Notable technical developments are included from Industrials, Consumer Discretionary and Financials.

U.S. Sector Updates

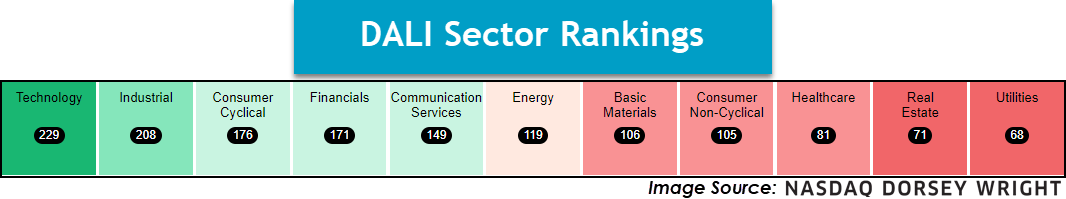

The past week saw no significant technical developments in the Technology, Communication Services, Energy, Basic Materials, Consumer Non-Cyclicals, Healthcare, Real Estate or Utilities Sectors. Those that saw noteworthy movement are included below, in order of their relative strength ranking in the DALI domestic equity sector rankings. Sector designations are based on DALI sector rankings and are as follows: 1 - 3 overweight, 4 - 7 equal-weight, and 8 - 11 underweight.

Industrial- Overweight, Improving

Weekly Industrial Update Video (2:34)

The sector continues to improve, as small-caps continue to flex their muscles in comparison to the rest of the small-cap representatives. Look towards PSCI for exposure to the space. XLI remains an option as well. UPS and FDX were notable movers for the last seven days. UPS struggled on the back of their investor day and remains a name to avoid. FDX is a technically weak stock but should remain on a laundry list if it can pick up additional technical attribute points.

Consumer Cyclical- Overweight

Weekly Consumer Cyclical Update Video (4:04)

Consumer Discretionary – Overweight – The Consumer Discretionary Select Sector SPDR Fund XLY was the best-performing sector fund over this past week's roll as it added 99 basis points and caused the fund to reverse back into Xs at $184. Domino’s Pizza DPZ was a notable upside mover as it gave a third buy signal and rallied to a 52-week high upon analyst upgrades. Dave & Buster’s PLAY fell on analyst downgrades but initiated a shakeout pattern (a bullish pattern) in a stock that possesses a 5 attribute rating and is pulling back from multi-year highs. Five Below FIVE and Lululemon LULU both had notable technical breakdowns following earnings last week, while Academy Sports & Outdoors ASO was able to maintain its positive technical picture following an earning miss and return to a sell signal.

Financials – Equal Weight

Weekly Financials Update Video (2:12)

Financials continued to show signs of strength over the past week. The Financial Select SPDR Fund (XLF) notched a new all-time high and is now sitting at $42 on its trend chart. Like many other names, XLF trades on a stem and in heavily overbought territory. This may be a concern in the short term, but the technical picture is still positive. Visa (V) and Mastercard (MA) reached a $30 billion settlement to limit credit and debit card fees for merchants. The stocks seemed to be unaffected by the news, but it is one of the antitrust announcements in history.