Earnings season has started in the usual fashion with banks at the forefront. So far, earnings have been generally positive for the big banks but not exceptional.

Introducing the KraneShares Tactical Emerging Markets Model

The purpose of the KraneShares Tactical Emerging Markets Model is to identify major themes in emerging markets. The Model is designed to provide overweight exposure toward Chinese equities during periods of strength, while reducing or eliminating exposure toward Chinese equities during periods of weakness.

Today's Weekly Analyst Rundown video has been separated into shorter, individual videos, in addition to the long-form video that is still found at the beginning of this report. Each asset class will be included at the top of the corresponding featured article today, and each sector that saw notable movement will have a video recording included in the US Sector Update or the Were You Aware. The Fund Score update will be included in tomorrow's Fund Score Overview article. The sections of the video that do not have a corresponding article or are covered in the Were You Aware are included below:

Weekly Momentum Update Video (3:27)

Weekly Size & Style Update Video (5:49)

Weekly Financials Update (6:16)

Earnings season has started in the usual fashion with banks at the forefront. So far, earnings have been generally positive for the big banks but not exceptional. Banks helped lead the broader financials sector higher at the end of 2023 but have since cooled off in recent months. Despite a fund score of 3.90, the SPDR S&P Bank ETF (KBE) is down 6.45% year-to-date. However, much of the weakness is due to KBE’s exposure to regional banks. Focusing more on regional banks, the SPDR S&P Regional Banking ETF (KRE) has a fund score of 2.03 and is down nearly 13% this year. KRE also entered a negative trend this month and is now sitting at 2024 lows.

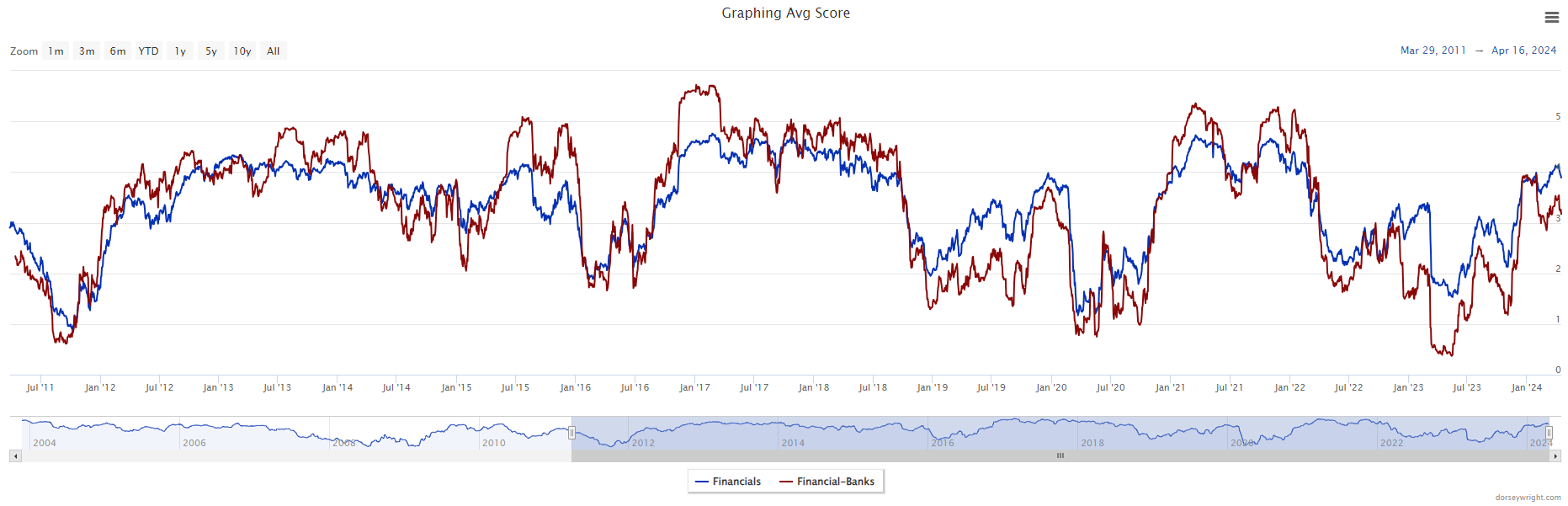

Overall, the banking sector has weighed down the broader financial sector. On the Asset Class Group Scores page, Financials is one of the best-scoring sector groups with an average score of 3.89. On the other hand, the Financial-Banks group has an average score of 3.17. The two groups generally head in the same direction, as seen in the image below. Therefore, further deterioration in the banking space would likely not be a good sign for the wider sector. One of the drivers behind the fierce rally for banking stocks, particularly regional banks, was the prospect of multiple Fed rate cuts this year. However, these expectations have largely been tampered and only one to two rate cuts are projected this year. Recent price action seems to confirm that “higher for longer” is not good for banks. If these expectations were to begin reverting to those at the end of 2023, then banks could stand to benefit. Until that happens, exposure to the banking sector should be limited to those with only strong technical readings.