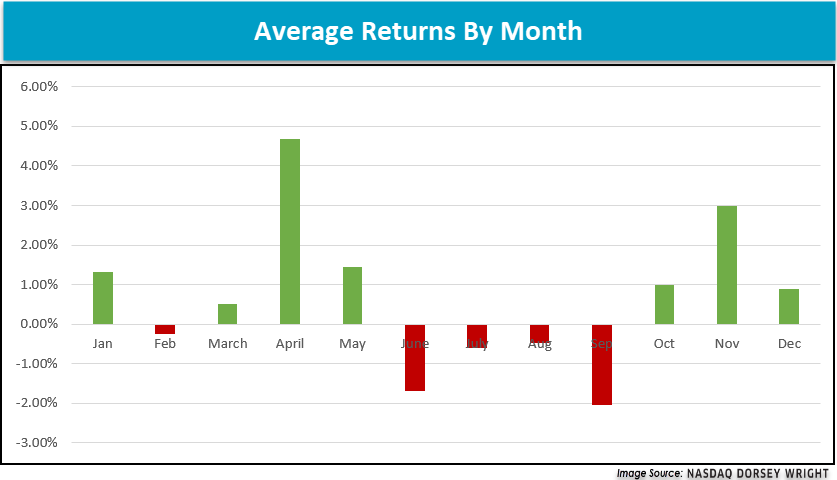

September has generally been one of the weakest months for the S&P 500; however, the momentum factor has historically been very strong.

Nasdaq ESG Summit - We invite you to join us for the inaugural Virtual Nasdaq ESG Summit on September 22, 2020, from 11:00 AM to 2:00 PM ET. The Summit will provide compelling views from industry experts with critical ESG knowledge and best practices you need to address short-term and long-term challenges. The event will kick off with a keynote address sure to inspire and provoke conversation around current ESG trends. Following the keynote, registrants can choose from a number of breakout sessions specifically geared towards their interests. For additional information about the summit and to register, click here.

September has historically been one of the weakest months for the S&P 500, a topic highlighted in a recent Prospecting piece that can be accessed here. On the other hand, the momentum factor has historically been very strong in September.

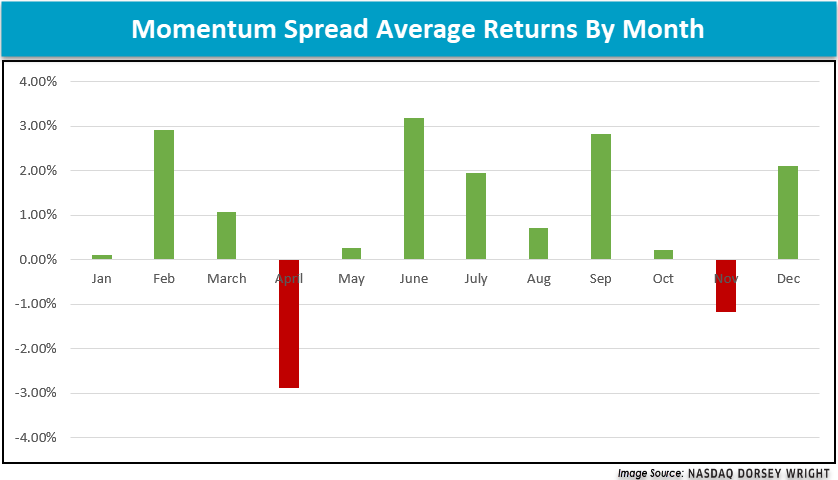

The momentum spread measures the difference between a basket of high momentum and low momentum stocks, with a positive spread indicating the leaders are outperforming the laggards. The spread is 50% long and 50% short so it truly measures the performance of the momentum factor. September has historically been a strong month for the leaders to outperform the laggards.

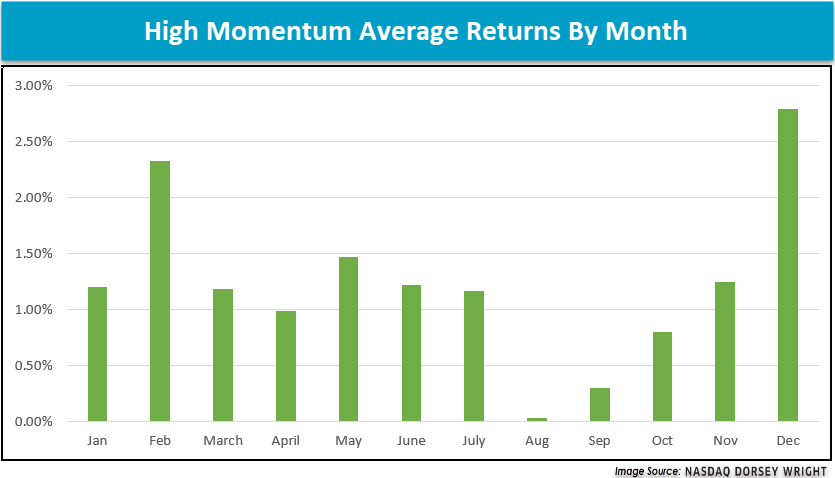

There are two pieces of the spread. First, the high momentum piece has historically returned less than average during September. However, we are getting to the time in the calendar year when high momentum begins to ramp up, which typically lasts through the end of the calendar year.

Second, the laggard side of the spread is what has really driven the dispersion in September, as historically being the worst month for the laggards.

While September has historically been a weak month for the overall market, momentum strategies have still been able to produce positive results on average over the years. This has primarily been driven by laggard underperformance during traditionally weak market periods. During periods like this, it is very important to limit exposure to any lagging securities and allocate to higher relative strength and momentum names. Historically, weak Septembers have been accompanied by laggard underperformance, while leaders have outperformed and offered an area to allocate during a typically unfavorable time for domestic equities.