Investors have a longstanding love-hate relationship with the month of October. Some of the more notorious market meltdowns have occurred, or at least escalated, in October. Still, the SP 500 (SPX) has had more double-digit gains in October than it has double-digit losses since 1950.

Last Friday, we looked at historical returns for the back half of September. Keeping with the theme and given that October is now just one week away, we wanted to discuss the tendency for investors to either love or hate the month of October.

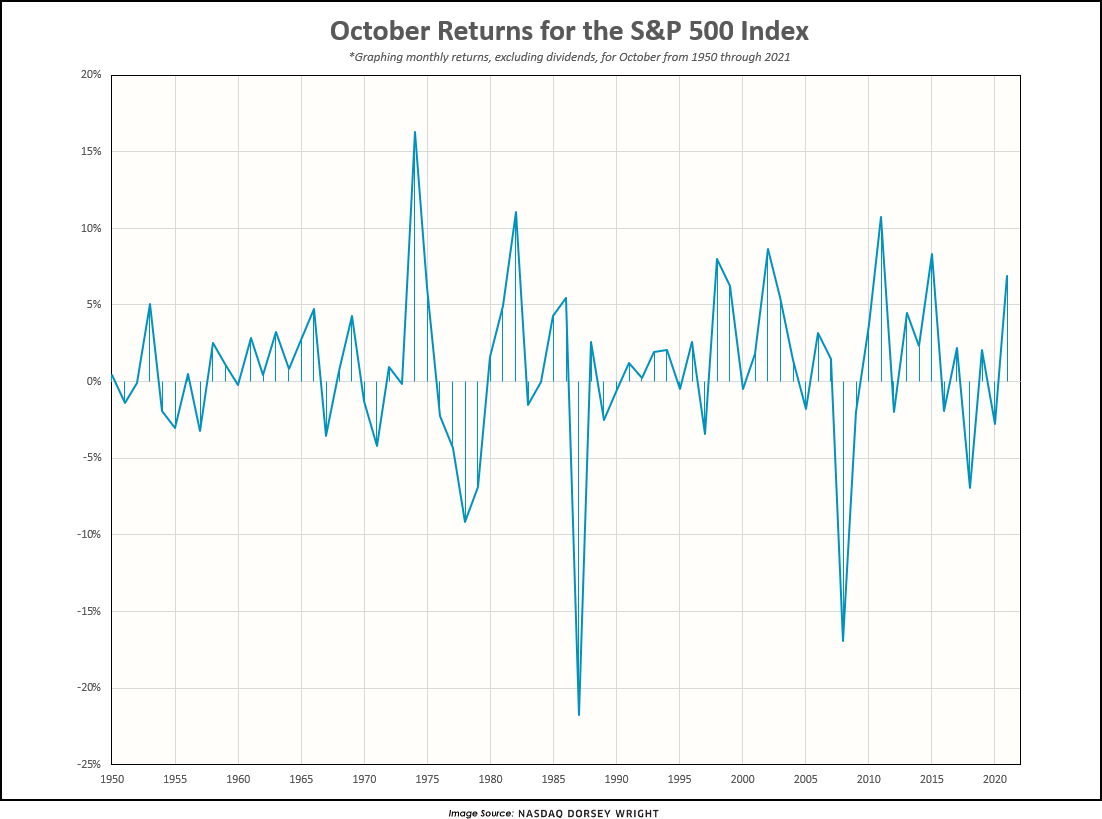

Investors have a longstanding love-hate relationship with the month of October. Some of the more notorious market meltdowns have occurred, or at least escalated, in October; including 1978 (-9%), 1987 (-22%), and 2008 (-17%). And several of the largest one-day market declines, including Black Monday (1987) and Black Tuesday (1929), happened in October. Still, the S&P 500 (SPX) has had more double-digit gains in October than it has had double-digit losses since 1950. In fact, October is often referred to as the "bear killer," as its end ushers in the beginning of the seasonally strong six months of the year.

October offered some of the more meaningful buying opportunities of the post-GFC long-term bull market including 2011 and, more recently, in 2015 when the S&P 500 rallied over 8% during the month. Furthermore, the S&P was up nearly 7% last year. However, the worst October since 2008 came just four years ago in 2018 as SPX fell nearly 7%, in keeping with October’s love-hate reputation. Historically speaking, October has been positive more often than not, as the S&P 500 has logged gains in 60% of the Octobers between 1950 and 2021. The average return for the month during this time frame is +0.85%.

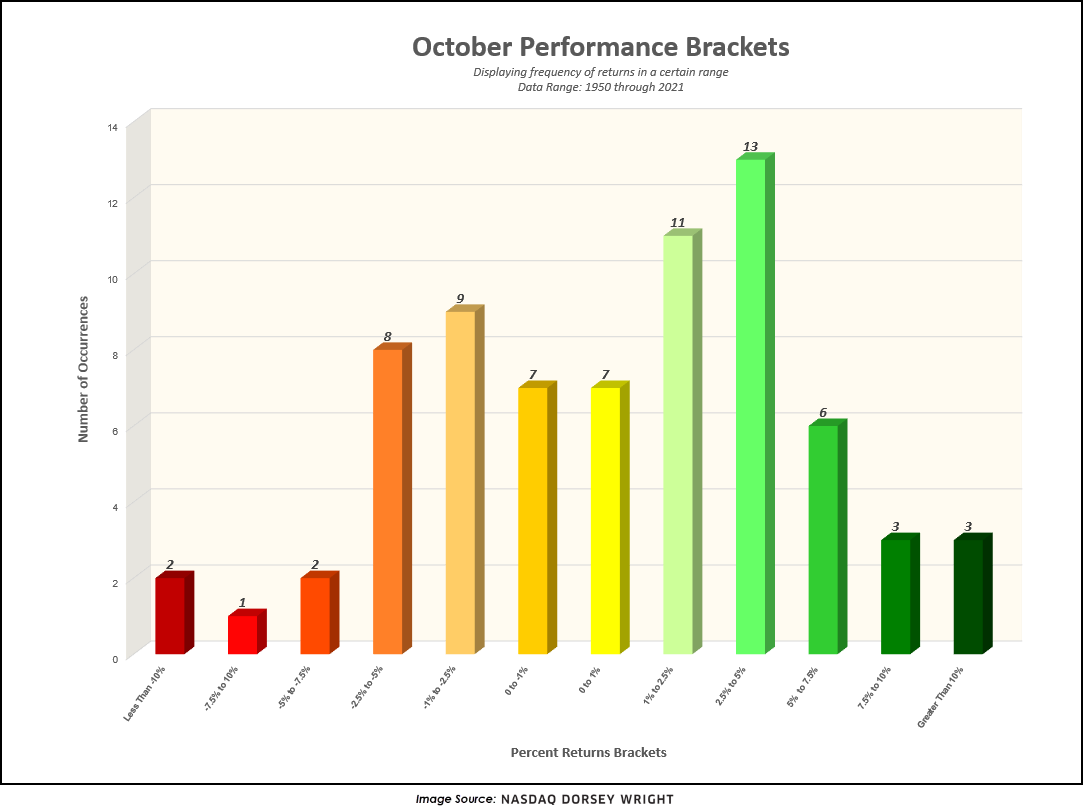

The histogram below is another visual that helps us wrap our hands around October's past behavior. It categorizes each October's return into a performance bracket, allowing us not only to see that there have been more up Octobers than down Octobers, but also the degree to which they have been up or down. If we look at the extremes, notice that only five Octobers since 1950 (including 2018) have experienced a decline in excess of -5%. The most common experience in October has been a gain in the range of 2.5% - 5%.

At the time of this writing, the S&P 500 is down over -5% for the month of September which makes the cut for the top 10 worst Septembers since data beginning in 1957. Following the 10 worst September returns, October was positive 60% of the time. When October was positive we saw an average gain of nearly 8%, and when October was negative we saw an average loss of about -5%. As mentioned before, October of 2008 posted a spectacular loss of -17% yet October of 1974 saw a gain of 16%. So, following a rough September, it would not be unusual to see volatility spill over into October.

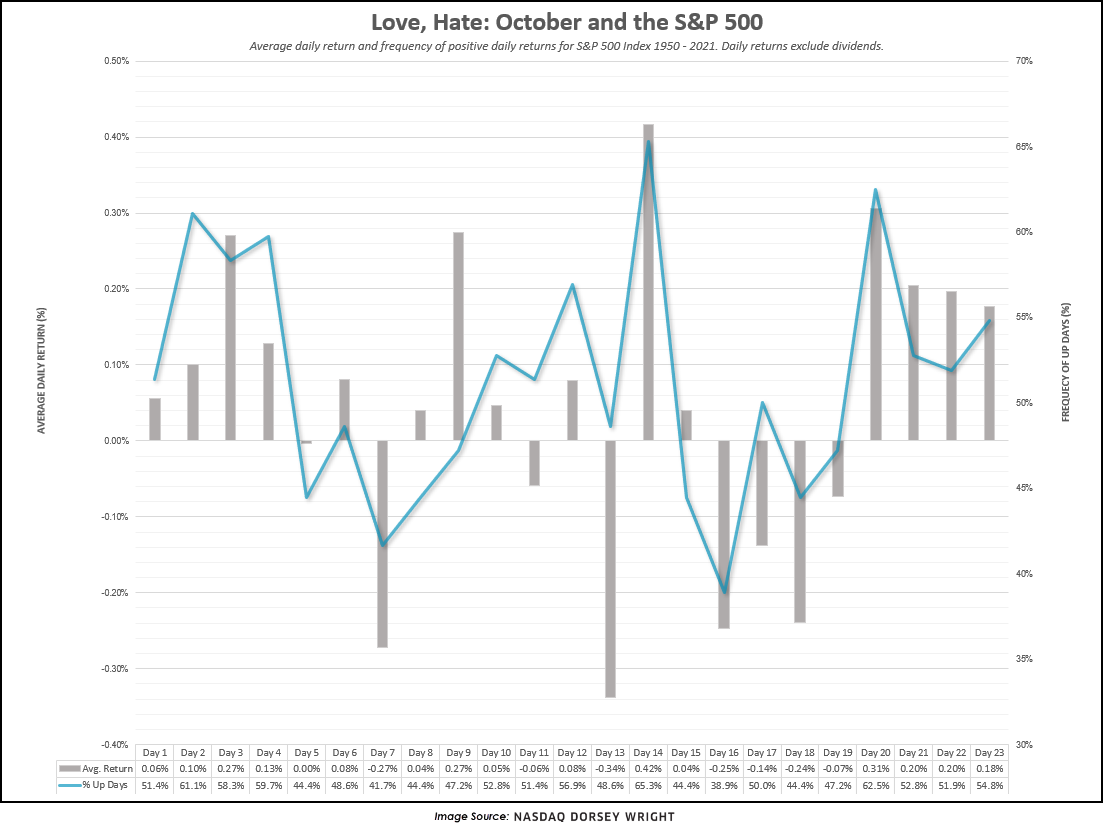

Finally, the graphic below illustrates the average daily returns of the S&P 500 Index in October going back to 1950, as well as the frequency of positive daily returns for each trading day. Historically, the month has both started and ended well, with the last four trading days of the month producing gains more times than not. The days in between have tended to produce a very different experience, with more substantial moves in both directions. However, 2022 has been a year unlike any other (by seemingly countless measurements), so there is a real possibility of deviating from historical norms.