We take a look at the fixed income space and what it means for your client's portfolios.

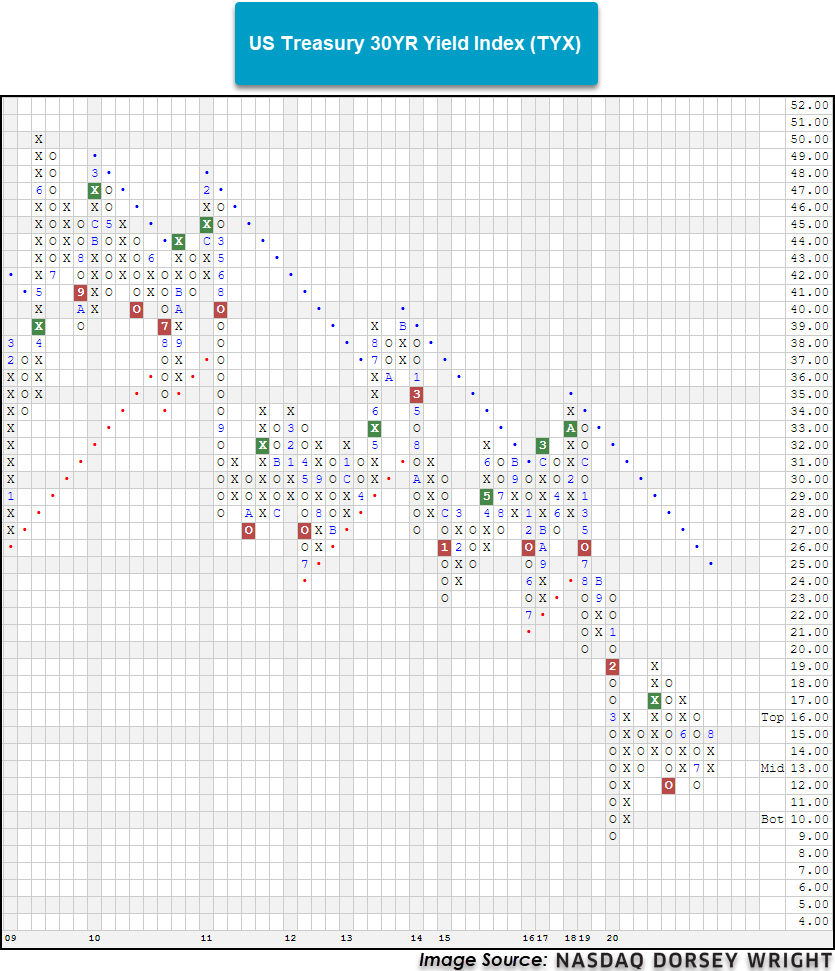

As treasury yields have stabilized over the last few months, nearly all fixed income groups still hold average group scores above the acceptable 3.00 threshold. However, this broad strength in the fixed income space has shown some shifting beneath the surface. During the COVID-19 sell-off, lower risk assets were in extremely high demand and treasury yields plummeted.

With the subsequent recovery in domestic equities, fixed income groups with closer ties to equity prices, such as Convertible Bonds and Corporate Bond-High Yield have done very well. On the other hand, fixed income groups tied to the US Treasury or Government have weakened. Although all these groups possess acceptable average group scores above 3.00, we can see that there are some glaring differences with regards to score direction.

The Convertible Bonds group has a strong score direction of 2.10 and is ranked second out of the 135 groups tracked on the Asset Class Group Scores page with an average group score of 4.96. Another area in the fixed income space that shown strong improvement is the Emerging Market Income group which has an average group score of 3.39 with a positive score direction of 1.40. We touched on this area a few weeks ago and its relationship to the US dollar which has fallen over the past few months. For a more in depth piece on a falling US Dollar and emerging market fixed income, click here.

As we begin the historically volatile month of October in an election year, it is important to manage the risk associated with your client’s portfolios. One of the many reasons of having an allocation to fixed income is to reduce the volatility associated with the equity portions of your client’s portfolios, as the two asset classes have had a negative correlation during equity market drawdowns for the most part. In an environment where the areas hot in the fixed income space are highly correlated to equity performance, it is important to not drift too far away from the purpose of fixed income allocations. Of course these more equity correlated fixed income groups deserve to be a part of your portfolio as they have shown high relative and absolute strength, but be sure you are balancing that extra risk associated with them to the greater purpose of a fixed income sleeve.