Along with equity and fixed income markets, Bitcoin is off to a shaky start in 2022; in fact, our Bitcoin Bogey Check is nearing a trigger.

Beginners Series Webinar: Join us on Friday, January 7th, at 2 PM (ET) for our first NDW Beginners Series Webinar of the new year. This week's topic is Creating Custom Models: Static Allocation & Model of Models. Register Here

Like equity and fixed income markets, the major cryptocurrencies are off to a shaky start in 2022, especially Bitcoin ($BTC). In the first several trading days $BTC is off 4.16% (through 1/5), tacking on to its poor trailing 30-day loss which is north of 10%. The underlying reasons for the sharp pullback remain largely unclear, but after a year in which BTC rallied nearly 60% perhaps some investors are realizing their gains in the new year. The mining crackdown in China, one of the most concentrated geographic regions for crypto transactions according to an MIT study, could also be catalyzing the exhale. Regardless of the rationale, we are seeing demand weaken for Bitcoin, pulling the crypto down towards a key level of support.

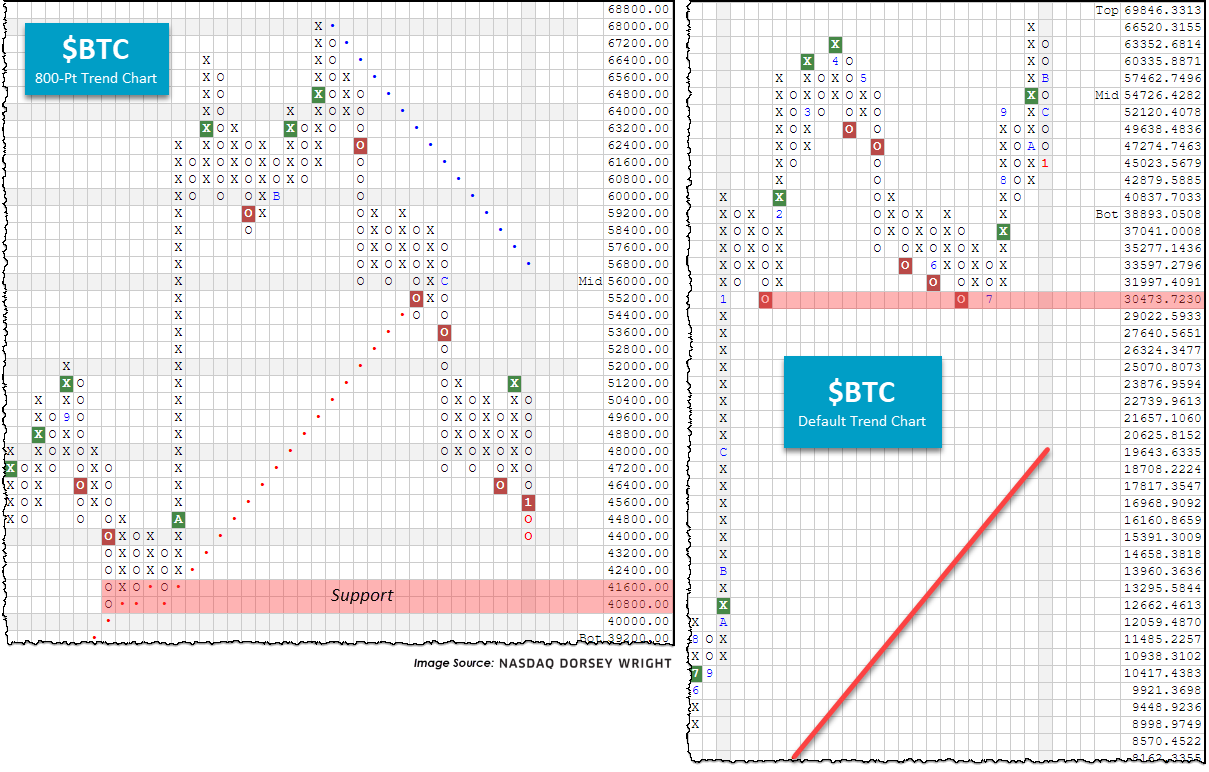

Looking to the 800-point chart (left-hand side), we spot key support offered near the 40,000 range – this is also confirmed on the longer-term default chart. Beyond 40,000 we would look towards 30,000, which appears to be a firmer level of support due to buyers repeatedly stepping in here on past drawdowns.

To some surprise, the volatility of Bitcoin is generally trending lower – likely due to the increase in market efficiency and the introduction of more digital assets. However, the moves are still relatively extreme, and tactical decisions to raise cash during past downturns have proved advantageous. We featured a “Bitcoin Bogey Check” in our Alternative Assets Update last August which used a 5% relative strength relationship between $BTC and MNYMKT to determine when to exit the market. If $BTC is on a relative strength buy signal versus MNYMKT, the bogey check passes, but if $BTC is on a relative strength sell signal versus MNYMKT, the bogey check fails.

In practice, this essentially cut losing trades short and let the winning trades run. The strategy was not correct on each signal given nor did we exit at tops or buy during bottoms, but the method did provide a framework to keep us out of a situation where we needed a 100% return after suffering a 50% loss to breakeven. As with other technical indicators, disciplines, and models, it is not about trying to time when to use them but spending extended time in the strategies.

The reason we bring this up today is that the previously explained Bitcoin Bogey is nearly failing. A further push lower for $BTC to 41,128 or lower would lead to an RS sell signal on the 5% RS chart against MNYMKT, indicating a risk-off posture.