Notable Technical Developments from the Technology, Financials, Consumer Discretionary, Communication Services, Utilities, Energy, and Real Estate Sectors.

U.S. Sector Updates

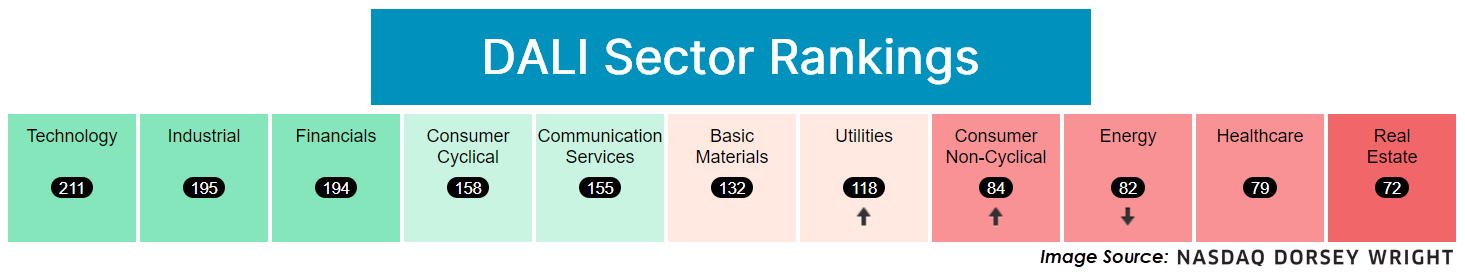

The past week saw no significant technical developments in the Industrial, Basic Materials, Consumer Staples, or Healthcare Sectors. Those that saw noteworthy movement are included below, in order of their relative strength ranking in the DALI domestic equity sector rankings. Sector designations are based on DALI sector rankings and are as follows: 1 - 3 overweight, 4 - 7 equal weight, and 8 - 11 underweight.

Technology – Overweight, Weakening

Weekly Technology Video (3:51)

The technology sector saw relative weakness over the past week amidst broad declines in global equities. The sector lost the most relative strength buy signals in our DALI sector rankings, dropping 27 RS tally signals to bring the total signal count to 211 signals. This is still notably ahead of Industrials, which sits second with 195 signals, but weaker than its 244 signal high in mid-July. Near-term participation readings are reaching washed-out positions, especially in semiconductors, as many of those stocks followed NVDA lower. Software stocks like MSFT saw weakness but maintained a more favorable technical picture. FICO is one software name that has continued to demonstrate resilience with consecutive buy signals.

Financials – Overweight, Improving

Weekly Financials Video (2:41)

Financials continue to pick up relative strength and is now the second-highest scoring broad sector group on the Asset Class Group Scores page. Despite the quick pullback in US equities over the last week, the Financial Select SPDR Fund (XLF) remains on a buy signal on its trend chart and has a fund score of 4.37. Moving forward, the $40 level will be of utmost importance.

Consumer Discretionary – Equal Weight

Weekly Discretionary Video (5:41)

Discretionary stocks fell and outpaced the broader market to the downside as the SPDR Consumer Discretionary Fund XLY fell more than 6% during this past week. Building DWABUIL led subsectors to the downside, declining over 8%, while Retail DWARETA, Leisure DWALEIS, and Gaming DWAGAME were all down more than 7%. Downside action led to a decrease in participation as the broader sector bullish percent ^BPECCONCYC reversed into Os and fell below 30%. This comes after the indicator had just reversed back into Xs following last Wednesday’s trading. Notable downside movers last week were Tesla TSLA, which dropped to a 0 for 5’er, and Amazon AMZN, which violated its bullish support line with downside action following earnings. Stocks that reported positive earnings over the past week were Ralph Lauren RL and Hilton HLT.

Communication Services – Equal Weight

Weekly Communications Services (3:36)

Communication Services remains as a firm equal weight this week. Larger tech-focused names have taken a step back, but the overall long-term picture remains defendable for now. DIS fell on earnings as park attendance slowed but streaming services improved. GOOGL (GOOG) faced anti-trust issues but pulled back to just above the bullish support line. Feel free to add as you see fit. SPOT also moved lower but remains a high RS name, while WBD popped on earnings despite being a 0/5'er. For those with exposure, continue to trim.

Utilities – Equal Weight, Improving

Utilities was the best-performing sector over the past week with the SDPR Utilities Fund XLU up 1.4%. This brought the fund to a 52-week high on the trend chart, and the broader sector was able to improve up to 7th in the DALI sector rankings. This week encompasses the busiest week of the quarter for earnings within the sector. Southern Company SO reported positive earnings last week and rallied to new highs, while ONEOK OKE also beat earnings and continues to maintain a 5 attribute rating. Notable earnings to cap off the weak include NRG Energy, Vistra VST, and Atmos ATO, each reporting on Thursday.

Energy – Underweight, Weakening

Energy lost 18 buy signals in the DALI sector rankings over the last week, falling from seventh to ninth place. The Energy Select Sector SPDR Fund (XLE) was down more than 6% over the last seven days, underperforming the S&P 500 by more than 250 basis points. XLE fell to a sell signal on its default chart when it broke a double bottom at $89 and continued lower, taking out two additional levels of support and violating its bullish support line; the fund has now taken out all support it has found since January.

Energy now sits squarely in underweight territory based on its DALI ranking. The last week also saw crude oil (CL/) fall to a sell signal and a negative trend on its chart.

Real Estate – Underweight

Weekly Real Estate Video (1:42)

Despite last week's volatility, the real estate sector continued to gain ground. The real estate group on the asset class group scores page now scores decisively above 3.0 and nearly two-thirds of stocks trade above their 50-day moving average. SPG defended key support and WELL has yet to take a breather, sitting at all-time highs. For more on the latest real estate move, click here.