Although September is typically a poor month for equity investors, there can often be asset class or equity sector trends of which to take advantage. One of those trends over the last 30 years has been found in gold, as well as other areas that tend to have lower correlations to equities.

We’re less than two weeks away from entering the month of September, which has earned a bad reputation with investors over the years. Historically, September has been the single worst-performing month for the S&P 500 Index SPX, the Dow Jones Industrial Average DJIA, and the Nasdaq Composite NASD (source: Stock Trader's Almanac 2020). The Almanac says “September is when leaves and stocks tend to fall; on Wall Street, it’s the worst month of all.”

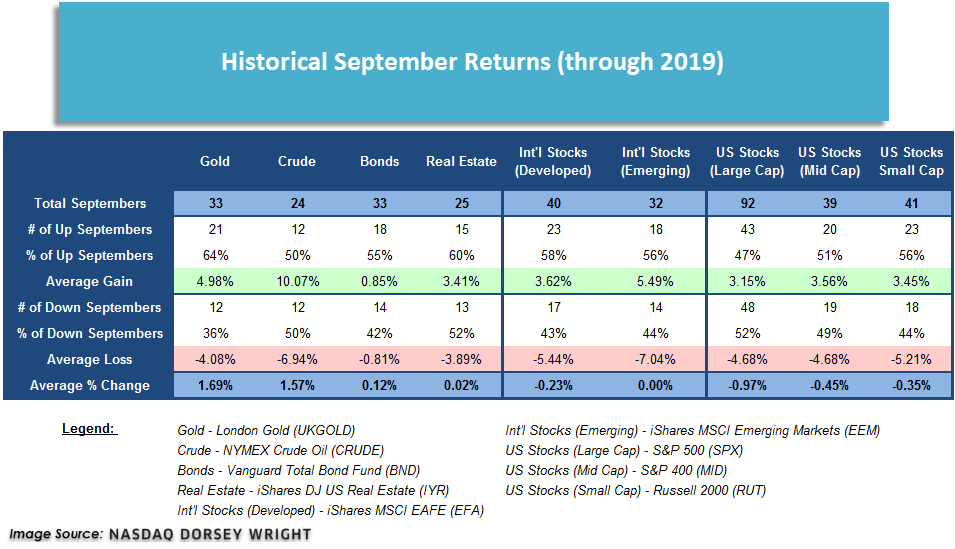

As a result of the poor equity performance, many investors look for opportunities in assets with low correlations to equities in the month of September. One asset in particular that receives a lot of credit for helping investors through this frustrating month is gold, and the numbers below support this statement. Gold has posted a positive return in 21 out of the 33 Septembers since 1987. In other words, September has been a positive month for gold investments about 64% of the time. The average return for gold during all 33 Septembers measured comes out to 1.69%, with an average of 4.98% during positive Septembers.

In the table below, you will also see the historical September returns for different asset classes as far back as data exists in our system. Not surprisingly, areas like gold, crude oil, and bonds have provided the best returns. In fact, each asset class (with the exception of US large-cap and mid-cap) has a greater historical probability of producing a gain for the month of September than it does at producing a loss. However, up versus down is just half the story -- the degree of those moves is another thing to consider. Take a look at the two international equity proxies in the table (the developed and emerging stock indexes). Even though they have historically posted a gain more than 50% of the time, the losing years outweigh the winning years in terms of the magnitude of movement. For example, developed international stocks have seen gains in 58% of the Septembers going back to 1980, producing an average return of 3.62%. However, during the years when this index was down during September, the average loss was -5.44%. As a result, the average return for the month of September is in the red at -2.3%. Similar numbers can be seen for US small-cap stocks as well.

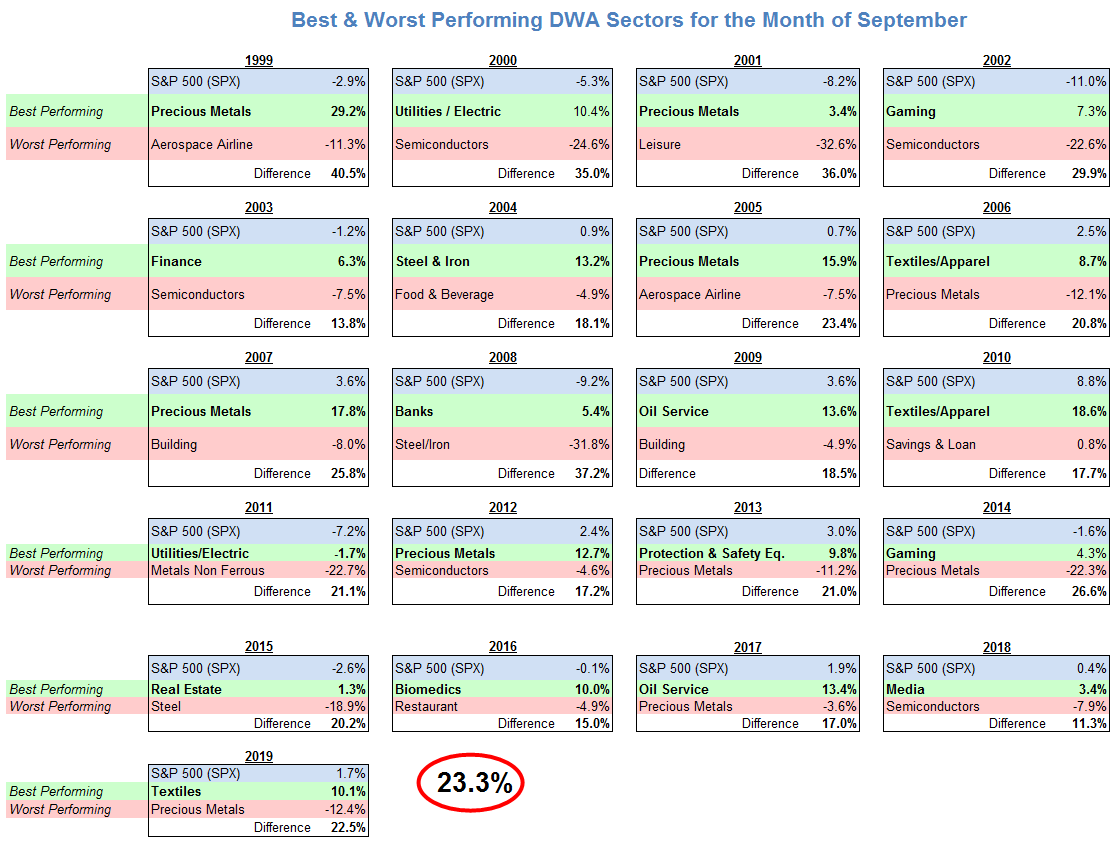

Although September is generally recognized as a poor month for equity investors, there have been a few impressive outlying Septembers, such as 2007, 2009, 2010, and 2013, all of which saw gains of 3% or greater for the SPX. Even though September has not generally been kind to the broad equity indexes, there have been opportunities provided by sector rotation. Take 2008 for instance. The SPX as a whole was down -9.20%, however, the DWA Bank Sector Index DWABANK actually provided a gain in excess of 5%. On the other side of the story, the Steel & Iron sector DWASTEE fell 31.8%, bringing the performance differential for September 2008 to 37.2%, the second-largest dispersion of all Septembers since 1999. On average, this differential is around 23% over the last 20 years. Last year, the DWA Textiles Index DWATEXT was up 10.1% while the DWA Precious Metals Index DWAPREC was the worst-performing, finishing down –12.4%. This was the largest difference between the best and the worst-performing in the last five years, although it was slightly below the average for the entire lookback period.

In the table below, you can see the best and worst-performing sectors during the month of September for each year going back to 1999. While Precious Metals has been the best performing sector five times, the most of any sector, it also tied for most Septembers as the worst performing sector with five; Semiconductors has also been the worst-performing sector in five Septembers.

We have no way of knowing whether this September will be positive or negative for the market and there are no shortage of factors this year that could sway performance one way or the other. However, it is beneficial to be aware of how September came to be known as the worst month for stocks and how other areas of the market have fared historically.