Commodities gained positive RS and continued to garner signals this week, but this time targeting notable relative leaders.

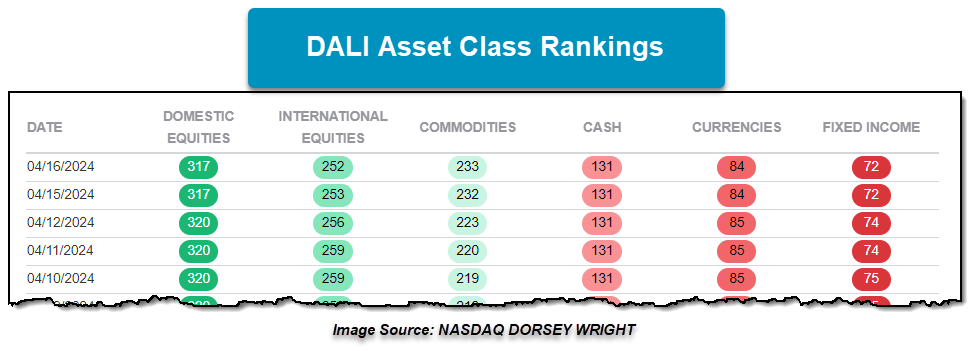

Commodities have continued to garner attention and tally signals within DALI over the past week, adding another 14 signals within DALI and the bulk of them came from Domestic and International Equities. As discussed last week, precious metals have been a big contributor in Commodities gaining positive RS and they continued to garner signals, but this time targeting notable relative leaders. In addition, base metals have begun to garner signals and broaden the commodity representatives showing positive RS. In total, Commodities snagged another 14 signals with three of them coming from domestic equities and seven coming from international equities. The recent underlying improvement within Commodities has been noted, but be sure to check out the International Equity Overview today as it will touch on the recent weakness within the international equity space.

The underlying changes among the individual asset class representatives within DALI have begun to broaden beyond small pockets within the asset classes and have affected relative strength relationships of proprietary broad asset class relationships. Below are the RS charts comparing the proprietary broad NDW Commodity Index against the proprietary broad NDW Domestic Equity Index and NDW International Equity Index on a 3.25% scale.

Following the hotter-than-expected CPI print last Wednesday, the RS chart comparing commodities to domestic equities reversed back into Xs to favor commodities in the near term, while the RS chart comparing commodities to international equities reversed back into Xs following Friday’s action. Bear in mind, both RS charts continue to remain on RS sell signals with domestic equities favored in the long-term since January of last year, while international equities have been favored since December 2023. Further positive RS would be needed from commodities to see the RS relationships flip to RS buy signals. With the likes of gold and silver trading at elevated levels, other areas of the commodity space could potentially be where signals may derive. As noted previously, base metals contributed to the recent pick up in positive RS as representatives for the space have shown positive RS against weaker relative assets. While domestic and international equities still maintain the first and second spots within the DALI asset class rankings, the gap between the top two asset classes and commodities has begun to narrow.

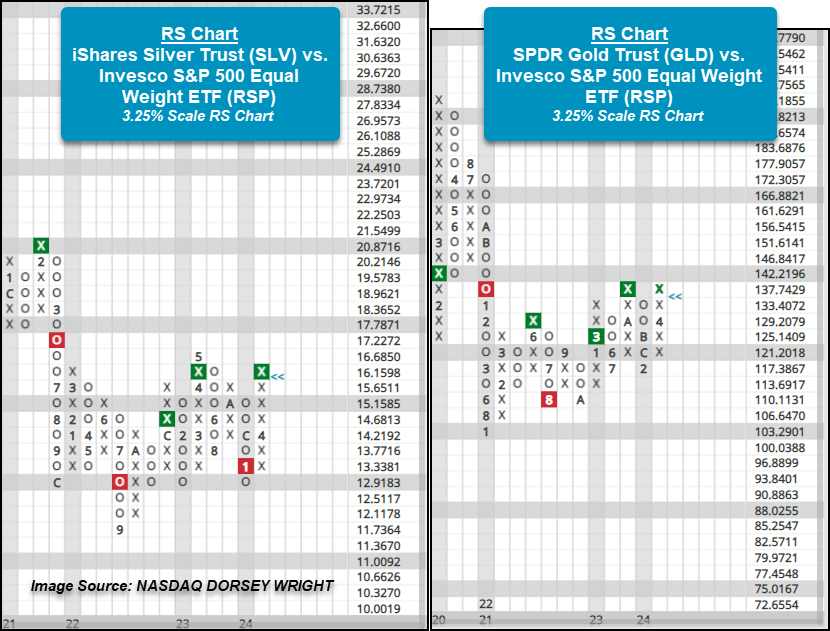

Precious metals have championed the narrowing between commodities and leading asset classes. The RS chart comparing the iShares Silver Trust SLV versus the Invesco S&P 500 Equal Weight ETF RSP on a 3.25% scale flipped back to an RS buy signal, favoring silver, after having been on an RS sell signal since just January of this year. Among the more intriguing RS relationships that favor precious metals is the SPDR Gold Trust GLD chart versus the Invesco S&P 500 Equal Weight ETF RSP on a 3.25% scale. Earlier this month the RS chart reversed back into Xs to favor Gold in the near-term, and this week’s action brought the chart up to form a double top and shows a potential for a third consecutive RS buy signal. Remember, most RS charts comparing the commodity proxies against domestic equity proxies continue to favor domestic equities in the long term – with the GLD vs. RSP relationship being among the exceptions. GLD has maintained an RS buy signal against RSP since March of last year, and while it appeared that the chart may change in February of this year, action this month saw the chart return to Xs. In simpler terms, Gold has been favored over the average US large cap stock since March of last year, and all this remains even with the strong performance shown by large caps for much of 2024 already. Though much of that performance from the large cap space has been strong among the biggest names in the market, it has still yet to be enough to get the GLD vs. RSP to flip back to favoring RSP. All this is intriguing considering the recent uptick in inflation, which has provided a boost for precious metals and shown that gold continues to maintain positive RS over the average US large cap stock.