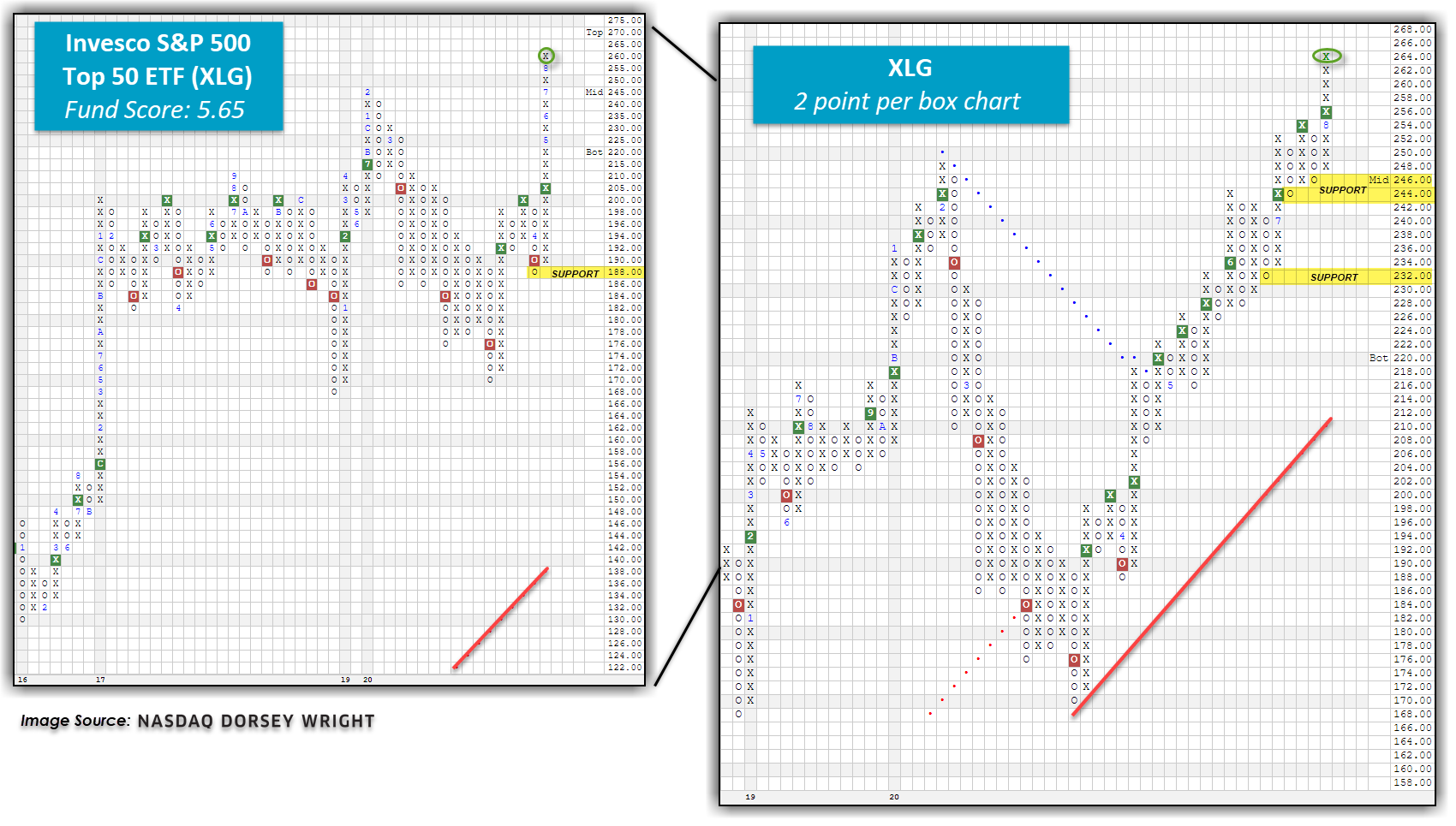

| XLG | Invesco S&P 500 Top 50 ETF | 263.85 | 1.38 | Positive | O | 5.65 | 229.69 | +6W |

Additional Comments:

Over the last week of market action, seven of the major market ETFs covered in this report finished in positive territory while three finished in the red. The top two performing funds for the week were the Invesco QQQ Trust QQQ and the Invesco S&P 500 Top 50 ETF XLG with gains of 4.82% and 2.77%, respectively, as we continue to witness those stocks in the large and mega-cap camps march higher. Small-caps struggled this week as the three worst-performing funds included the Invesco S&P 500 Equal Weight ETF RSP, iShares S&P MidCap 400 Index Fund IJH, and the iShares S&P SmallCap 600 Index Fund IJR with respective losses of -0.15%, -0.38%, and -1.32%. Today, we'll walk through how to use smaller scales/box sizes to identify tighter support levels on those charts that may be trading on a stem, such as the QQQ and the XLG.

When tracking the price action of a security over time using the Point & Figure methodology, we can target a shorter-term picture that is more sensitive to price movements by using a smaller box size to view the chart. In the images below, we look at both the default charts for the QQQ and XLG versus their respective 2-point per box charts.

In both cases, the default charts have been on a long stem of X's that have been intact since April of this year. As the indexes continue to better their highs, new X's are added to these columns, moving them further from potential support levels for those who may be entering new positions or holding open positions. When we look at the more sensitive 2-point per box charts, we can identify better areas of support and resistance. For example, the 2-point chart for the QQQ shows a pullback and subsequent reversal up into X's that occurred just this month. With yesterday's market action, this chart broke a double top at $276 before pushing higher to $278, marking the second consecutive buy signal for the fund in addition to printing a new record high. This price action also establishes support at the $266 level as a result of the QQQ's brief exhale, with additional support offered at $252. We find that these support levels are much more manageable when compared to the QQQ's default chart support, which sits at $182, more than -34.5% away from where the fund is trading today.

Concerning XLG, the 2-point per box chart reveals a total of eight consecutive buy signals that have occurred over the last four months as well as a recent rally to new all-time highs at $264. In terms of support levels for the XLG, we can identify $246 as initial support, with additional support coming in at $244 and $232. In comparison, the default chart for the XLG offers initial support at $188, over -28% away from where XLG trades today. Overall, both the QQQ and XLG offer bullish technical pictures with scores over the strong 5.50-level. Although at first glance they may appear too overbought for new positions, the more sensitive box sizes show attractive entry points at current levels, with reasonable support nearby.

SECTOR BULLISH PERCENT CHANGES

| Reversed to X | Reversed to O |

|---|---|

| 0 | 1 (BPPROT | 60), |

| To Xs | To Os |

|---|---|

| Metals Non Ferrous ( 0.97 to 54 ) | None |

Average Level

62.20

| Sector |

|---|

| None |

| Sector |

|---|

| Oil (46%) - Bear Correction |

| Oil Service (42%) - Bull Alert |

| Savings & Loans (48%) - Bull Confirmed |

| Sector |

|---|

| Internet (56%) - Bull Correction |

| Precious Metals (56%) - Bull Correction |

| Protection Safety Eq (60%) - Bear Alert |

| Software (56%) - Bear Confirmed |

SECTOR INDICATOR CHART CHANGES

PT is the percentage of stocks within a sector that are trading above their bullish support lines. RSX is the percentage of stocks within a sector whose relative strength charts are in a column of Xs. RSP is the percentage of stocks within a sector whose relative strength charts are on a buy signal. The strongest sectors, i.e. market leaders, will have most of these indicators positive and moving higher in a column of Xs.

|

There were only rising sector PT charts this week, with 13 rising and none moving lower. The following sector charts rose: Autos and Parts [^PTAUTO], Building [^PTBUIL], Chemicals [^PTCHEM], Food Beverages/Soap [^PTFOOD], Forest Prods/Paper [^PTFORE], Leisure [^PTLEIS], Metals Non Ferrous [^PTMETA], Restaurants [^PTREST], Retailing [^PTRETA], Telephone [^PTTELE], Transports/Non Air [^PTTRAN], Wall Street [^PTWALL]-Rev. , Waste Management [^PTWAST]. There were 1 that reversed to X. |

|

| ^PT Charts Reversing Up - | ^PT Charts Reversing Down - |

|

|

| ^PT Charts Moving Higher - | ^PT Charts Moving Lower - |

|

|

|

There were mostly falling sector RSX charts this week, with 9 falling and 7 rising. The following sector charts rose: Aerospace Airline [^RSXAERO]-Rev. , Gaming [^RSXGAME], Leisure [^RSXLEIS]-Rev. , Machinery and Tools [^RSXMACH]-Rev. , Protection Safety Equipment [^RSXPROT]-Rev. , Restaurants [^RSXREST], Transports/Non Air [^RSXTRAN]-Rev. . The following sector charts fell: Banks [^RSXBANK], Biomedics/Genetics [^RSXBIOM], Drugs [^RSXDRUG], Utilities/Electricity [^RSXEUTI]-Rev. , Healthcare [^RSXHEAL], Internet [^RSXINET], Metals Non Ferrous [^RSXMETA]-Rev. , Precious Metals [^RSXPREC], Software [^RSXSOFT]. There were no sector RSX charts that moved to a buy or sell signal this week. |

|

| ^RSX Charts Reversing Up - | ^RSX Charts Reversing Down - |

| ^RSX Charts Moving Higher - | ^RSX Charts Moving Lower - |

|

There were equal amounts of rising and falling sector RSP charts this week, with 5 both rising and falling. The following sector charts rose: Autos and Parts [^RSPAUTO], Gaming [^RSPGAME]-Rev. , Metals Non Ferrous [^RSPMETA], Restaurants [^RSPREST]-Rev. , Telephone [^RSPTELE]. The following sector charts fell: Biomedics/Genetics [^RSPBIOM], Utilities/Electricity [^RSPEUTI], Forest Prods/Paper [^RSPFORE]-Rev. , Oil Service [^RSPOILS], Textiles/Apparel [^RSPTEXT]. There were 2 that reversed to X and 1 that reversed to O. |

|

| ^RSP Charts Reversing Up - | ^RSP Charts Reversing Down - |

|

|

| ^RSP Charts Moving Higher - | ^RSP Charts Moving Lower - |

FAVORED SECTOR STATUS CHANGES

A sector is considered to be Favored if it has 3 or 4 of the sector indicators (Relative Strength, RSX, RSP, & PT) positive, Average if it has 2 of the 4 indicators positive, & Unfavored if it has 0 or 1 of the indicators positive. The table below contains those sectors that have experienced a Favored Sector Status change over the past week. It is best to focus on sectors that are about 50% or lower on their Bullish Percent charts & are in Xs. Note: If a sector moves from Favored to Average, it doesn't necessarily mean that the sector in question has to be sold - it just means you need to evaluate your individual positions with exposure to that sector.

| Changes since 08/12/2020 | Full Report |

|

|

|

|

||||||

|

|

|

|

|

|

||||

|

|

|

|

|

||||

|

|

|

|

|

|

||||

Remember, these are technical comments only. Just as you must be aware of fundamental data for the stocks we recommend based on technical criteria in the report, so too must you be aware of important data regarding delivery, market moving government releases, and other factors that may influence commodity pricing. We try to limit our technical comments to the most actively traded contracts in advance of delivery, but some contracts trade actively right up to delivery while others taper off well in advance. Be sure you check your dates before trading these contracts. For questions regarding this section or additional coverage of commodities email james.west@dorseywright.com.

Data represented in the table below is through 8/18/20:

Broad Market Commodities Report

Portfolio View - Commodity Indices

| Symbol | Name | Price | PnF Trend | RS Signal | RS Col. | 200 Day MA | Weekly Mom |

|---|---|---|---|---|---|---|---|

| CL/ | Crude Oil Continuous | 42.57 | Positive | Buy | X | 42.37 | -7W |

| DBLCIX | Deutsche Bank Liquid Commodities Index | 282.00 | Negative | Sell | O | 278.45 | +19W |

| DWACOMMOD | DWA Continuous Commodity Index | 511.17 | Positive | Buy | O | 462.00 | -184W |

| GC/ | Gold Continuous | 2012.50 | Positive | Buy | X | 1663.24 | +7W |

| HG/ | Copper Continuous | 2.97 | Positive | Buy | X | 2.60 | -3W |

| ZG/ | Corn (Electronic Day Session) Continuous | 327.00 | Negative | Buy | O | 350.10 | -5W |

Similar to the equity markets we note broadening upside participation in the alternative assets space, recently demonstrated by positive advances from lumber LBS/.

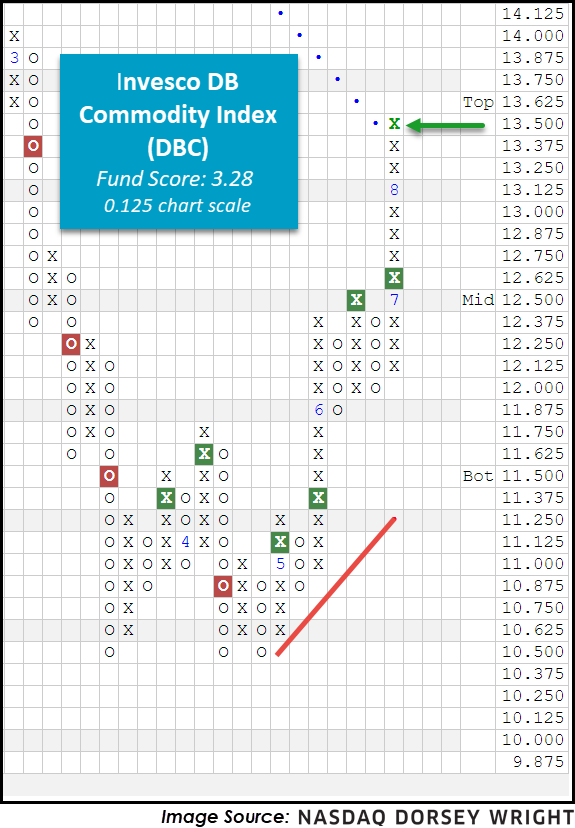

Akin to large cap growth and technology carrying the equity markets higher, precious and industrial metals were a lone bright spot in the commodities space for an extended period. However, as of lately we find increased participation from agricultural and energy-related spaces, manifesting in broad commodity tracking ETFs like the Invesco DB Commodity Index DBC giving four consecutive buy signals and reentering a positive trend. DBC also boasts a healthy fund score of 3.28 atop a strongly positive score direction of 2.90, adding to the favorable technical picture. Furthermore, the ETF is now experiencing a flip to positive monthly momentum after being negative for six months, suggesting the potential for additional appreciation. Supplementary confirmation can be found on the Asset Class Group Scores (ACGS) page as the Commodities group as a whole is just below the sought-after 3.00 average score line, an area last (briefly) visited in May of 2018.

All this said, the leaders are still leading. Darlings like Gold GC/ and Silver SI/ remain technically robust, each trading on Point and Figure buy signals near the top of their ten-week trading band. In fact, SI/ completed a bullish triangle just yesterday (8/18) and the industrial metal Copper HG/ resides just one box away from breaking a spread quadruple top to reach a 52-week high on its default chart. As for “new participants” in the commodities space, apart from a few soft commodities highlighted last week we find Lumber LBS/ demonstrating technical strength. Take for example the iShares S&P Global Timber & Forestry ETF WOOD and its largest holding Weyerhaeuser Company WY, each of which are nearing heavily overbought territory as a result of recent price appreciation. Thematically speaking, Home Depot HD even mentioned the shortage in lumber on a recent conference call and how respective prices consequently climbed (Source: wsj.com).

At the end of the day, supply and demand remain the driver of prices and temporary imbalances can lead to reversions (whether to the upside or downside). Sustained periods of demand or supply will thus lead to defined leaders and laggards, so if and when those trends change in the alternative assets space we will be sure to highlight them here.

Average Level

37.71

| AGG | iShares US Core Bond ETF |

| USO | United States Oil Fund |

| DIA | SPDR Dow Jones Industrial Average ETF |

| DVY | iShares Dow Jones Select Dividend Index ETF |

| DX/Y | NYCE U.S.Dollar Index Spot |

| EFA | iShares MSCI EAFE ETF |

| FXE | Invesco CurrencyShares Euro Trust |

| GLD | SPDR Gold Trust |

| GSG | iShares S&P GSCI Commodity-Indexed Trust |

| HYG | iShares iBoxx $ High Yield Corporate Bond ETF |

| ICF | iShares Cohen & Steers Realty ETF |

| IEF | iShares Barclays 7-10 Yr. Tres. Bond ETF |

| LQD | iShares iBoxx $ Investment Grade Corp. Bond ETF |

| IJH | iShares S&P 400 MidCap Index Fund |

| ONEQ | Fidelity Nasdaq Composite Index Track |

| QQQ | Invesco QQQ Trust |

| RSP | Invesco S&P 500 Equal Weight ETF |

| IWM | iShares Russell 2000 Index ETF |

| SHY | iShares Barclays 1-3 Year Tres. Bond ETF |

| IJR | iShares S&P 600 SmallCap Index Fund |

| SPY | SPDR S&P 500 Index ETF Trust |

| TLT | iShares Barclays 20+ Year Treasury Bond ETF |

| GCC | WisdomTree Continuous Commodity Index Fund |

| VOOG | Vanguard S&P 500 Growth ETF |

| VOOV | Vanguard S&P 500 Value ETF |

| EEM | iShares MSCI Emerging Markets ETF |

| XLG | Invesco S&P 500 Top 50 ETF |