Odds and Ends: The S&P 500 hits a new intraday high and Silver continues higher.

Monday Market Update Webinar Replay: Missed Monday's (8/17) webcast? Click the link(s) below for a recap:

Upcoming KKM webinar: Join KKM on Wednesday, August 19th at 3 pm ET for a webinar focusing on models powered by Nasdaq Dorsey Wright methodology. The topic will be on "Dynamic & Active: Time to revisit two investment themes (powered by Nasdaq Dorsey Wright) for 2020", which is hosted by KKM and sponsored by Adhesion Wealth. Click here to register.

Odds and Ends: The S&P 500 hits a new intraday high and Silver continues higher.

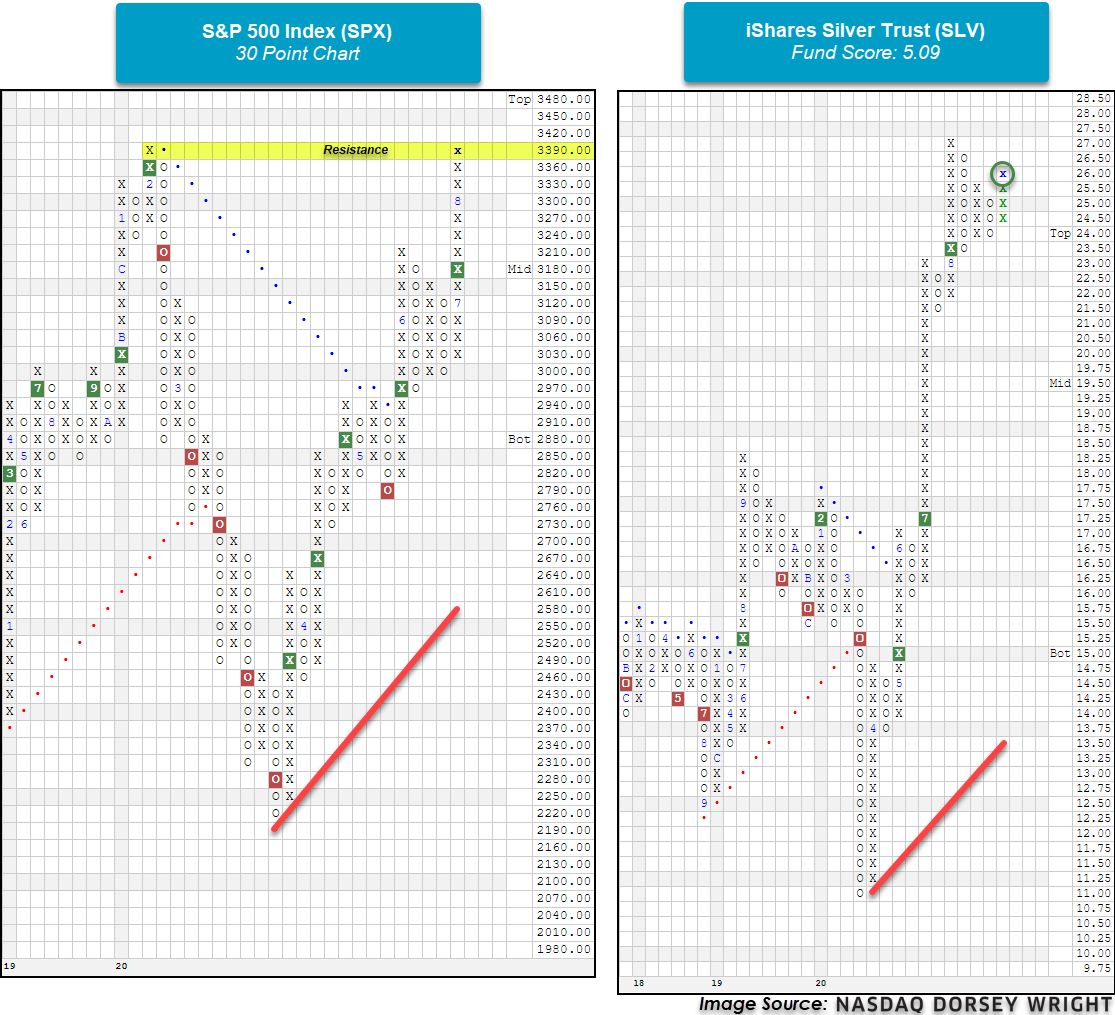

The S&P 500 Index SPX reached a new intraday high of 3395.06 and printed an X at the 3390 mark on its default chart (Source: FactSet). The S&P 500 Index Funds group is the highest scoring group within the macro grouping on the asset class group scores page with an average score of 4.62. On its Point and Figure chart, SPX now sits at resistance established in February of this year.

Precious metals have been a bright spot as the iShares Silver Trust SLV broke a double top with today’s intraday action to complete bullish triangle and is now on its fourth consecutive buy signal. SLV has a fund score of 5.09 and a positive score direction of 3.08. Recent price action has put SLV into heavily overbought territory with an overbought/oversold reading of 134%. Those wishing to take a long position may be best served to wait for a pullback or price normalization before doing so. The precious metals group on the asset class group scores page currently has an average group score of 4.44 highlighting the strength of the sector.