Investors like to Buy What They Know. Has this Worked So Far this Year with Household Names?

|

Beginners Series Webinar: Join us on Friday, May 3rd at 2 PM (ET) for our NDW Beginners Series Webinar. This week's topic is: Idea Generation with Stocks and Funds Register Here |

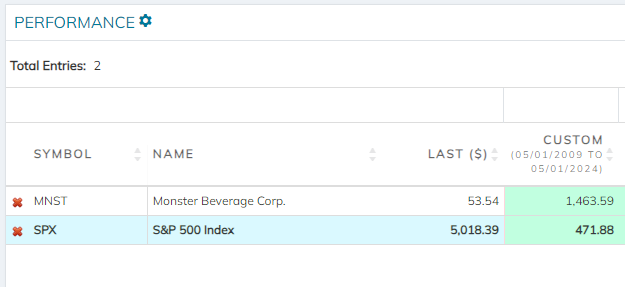

If you take a trip to Richmond, stop in the NDW office. While you're there, take a look inside the fridge. While each analyst has his respective favorite drink of choice- the one thing you will notice is that there is no shortage of caffeine to be had. From the 300 mg Bang Energy to perhaps the more health-conscious V8 energy drink (with a measly 80 mg of caffeine,) we always have plenty in stock. For clients, it can be easy to “buy what you know,” like owning shares of their favorite supermarket, apparel, or yes, even energy drink. If your client liked Monster MNST over the last 15 years, that wasn’t such a bad strategy. Since May 1st, 2009 MNST is up nearly 1,500%- more than tripling SPX's performance over the same time frame.

With caffeine being such a mainstay in many clients' lives, this week’s negative trend change for MNST brings a nice opportunity to cover this ‘Buy What You Know” idea with an NDW lens. To the dismay of some in the office who enjoy a Monster energy drink from time to time, the negative trend break leaves MNST at its worst technical attribute rating in roughly 2 years, suggesting the stock could be having some caffeine withdrawals in the near-term. While it does remain technically actionable by our standards, 2024’s decline leaves much to be desired for the name. Yesterday’s WYA talked about the lackluster results for the other side of everyone’s caffeine addiction- SBUX, as it cited weak demand across the globe. For those of you at home keeping track of the “buy what you know” tally- chalk the caffeine crew up for a mid-afternoon crash.

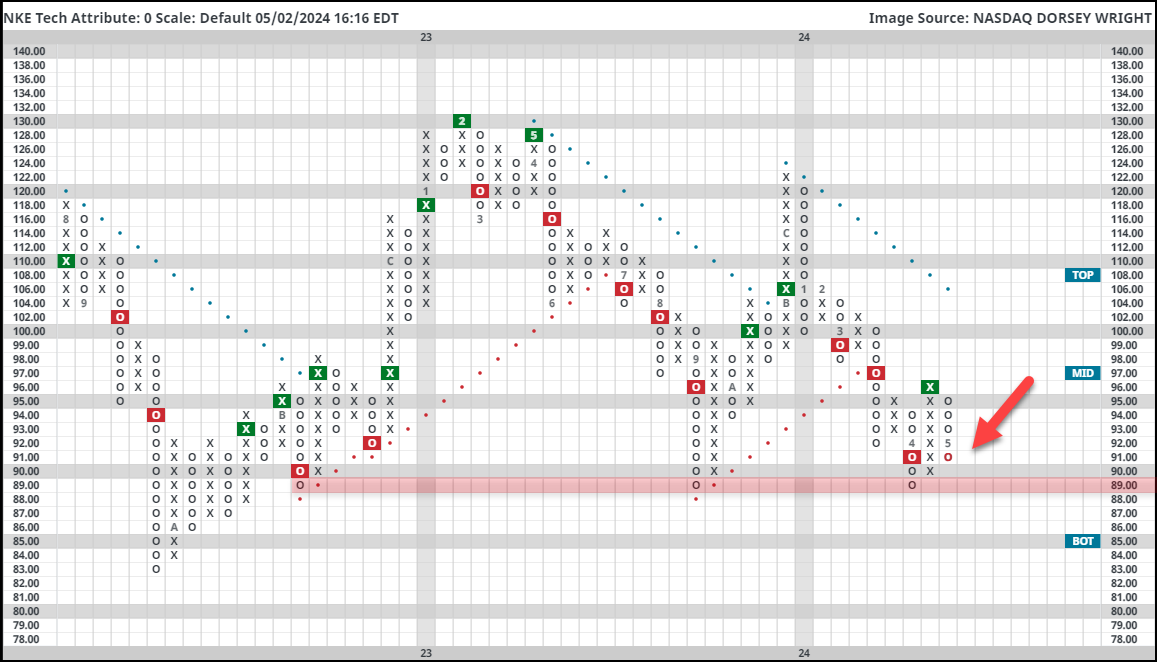

Nike has failed to motivate investors to ‘Just Do It” so far in 2024, as this 0/5’er has fallen nearly 17% through April. The stocks ranks poorly within the Apparel Sector Matrix as it looks to hold off an attack of significant lows around $89. The path of least resistance looks to be lower for now… so perhaps pull out your Nike Shoes and run away from the name. LULU is in a similar position, falling over 30% in 2024. Clearly, investors may “know” these brands, but it doesn’t seem as if they are buying their products… or their stock… quite as much as they used to.

Consumer spending has been the backbone for the economy over the last few years. But even as low cost options like MCD cite a more cost-conscious customer, it goes without saying that the “quality” brands our clients enjoy (typically consumer discretionary firms) face a changing consumer profile. Of course, buying “what you know” is completely subjective- that being not everyone likes caffeine or finds themselves taking part in the growing “athleisure” movement with NKE or LULU. While the exact economics behind a changing consumer are outside the scope of today’s piece, it does beg the question: How can I help my client “Buy What They Know” while ensuring price sits on our side? Technical Attribute Scores give you a quick and easy way to do just that. A use case entails a client calling and asking your opinion on their favorite brand for their portfolio. A quick look at the NDW score (sticking to strong stocks with a 4 or 5 TA score) gives you an opinion on the technical side of things, helping shield your client from names they might know… but are better suited for their closet rather than their portfolio.