US Treasury yields dropped sharply over the last week following the weaker-than-expected jobs report. in the system. Bets for more aggressive cutting from the Fed have increased.

Weekly Fixed Income Update Video (5:43)

US Treasury yields dropped sharply over the last week following the weaker-than-expected jobs report. The US Treasury 10-year Yield Index (TNX) fell to 3.7%, its lowest level in a year. The core US market has continued to improve with the decline in yields. The US Government-Long group has crossed above the 3.0 score threshold and the US Fixed Income Long Duration group is on the verge of doing so. Meanwhile, the inverse fixed income group now ranks last out of all fixed income groups and 131st out of all 134 groups in the system.

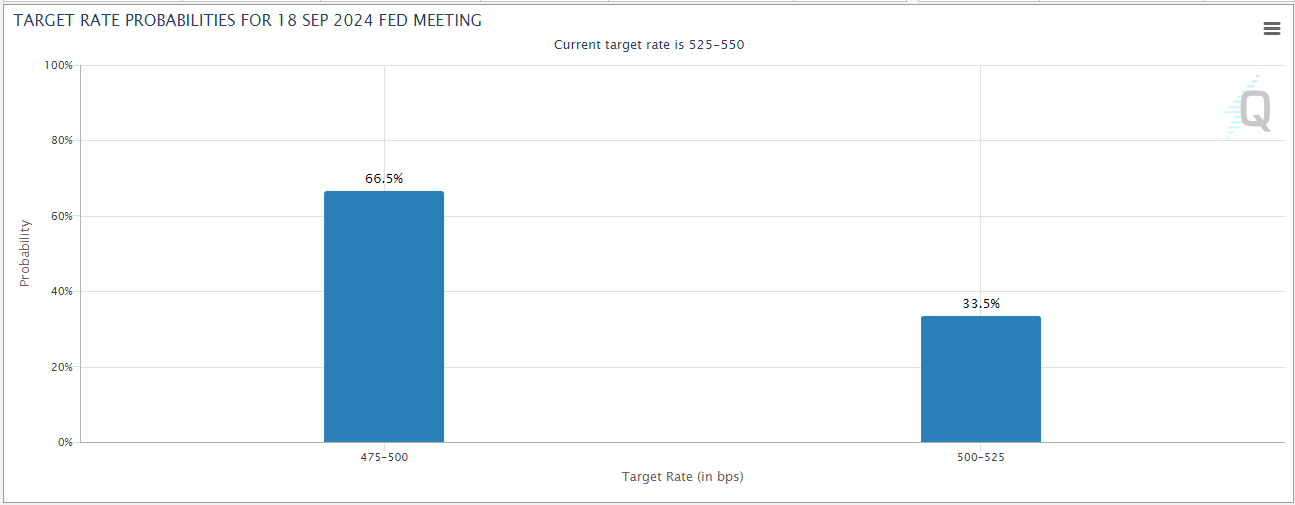

Bets for more aggressive cutting from the Fed have increased. Fed futures are now pricing in nearly a 65% chance of a 50 bps cut at the September meeting; the odds of a 50 bps cut are up significantly from a week ago when the market was pricing in an 88% chance of a 25 bps cut.

Image Source: CME Group

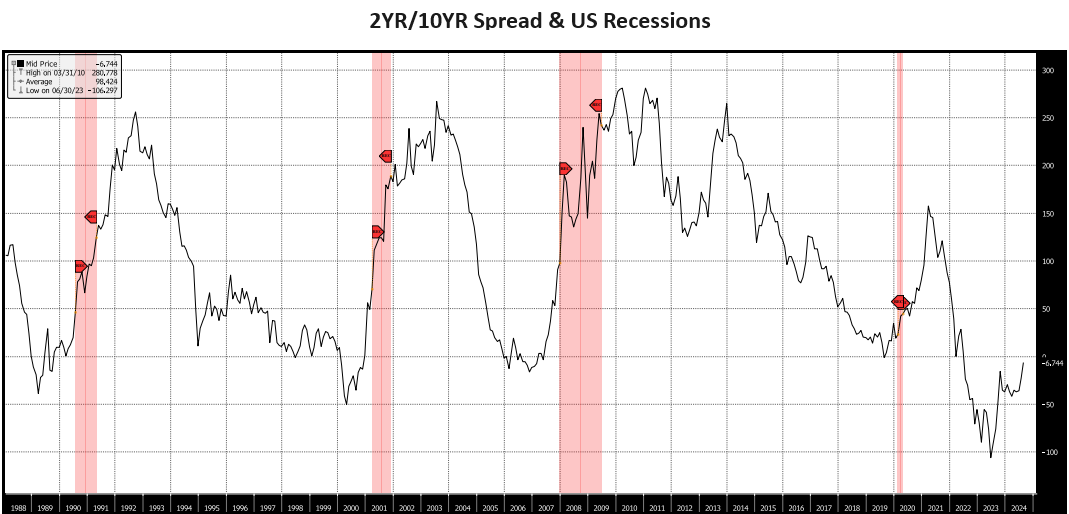

The two-year/10-year spread is now the least inverted it has been since mid-2022 and it could turn positive in the short-term. Inversion of the yield curve is widely discussed as a sign of economic downturn, but historically, recessions have happened more closely in time to when the two/10 spread normalized than when it inverted. It has been argued that, in this case, disinversion is a sign of a modest slowing, i.e., the Fed’s plan for a “soft landing” is working. We won’t know for some time which scenario – soft landing or recession – is correct. But, if the curve does normalize, it could add to the growth concerns that have emerged recently.

Image source: Bloomberg