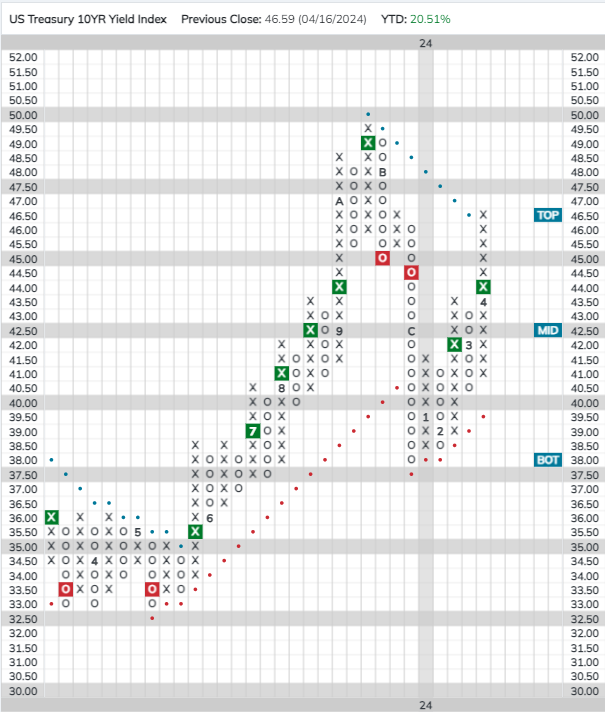

US Treasury yields rose over the last week, with the US Treasury 10-year Yield Index (TNX) hitting its highest level this year.

Weekly Fixed Income Update Video (2:38)

US Treasury yields rose over the last week. The US Treasury 10-year Yield Index (TNX) returned to a positive trend on Monday when it hit 4.65% on Monday, its highest level since November. Further out on the yield curve, the 30-year yield index is now testing its bearish resistance line at 4.8%.

iShares US Core Bond ETF (AGG) violated its trend line in Monday’s trading. AGG now sits in heavily oversold territory, while yields sit in heavily overbought territory. As result, it’s possible we could see bonds bounce from somewhere near current levels. However, the core of the market has clearly deteriorated from already weak conditions.

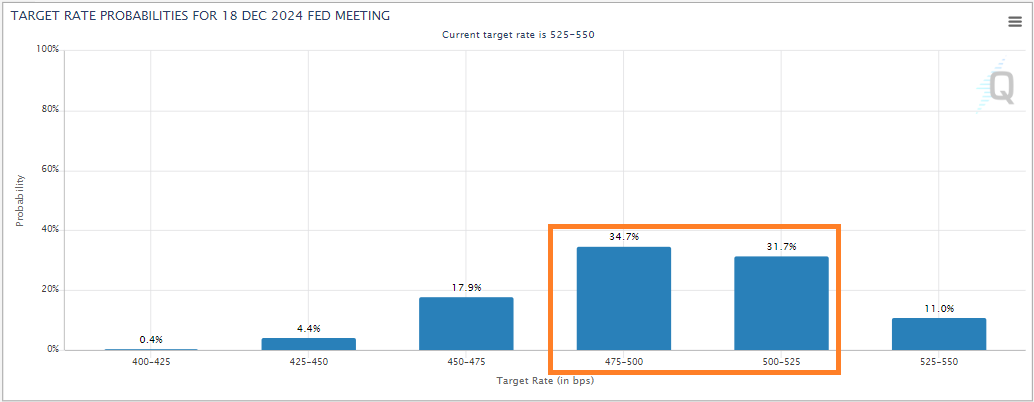

In comments on Tuesday, Fed Chair Powell said that recent data show that progress on inflation has stalled, casting doubt on the Fed futures are now pricing in a first rate cut in September and are roughly evenly split between one and two cuts for the year. Current Fed futures pricing shows that investors still expect that the Fed will cut rates this year. However, if the market begins seriously the consider the possibility that the Fed’s next move could be a hike, could see long-term yields push even higher.

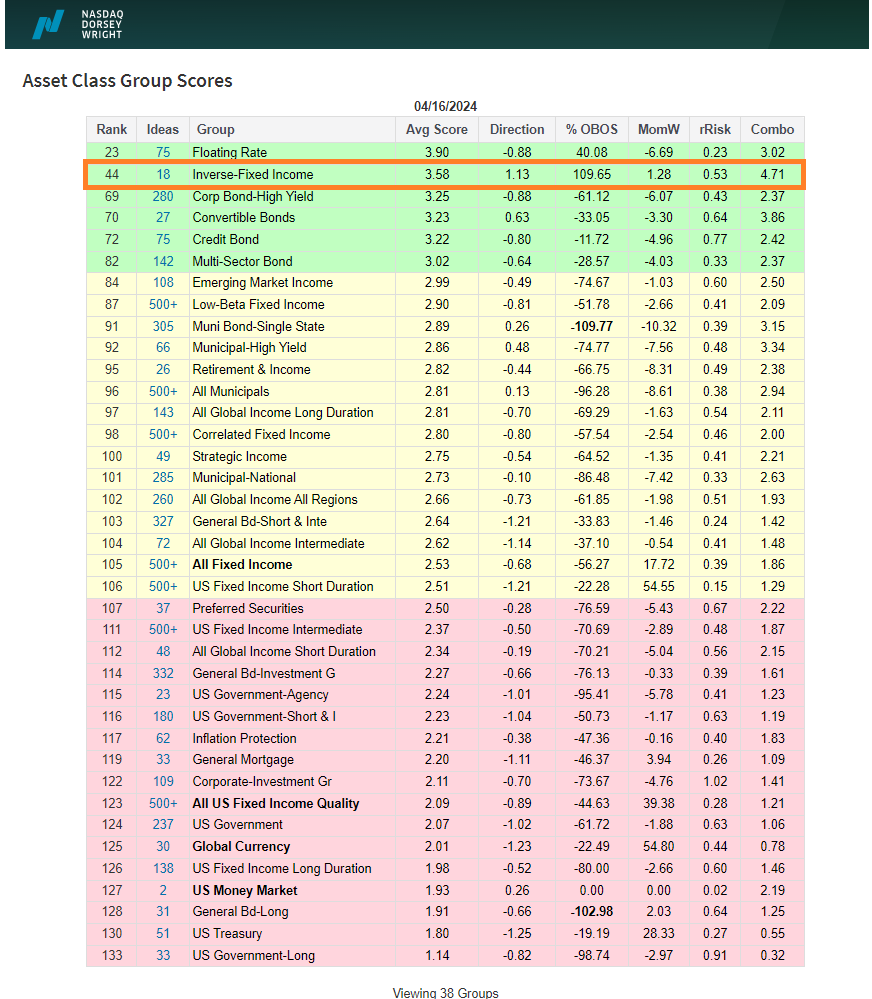

Inverse fixed income now sits in second place in the ACGS FI rankings, illustrating the further weakening of the market. Meanwhile, headcount in the red zone has grown as the recent rise in rates has further weakened the core market.