Gold hit an all-time high this week and materially outperformed copper, two things worthy of close attention.

Remember, these are technical comments only. Just as you must be aware of fundamental data for the stocks we recommend based on technical criteria in the report, so too must you be aware of important data regarding delivery, market moving government releases, and other factors that may influence commodity pricing. We try to limit our technical comments to the most actively traded contracts in advance of delivery, but some contracts trade actively right up to delivery while others taper off well in advance. Be sure you check your dates before trading these contracts. For questions regarding this section or additional coverage of commodities email will.gibson@nasdaq.com.

Data represented in the table below is through 7/16/2024:

Broad Market Commodities Report

Portfolio View - Commodity Indices

| Symbol | Name | Price | PnF Trend | RS Signal | RS Col. | 200 Day MA | Weekly Mom |

|---|---|---|---|---|---|---|---|

| CL/ | Crude Oil Continuous | 80.76 | Positive | Buy | X | 79.04 | + 5W |

| DBLCIX | Deutsche Bank Liquid Commodities Index | 476.70 | Negative | Sell | O | 482.64 | + 3W |

| DWACOMMOD | DWA Continuous Commodity Index | 868.83 | Positive | Buy | O | 830.98 | - 6W |

| GC/ | Gold Continuous | 2462.40 | Positive | Buy | X | 2140.15 | + 2W |

| HG/ | Copper Continuous | 4.44 | Positive | Buy | X | 4.07 | - 8W |

| ZG/ | Corn (Electronic Day Session) Continuous | 395.75 | Negative | Sell | O | 450.49 | - 7W |

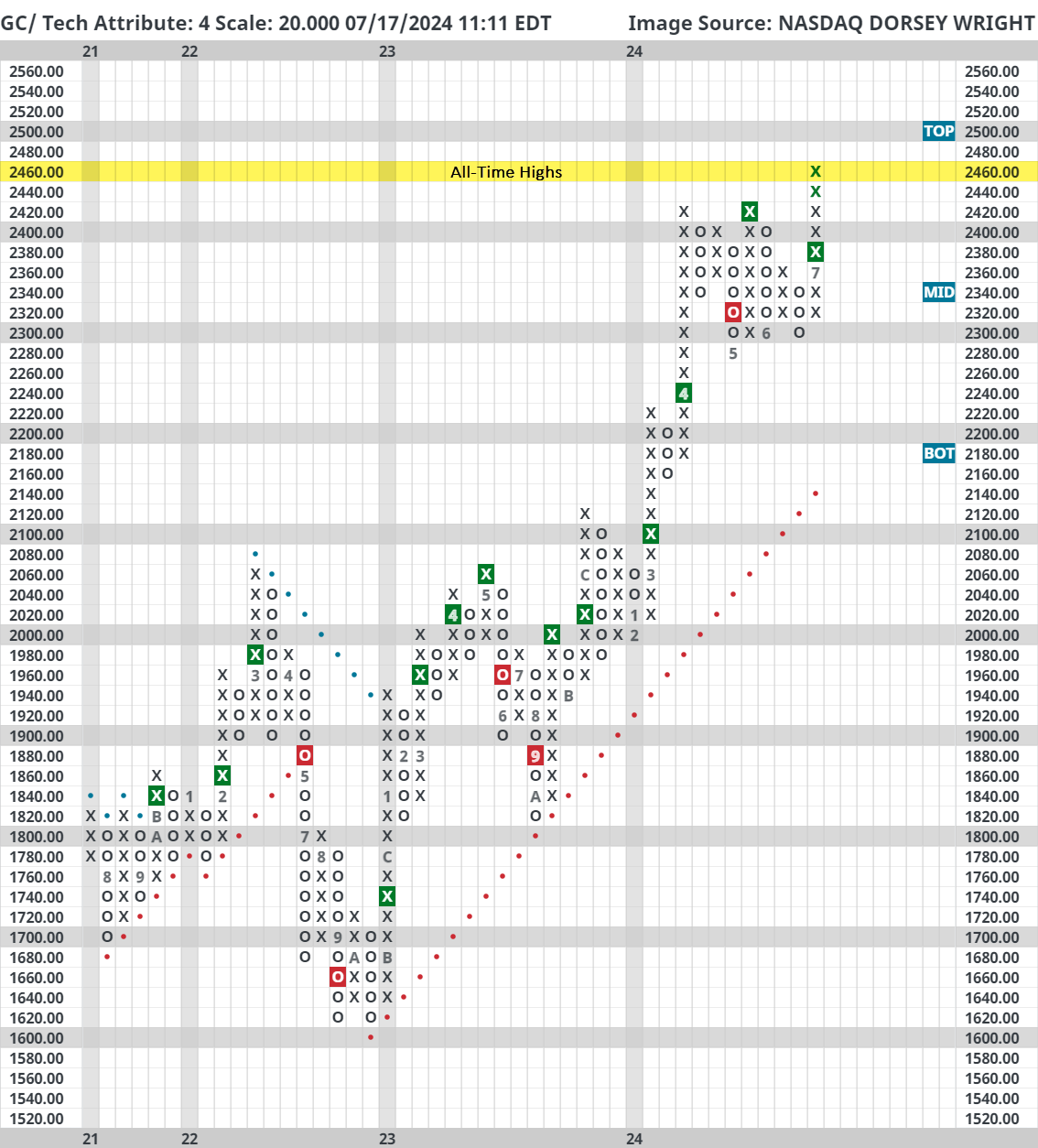

Last week we talked about gold’s (GC/) consolidation pattern and seasonal tendency to underperform in the back half of an election year. However, in the past seven days gold rallied over 4% and reached all-time highs. What happened?

In short, June CPI data came in softer than expected, and consequently investors accelerated their rate cut expectations. Odds of a September rate cut are currently just below 100%.

Recall that gold typically performs well when real yields are falling. So, if inflation is moderating and interest rates are declining just as fast (or faster), zero yielding gold looks more attractive. Also, remember that gold is viewed as a safe haven asset and rate cuts are economically stimulative actions. By that definition, falling real yields and investor concern are arguable mutually inclusive – which should pose some healthy concerns about the current environment.

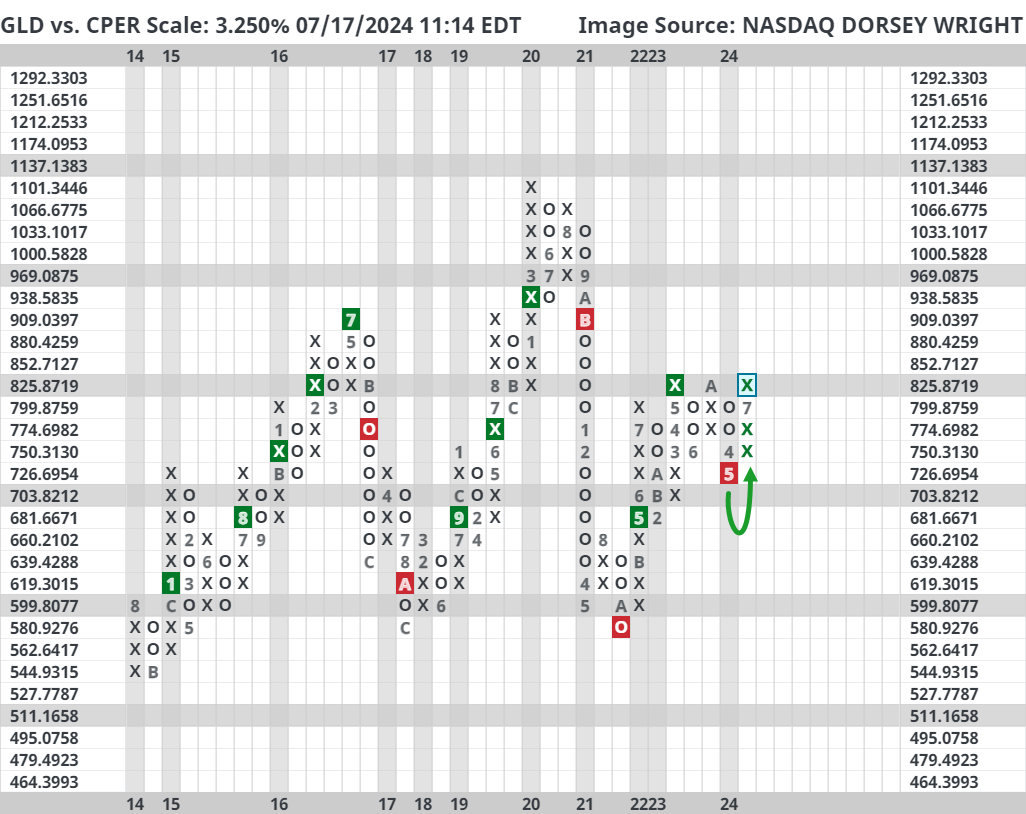

Another notable development related to gold last week – GLD reversed up against CPER on a 3.25% relative strength chart. Said differently, we have seen gold outperform copper by about 10%.

CPER still maintains a relative strength buy signal against GLD, which is historically a good sign for equities as further explained here, but the latest reversal poses a threat. Technically it is fine to see gold appreciate, but ideally not more than copper.