We note broadening participation in the alternative assets space, providing an update on current leaders and recent participants like lumber

Remember, these are technical comments only. Just as you must be aware of fundamental data for the stocks we recommend based on technical criteria in the report, so too must you be aware of important data regarding delivery, market moving government releases, and other factors that may influence commodity pricing. We try to limit our technical comments to the most actively traded contracts in advance of delivery, but some contracts trade actively right up to delivery while others taper off well in advance. Be sure you check your dates before trading these contracts. For questions regarding this section or additional coverage of commodities email james.west@dorseywright.com.

Data represented in the table below is through 8/18/20:

Broad Market Commodities Report

Portfolio View - Commodity Indices

| Symbol | Name | Price | PnF Trend | RS Signal | RS Col. | 200 Day MA | Weekly Mom |

|---|---|---|---|---|---|---|---|

| CL/ | Crude Oil Continuous | 42.57 | Positive | Buy | X | 42.37 | -7W |

| DBLCIX | Deutsche Bank Liquid Commodities Index | 282.00 | Negative | Sell | O | 278.45 | +19W |

| DWACOMMOD | DWA Continuous Commodity Index | 511.17 | Positive | Buy | O | 462.00 | -184W |

| GC/ | Gold Continuous | 2012.50 | Positive | Buy | X | 1663.24 | +7W |

| HG/ | Copper Continuous | 2.97 | Positive | Buy | X | 2.60 | -3W |

| ZG/ | Corn (Electronic Day Session) Continuous | 327.00 | Negative | Buy | O | 350.10 | -5W |

Similar to the equity markets we note broadening upside participation in the alternative assets space, recently demonstrated by positive advances from lumber LBS/.

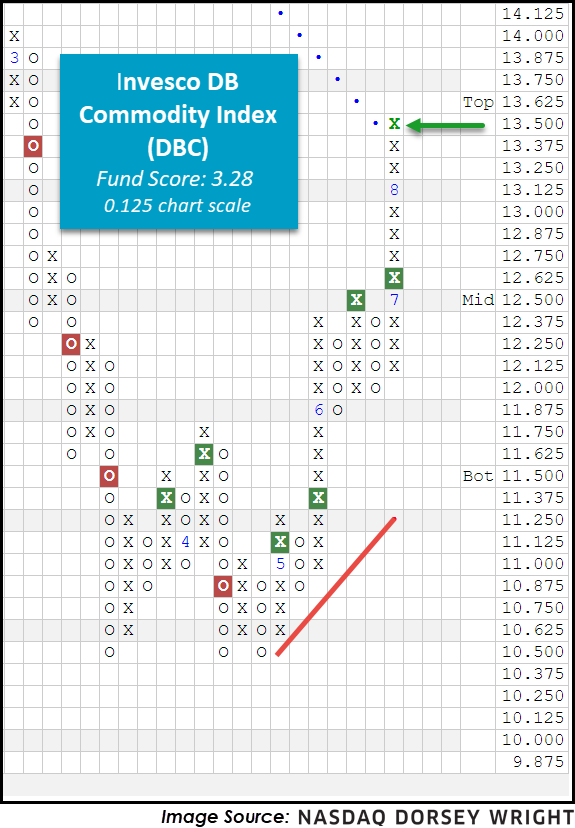

Akin to large cap growth and technology carrying the equity markets higher, precious and industrial metals were a lone bright spot in the commodities space for an extended period. However, as of lately we find increased participation from agricultural and energy-related spaces, manifesting in broad commodity tracking ETFs like the Invesco DB Commodity Index DBC giving four consecutive buy signals and reentering a positive trend. DBC also boasts a healthy fund score of 3.28 atop a strongly positive score direction of 2.90, adding to the favorable technical picture. Furthermore, the ETF is now experiencing a flip to positive monthly momentum after being negative for six months, suggesting the potential for additional appreciation. Supplementary confirmation can be found on the Asset Class Group Scores (ACGS) page as the Commodities group as a whole is just below the sought-after 3.00 average score line, an area last (briefly) visited in May of 2018.

All this said, the leaders are still leading. Darlings like Gold GC/ and Silver SI/ remain technically robust, each trading on Point and Figure buy signals near the top of their ten-week trading band. In fact, SI/ completed a bullish triangle just yesterday (8/18) and the industrial metal Copper HG/ resides just one box away from breaking a spread quadruple top to reach a 52-week high on its default chart. As for “new participants” in the commodities space, apart from a few soft commodities highlighted last week we find Lumber LBS/ demonstrating technical strength. Take for example the iShares S&P Global Timber & Forestry ETF WOOD and its largest holding Weyerhaeuser Company WY, each of which are nearing heavily overbought territory as a result of recent price appreciation. Thematically speaking, Home Depot HD even mentioned the shortage in lumber on a recent conference call and how respective prices consequently climbed (Source: wsj.com).

At the end of the day, supply and demand remain the driver of prices and temporary imbalances can lead to reversions (whether to the upside or downside). Sustained periods of demand or supply will thus lead to defined leaders and laggards, so if and when those trends change in the alternative assets space we will be sure to highlight them here.