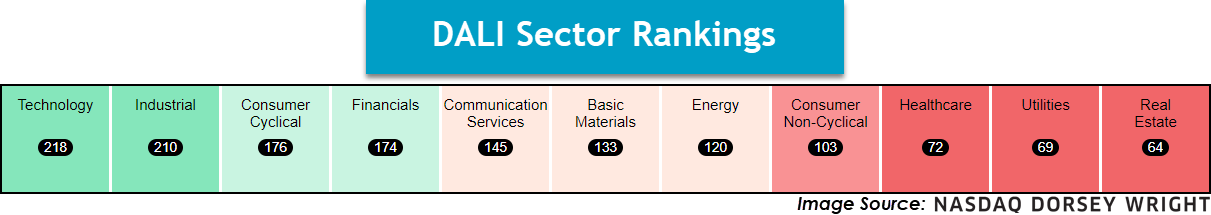

The past week saw no significant technical developments in the Industrial, Financials, Healthcare, Basic Materials, Energy, Consumer Non-Cyclical, or Real Estate Sectors. Those that saw noteworthy movement are included below, in order of their relative strength ranking in the DALI domestic equity sector rankings. Sector designations are based on DALI sector rankings and are as follows: 1 - 3 overweight, 4 - 7 equal-weight, and 8 - 11 underweight.

U.S. Sector Updates

The past week saw no significant technical developments in the Industrial, Financials, Healthcare, Basic Materials, Energy, Consumer Non-Cyclical, or Real Estate Sectors. Those that saw noteworthy movement are included below, in order of their relative strength ranking in the DALI domestic equity sector rankings. Sector designations are based on DALI sector rankings and are as follows: 1 - 3 overweight, 4 - 7 equal-weight, and 8 - 11 underweight.

Technology – Overweight

Weekly Technology Video (3:04)

Technology continues to maintain its position at the top of our DALI sector rankings. Some near-term participation readings have reversed higher, including the Bullish Percent for Technology ^BPECTECH. AAPL moved back to a buy signal after releasing earnings last week, raising the stock to a suitable 3 for 5 TA rating. Semiconductors have also shown improving participation, leading the ^PTECSEMI to reverse up. This improving participation is a positive sign heading into the earnings announcements of larger names like NVDA in a couple of weeks.

Consumer Discretionary – Overweight

Weekly Consumer Discretionary Video (4:13)

Discretionary stocks lagged the broader market over the past week's roll but didn’t impact the overall technical picture as the sector remains in the top 3 of DALI. Positive chart action occurred on the charts of the First Trust Consumer Discretionary AlphaDEX Fund FXD and the Amplify Online Retailing ETF IBUY, as each put in a higher bottom and reversed back into Xs. Retailing stocks were a notable subsector as Carvana CVNA rose 30% on earnings, while DoorDash DASH fell over 10% and gave a third consecutive sell signal. MGM and WYNN both reported positive earnings, but both reversed down during Wednesday’s trading as Vegas Union strikes continue to not be resolved. Upcoming earnings next week are Home Depot HD (5/14) and TJX (5/15).

Utilities – Underweight

Utilities saw another positive week as XLU rallied over 4%. The fund rallied to a 52-week high during Tuesday’s trading before improving upon it during Wednesday’s trading. XLU scores just below 4 at 3.97, and a move above the 4 score threshold would mark the first time since September 2022. The bullish percent ^BPECUTILITY and positive trend ^BPPTUTILITY indicators reach their highest levels since September 2022 and April 2023, respectively. Additionally, the RS in Xs chart – which measures the percent of stocks maintaining positive near-term relative strength against the S&P 500 Equal Weight Index - reversed back into Xs following last Thursday’s action. Overall, the sector has shown an increase in stocks on buy signals, trading in a positive trend, and maintaining positive near-term RS against the market. Southern Company SO, NRG, and Nisource NI were notable earnings over the past week. Atmos ATO is due to report on Wednesday, while Constellation CEG and Evergy EVRG are due to report on Thursday (5/9).