What to Make of Recent Action.

No matter how long you’ve been in the business, no matter how many corrections or pullbacks you have seen, days like today are always a bit spooky. The hot unemployment numbers from today (8/2) gave investors a concern that the odds of a soft landing might not be as high as markets had hoped for. The VIX, or “fear gauge” as some call it, spiked over 50% intraday as investors geared up for further uncertainty. Small caps, which were previously lifted higher on the idea of September rate cut found themselves getting hammered with intraday action. This, of course, comes at a time when markets were looking for any reason to pile onto the small cap train as market breadth was improving as we opened August. But the point of today’s piece isn’t to talk about small caps… let’s let the dust settle there before any calls are truly made. The main focus for the WYA is simple: To help cut through the noise as clients see red in their portfolios.

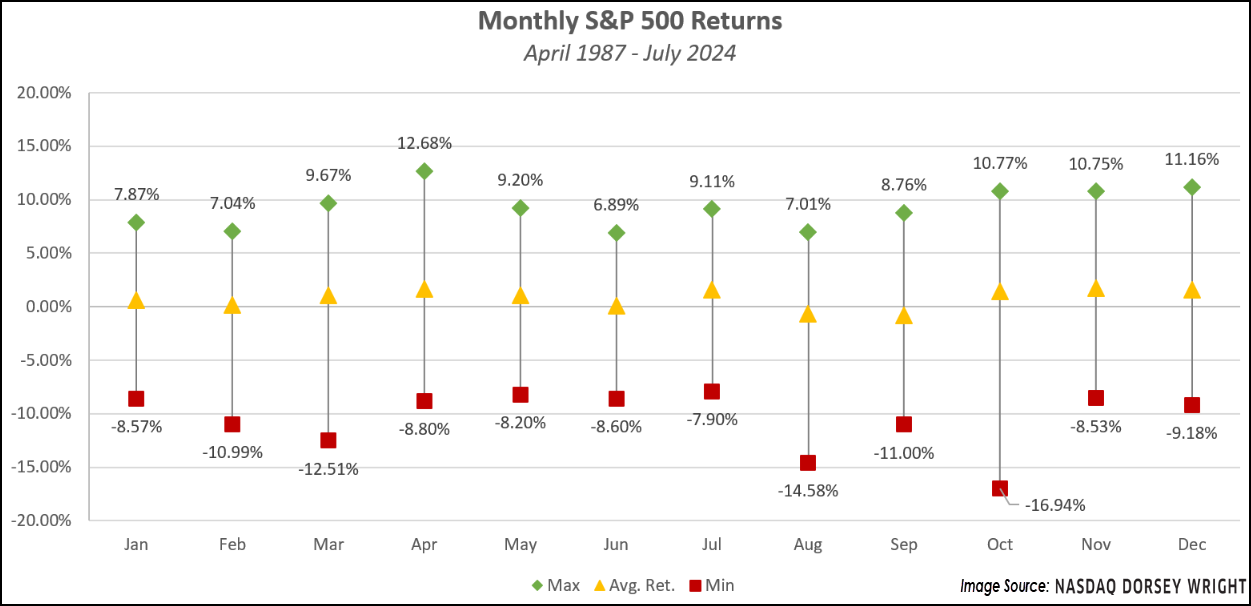

To start, let's take a look at what the month of August brings markets. The chart below walks through average market returns for each calendar month. We have touched on weakness during the summer months, with August bringing in below-average returns historically. Dating back to 1987, SPX has posted an average return of -0.67%, only beating next month- September historically. Minimum/Maximum monthly readings are also less attractive than the “normal” months. All this to say- remember we are in a seasonally weak part of the year. While the magnitude of August's pullback so far has been intense- if there was a time of year for it to be more “normal”, now would be the time for it.

With intraday action, SPX will also post its first sell signal since October of 2023 on its default chart. It may seem like common knowledge- but markets can’t go up every day. Pullbacks are normal, exhales are normal, and yes, even “sell” signals are normal from time to time. Now, those aren’t excuses to fall asleep at the wheel… but simply a reminder that swift exhales within an overall strong market uptrend are nothing to pull the emergency exit over. To close, we will offer a few things the analyst team has their eye on as volatility does pick up:

- 1 sell signal is “normal”, but a series of lower tops and sell signals could be more concerning for broad markets. Watch SPX around old resistance at 5,250.

- Small caps and the longevity of their rally. If the space falls, market breadth should narrow, a net negative.

- The strength of the “core.” Perhaps zooming out of solely technicals, if the economy is unable to achieve a soft landing, what areas emerge as relative strength leaders?

As clients call in and question where their portfolios are positioned, remember that part of the job is helping calm panic as markets ebb and flow. While there are elements of the markets that are definitely eye-catching (and could be concerning if we see further downside action…) domestic equities remain in control. Make sure to use the alerts manager to keep track of notable charts easily.