US Treasury yields cooled on the heels of last week’s Fed meeting.

Weekly Fixed Income Update Video (3:24)

US Treasury yields cooled on the heels of last week’s Fed meeting. There had been speculation that the Fed’s next move could be to raise rates due to sticky inflation. However, after the meeting Chair Powell said that a rate increase is unlikely, suggesting that the Fed’s bias is to lower rates from here, which eased some of the upward pressure on yields. TNX fell to 4.45% and the two-year yield has dropped back below 5%. While the pressure on yields has eased, we may not see rates move materially lower until it becomes clear when the Fed will actually lower rates. The common theme from FOMC members has been that they have not yet seen enough evidence that inflation is moving back to 2% to justify loosening policy.

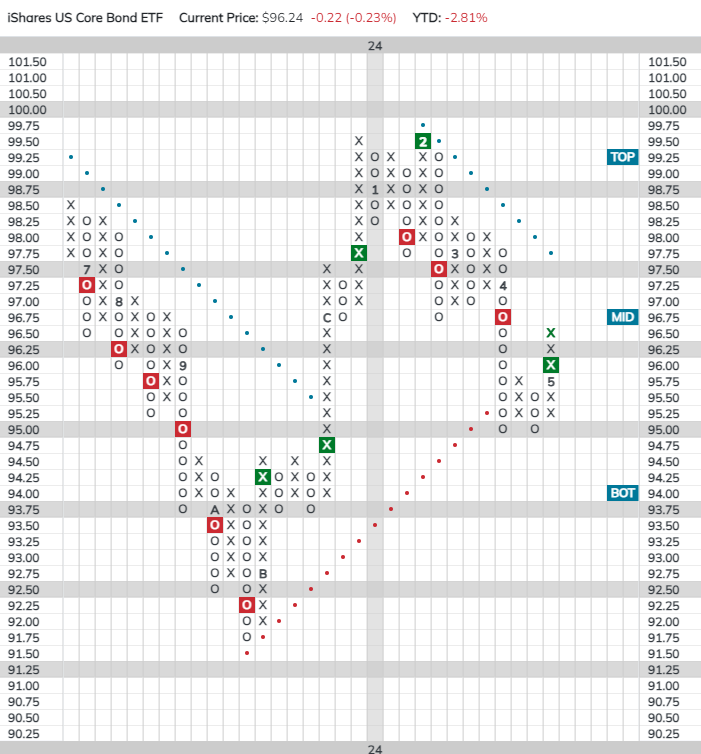

The decline in rates gave a boost to bonds and the iShares US Core Bond ETF (AGG) returned to a buy signal when it broke a double top at $96. Overall, the technical picture for AGG (and core bonds in general) remains decidedly negative as the fund is trading in a negative trend and has a weak 0.81 score.

The decline in rates over the last week has had little effect on relative strength in the fixed income market. Virtually all core groups sit in the red zone near the bottom of the Asset Class Group Scores fixed income rankings. Meanwhile, inverse fixed income still sits near the top, trailing only floating rates.