We examine the effects of a falling US dollar on domestic and international bonds.

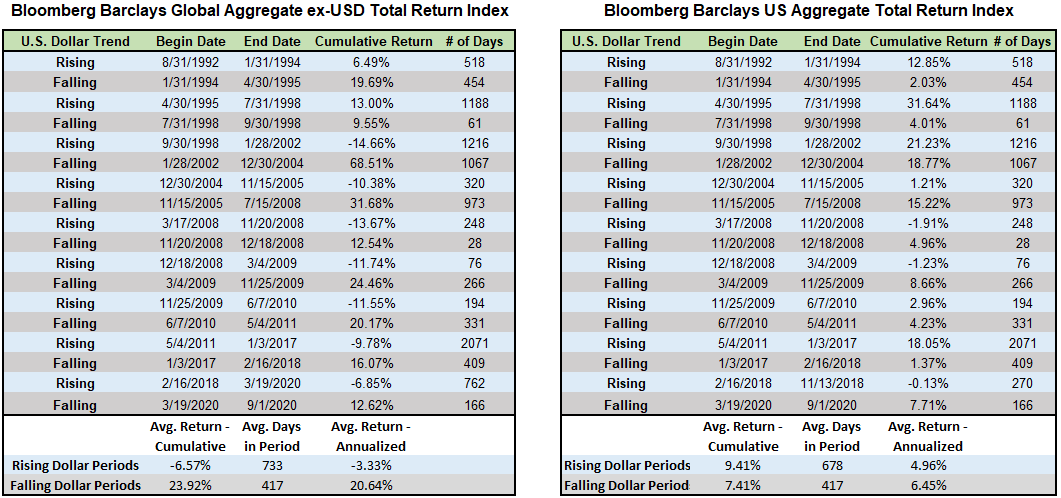

As mentioned in other sections of today’s report the US dollar index DX/Y has now fallen 10% from its March high. Over the years, we have examined the effect a rising or falling dollar environment has on a variety of investments. Today we’ll take a look at how two broad fixed income indices – the Bloomberg Barclays Global Aggregate ex-USD Total Return Index (the ex-US Global Agg), representing foreign bonds, and the Bloomberg Barclays US Aggregate Total Return Index (the U.S. Agg), representing domestic bonds, have performed in each environment.

For our U.S. dollar studies we generally use the following parameters to define a rising or falling dollar environment:

Rising Dollar Market: Any move of at least 10% from a low constitutes a new "rising dollar market." The beginning of this trend is established at the low watermark and the trend remains in force until a correction of at least 10% occurs, at which point the peak of that rally then marks the end of the rising trend in the dollar. This represents a "trough to peak" move in the dollar, and that time period is what we use to qualify a rising dollar market.

Falling Dollar Market: Any decline of at least 10% in the dollar index from a peak begins a "falling dollar market". The beginning of this trend is established at the high watermark and the trend remains in force until a rally of at least 10% occurs off a low, at which point the trough of that decline marks the end of the falling trend in the dollar. This represents a "peak to trough" move in the dollar, and the time period within is what we used to qualify a falling dollar market.

For this comparison, we have used the same definitions for a rising and falling dollar environment. However, because only month-end values for the ex-US Global Agg prior to September 1, 2000, we have adjusted the rising and falling dollar periods prior to this date to correspond to the nearest monthly index value. As a result, these periods will differ from the periods in our other studies.

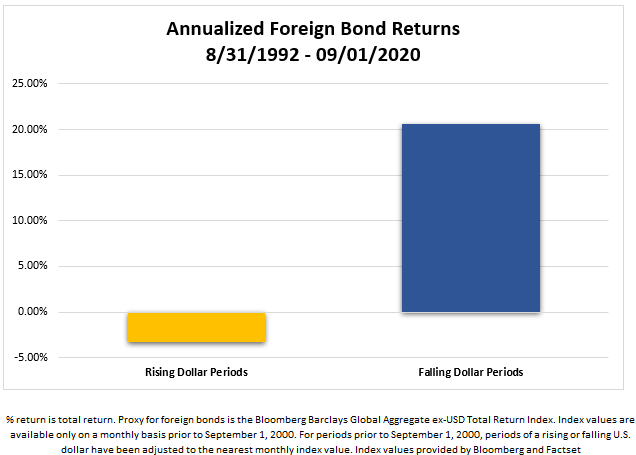

As we can see from the Global ex-USD Agg table, returns on foreign bonds are vastly different in a falling vs. a rising dollar environment. In a falling dollar environment, foreign bonds have had much higher returns than domestic bonds have had in either type of environment. On the other hand, in a rising dollar environment, foreign bonds have typically had negative returns, far below the returns of U.S. bonds in either a falling or rising dollar market. These results demonstrate how significant an impact currency exchange rates can have on fixed income returns.

Looking only at the cumulative returns, it would appear that the US bonds have performed better in a rising dollar markets than in falling dollar markets. However, the average duration of rising dollar markets has been significantly longer than that of falling dollar markets (678 days vs. 417 days). When we account for this by annualizing the returns, we see that US bonds have actually performed better in falling dollar environments on average.

Unlike with foreign bonds, where the explanation for higher returns in a falling dollar environment is fairly straightforward, the higher returns exhibited by domestic bonds is a bit more perplexing – with no currency translation involved, U.S. investors’ returns on domestic bonds should not be affected by currency fluctuations. One explanation may be that falling dollar environments often correspond to periods of falling interest rates, which boost fixed income returns.

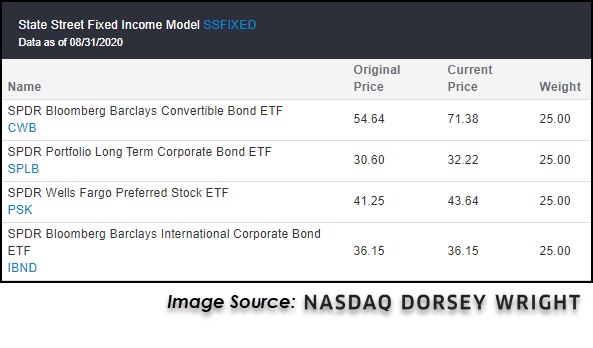

There was also a related change to the State Street Fixed Income Model SSFIXED the model added the SPDR Bloomberg Barclays International Corporate Bond ETFIBND and removed the SPDR Portfolio Aggregate Bond ETFSPAB. As the performances of the two indexes we examined demonstrated – a falling dollar is a strong tailwind for the performance of foreign bonds and has certainly been a factor in IBND’s relative strength gain against SPAB which is based on the US aggregate bond index. The model's full holdings can be seen below.